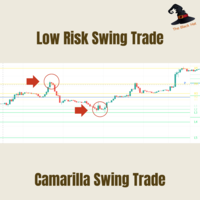

Camarilla Swing Trade

- Uzman Danışmanlar

- Chayakorn Rakwongthai

- Sürüm: 1.10

- Güncellendi: 19 Aralık 2023

- Etkinleştirmeler: 5

Camarilla Swing Trade is an Expert Advisor. It has a Swing Trade trading strategy using entry and exit points from Camarilla Pivot Points, trading when there is an advantage in buying or selling. And there is a system to prevent damage to the investment portfolio by not trading in cases where the price on TF week is very volatile. Support and resistance points are calculated from the High Low Close of the previous TF Week's price.

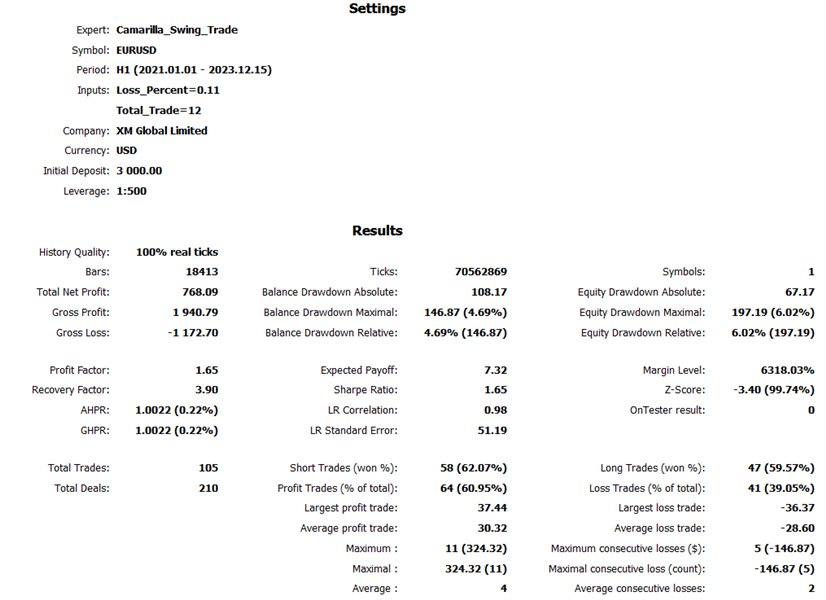

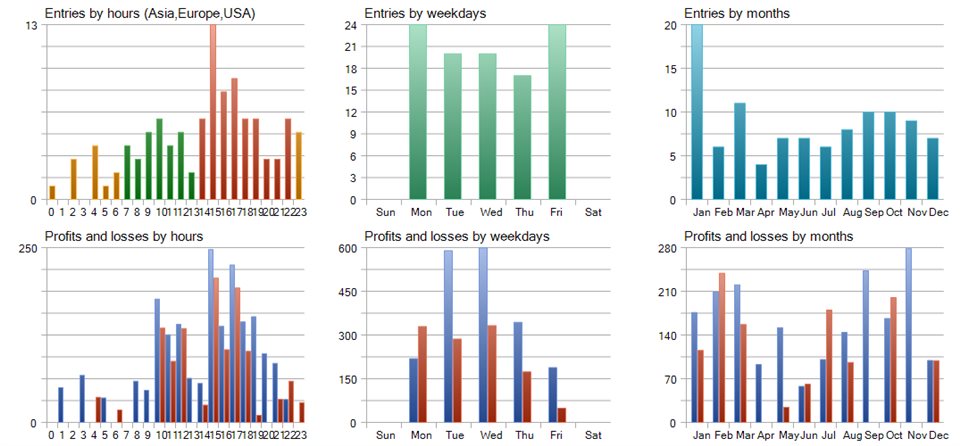

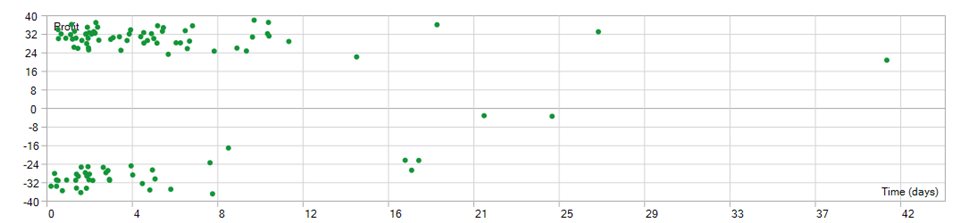

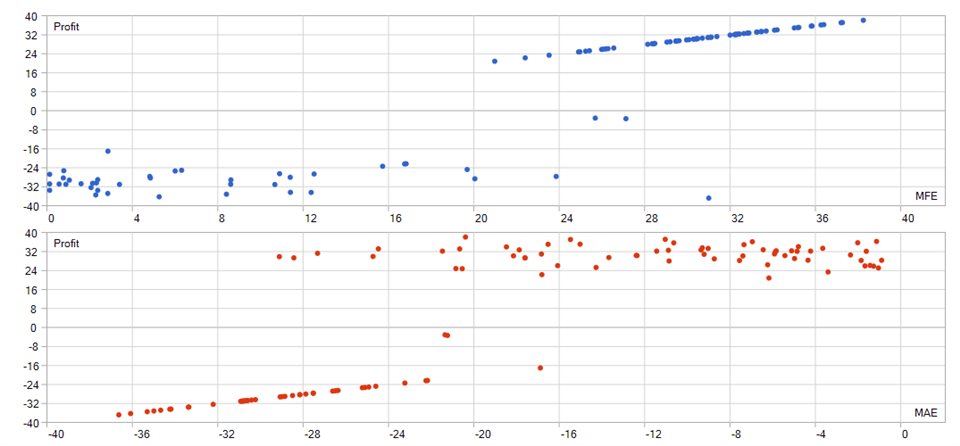

Testing from testing EURUSD on TF for 1 hour during 01.01.2021 to the present, got a return from 3000 USD to 3768 USD while having a Max Drawdown of 6%. There is also a Win rate of more than 60%.

What are Camarilla Pivot Points?

1.Camarilla Pivot Points is a modified version of the classic Pivot Point.

2.Camarilla Pivot Points was launched in 1989 by Nick Scott, a successful bond trader.

3.The basic idea behind Camarilla Pivot Points is that price tends to revert to its mean until it doesn't.

4.Camarilla Pivot Points is a mathematical price action analysis tool that creates possible intraday support and resistance levels.

Camarilla Pivot Points are a set of eleven levels that resemble support and resistance values for a current trend.

CPP - Camarilla Pivot Points

Support 1-5

Resistance 1-5

Camarilla Swing Trade Strategy

Buy Entry

1. The opening price of the Week candlestick is greater than CPP.

2. Identify the buying advantage when CPP is less than Support Line 2.

3. When the price breaks the support line between the 2nd and 4th support lines, then the price reverses and rises above the said support line.

4. Set SL at points S5 and TP equal to the distance between the entry point and the SL point.

Sell Entry

1. The opening price of the Week candlestick is less than CPP.

2. Identify the advantage in purchasing when CPP is greater than Resistance line 2.

3. When the price breaks the resistance line between the 2nd and 4th resistance lines, then the price has reversed down to stand below the said resistance line.

4. Set SL at points R5 and TP equal to the distance between the entry point and the SL point.

Input

Loss_Percent = The total risk that can be accepted is calculated in percentage units, for example 0.01 means the maximum risk is 1 percent.

Total_Trade = Total number of trades per buy or sell.

Example Loss_Percent = 0.02 Total_Trade = 10 means that the purchase will be made no more than 10 times. If all 10 sticks have been bought, the trade will not continue until the position is closed, divided into buy 10, sell 10 and the risk on the stick will be equal to 0.02/10. or 0.002 percent

default Input

Loss_Percent = 0.11;

Total_Trade = 12;

Requirement

1. Minimum investment 3000 USD.

2. Maximum leverage is more than 80 times.

3. Suitable for people who take low risks and expect appropriate returns.