Crispr

- Uzman Danışmanlar

- Elvis Wangai Muriithi

- Sürüm: 1.0

- Etkinleştirmeler: 10

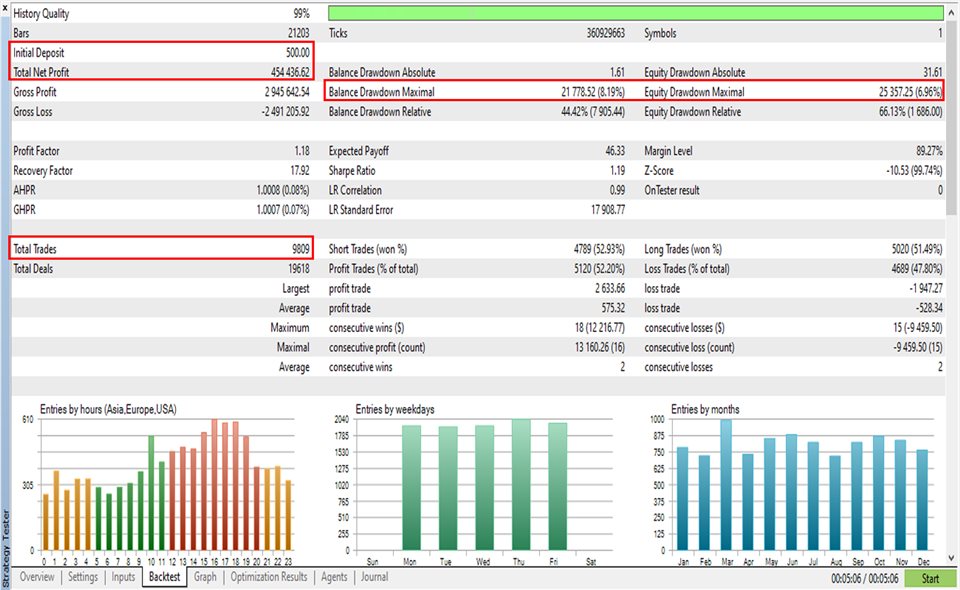

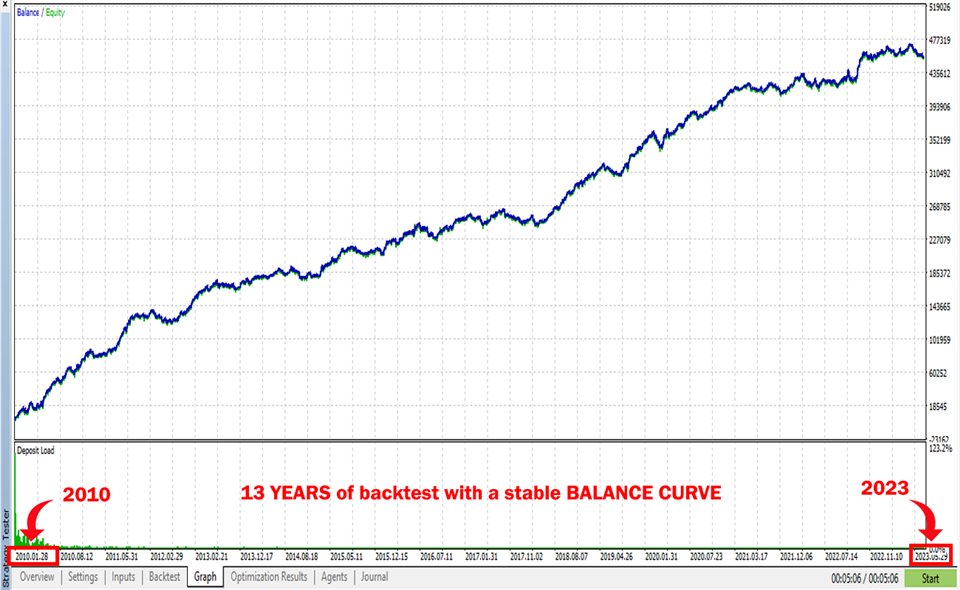

CRISPR is a complex EA which uses more than 6 both traditional and custom indicators to generate high-probability trading setups. Each indicator is a combination of a filter and an entry which has contributed to its stable balance curve over the last 13 years. All trade settings such as SL, TP and trailing stop have been set internally with optimized values which makes the EA a plug and play without having to change the inputs.

Moreover, this EA also has a risk monitoring feature to track both daily and overall drawdown which makes it possible to use it on a prop-firm account.

Advantages of using this EA

- Risk monitoring feature

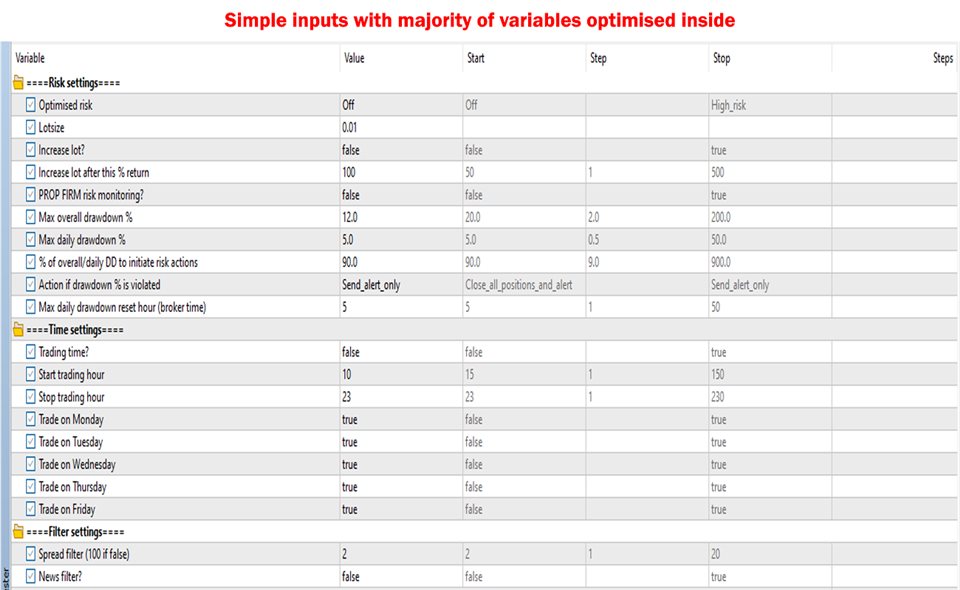

- Plug and play inputs (inputs are very few and user friendly)

- Auto-lot feature

- Each trade has a protective SL and TP

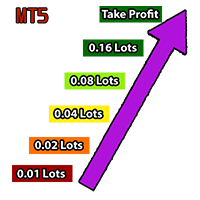

- No risky techniques such as martingale and grid which might cause severe account lose

Symbol and timeframe

This EA is designed to trade GBPUSD market structure on H1 timeframe due to its ranging nature.

Trading account

- Leverage: Any

- Account type: Hedging (Preferably ECN or RAW account)

- Minimum balance: Preferably $200

Input parameters

Risk settings

- Optimized risk: These are dynamic lots calculated internally based on your total account deposit (Recommended for use).

- Increase lots after this % return: For example, if the value is 50% and you are running a $10k account, the lotsize will increase with a certain ratio, once your account balance hit $15k.

- % of overall/daily DD to initiate risk actions: For example if the value is set to 80% and the daily DD is set to 10%, risk actions will be initiated once your daily DD hits 8% (80% of 10%).

- Action if daily/overall DD is violated: The action you need the EA to perform when the DD percentages are violated. Can be either to send the alert to the user or close all positions.