EA Dance GBPJPY h1

- Uzman Danışmanlar

- Sergey Demin

- Sürüm: 1.20

- Etkinleştirmeler: 15

Automatic advisor for the GBPJPY currency pair. Timeframe H1

I created this advisor specifically for prop company.

All the efforts of five years went into creating a safe product. The Advisor consists of 22 small advisors and is a ready-made Portfolio.

I also use the advisor in my portfolio trading:

Attention: The advisor uses three large trading strategies (!):

- Trend trading;

- Reverse trading (on the reverse price movement);

- Trading by Seasonal Patterns (time cycles)

The advisor does NOT use toxic strategies:

| Strategy | Availability |

|---|---|

Small take profit with a huge stop loss | No |

Quick breakeven and large stop loss | No |

Grid | No |

Martingale | No |

Grid + Martingale | No |

The advisor was created and tested using precise tick quotes from Dukascopy with a quality of 99%. Passes the Monte Carlo test perfectly!

The advisor consists of 22 small advisors that use the following strategies:

Strategy one - trading on the trend:

- MACD;

- Ichimoku;

- ATP;

- Bollinger Bands;

- EMA;

- my secret additive

Strategy two - reverse (for the price to return to its average value):

- Keltner Channel;

- CCI Oscillator;

- StdDev;

- QQE;

- LinReg;

- Williams%R;

- my secret additive

and other indicators and oscillators.

Strategy three - Seasonal time patterns of the GBPJPY currency pair.

Patterns are taken from the largest researcher:

Analytical organization for the study of time cycles in trading - seasonax.com

Advisor settings:

At the request of many traders, I have moved all Take Profit and Stop Loss values for each trading tactic embedded in this complex adviser to the external settings of the adviser.

Indicator parameters have also been moved to the external settings. This is necessary for optimization.

The adviser has already been selected with the best parameters.

But many professional traders search for improved adviser parameters every year or half a year.

Recommended Money Management:

Risk per trade = 1% or less!

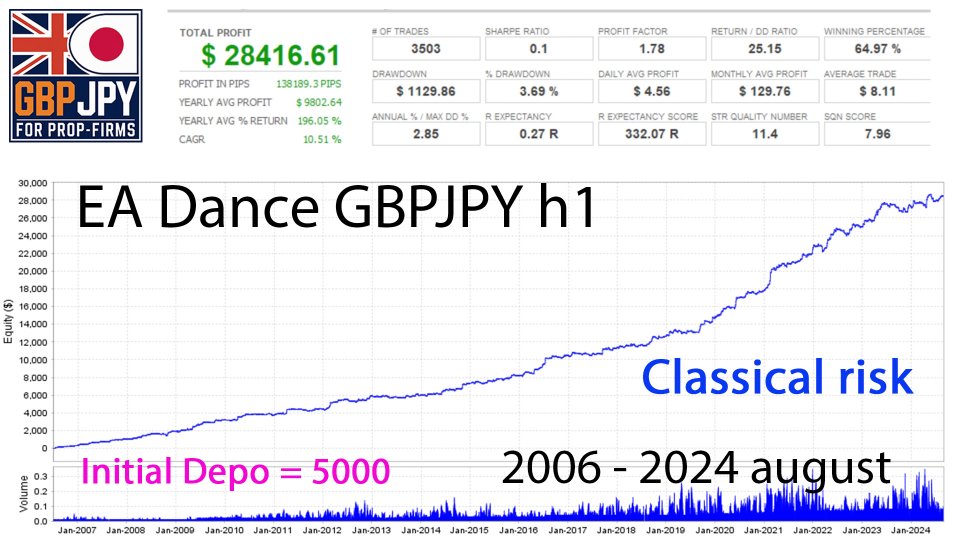

For prop firms: Risk per trade = 0.25% or less!

Please note:

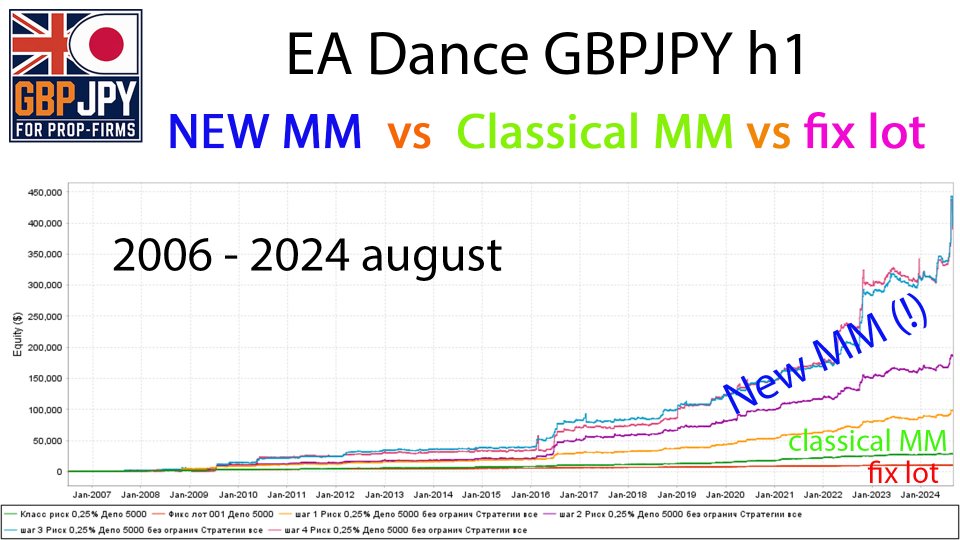

The advisor uses three types of Money Management (optional):

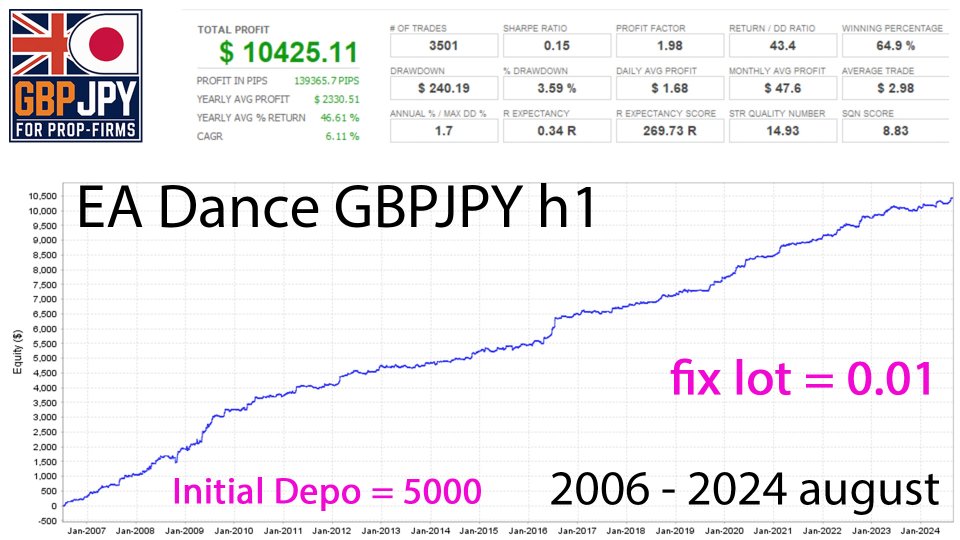

- fixed lot trading;

- % of the deposit size for one transaction;

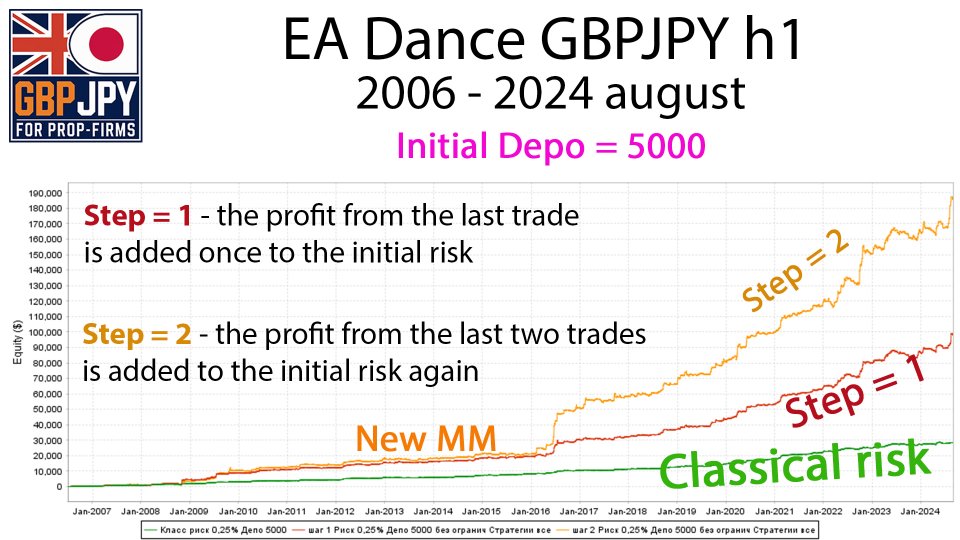

- New MM (!) - Explanation:

Let's say the advisor opened one transaction with an initial risk = 1%. And closed with Take Profit = 3/1. That is, the profit from one transaction was 3%.

The next transaction will be opened with an initial risk = 1% + the profit received in the previous transaction = 3%. The total risk for the new transaction = 1% + 3% = 4%.

Next, if the advisor makes a loss, then the total risk for two transactions will be = -2%.

But if the advisor makes a profit, then the total profit for two transactions will be = 15% (instead of 6%).

Please use New MM only on your personal accounts (do not use on prop firm accounts) and with the settings parameter Step MM= 1 or 2 (profit will be added to the initial risk only 1 or 2 times). Risk per trade = 0.25% or less.

Testing 2006 - 2024 August.

Initial Deposit = $5,000:

Types of Money Management Profit (dollars) Profit factor Max Drawdown (%) Ret/DD ratio

New Money Management often increases profits sharply, but also increases drawdowns. But in New MM, profits increase more than drawdowns can increase.

Please note:

the adviser does not guarantee future profitability based on past profitability.

Use ONLY available funds in trading!