Institutional Momentum Stochastic Index

- Göstergeler

- Agustinus Biotamalo Lumbantoruan

- Sürüm: 1.0

The Stochastic Momentum Index (SMI), developed by William Blau and featured in the January 1993 edition of Technical Analysis of Stocks & Commodities magazine, introduces a unique perspective to trading analysis.

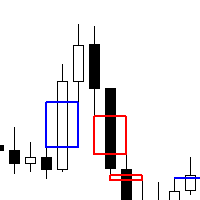

Distinguished from the conventional Stochastic Oscillator, which evaluates the current close in relation to the recent x-period high/low range, the SMI assesses the close's position relative to the midpoint of this range.

This innovation yields an oscillator with a range of +/- 100, renowned for its reduced volatility compared to the standard Stochastic Oscillator:

- A positive SMI reading occurs when the close exceeds the midpoint of the range.

- Conversely, a negative SMI reading signals when the close falls below this midpoint.

The SMI doesn't stop at providing a fresh view of market momentum. It also incorporates price's swing high and swing low points, conveniently plotted as colored dots. This feature proves invaluable in identifying key level support and resistance, further enhancing its utility for traders and investors seeking precise market insights.