Fan sayfamıza katılın

Öyleyse bir link gönderin -

başkalarının da faydalanmasını sağlayın

- Görüntülemeler:

- 12545

- Derecelendirme:

- Yayınlandı:

- 2020.09.25 21:37

- Güncellendi:

- 2020.09.26 23:30

-

Bu koda dayalı bir robota veya göstergeye mi ihtiyacınız var? Freelance üzerinden sipariş edin Freelance'e git

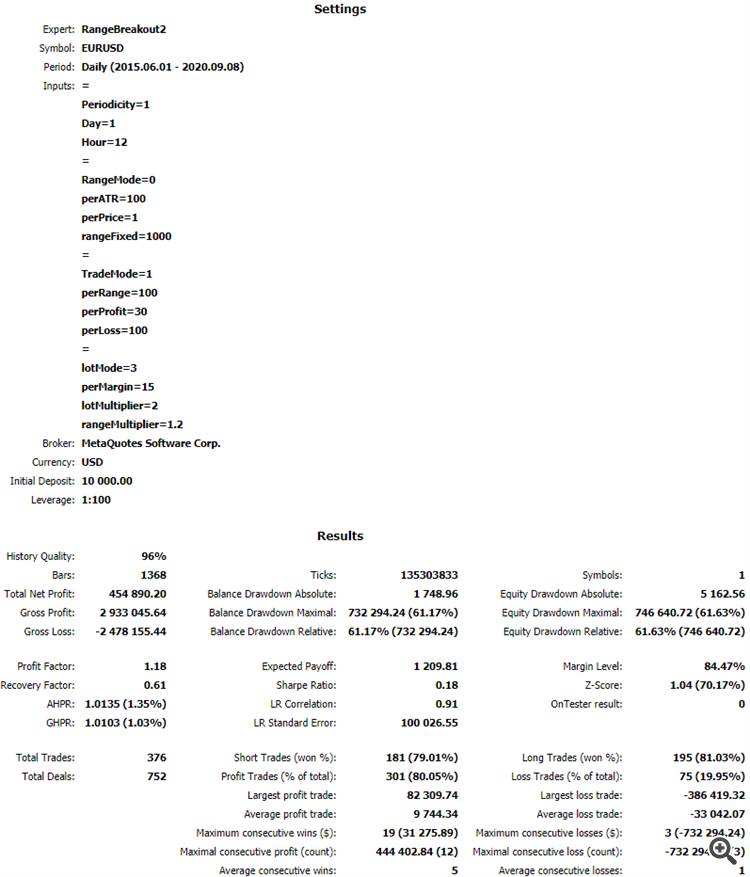

This expert has extended features relative to the previous. Please examine the previous one before proceeding. Periodic Range Breakout 1.0

[WARNING]

- The main purpose of this purely mechanical expert is to make use of statistical and analytical observations to gain insight into how markets work.

- Using it for trading could result in financial loss.

[MAIN IDEA]

- At the beginning of the period, we'll take the current value of the time-dependent variable which in case ask price of an fx instrument as a reference.

- Then performing addition and subtraction on this value by user-specified range to obtain high and low breakout levels.

- If price breaks high level upward buy-stop or sell-limit order will get opened.

- If price breaks low level downward buy-limit or sell-stop order will get opened.

- Take-Profit and Stop-Loss levels are determined by taking specific portion of the range in pips.

- If trade ends with loss, it will get compensate it in the next trade if requested by user by incrementing volume or take-profit level as set.

[MAIN FEATURES]

- PERIODICITY MODES

- Weekly: take close price of a specific hour of a day of week as reference.

- Daily: take close price of a specific hour of any day as reference.

- NonStop: take current price immediately as reference, if there isn't any trade opened.

- RANGE CALCULATION MODES

- ATR: user-specified percentage of ATR(20).

- Percent: user-specified percentage of current price.

- Fixed: constant user-specified pips.

- TRADE MODES

- Stop: if high breaks open buy, if low breaks open sell.

- Limit: if high breaks open sell, if low breaks open buy.

- Random: randomly select orders. doesn't work in tester mode.

- TRADE PARAMETERS

- Range Percentage: percentage of calculated range used to evaluate take-profit and stop-loss.

- Take-Profit Percentage: take-profit in pips as percentage of derived range.

- Stop-Loss Percentage: stop-loss in pips as percentage of derived range.

- LOT MANAGEMENT MODES

- Constant: never increment volume after loss.

- Linear: multiply volume by linearly incremented coefficients after loss. (1, 2, 3, 4, ...)

- Martingale: multiply volume by a number between 1 and 2 after loss.

- Fibonacci: increment volume as fibonacci sequence after loss. (1, 1, 2, 3, 5, 8, ...)

- OTHER MONEY MANAGEMENT PARAMETERS

- Margin Percentage: how much of free margin will be used in trade initally or trade after winning trade.

- Lot Multiplier: multiplier used in martingale mode.

- Range Multiplier: multiplier used to increment take profit level after each loss. this was based on an assumption that previous loss increases the interval of success.

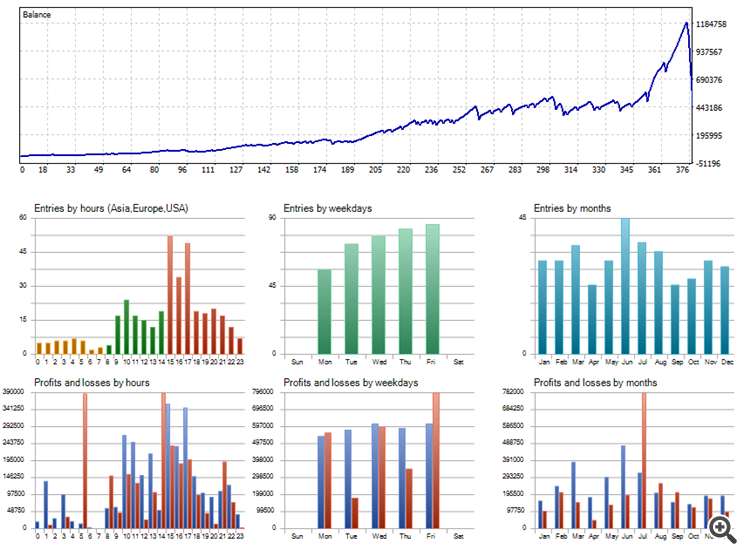

[OBSERVATIONS]

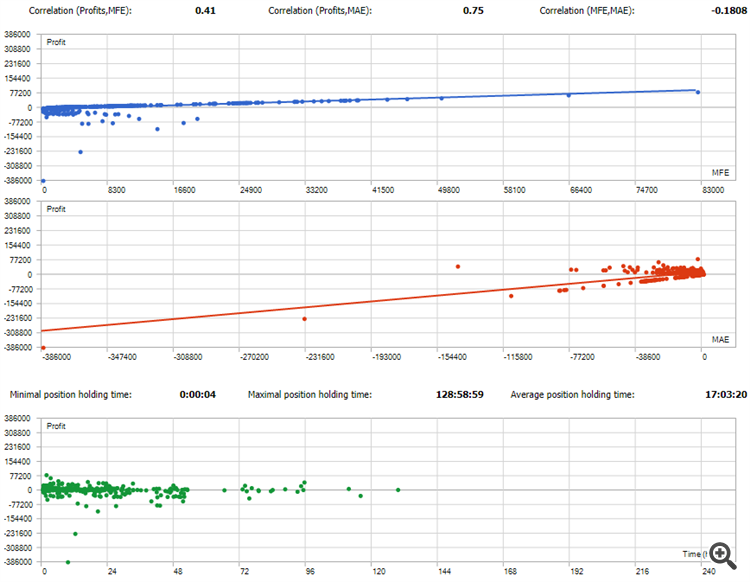

- Profit and Loss counts are highly dependent on the selection of take-profit and stop-loss ratios. if these ratios converges counts are converges also and vice versa.

- Lower take-profit ratio relative to stop-loss increases chance of success in short term, but rare cases like consecutive losses greater than expected crashes equity. randomizing will reduce the probability of encountering these types of risk.

Get Last Deal History

Get Last Deal History

This script is to get the last deal history data, for example : profit, deal type, etc, and put the Comment on the chart.

Proxy - structural design pattern

Proxy - structural design pattern

Provide a surrogate or placeholder for another object to control access to it

Attractive Market Watch List for Potential Entries

Attractive Market Watch List for Potential Entries

Are you tired and lost when it comes to creating an attractive market watch list ? You always see pro traders creating an attractive market watch list in which they draw support/resistance and create all possible scenario ? Well we will guide you step by step to create your own attractive market watch list for potential entries.

Chain of responsibility - behavioral design pattern

Chain of responsibility - behavioral design pattern

Avoid coupling the sender of a request to its receiver by giving more than one object a chance to handle the request. Chain the receiving objects and pass the request along the chain until an object handles it