I tried in both italian and english forum, i got no answers :(

хорошо

используйте

riskPerc

который присутствует в Вашем листинге, от 1 до 100

при этом

если 100, то это значит, что у Вас на маржу будет использовано 100% депозита

также, в расчете лота, не учтено плечо

лучше всего изменить функцию расчета лота на другую и сначала попробовать на демосчетах с разным плечом

SYMBOL_TRADE_CONTRACT_SIZE

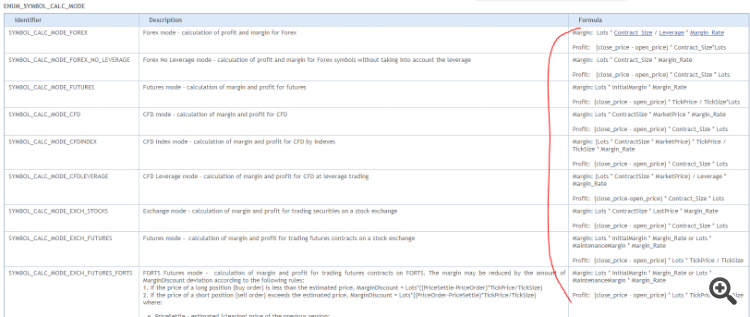

Each market has its own calculation formula

https://www.mql5.com/en/docs/constants/environment_state/marketinfoconstants

- www.mql5.com

Hi everyone, I should start by saying that I’m quite a beginner, so please forgive me if the question might seem a bit silly. Let's take an example: I have an account with 10k dollars, contract size = 1, and leverage = 1:25. I want to open a position on US30 with a 490 pip stop loss, with 1% risk. If I calculate the lot size through https://www.cashbackforex.com/tools/position-size-calculator, it tells me that the correct lot size is 2.041 Lots. It is the same result I get using this simple function that I wrote after watching some videos tutorial about how to compute it:

The problem is that if I apply that lot size, once the stop loss is hit, it wipes out almost (not all my account cause i round the lot size to 2) my entire account. Specifically, it seems that the lot size is 100 times greater than it should be, meaning I’m risking 100% instead of 1% (lol). Can anyone help me understand what I missed? I suspect that leverage might have something to do with it since I'm not considering it in the calculations, but I'm not sure at all.

Entry: 33768.10

SL: 33719.10

--> -9900 $

Приведенный код написан странно.

Посмотрите готовый пример из книги LotMarginExposureTable.mq5 (https://www.mql5.com/en/book/automation/experts/experts_ordercalcmargin) - все исходники есть в кодебазе.

В частности, для US30m при заявленном депозите, риске 1% и дистанции стоп-лосса (490 пунктов - если отличаете от пипсов, то сами сконвертируйте), получаем лот 0.2

- www.mql5.com

- Бесплатные приложения для трейдинга

- 8 000+ сигналов для копирования

- Экономические новости для анализа финансовых рынков

Вы принимаете политику сайта и условия использования

Hi everyone, I should start by saying that I’m quite a beginner, so please forgive me if the question might seem a bit silly. Let's take an example: I have an account with 10k dollars, contract size = 1, and leverage = 1:25. I want to open a position on US30 with a 490 pip stop loss, with 1% risk. If I calculate the lot size through https://www.cashbackforex.com/tools/position-size-calculator, it tells me that the correct lot size is 2.041 Lots. It is the same result I get using this simple function that I wrote after watching some videos tutorial about how to compute it:

The problem is that if I apply that lot size, once the stop loss is hit, it wipes out almost (not all my account cause i round the lot size to 2) my entire account. Specifically, it seems that the lot size is 100 times greater than it should be, meaning I’m risking 100% instead of 1% (lol). Can anyone help me understand what I missed? I suspect that leverage might have something to do with it since I'm not considering it in the calculations, but I'm not sure at all.

Entry: 33768.10

SL: 33719.10

--> -9900 $