ANALYSIS.

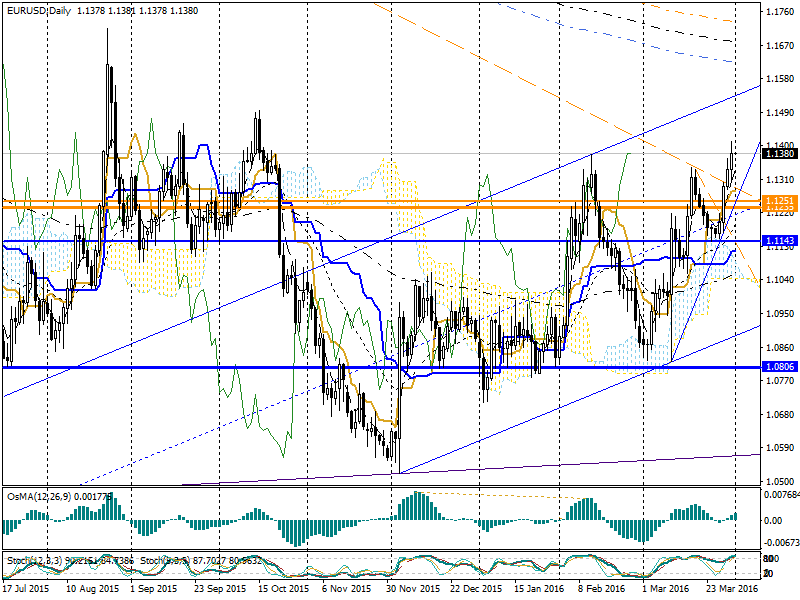

Last month, the couple started Open (1.0880) with testing (Down W1 broken channel), then was made up of the expected pullback correction (Up W1 channel), a sharp decrease of EMA120 to Low (1,0821) and rollback continuation of settlement penetration resistance S1-m level to High (1,1411) and Close (1,1269).

Video: https://youtu.be/ulTmRZPUajE

FORECAST.

Calculated monthly level:

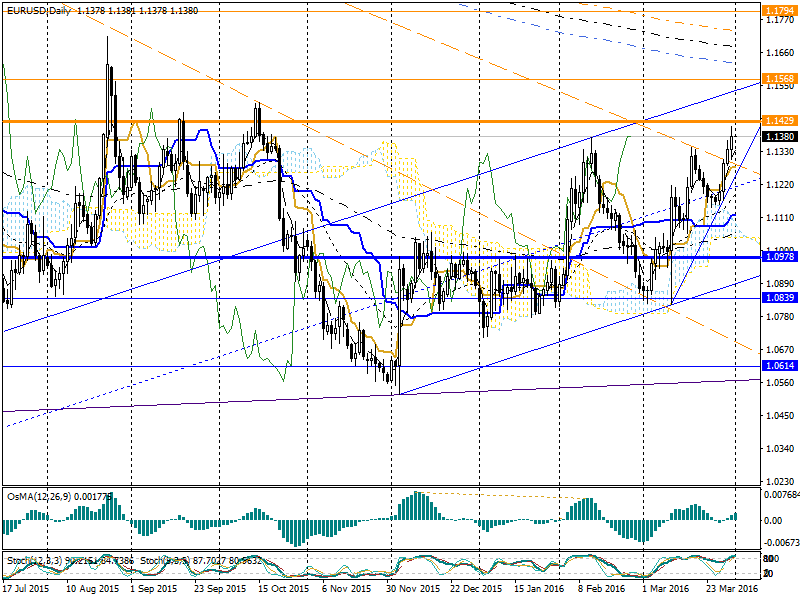

Support (S1-m / S2 / S3 = 1.0978 / 1.0839 / 1.0614), resistance (R1-m / R2 / R3 = 1.1429 / 1.1568 / 1.1794).

Key support levels (1st from 1.1090 to 1.1200 late in the day, 2nd 1, 1043 to 1.1100).

The pair is adjusted upward channel Up W1 canal (from 1.0895 to 1.1022).

Trending indicators Ichimoku, EMA24, EMA120 indicate the general direction of movement UP-quotations.

Indicator OsMa marked decrease in activity of bulls on test (Down W1 broken), which provides the basis for planning of trading correction.

Given the orientation of oscillators Stochastics, expect a test levels (R1-m, Ddown W1 broken, and up H4), where it is recommended to consider the activities of the parties on the charts of smaller timeframes.

For shopping, on condition of formation reversal entry points may be the following turn: upH4, DownW1, middle of channel Up W1, EMA24, EMA120, key support levels.

The target levels of long positions is calculated resistance levels R1-m, R2, EMA 521, R3.

For correction of alternative sales, on condition of formation of reversal levels (R1-m,) and breakdown below (UpH4, middle of Up W1 channel), target levels are equal EMA120, key support levels to S1-m and Up W1 chanel.

Video: https://youtu.be/11SMEV9M8pg