Arog mt5

- Uzman Danışmanlar

- Nadiya Mirosh

- Sürüm: 1.2

- Etkinleştirmeler: 5

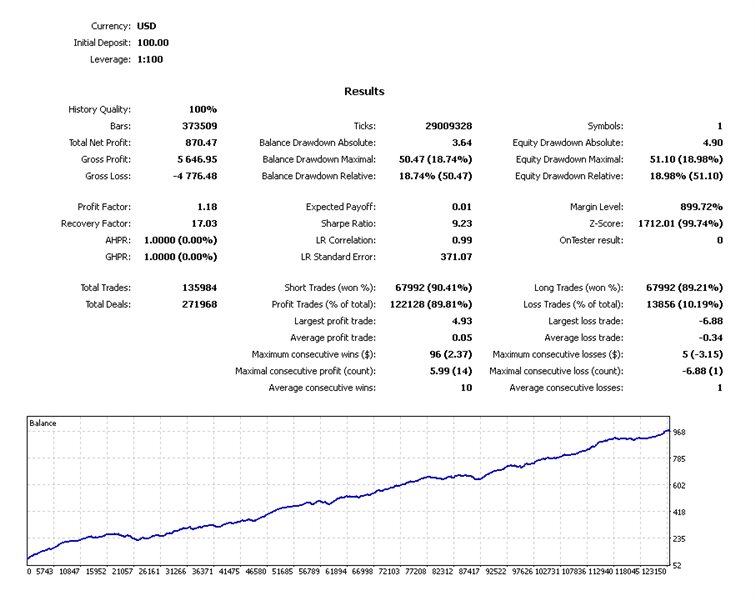

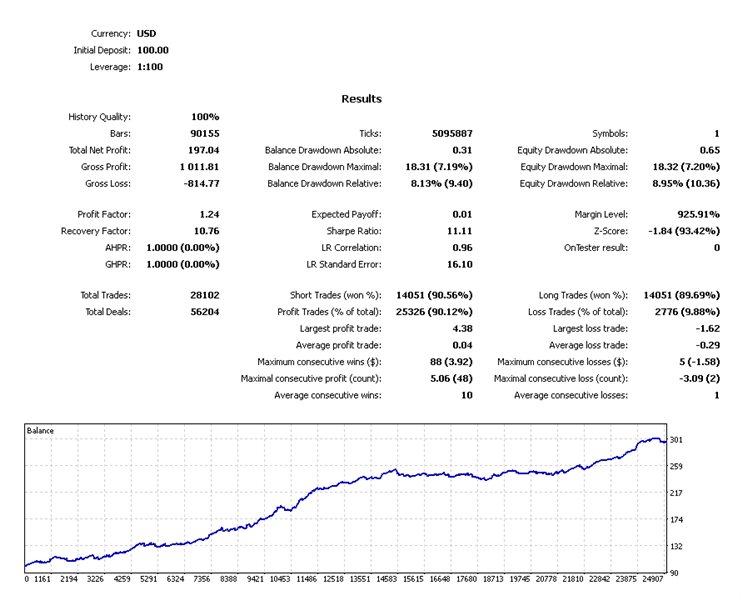

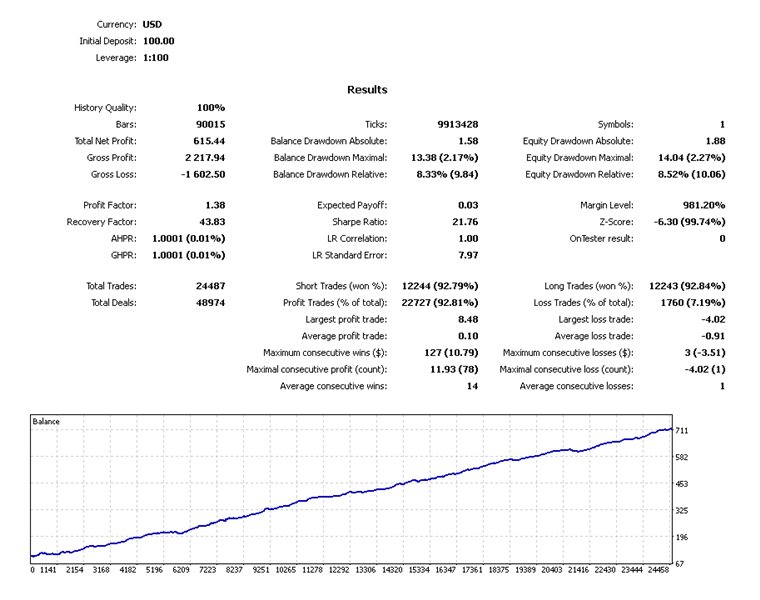

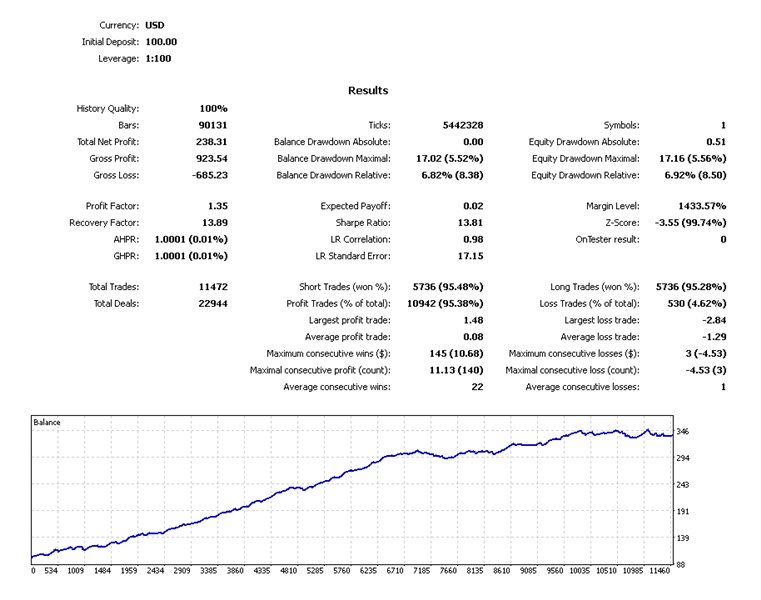

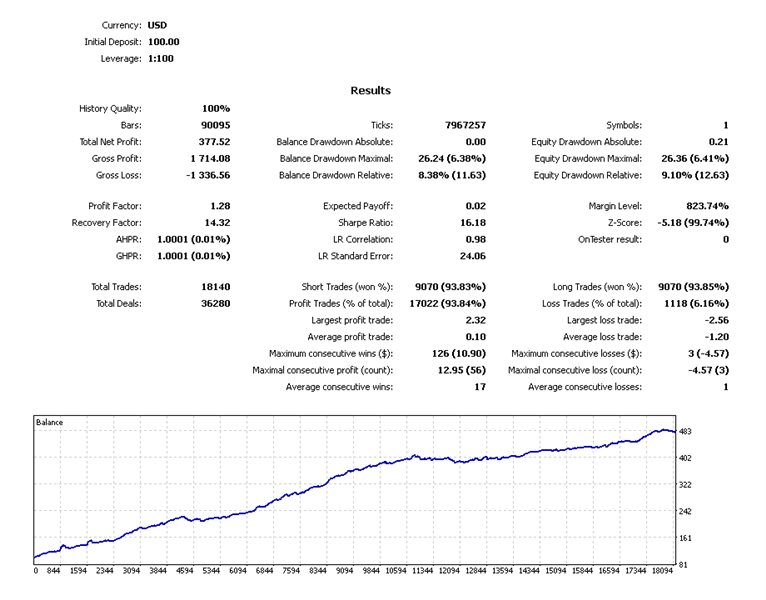

Forex trading advisor Arog is an automatic scalping system that opens and closes transactions using a special tick analysis algorithm programmed in code without human intervention. The main task is to instantly make a deal where a person wastes time on analysis and decision-making. Scalp trading or scalping is a short-term trading strategy that a trader uses to frequently make small profits from small price changes that add up to a large amount over time. This strategy is very popular in markets with high volatility.

They also automate trading, removing the emotional burden from a person and saving time. Scalping is one of the types of short-term strategies, and the shortest of them. Using this technique, a trader makes a significant number of operations, each of which is opened for a short period of time. The profit from each individual transaction is very small, but in terms of the total amount of transactions it can reach decent values. The scalping strategy involves many short-term trades on small time frames. When trading with this strategy, a trader will often close a trade within minutes or even seconds.

This strategy is well suited for beginners, since it is automated and manual work can be very taxing on the nervous system. It is necessary to constantly monitor the charts so as not to miss a good opportunity, or so that an open position does not go deep into the negative. The Arog trading robot, which is capable of generating a large number of short-term transactions without the participation of a trader, helps solve the problem of the scalper’s high emotional load.

The Arog trading advisor is an automatic algorithm that performs the following tasks:

- Instantly processes large amounts of data. Some robots even include fundamental analysis;

- Automates trading. Performs actions that were performed manually;

- Manages risks. The risk management system embedded in the code eliminates the emotional factor.

Environment for work.

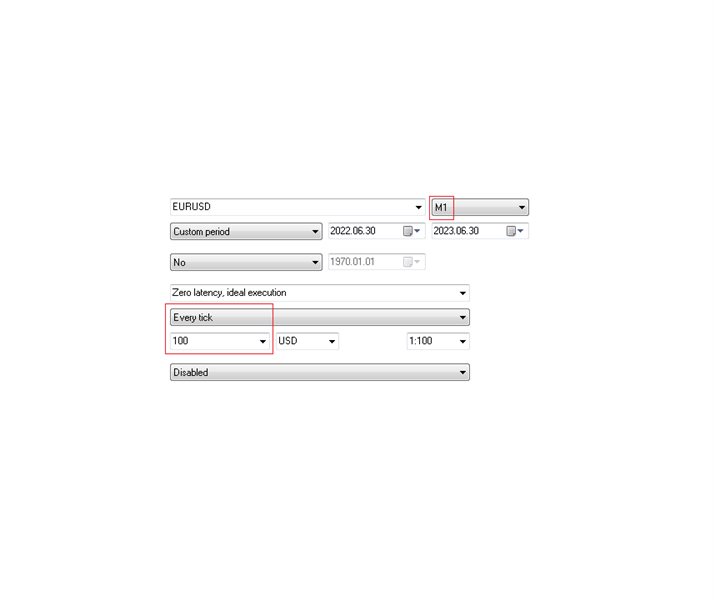

This algorithm can be used both on the shortest minute timeframes M1, and on the longer M5 or M15. At the same time, when moving to a longer period of time, for example from M5 to M15, a decrease in profitability may occur. Leverage – from 1:100. The bot works on most currency pairs. It is necessary to take into account such broker parameters as the minimum allowed distance of stop loss and take profit to the price, spread, commission.

Forex advisor Arog parameters:

- Magic – Magic number.

- Volume Stable – Fixed lot.

- Money Management – Automatically calculated lot.

- Lot Decimal – Rounding of lots.

- Take-Profit – Take profit.

- Stop-Loss – Stop loss.

- MinProfit Close – Minimum profit at closing.

- Draw Down – The maximum drawdown at which closing occurs.

- Spread Restrictions – Restriction on the maximum spread.

- Analysis Restrictions – Analysis of the number of ticks.

- Size Pattern – The size of the tick pattern.

- Minimum Identification – Minimum amplitude for registering a folder.