İş Gereklilikleri

Options I would need,

- Enter the trade immediately after the trading signal or enter the trade after the closing candle.

- On & Off Buy/Sell Trading

- Close the position after a reversal signal or not.

- Maximum of 2 trades at the same time.

- TP & SL in points or Trailing stop

- Fixed lots or % risk based on balance

- Long Position On/Off Function: The long position strategy is applied only when the long position is "on." If it is "off," the long position strategy is not applied.

- Short Position On/Off Function: The short position strategy is applied only when the short position is "on." If it is "off," the short position strategy is not applied.

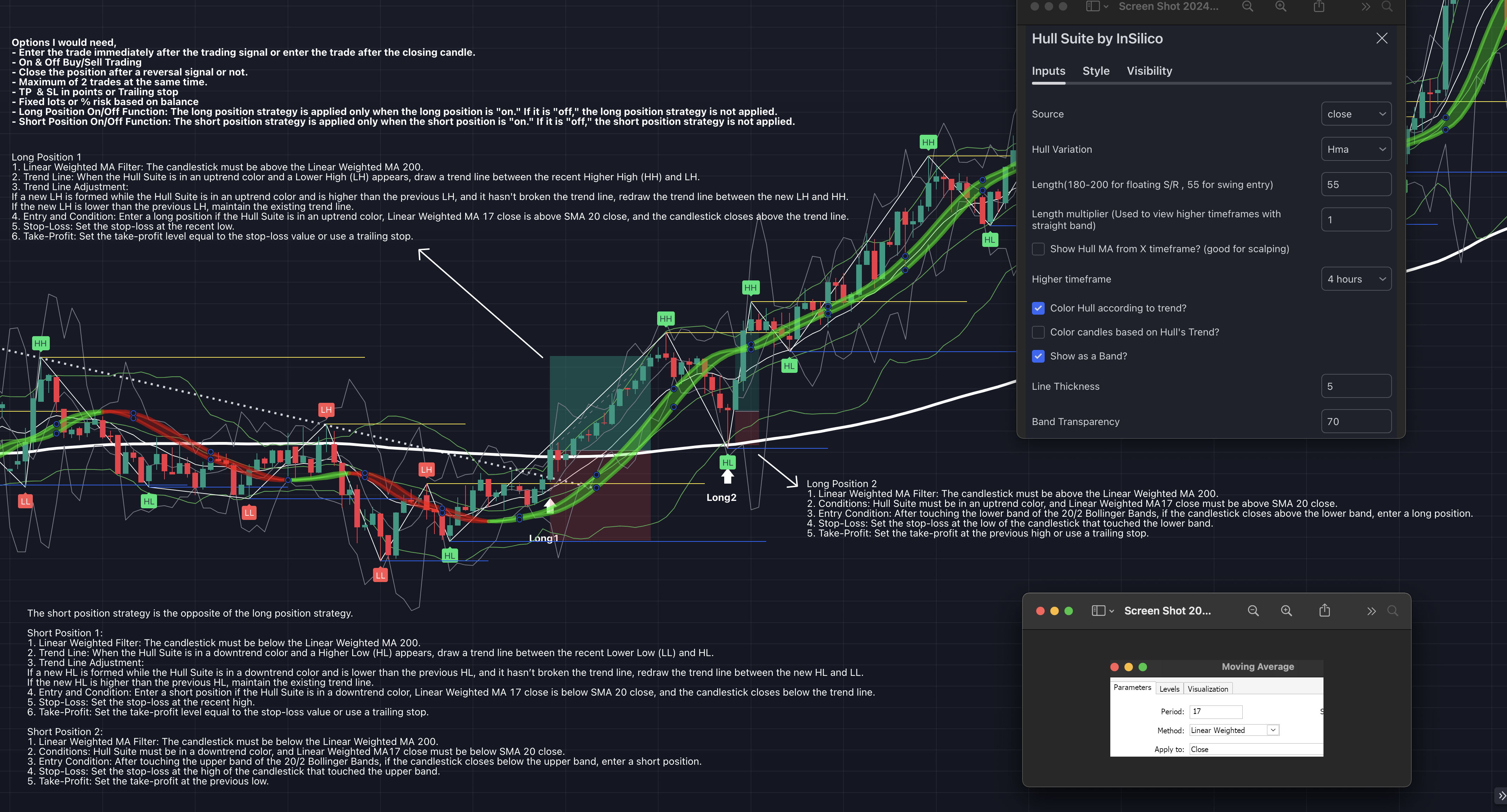

Long Position 1

1. Linear Weighted MA Filter: The candlestick must be above the Linear Weighted MA 200.

2. Trend Line: When the Hull Suite is in an uptrend color and a Lower High (LH) appears, draw a trend line between the recent Higher High (HH) and LH.

3. Trend Line Adjustment:

If a new LH is formed while the Hull Suite is in an uptrend color and is higher than the previous LH, and it hasn't broken the trend line, redraw the trend line between the new LH and HH.

If the new LH is lower than the previous LH, maintain the existing trend line.

4. Entry and Condition: Enter a long position if the Hull Suite is in an uptrend color, Linear Weighted MA 17 close is above SMA 20 close, and the candlestick closes above the trend line.

5. Stop-Loss: Set the stop-loss at the recent low.

6. Take-Profit: Set the take-profit level equal to the stop-loss value or use a trailing stop.

Long Position 2

1. Linear Weighted MA Filter: The candlestick must be above the Linear Weighted MA 200.

2. Conditions: Hull Suite must be in an uptrend color, and Linear Weighted MA17 close must be above SMA 20 close.

3. Entry Condition: After touching the lower band of the 20/2 Bollinger Bands, if the candlestick closes above the lower band, enter a long position.

4. Stop-Loss: Set the stop-loss at the low of the candlestick that touched the lower band.

5. Take-Profit: Set the take-profit at the previous high or use a trailing stop.

The short position strategy is the opposite of the long position strategy.

Short Position 1:

1. Linear Weighted Filter: The candlestick must be below the Linear Weighted MA 200.

2. Trend Line: When the Hull Suite is in a downtrend color and a Higher Low (HL) appears, draw a trend line between the recent Lower Low (LL) and HL.

3. Trend Line Adjustment:

If a new HL is formed while the Hull Suite is in a downtrend color and is lower than the previous HL, and it hasn’t broken the trend line, redraw the trend line between the new HL and LL.

If the new HL is higher than the previous HL, maintain the existing trend line.

4. Entry and Condition: Enter a short position if the Hull Suite is in a downtrend color, Linear Weighted MA 17 close is below SMA 20 close, and the candlestick closes below the trend line.

5. Stop-Loss: Set the stop-loss at the recent high.

6. Take-Profit: Set the take-profit level equal to the stop-loss value or use a trailing stop.

Short Position 2:

1. Linear Weighted MA Filter: The candlestick must be below the Linear Weighted MA 200.

2. Conditions: Hull Suite must be in a downtrend color, and Linear Weighted MA17 close must be below SMA 20 close.

3. Entry Condition: After touching the upper band of the 20/2 Bollinger Bands, if the candlestick closes below the upper band, enter a short position.

4. Stop-Loss: Set the stop-loss at the high of the candlestick that touched the upper band.

5. Take-Profit: Set the take-profit at the previous low.