Nasadaq rsi macd

- Uzman Danışmanlar

- Alfonso Martin De Lara

- Sürüm: 1.0

- Etkinleştirmeler: 5

The Nasdaq is an index with a lot of movement, and at the moment, the technology sector not only has a future but, with the emergence of AI, it becomes increasingly powerful and indispensable.

The foundations of the new society will be based on technological development.

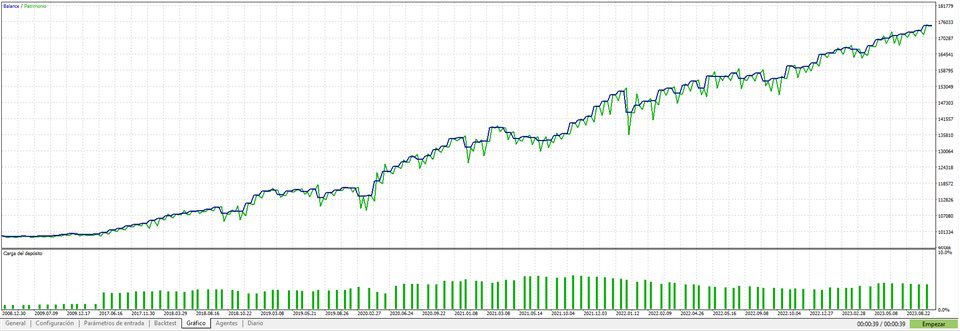

As for the expert, performs buying operations in DAILY TIMEFRAME using price reversal with RSI, accompanied by MACD. He also closes operations through RSI overbought conditions. He does not use stop loss, so it is not suitable for funding tests that require stop loss. However, for personal use or for some important funding company that I detail below, it is very viable.

The size, by definition, is 1 lot for an account of 100k. Depending on the risk, adjust the volume, as the price with 1 lot and 100k can decrease by a drawdown of 11%, which on a smaller account like 10k is better with 0.1 lots, and for 1k, 0.01 lots.

Its annual profitability of 13%-14% is ideal to accompany it with two other experts like the Eurodollar and Gold.

For 100k, this portfolio is offering a return of 44% with a closed drawdown of 5% , using 2 lots for the Eurodollar and 1 lot for Gold and Nasdaq, for an account of 100k.

As always, adjust the volume to the available capital.

You can be more prudent by halving the volume, even with the average expected return of 22%, with very little drawdown, ideal for accessing funding tests like FTMO's swing, which does not require stop losses and has no time limit, allowing a drawdown of 10%.

Patience is the mother of growth, and we support a reasonable and prudent philosophy always.