Fan sayfamıza katılın

Öyleyse bir link gönderin -

başkalarının da faydalanmasını sağlayın

- Görüntülemeler:

- 36006

- Derecelendirme:

- Yayınlandı:

- 2017.09.25 08:28

- Güncellendi:

- 2019.02.04 15:32

-

Bu koda dayalı bir robota veya göstergeye mi ihtiyacınız var? Freelance üzerinden sipariş edin Freelance'e git

The indicator identifies consecutive High candles and consecutive Low candles. The first candle must have an (x) pip long adjustable body for the first condition to be met, the candle must also be below or equal to the 20 stochastic level for consecutive High candles or above or equal to the 80 stochastic level for consecutive Low candles. You can set your own stochastic levels.

If the above conditions are met, then the indicator looks at candle 2. Candle 2 must also have an (x) pip long adjustable body for the condition to be met, however, it is not dependent on the stochastic levels. If conditions for candle two are met then the indicator will send an alert just after candle 1 closes and place an arrow on the chart.

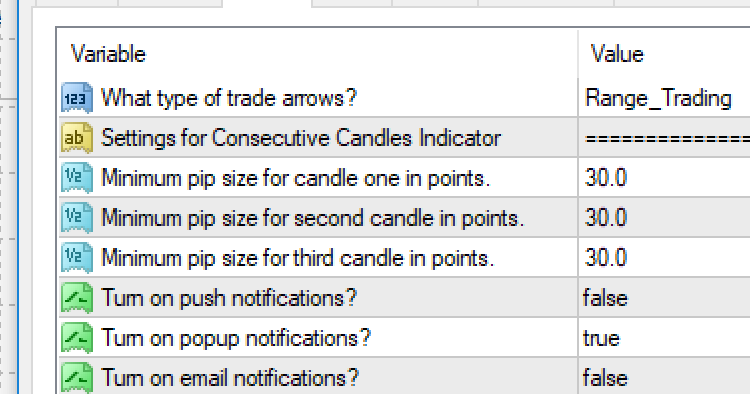

Inputs of interest

- Minimum pip size for candle one. Pips in actual points, this is automatically converted for 4-digit brokers.

- Minimum pip size for second candle.

- Minimum pip size for third candle.

- Turn on push notifications?

- Turn on popup notifications?

- Turn on email notifications?

- Arrow? Choose between Trend_Trading, Range_Trading, or No_Arrows.

- Candles before alert. Options are two or three

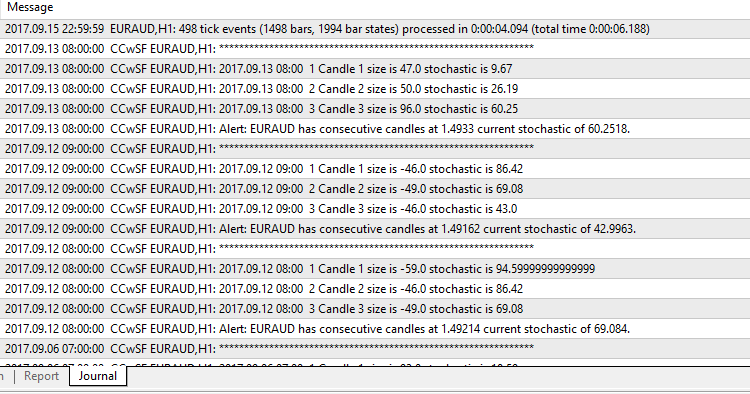

- Verbose = Turn details on or off in Expert Tab

- KPeriod = 5

- Slowing = 3

- DPeriod = 3

- MAMethod = sma

- PriceField = close/close

- overBought = 80

- overSold = 20

- BuyColor = Green

- SellColor = Red

For the purpose of clarity, let us divide trading styles into two types trend or range. With trend trading, if the price is going up you expect when you place your trade for it to continue in the same direction. With range trading, you expect the price to reverse so you place a trade in the opposite direction of recent movement.

So for example if three large bullish bars print according to your pip size specification and the stochastic was overbought at the time of the first bar printing are you expecting price to continue going up, and thus would like an up arrow printed on the chart, or if range trading and you would want a print down arrow at that time expecting price to go lower now that it has been in overbought territory for some time.

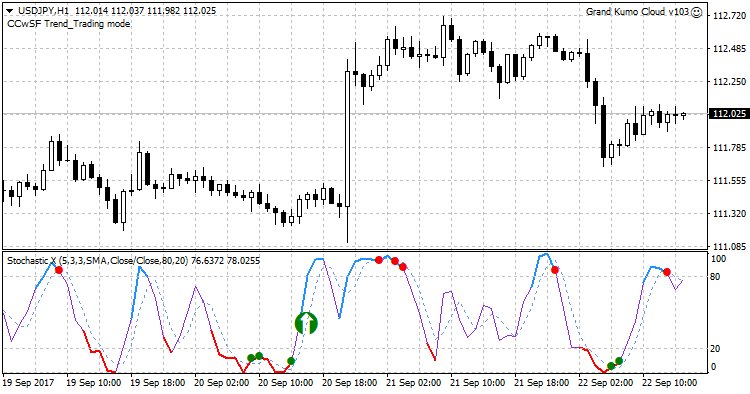

Trend Mode

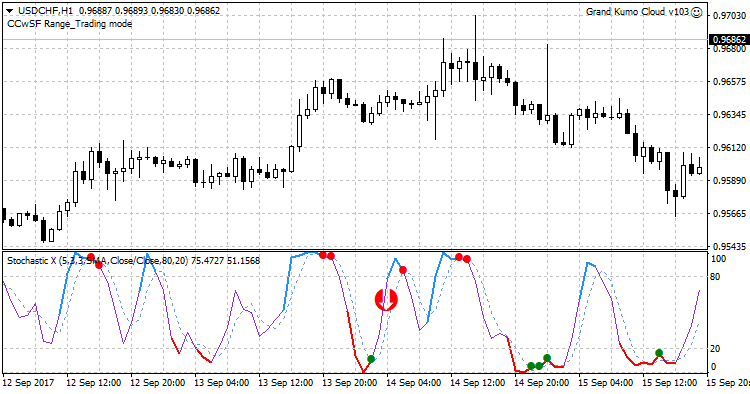

Range Mode

Some Inputs

Verbose Mode

Simpler Trend

Simpler Trend

Get a grasp of the current trend by candle colors.

All In One Divergence

All In One Divergence

Indicator to trade divergence. One of 30 indicators can be selected.

News EA Template Without DLL From 2 Sources

News EA Template Without DLL From 2 Sources

The functions included in this template use two news sources - Investing.com and Dailyfx.com. The template doesn’t use DLL.

Simple Regression Channel

Simple Regression Channel

As simple Regression Channel code for MetaTrader 4.