Nyasasaurus MT5

- Uzman Danışmanlar

- Szymon Palczynski

- Sürüm: 3.40

- Güncellendi: 3 Ocak 2025

- Etkinleştirmeler: 5

Semi-automatic trading, also known as semi-auto trading or semi-algorithmic trading, is a trading approach that combines human decision-making with automated trading systems. In this setup, traders use algorithms and computer programs to assist them in making trading decisions, but the final execution of trades is still controlled by human judgment.

Here are some advantages of semi-automatic trading:

1. Speed and Efficiency: Computer algorithms can process vast amounts of data and execute trades in a matter of milliseconds. This speed is crucial in markets where split-second The trading expert to have a comprehensive set of features designed to optimize trading performance and manage risk effectively. Here's a brief recap:

2. Elimination of Emotional Biases: Semi-automated trading systems are not influenced by fear, greed, or other negative emotions, making them less susceptible to making irrational choices. Traders can rely on predefined strategies and rules, reducing the risk of making costly mistakes driven by emotions.

3. Consistency: Semi-automated trading systems can execute trades with a high degree of consistency. They follow predefined rules and strategies rigorously, ensuring that every trade adheres to the established criteria.

4. Multitasking: Semi-automated trading allows traders to monitor multiple markets and instruments simultaneously. This multitasking capability can be invaluable for traders who want to diversify their portfolios and capture opportunities in various assets.

5. Backtesting and Optimization: Traders can backtest their strategies using historical data with semi-automated trading systems. This enables them to assess the performance of their strategies under different market conditions and make necessary adjustments for optimization.

1 minute to make a decision based on the system's recommendations, and then the robot would execute the rest of the trading process based on your decision. This approach allows you to leverage the speed and efficiency of automated trading while still maintaining control over the final trading decisions. Please note that while semi-automatic trading can offer many benefits, it's important to thoroughly understand the system and its risks before getting started. Always ensure that your trading decisions are well-informed and align with your financial goals and risk tolerance.

After you've made your purchase, feel free to reach out to me. I can provide you with a general trading strategy that can be applied to all currency pairs. However, please note that while I can provide a strategy, its effectiveness will depend on a variety of factors including market conditions, your risk tolerance, and your understanding of the forex market. Always remember to trade responsibly and never risk more than you are willing to lose.

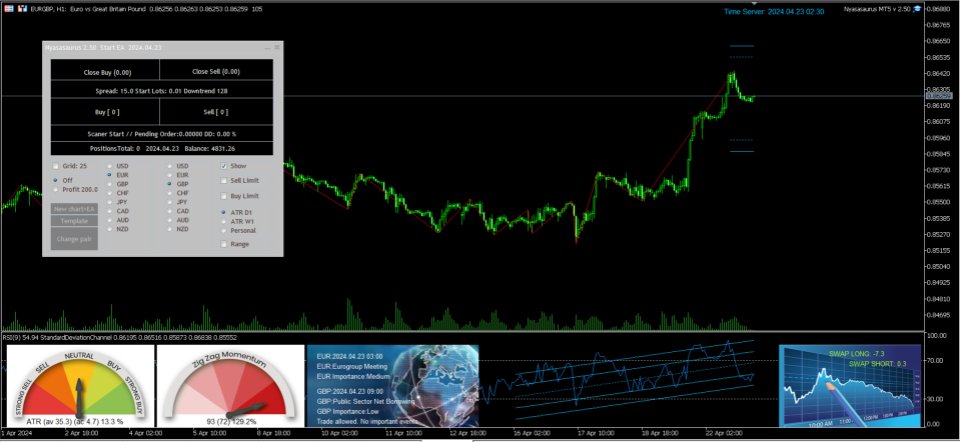

The recommended monitor resolution is 1920x1080 pixels - for semi-automatic trading.

Absolutely, learning to trade on the forex market using a semi-automatic system can be a great approach. This method combines the benefits of both manual and automated trading.

Here's a basic outline of how you might go about it:

1. Education: Start by learning the basics of forex trading, including how the market works, how to read forex charts and quotes, and the factors that influence currency movements.

2. Choose a Trading Strategy: There are many different trading strategies available, each with its own set of rules for when to enter and exit trades. Some strategies are based on technical analysis, others on fundamental analysis, and some combine both. Choose a strategy that aligns with your personal trading style and risk tolerance.

3. Set Up Your Semi-Automatic System: Once you have a strategy, you can set up your semi-automatic trading system. This typically involves programming your trading platform to monitor the market for signals that align with your strategy. When a signal is detected, the system alerts you, and you have the option to execute the trade.

4. Backtest Your System: Before you start trading live, it's important to backtest your system using historical data. This can help you fine-tune your strategy and identify any potential issues.

5. Start Trading: Once you're comfortable with your system and strategy, you can start trading. Remember to start small and gradually increase your risk as you gain more experience and confidence.

The trading expert to have a comprehensive set of features designed to optimize trading performance and manage risk effectively. Here's a brief recap:

1. Partial Position Closing System: This feature allows for the closure of a portion of an open position, securing some profits while leaving the position open for potential further gains.

2. Two Trailing Stops:

- The first is set for the initial position and moves with the price change, helping to secure profits when the price moves in a favorable direction.

- The second is more advanced and is set for all other open positions. It can be more dynamic and focused on maximizing profits and protecting capital.

3. Dynamic Trailing Stop: Unlike a regular trailing stop, a dynamic trailing stop adjusts to changing market conditions, which can help maximize profits and protect capital.

4. Quick Closing of Most Positions: The goal is to close most positions as quickly as possible in the case of an expanded grid, which can help minimize losses in the event of sharp price movements.