KT Trades Info MT4

- Göstergeler

- KEENBASE SOFTWARE SOLUTIONS

- Sürüm: 1.0

- Etkinleştirmeler: 5

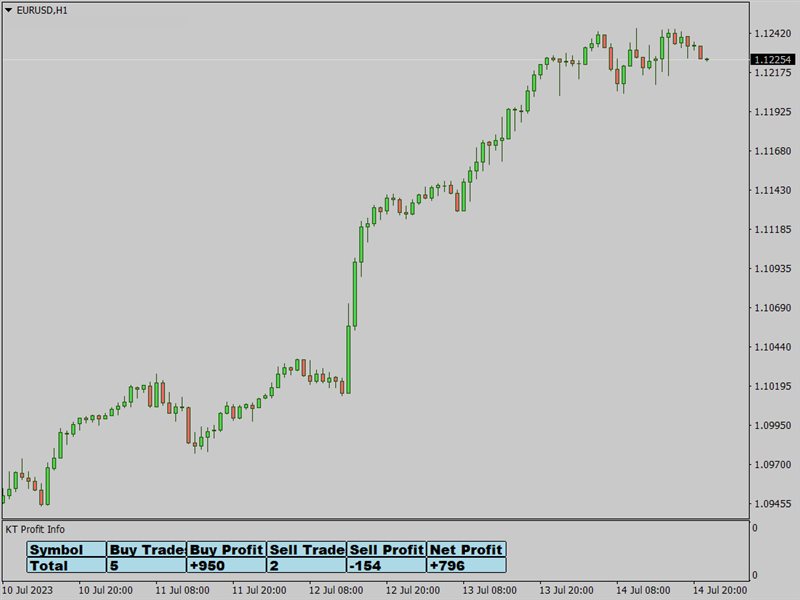

The KT Trades Info indicator is useful for traders wishing to stay informed about their trading performance. This indicator provides real-time updates on the profitability of all ongoing and completed trades, enabling traders to make well-informed decisions. By incorporating key financial metrics, it provides a comprehensive picture of a trader's financial status at a glance.

This means traders can monitor their performance with increased accuracy and precision, facilitating better risk management and strategic planning.

Features

- Real-Time Profit/Loss Calculation: This indicator continuously calculates the profit or loss of open and closed trades, and the indicator displays this information in real time.

- Performance Metrics: It provides key metrics such as gross profit, gross loss, net profit, total number of trades, and winning and losing trades.

- Winning Percentage: The indicator often calculates the percentage of winning trades against the total number of trades, clearly indicating your success rate.

- Trade Details: Detailed information about each trade is also displayed, including the trade's opening price, closing price, type of trade (buy or sell), and the number of pips gained or lost.

- Customization Options: Traders can customize the indicator's display, including the placement on the chart, the font size, and the color of the text. This allows you to tailor the indicator to your specific preferences.

- Currency Conversion: The indicator can convert the profit and loss figures into your preferred currency for those trading in various currencies.

Pro-Tips

- Use it as a performance benchmark to evaluate your trading strategies. By understanding which trades are profitable and which are not, you can tweak your strategies to improve overall performance.

- A high win rate can give you confidence in your trading strategy, but remember to consider the profitability of each trade. A few large losses can outweigh many small wins.

- Make the most of the customization options available. Adjust the settings to suit your preferences so you can read and understand the data more effectively. The right configuration can help you quickly assess your trading performance.

- Look beyond gross profits. Analyze the total amount of net profits and other metrics to gain a comprehensive understanding of your trading performance. High gross profit and high gross loss could mean your strategy is high-risk.

- Consistently review your performance over time. Use the historical data to compare your current trading performance with the past. This helps in identifying any trends or changes in your trading habits.