Crypto Bull Rider

- Experts

- Roberto Lo Baido

- Versão: 1.4

- Atualizado: 24 maio 2024

- Ativações: 5

Crypto Bull Rider is an Expert Advisor that uses a statistical study on historical BITCOIN data.

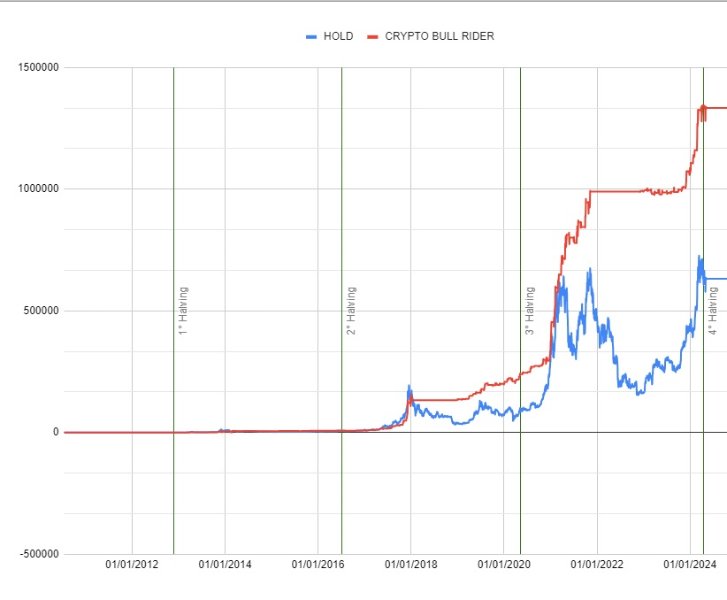

This study identifies the time windows (between the various Halvings) during which BTCUSD is Bullish and automates the opening and closing of medium-term LONG positions.

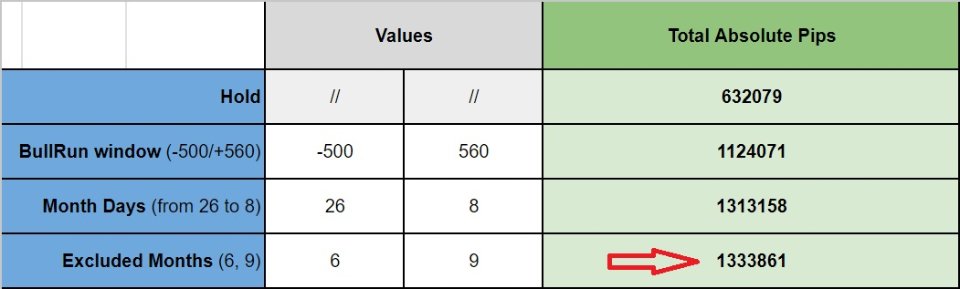

This kind of trading has proven to be more effective than a simple Bitcoin BUY & HOLD strategy, because it only rides the BULLISH periods discarding the CRYPTO WINTER periods (see screenshot of the comparison chart).

Default settings are optimized based on the statistical study, but can be modified at will.

The EA works like this:

- Opens only one trade at a time on the market.

- It operates only during the Bullish window, i.e. between N days before and N days after Halvings.

- Inside this window:

- It holds the position only on some days of the month.

- It excludes some months that have proven to be unprofitable on a statistical basis.

- It excludes, if selected, some days of the week.

The EA only works on BTCUSD even if loaded on other assets and works on daily timeframe even if loaded on different TimeFrames.

Once loaded, a dashboard appears on the chart showing the EA status and, at the top, 5 cells indicating the operational status (Active in GREEN/Not active in RED) for the days from yesterday onwards for 5 days.

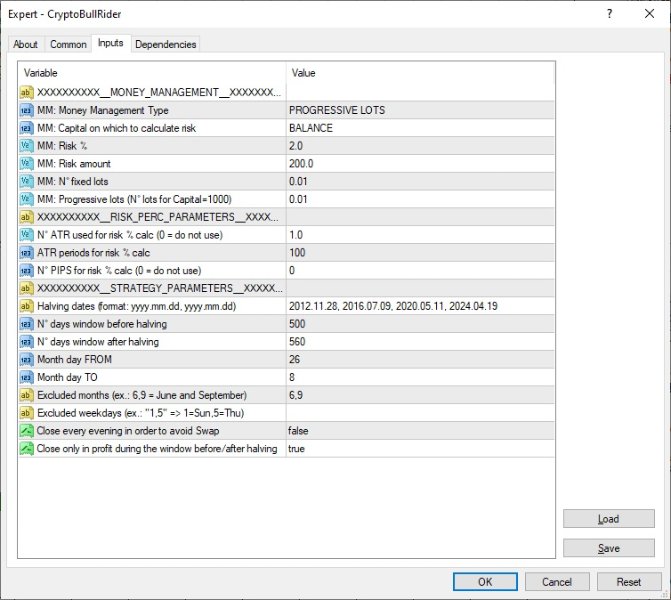

PARAMETER DESCRIPTION (THE PRESET PARAMETERS ARE THE SUGGESTED ONES):

Money Management

- Money Management Type: you can choose between 4 types of money management:

- Risk %: Risk capital percentage for each trade.

- Fixed Amount: Fixed amount of capital risk for each trade.

- Fixed Lots: Fixed number of lots for each trade.

- Progressive Lots: Number of lots proportional to current capital.

- Capital on which to calculate risk: it is possible to choose whether to use BALANCE or EQUITY for money management modes 1,2 and 4.

- Risk % (mod. 1): percentage of capital risk.

- Risk Amount (mod. 2): Amount to risk.

- N° fixed lots (mod. 3): n° of fixed lots.

- Progressive lots (mod. 4): number of lots for a 1000 capital (if the capital is different, the lots will be calculated proportionally).

Parameters for risk management (mod. 1 and 2)

- N° of ATRs used for risk % calc: number of ATRs to use for the calculation of the Stop Loss, necessary for the mods. 1 or 2. The Stop will only be calculated to find the number of Lots to trade, but will not be set.

- ATR periods for risk % calc: number of periods for calculating ATRs.

- N° Pips for risk % calc: as an alternative to ATRs, you can set a fixed number of Pips for risk.

Strategy parameters

- Halving dates: set the Halving dates (past + an estimate of the next one).

- N° days window before Halving: n° days before a Halving (start of Bullish period).

- N° days window after Halving: n° days after a Halving (end of Bullish period).

- Month day FROM: day of the month from which to start operations.

- Month day TO: day of the month on which to end operations.

- Excluded months: excluded months.

- Excluded weekdays: excluded days of week.

- Close every evening in order to avoid Swap: closes the operation every evening before midnight to reopen it shortly after the bar change to avoid the SWAP. We do not recommend activating this option because what you save in SWAP is most of the time less than what you lose in commissions and SPREAD.

- Close only in profit during the window before/after Halving: if a trade is in loss it is not closed during the excluded periods, but remains open until it returns in profit or until the Bullish window closes.

The expert advisor is based, as already mentioned, on an accurate statistical study that describes how BTCUSD behaved during previous Halvings, but even if accurate, a study of past data cannot be a guarantee of future results.