Pullback ATR

- Uzman Danışmanlar

- Sergio Tiscar Ortega

- Sürüm: 1.20

- Güncellendi: 20 Mayıs 2024

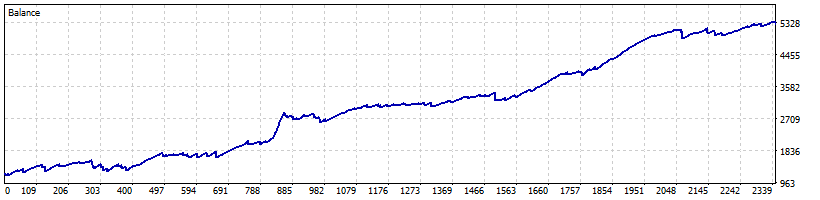

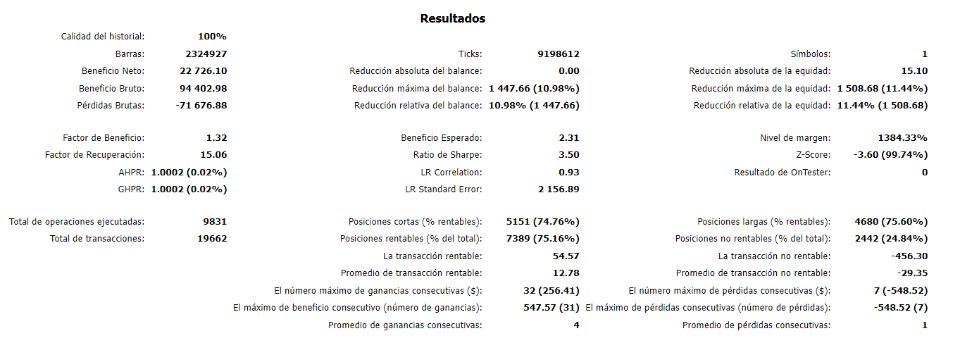

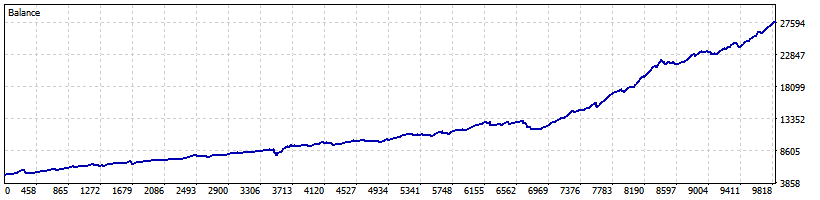

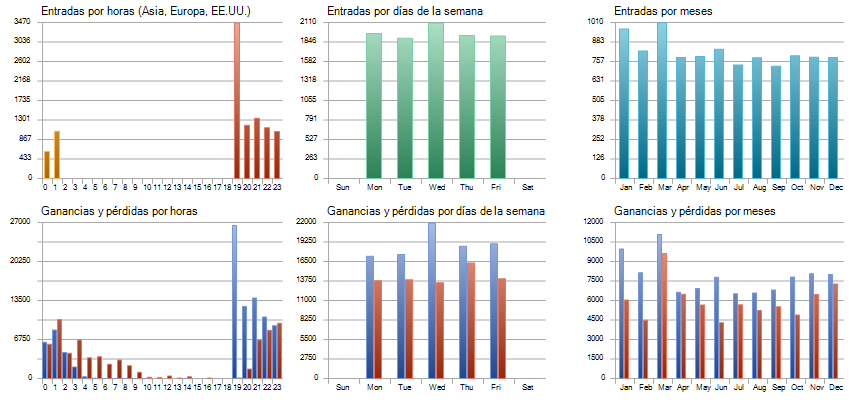

Introducing our innovative Expert Advisor (EA) designed to capitalize on pullback opportunities in the forex market, with the support of the Average True Range (ATR) indicator. This strategy focuses on identifying moments when the price temporarily retraces within a dominant trend, offering potential entry points with controlled risk.

The ATR is a volatility indicator that measures the amplitude of price movements over a given period of time. By integrating the ATR into our EA, we can assess the strength and extent of price movements, allowing us to identify significant pullbacks more accurately.

Key features of our EA:

-

Pullback Strategy: Our EA is based on a pullback strategy that seeks to capitalize on temporary corrections within a primary trend. It buys at support levels during an uptrend and sells at resistance levels during a downtrend, expecting the price to resume its original direction.

-

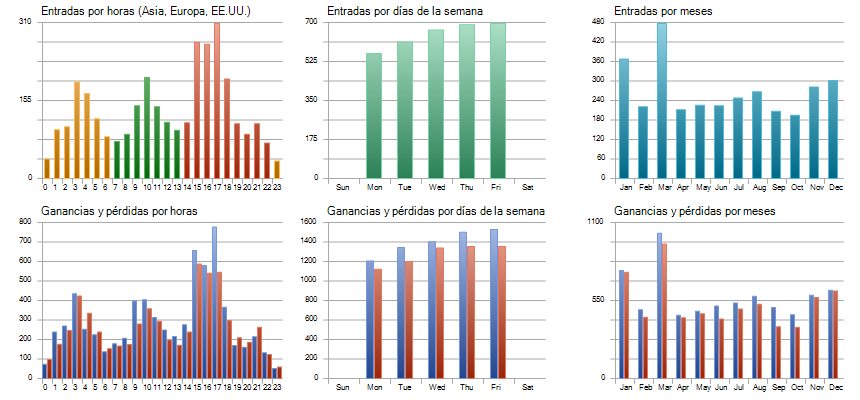

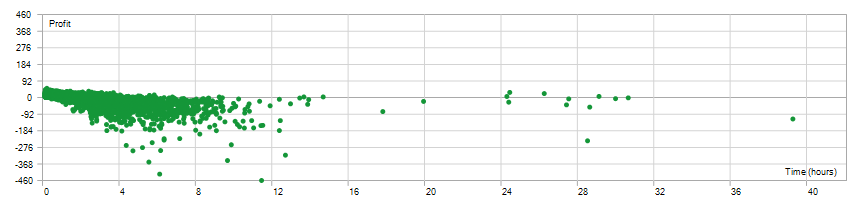

Various sets: This EA can be used in higher timeframes to obtain a mid-range system or in lower timeframes, and together with the time filter, to obtain a scalping system.

-

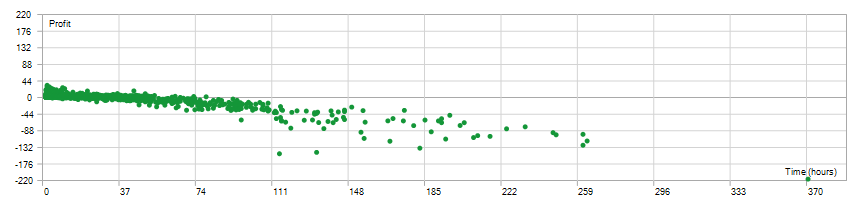

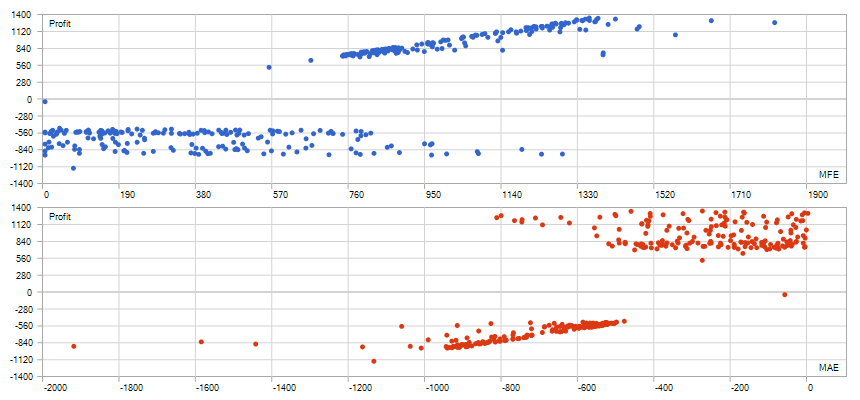

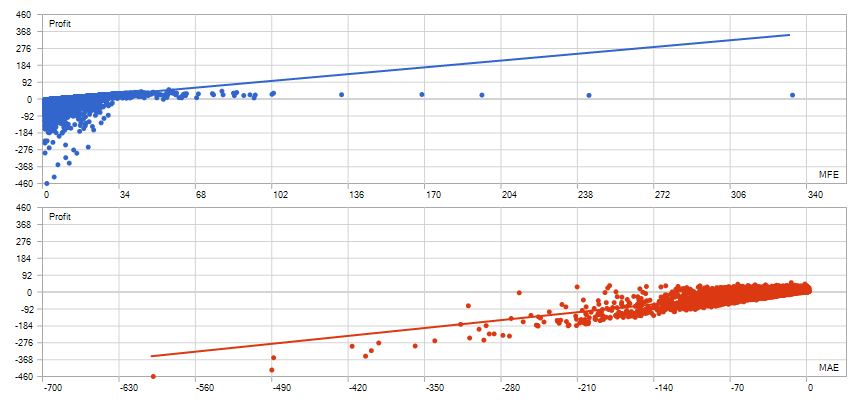

Utilization of ATR: The ATR is used to determine the expected amplitude of pullbacks and establish appropriate entry and exit levels. This helps traders manage risk effectively by adjusting their positions according to market volatility.

-

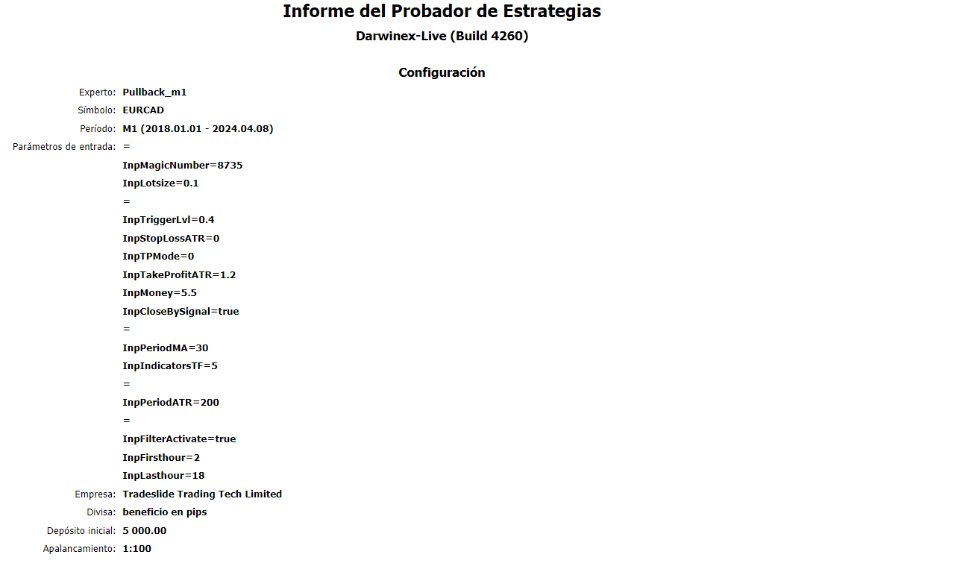

Flexible Customization: Our EA offers customization options that allow users to adjust parameters such as the ATR period and entry/exit levels, enabling them to tailor the strategy to their trading preferences and risk tolerance.

-

Risk Management: We incorporate risk management tools, such as stop-loss and take-profit orders, to protect capital and optimize profits. These measures help control risk and ensure that losses are kept in check in the event of adverse market movements.

It is important to note that while our strategy is based on sound principles supported by the ATR indicator, past performance is not indicative of future results in the forex market. Trading carries inherent risks, and it is essential to trade cautiously and employ proper risk management in all transactions.

Kullanıcı incelemeye herhangi bir yorum bırakmadı