Fair Value Gap Indicator MT4

- Göstergeler

- Ahmed Alaoui Chrifi

- Sürüm: 1.0

- Etkinleştirmeler: 5

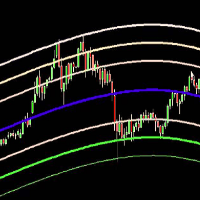

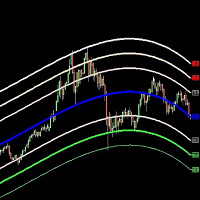

This powerful tool acts as a magnet, pulling the price back to its starting point before making a move. By identifying these gaps on charts, you can take advantage of bearish bias trades and predict potential future price movements with greater accuracy.

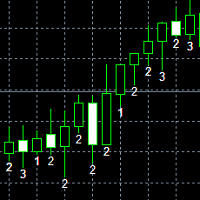

Created by a three-candle sequence, the Fair Value Gap Indicator is suitable for both bullish and bearish trades. It empowers you to make informed decisions and spot market inefficiencies like never before.

Don't hesitate, start using the Fair Value Gap Indicator today and elevate your trading game.

Understanding the Fair Value Gap

To understand the Fair Value Gap, analyze large candles with neighboring candles' wicks not fully overlapping within a three-candle sequence, indicating buying or selling imbalances in the market.

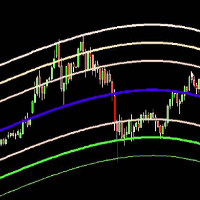

Fair value gaps, also known as FVGs, are visualized as significant price discrepancies that occur when the wicks of adjacent candles don't completely overlap. These gaps provide valuable insights into market dynamics and can act as magnets for future price movements.

The concept of fair value gaps revolves around the idea that when the price fills the gap before a downward move, it acts as a magnet, pulling the price back to its starting point before continuing higher. This pattern is often observed in bearish bias trades. Traders use fair value gaps to identify potential entry or exit points, as they indicate market imbalances and predict future price movements.

The Fair Value Gap indicator, available on the TrendSpider platform, simplifies the process of identifying and analyzing fair value gaps. By providing visual cues, it helps traders effortlessly spot potential trading opportunities.

To effectively trade fair value gaps, it's essential to understand their significance in price movement and use them in conjunction with other technical analysis tools for confirmation. By creating custom scans to identify and track fair value gaps, traders can stay updated on potential trading opportunities in real-time.

Factors Influencing the Fair Value Gap

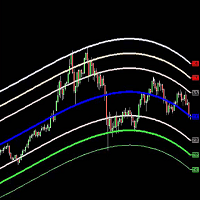

Factors influencing the Fair Value Gap include the presence of significant bearish or bullish candlesticks, indicating undervalued or overrated fair value gaps, respectively. These candlesticks provide valuable information about market sentiment and can help traders identify potential trading opportunities.

When there's a bearish candlestick pattern, it suggests that the market is experiencing selling pressure and the fair value gap may be undervalued. This could indicate a potential opportunity to enter a short trade, anticipating a downward move.

On the other hand, a bullish candlestick pattern suggests buying pressure and an overrated fair value gap. Traders can use this information to consider entering a long trade, expecting the price to rise.

By analyzing these candlestick patterns, traders can gain insights into market imbalances and inefficiencies, allowing them to make more informed trading decisions.

The fair value gap indicator serves as a useful tool for identifying and analyzing fair value gaps, helping traders navigate the market and uncover potential trading opportunities.

Interpreting the Fair Value Gap Indicator

First, analyze the Fair Value Gap Indicator to gain insights into potential market imbalances and trading opportunities. The Fair Value Gap Indicator is a valuable tool for price action traders to identify market imbalances and make informed trading decisions.

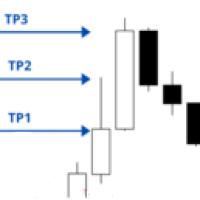

By analyzing fair value gaps on charts, traders can identify potential market gaps and predict future price movements. These gaps can indicate bullish or bearish bias trades when the price fills the gap before a move in the respective direction.

For bullish trades, the fair value gap acts as a magnet that pulls the price back to its starting point before continuing higher. On the other hand, for bearish trades, the fair value gap acts as a magnet that pulls the price back to its starting point before continuing lower.

Traders can use the Fair Value Gap Indicator to identify potential entry or exit points, leveraging them for potential market opportunities. This indicator is a powerful tool for price action traders to identify market imbalances and make profitable trading decisions.

Using the Fair Value Gap in Investment Analysis

Analyze the Fair Value Gap Indicator to incorporate it into your investment analysis and identify potential market imbalances and trading opportunities.

The Fair Value Gap Indicator is a powerful tool that can enhance your investment analysis by providing visual cues for potential trading opportunities. By utilizing this indicator, you can visualize areas of potential market imbalances and predict future price movements.

The Fair Value Gap Indicator highlights fair value gaps on charts, allowing you to identify and track these value gaps as they form. These gaps can act as magnets for future price movement, indicating potential entry or exit points for your trades.

By understanding the significance of fair value gaps in price action analysis, you can make informed trading decisions. Incorporating the Fair Value Gap Indicator into your investment analysis can help you identify market inefficiencies and imbalances, giving you an edge in the market.

It's a valuable tool that can assist you in identifying potential trading opportunities and optimizing your trading strategy.

Limitations of the Fair Value Gap Indicator

To fully understand the Fair Value Gap Indicator, it's important to acknowledge its limitations.

While this indicator can help identify potential market imbalances and predict future price movements, it isn't foolproof and should be used alongside other technical analysis methods.

Value gaps occur based on a three-candle sequence, but external factors and unexpected market developments can impact whether or not these gaps get filled, affecting the reliability of predictions made solely on the indicator.

Additionally, the Fair Value Gap Indicator may not be directly usable in the scanner on the TrendSpider platform, limiting its application for scanning and identifying potential trading opportunities. Therefore, it's crucial for traders to use other technical analysis tools to confirm potential trading opportunities presented by Fair Value Gaps.

Relying solely on the indicator may not provide sufficient information for making trading decisions.

In conclusion, the Fair Value Gap Indicator is a powerful tool for price action traders to spot market inefficiencies and imbalances. By analyzing fair value gaps on charts, traders can make informed decisions and take advantage of bearish bias trades.

This indicator acts as a magnet, pulling the price back to its starting point before continuing higher.

With the Fair Value Gap Indicator in your arsenal, you can accurately predict potential future price movements and elevate your trading to new