Best Martingale Strategy

- Uzman Danışmanlar

- Zafar Iqbal Sheraslam

- Sürüm: 1.0

- Etkinleştirmeler: 10

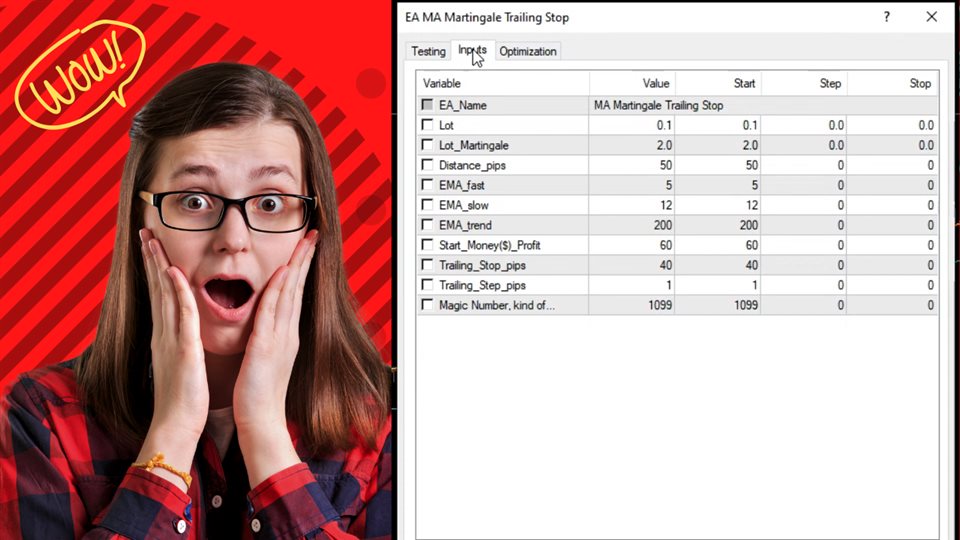

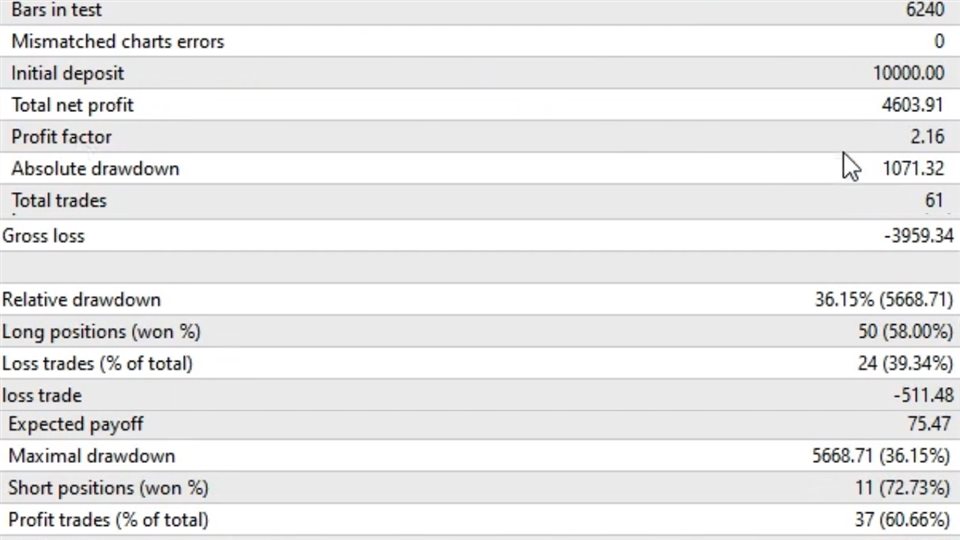

EA Martingale is a popular betting strategy that has been applied to various forms of gambling, including trading and investing. However, it's important to note that Martingale strategies can be extremely risky and are not recommended for serious financial endeavors, as they can lead to substantial losses. This strategy relies on the idea of doubling your bet after each losing trade in the hope of eventually making a profit. Here's how you might apply a Martingale strategy in the context of Electronic Arts (EA) stock trading:

Disclaimer: Martingale strategies are high-risk and not recommended for real-world trading. They can lead to significant losses and should only be used for educational purposes.

Martingale Strategy for EA Stock Trading:

-

Start with an initial investment: Begin with a specific amount of money you are willing to invest in EA stock.

-

Determine your betting unit: This is the amount of money you will initially invest in EA stock. For example, let's say your betting unit is $100.

-

Buy EA stock: Invest your betting unit (e.g., $100) in EA stock.

-

Set a take-profit level: Determine the level at which you want to take your profit. This could be a fixed percentage gain or a specific price point.

-

Set a stop-loss level: Decide on a point at which you will cut your losses to protect your capital.

-

Monitor the trade: If the EA stock price goes up and hits your take-profit level, close the trade and realize your profit.

-

If the stock price goes down (loss occurs):

- Double your bet: Invest twice the amount of your previous bet in EA stock (e.g., $200 if your initial bet was $100).

- Continue to double your bet after each losing trade until you reach your take-profit level or until you decide to stop.

-

Take-profit or stop-loss reached: Once you hit your take-profit level or your predetermined stop-loss level, close the trade regardless of your profit or loss.

Important considerations:

- Martingale strategies can quickly deplete your capital if the stock price continues to move against your trades.

- There is no guarantee that a losing streak will end, and you may run out of capital before you can recover your losses.

- Real-world trading involves transaction costs, which can further erode your capital when using a Martingale strategy.

- It's crucial to have a clear exit strategy and risk management plan in place.

In summary, Martingale strategies are generally not recommended for trading or investing, as they carry significant risks and may lead to substantial losses. It's advisable to explore more conservative and risk-conscious strategies when engaging in financial markets.