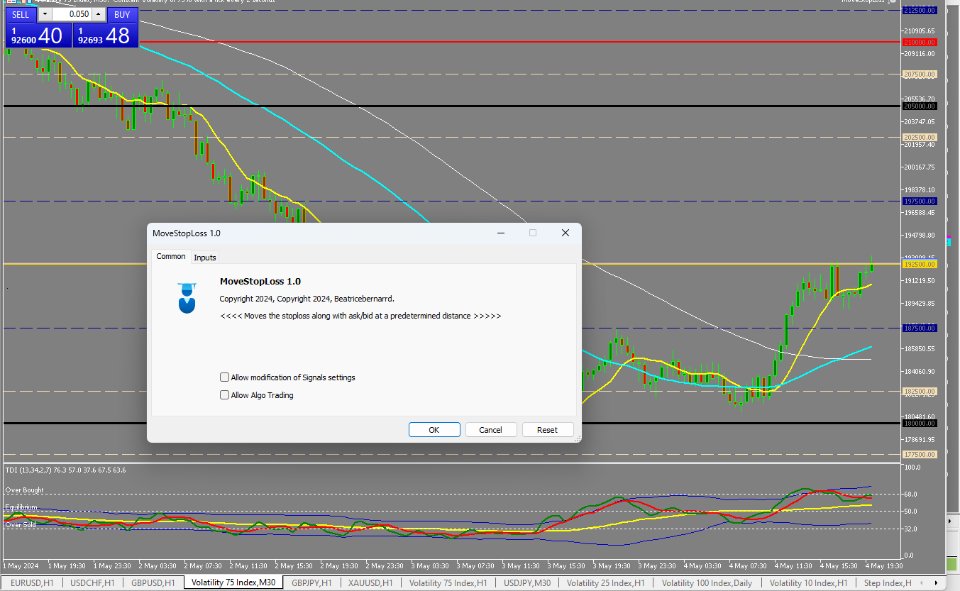

Move Stoploss Pro

- Yardımcı programlar

- Beatrice Bernard Mgaya

- Sürüm: 1.0

Ladies and gentlemen, let me explain a simple tool that can help adjust stop-loss positions based on historical data and customized distance.

Tool Name: Trailing Stop Pro

Description: A trailing stop is a risk management tool commonly used in trading. It allows traders to set a dynamic stop-loss level that automatically adjusts as the price moves in their favor. Here’s how it works:

-

Initial Stop-Loss:

- When you enter a trade, you set an initial stop-loss level. This is the price at which you’re willing to exit the trade if it goes against you.

- For example, if you’re long (buying) EUR/USD, you might set an initial stop-loss at 1.2000.

-

Customized Distance:

- You then specify a customized distance (usually in pips) from the current market price.

- This distance determines how far the stop-loss will trail behind the price as it moves in your favor.

-

Dynamic Adjustment:

- As the price moves in your favor (up for long trades, down for short trades), the trailing stop adjusts automatically.

- If the price moves in your favor by the specified distance (e.g., 20 pips), the stop-loss is moved to lock in profits.

- If the price reverses and reaches the adjusted stop-loss level, the trade is closed.

-

Advantages:

- Trailing stops allow you to capture more profit during strong trends without manually adjusting your stop-loss.

- They protect profits by following the price movement dynamically.

- Traders can customize the distance based on their risk tolerance and trading strategy.

-

Considerations:

- Be cautious not to set the trailing distance too tight, as it may result in premature stop-outs during minor price fluctuations.

- Trailing stops are not foolproof and won’t prevent losses in all scenarios (e.g., sudden market gaps).

Remember that while trailing stops can be powerful tools, they should be used in conjunction with a well-defined trading plan and risk management strategy. Always consider your risk-reward ratio and overall market conditions when implementing any stop-loss technique.