MultiCurrencyWPR

- Göstergeler

- Stanislav Korotky

- Sürüm: 1.2

- Güncellendi: 24 Kasım 2021

- Etkinleştirmeler: 5

MultiCurrencyWPR (MCWPR) indicator applies conventional WPR formula to plain Forex currencies (that is their pure strengths extracted from Forex pairs), market indices, CFDs and other groups of tickers. It uses built-in instance of CCFpExtraValue to calculate relative strengths of selected tickers.

Unlike standard WPR calculated for specific symbol, this indicator provides a global view of selected part of market and explains which instruments demonstrate maximal gain at the moment.

It allows you to:

- choose from multiple currencies to trade from a single window;

- refine signals of standard WPR which may be overoptimistic estimates of overbought/oversold states by means of reinforced signals from "currencies" on both sides of work symbol;

- analyze underlying nature of price changes;

As with CCFpExtraValue, other features of the indicator are:

- arbitrary groups of tickers and currencies: Forex, CFD, futures, spots, indices;

- time alignment of bars for different symbols with proper handling of possibly missing bars including instances of different trading schedule;

- up to 30 instruments (only first 8 are displayed).

Parameters

- WPR - WPR period; default is 24;

- GlobalRange - a flag switching work mode; false - WPR ranges are calculated separately for every "currency"; true - a common WPR range is calculated among all "currencies"; default is false;

- Instruments - comma separated list of instruments

- with a common currency;

- for Forex symbols the common currency is either a quote currency or a base currency, which is detected in all given symbols; if the auto-detection failed (as for non-Forex tickers), DefaultBase parameter is used (here, 'base' means a common currency between all tickers, not a base currency of a Forex symbol);

- the default set of instruments includes all Forex majors EURUSD,GBPUSD,USDCHF,USDJPY,AUDUSD,USDCAD,NZDUSD;

- please note, that NZDUSD can be missing at some demo servers, so don't forget to edit as appropriate;

- MA_Method - moving average method, the default is linear weighted;

- Price - moving average applied price type, the default is open price;

- Smooth - moving average period for smoothing, the default is 1;

- All_Bars - number of bars to calculate on, 0 means all available bars, default is 1000;

- BarByBar - false means re-calculating 0-th bar on every tick, true (default) means calculating a bar on the 1st tick and when closed;

- DefaultBase - default common currency to use; it's used only if the base can not be detected automatically.

- ShowLegend - allows for enabling/disabling legend output in the left upper corner of the indicator subwindow.

Description

While filling in Instruments please, make sure you enter existing symbols - if the symbol is misspelled or unavailable on your server, an error occurs. If Instruments parameter contains a symbol missing in Market Watch or with insufficient data, indicator writes a message in the Experts log.

When number of Instruments is greater than 8, all of them participate in calculations and affect chart lines, but only first 8 are displayed. Though it's feasible to have more than 8 lines, it would produce difficulties with perception.

MCWPR allows you analyzing many interesting clusters, for example, oil industry (#LKOH, #ROSN, #SGNS, #SIBN), foods (wheat, corn, soy), banks, etc.

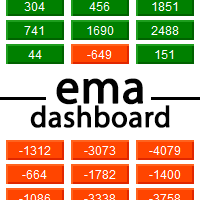

On the 1-st screenshot MCWPR is shown along with standard WPR. In MCWPR GlobalRange is false.

On the 2-nd screenshot MCWPR's GlobalRange is changed to true. Please note 2 vertical lines. Red is denoting a bar where standard WPR signals "oversold" state and suggests to buy, whereas MCWPR is clearly showing that there is no signal. If WPR would be used solely to buy, the trade will most likely end in a loss. Blue line is denoting the place where actual buy signal is generated, confirmed by MCWPR.

The 3-rd screenshot demonstrates MCWPR with typical price and smoothing.

Next screenshots show charts for other Forex symbols.

Two last screenshots display tickers from oil industry.