Price Trap Breakout

- Uzman Danışmanlar

- Nicholas Jones

- Sürüm: 1.0

- Etkinleştirmeler: 10

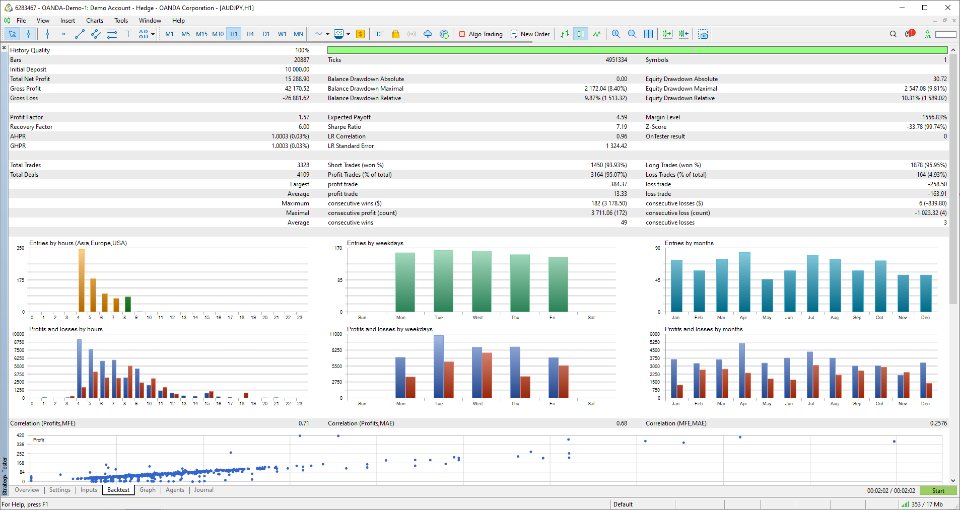

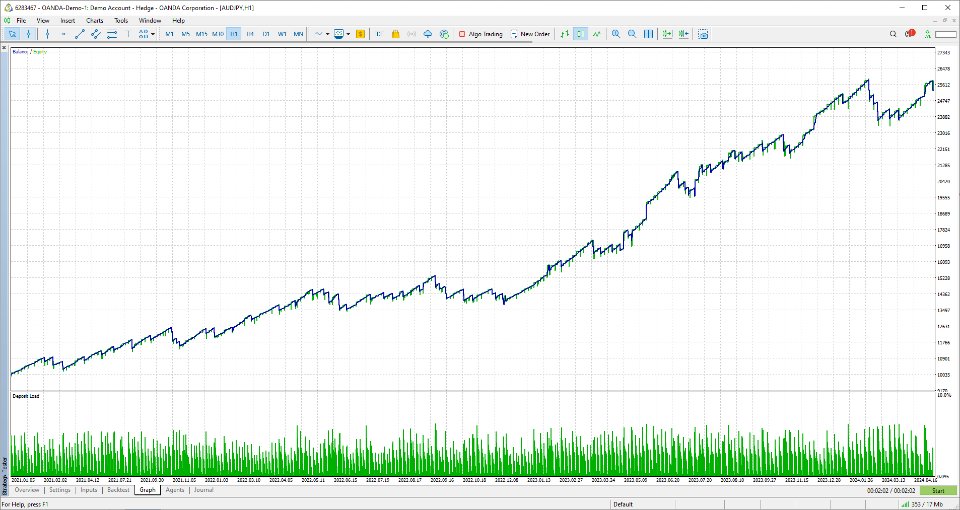

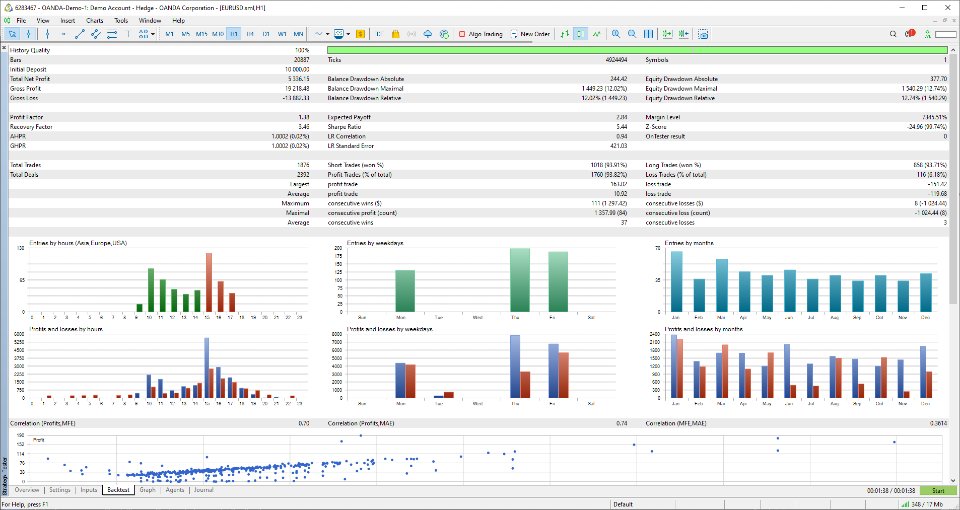

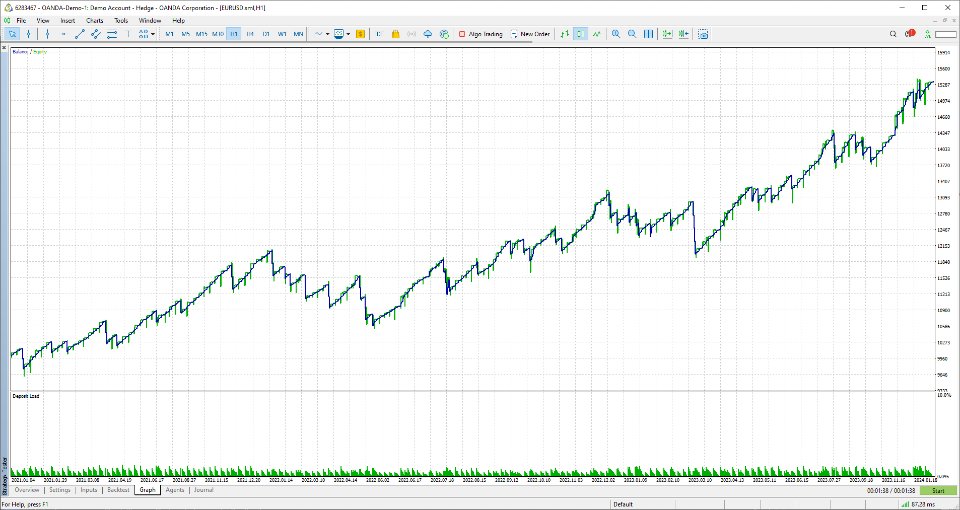

Summary

- Since 2018, my forex trading journey has been centered around a breakout strategy, often referred to as the price trap, which has proven to be remarkably successful. By incorporating AI into my trading methodology, I've been able to amplify my profitability even further. This approach has not only allowed me to generate substantial profits but has also granted me the freedom to spend more quality time with my loved ones. Sharing my strategy with others demonstrates my confidence in its effectiveness and my desire to help fellow traders achieve similar success. Overall, I've found a winning formula that not only brings financial rewards but also enriches my work-life balance, enabling me to enjoy the best of both worlds.

$$$ Original Price $499.99 $$$ 50% off Discount Limited Time Only $249.99 $$$

Trading Strategy

How to use The A Range- The A Range is calculated from 9AM-5PM AEDT (Sydney time). The goal is to price trap the resistance and support during the Sydney session.

- Range Time: Start 0:00 - 8:59 End GMT+2

- Range Size less than 50 pips when trading Major Pairs

- Range Size less than 75 pips when trading Non-Major Pairs

- Adjust entry price to avoid false break out on the A Range

- Trade All Currencies and Timeframes M1, M5, M15, M30, H1 and H4

Create your own range time and set files and share it with the price trap community!!!

Set Files

- EUR/USD H1 Set File (Display)

- AUD/JPY H1 Set File (Display)

- Multi-Set File H1 (Asian Session)

- Multi-Set File H1 (London Session)

- Multi-Set File H1 (New York Session)

- All Range Times are in GMT+2

- Send a Message for Set Files

User Guide

General

- Magic number: A unique identifier that distinguishes between different orders or trades placed by an Expert Advisor (EA). Make sure each EA you are using has a different magic number.

- Buy or Sell - Allow only buy or sell or both buy and sell.

- Partial Pips - Taking Partial Pips along the way.

- Breakeven - Moving Stop loss to breakeven after so many pips.

- Trailing Stop Loss - Trailing so many pips after the trade is active.

- Activate EA Dashboard Panel: Activate the EA Dashboard Panel, very useful to check the current day statistics.

Volume Type

- Fixed: Choose to trade with a fixed lot size

- Risk From Balance: Choose to risk a percentage of your balance.

- Risk From Equity: Choose to risk a percentage of your equity.

- Risk From Free Margin: Choose to risk a percentage of your Free Margin.

- Max Trades - You can define here the maximum trades to be opened per session.

- Max Simultaneous Open Trades - This parameter will help you limit the number of simultaneous open trades. It is handy to limit the drawdown.

- R/R - Default - 1:2 Risk to Reward Ratio - Adjust R/R and minimize your losses and maximize your profits.

Range Time Settings

- Range Start Hour: Hour for the start time of the daily range.

- Range Start Minute: Minute for the start time of the daily range.

- Range End Hour: Hour for the end time of the daily range

- Range End Minute: Minute for the end time of the daily range

- Delete Orders Hour: Hour for the expiration time of pending orders.

- Delete Orders Minute: Minute for the expiration time of pending orders.

Range Filter Settings

- Min Range Points: Ranges are ignored if they are smaller than the Min Range Pips

- Max Range Points: Ranges are ignored if they are bigger than the Max Range Pips

- Choose Range color.

- X pips from the Range - Adjust the entry from the Range

- SL X pips from the Range - Adjust the stop loss from the Range.

Day Filter

Use Day Control: Enable day filtering to prevent the EA of trading certain weekdays.

- Trade Monday: Yes/No

- Trade Tuesday: Yes/No

- Trade Wednesday: Yes/No

- Trade Thursday: Yes/No

- Trade Friday: Yes/No

- Trade Saturday: Yes/No

- Trade Sunday: Yes/No

News Filter

- Avoid News: Choose to avoid trading during the news. This implies posting new positions or orders and also taking control of current open positions or orders

- Use News Filter: True/False

- Consider high-impact events: True/False

- Consider medium impact events: True/False

- Consider low-impact events: True/False

- Stop trading before news in minutes: Decide when to stop taking new trades before news

- Start trading after news in minutes: Decide when to start taking new trades after news

- Draw news on chart:

- High Events Color

- Medium Events Color

- Low Events Color