US DOLLAR – Is a Summer Rate Hike Dead? We’ll find out from the Fed

Data Review

· Jobless Claims 264K vs. 268K Previous

· University of Michigan Consumer Sentiment Index 94.3 vs. 94.7 Previous

· UMich Expectations 83.2 vs. 84.9 Previous

Data Preview

· Retail Sales – Potential upside surprise given higher gas prices and stronger spending reported by Johnson Redbook

· Empire State & Philly Fed – Manufacturing Sector Could Benefit from Weaker Dollar in June

· CPI & PPI – Looking for inflation to rise given uptick in gas prices

· Housing Starts & Permits – Potential downside surprise given strong April numbers

Key Levels USD/JPY

· Support 105.50

· Resistance 108.00 then 110.00

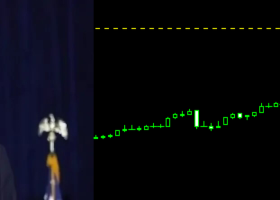

Here’s a look at how the major currencies performed against the USD this past week.

As you can see, there wasn’t much consistency. The dollar ends the week higher against euro and the British pound, unchanged against the Japanese Yen and Australian dollar and weaker versus the Swiss Franc, Canadian and New Zealand dollars.

The big story for the dollar this week was Fed Chair Janet Yellen’s speech on Monday. She avoided saying that “rates will rise in the coming months,” and that sent the dollar tumbling because investors interpreted it to mean that a summer rate hike won’t be happening. U.S. data and the Federal Reserve’s monetary policy announcement will be the main focus but there are key releases from many parts of the world that can have a significant impact on currencies. This means it won’t be a week where direction is dictated solely by the market’s appetite for U.S. dollars. Instead there will be just as many if not more opportunities for relative value plays in currency crosses. Had last week’s non-farm payrolls report been strong, investors would have been looking for the Fed to set the stage for a July rate hike but now the chance of July tightening has fallen to 20%.

Yet the FOMC statement and Janet Yellen’s press conference will still rock the dollar because investors are on the fence about the timing of the next rate hike. If Yellen refrains from saying that rates could rise in the coming month(s) and expresses concerns about the economy, the dollar will extend its slide but if she is even slightly more hawkish than the market expects, the dollar will rise quickly and aggressively. The Fed’s rate decision is on Wednesday and U.S. retail sales are scheduled for release on Tuesday which means consumer spending will shape the market’s expectations for FOMC. There is also a Bank of Japan monetary policy announcement but with the upward revision to GDP, no changes are expected. BoJ Governor Kuroda could strike a dovish tone that may send the yen slightly lower but the impact on the currency should be limited.