KT Pull Back Arrows MT4

- Göstergeler

- KEENBASE SOFTWARE SOLUTIONS

- Sürüm: 1.0

- Etkinleştirmeler: 5

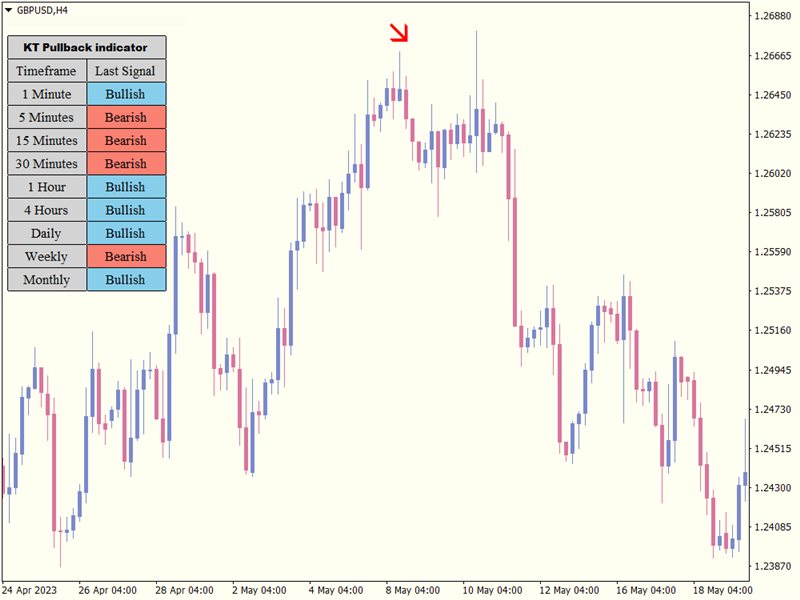

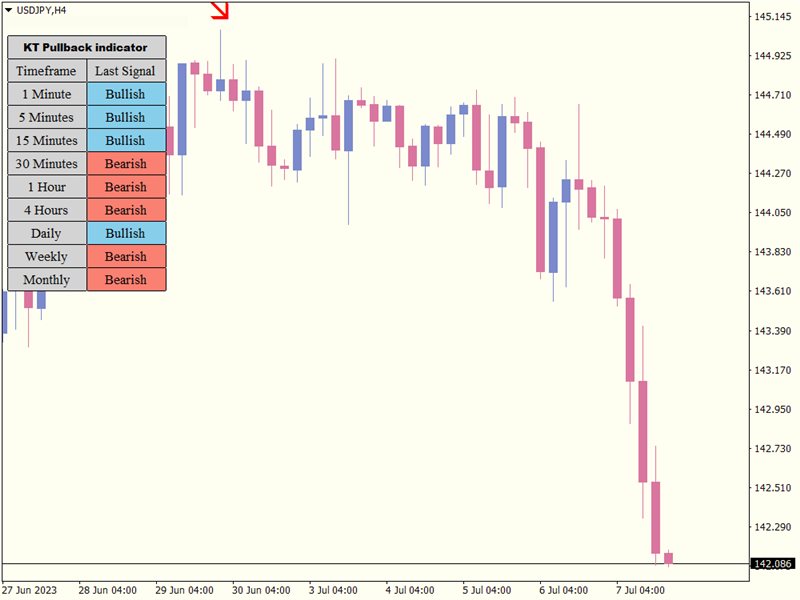

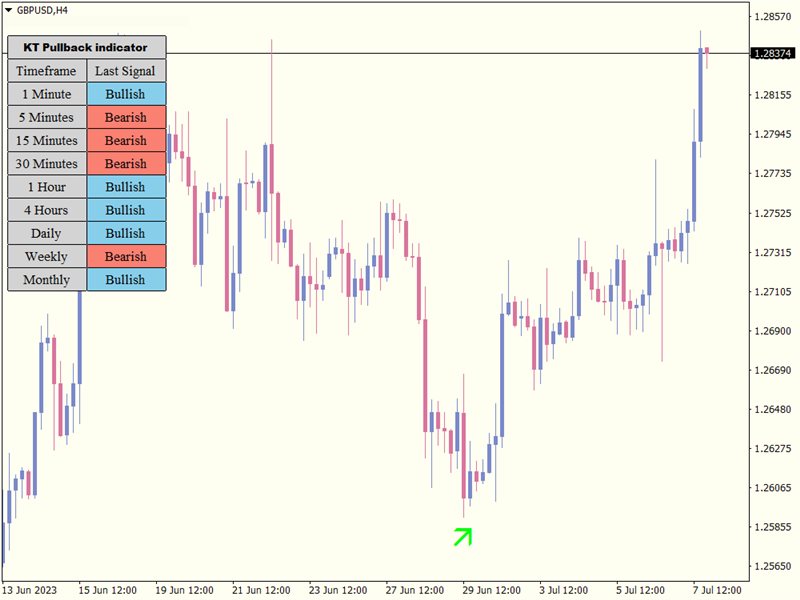

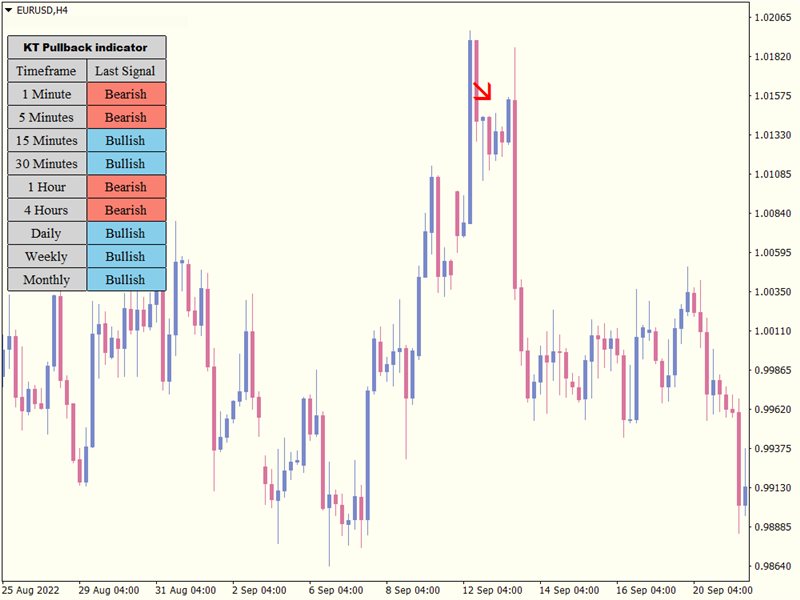

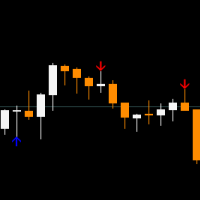

The KT Pull Back Arrows shows the pull back arrows using the RSI (Relative Strength Index) to identify suitable pull-back entry areas within the overbought and oversold zones. The indicator effectively pinpoints favorable moments for initiating pull-back trades by leveraging these RSI thresholds.

Trend trading is often considered the most profitable strategy in the Forex market. It is the equivalent of riding the wave, going with the flow, and capitalizing on market momentum. However, timing is everything in this game. Jumping into a trend too late can be akin to stepping off a cliff - risky and potentially disastrous, often leading to a trade stop-out.

This is where the art of trend retracement or pullback comes into play. But predicting the extent of a trend pullback is no easy feat. Even with the aid of Fibonacci retracement, pinpointing the exact retracement point can be akin to finding a needle in a haystack. But fear not; this indicator will turn the tide in your favour.

Features

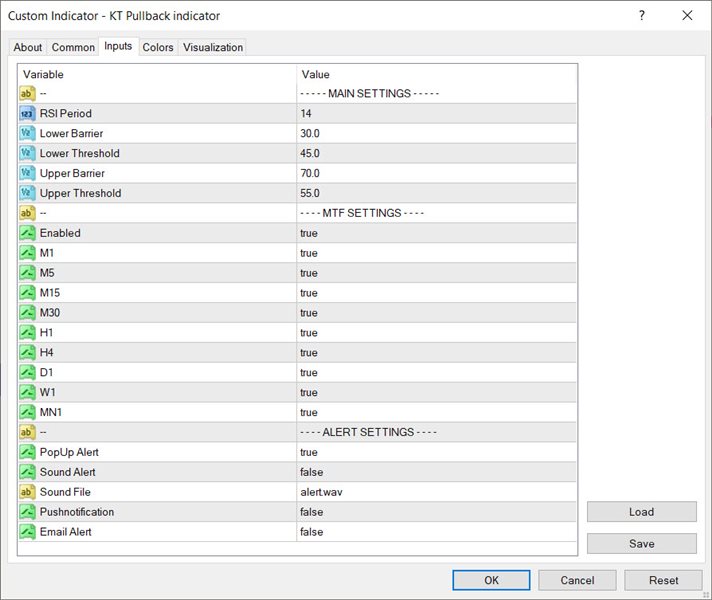

- You can customize the RSI values to adjust the pullback detection according to a particular instrument and timeframe.

- It can be used for both long and short trades.

- The trend direction identification feature works by analyzing the retracement values in relation to the overall market movement.

- It can be used on any instrument your trading platform offers, including FX pairs, Gold, Silver, Indices, Futures, Stocks, etc.

Pro-Tips

- The indicator can be integrated with other technical indicators to enhance its effectiveness. For instance, using it in conjunction with support resistance levels can help confirm the trend direction.

- For instance, in a highly volatile market, you might need to adjust your interpretation of the RSI value or play around with the indicator input settings to optimize your trading strategy.

- To maximize your profits and minimize potential losses, always ensure that your trades have a favorable risk-reward ratio, which can be effectively managed using the pullback entry.