ICT interbank price delivery algorithm look back

- Göstergeler

- Minh Truong Pham

- Sürüm: 1.1

- Güncellendi: 23 Ekim 2023

- Etkinleştirmeler: 5

This script automatically calculates and updates ICT's daily IPDA look back time intervals and their respective discount / equilibrium / premium, so you don't have to :)

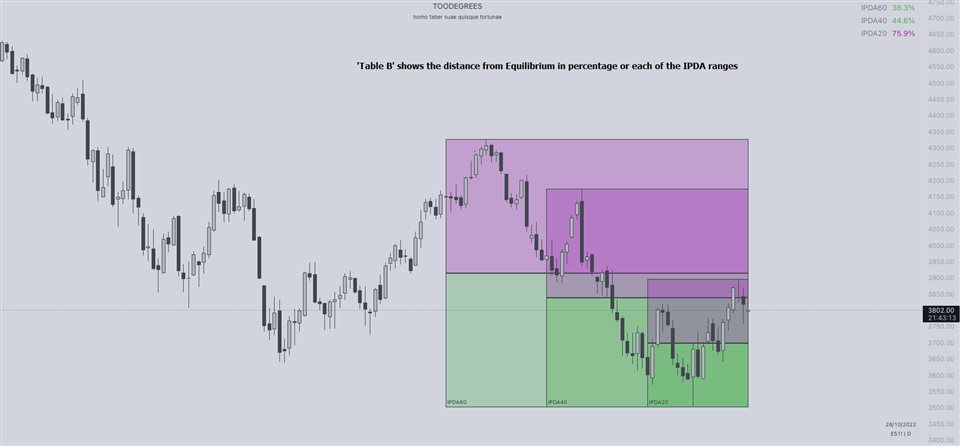

IPDA stands for Interbank Price Delivery Algorithm. Said algorithm appears to be referencing the past 20, 40, and 60 days intervals as points of reference to define ranges and related PD arrays.

Intraday traders can find most value in the 20 Day Look Back box, by observing imbalances and points of interest.

Longer term traders can reference the 40 and 60 Day Look Back boxes for a clear indication of current market conditions.

Settings:

IPDA Data Ranges Type: There are 3 type relax with IPDA and Timeframe as follow:

+ CLASSIC. This mode apply for D1 timeframe chart only. Data calculated and show in D1 chart timeframe.

+ CLASSIC at LTF: This mode apply for timeframe lower than D1. Data calculated in D1 chart timeframe and shown in current timeframe.

+ LTF: This mode apply all timeframe. Data calculated in current and show in current timeframe.

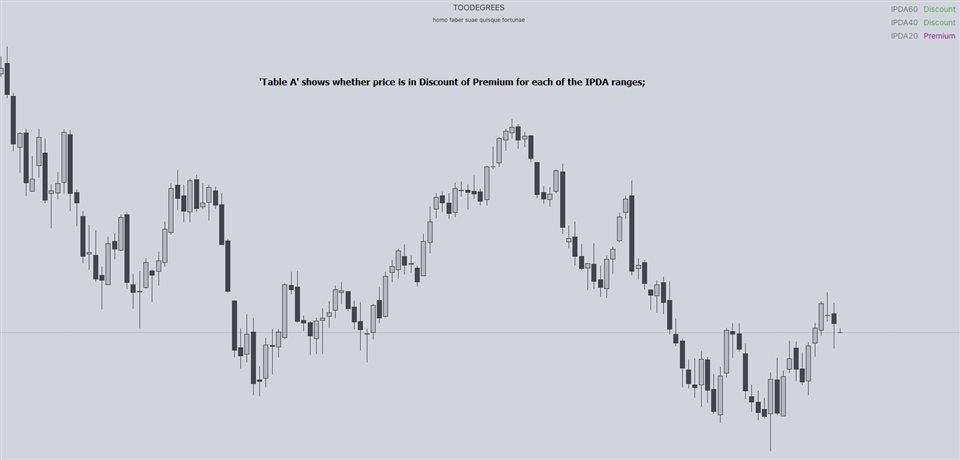

IPDA Plot Format: There are 3 type: Boxes is shown box on chart; Table A and B is show information as table at top right of chart (in table mode, can change text color and brg color at bottom of setting)

Other setting relax with show ipda and style.