Slow AMA

- Göstergeler

- David Ben Svaiter

- Sürüm: 1.5

- Etkinleştirmeler: 5

Compared to simple or exponential moving averages, slow adaptive trend lines might offer a more nuanced view of the trend by adjusting their sensitivity based on market conditions. However, their slow nature might also mean they are late in signaling reversals when market conditions change rapidly - and that is the difference between them and our SlowAMA.

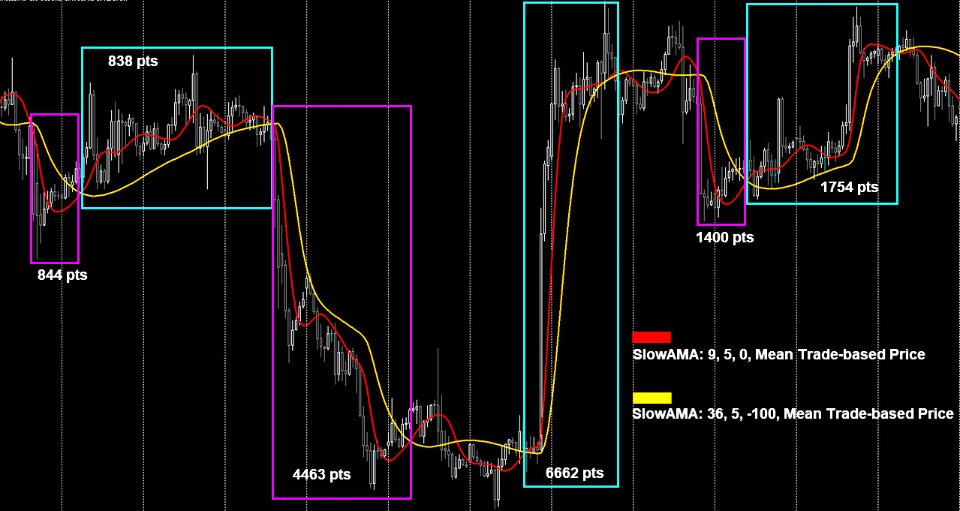

SlowAMA was designed to be a better long-term trend indicator than EMA and other Moving Averages. It uses our JurMA calculations, reducing the lag and noise and improving the smoothness.

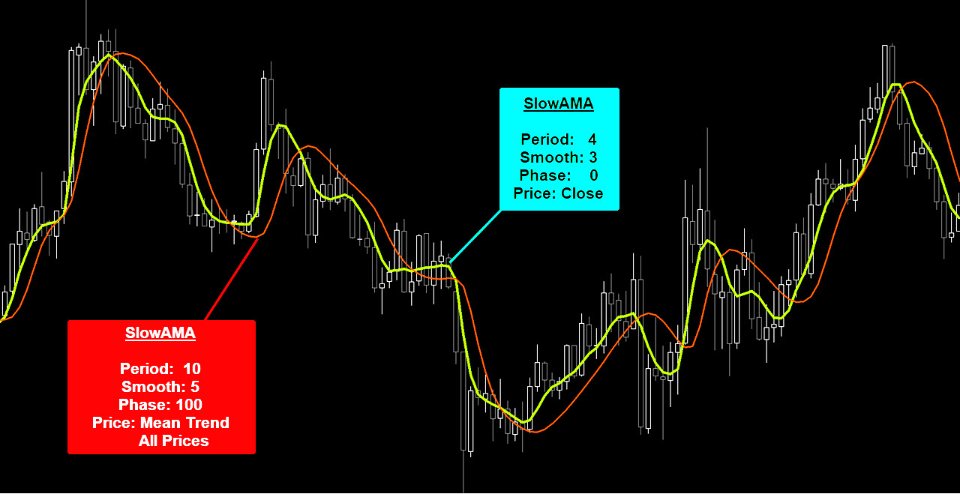

Depending on the length of the long-term goals, users can change the PERIOD ON ANALYSIS, SMOOTHNESS, and PHASE, and a good strategy can be focused on one or many SlowAMA lines.

The PERIOD helps you to define how many candles will be the "base" for all other calculations, and SMOOTHNESS acts on how the average should be calculated. But beyond SIMPLE and EXPONENTIAL ways, the SlowAMA smoothness algorithm is much more sophisticated to avoid the characteristic lag found in other traditional adaptive moving average algorithms.

In addition to both parameters, SlowAMA offers a PHASE feature parameter to adjust this indicator's behavior, particularly in terms of the "quality of the transitional process". It refers to how the SlowAMA adapts when there are shifts in market trends or volatility and, used with SMOOTHNESS, is excellent for balancing between responsiveness (quick reaction to price changes) and filtering out noise.

Here's a breakdown of what the PHASE parameter influences:

- Higher PHASE setting (100): it makes the SlowAMA more responsive to recent price changes, reducing lag and allowing it to follow the price movements closely. This setting helps identify trends and reversals more quickly.

- Lower PHASE setting (-100): it makes SlowAMA less responsive to recent price changes but more stable and less prone to noise and false signals. This setting is beneficial for filtering out market noise and identifying longer-term trends.

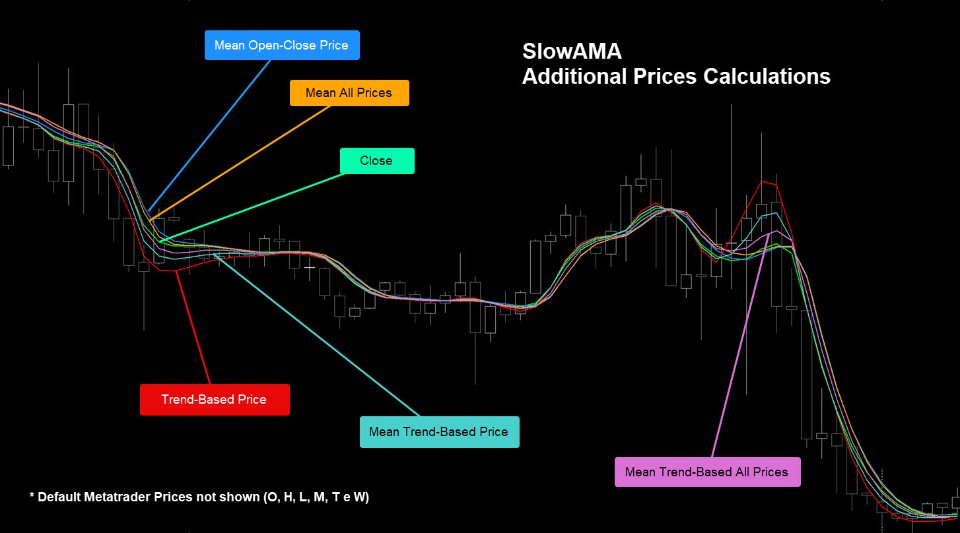

Additionally, SlowAMA provides a diverse range of pricing options for computations that augment the standard price calculations inherent in the MetaTrader platform:

- Metatrader default (Close, Open, High, Low, Median, Typical, Weighted prices);

- Mean Open-Close: (Open+Close)/2;

- Mean All Prices: (Open+Close+High+Low)/4;

- Trend-Based: High for Bull candles, Low for Bear candles, Close otherwise;

- Trend-Based Mean: (High+Close)/2 for Bull candles, (Low+Close)/2 for Bear candles, Close otherwise;

- Mean Trend-Based All Prices Weightet: Trend-based sophisticated formula with all prices.

Characteristics:

- Non-Repaint Slow Adaptive Moving Average, optimizing the identification of consistent trends.

- PHASE, SMOOTHNESS, and PERIOD parameters for total customization for any Asset and timeframe.

- Faster average calculation than iMA() and other Metatrader's Technical Indicators.

- 12 different price calculations (7 Metatrader Default + 5 custom calculations).

- It allows you to change its line's style, color, and width freely.

- It can be used with any ASSET and TIMEFRAME.

- Accepts its incorporation into "Expert-Advisor" via iCUSTOM call.

- Reports data buffers in the Data Window.