📌 -69,802 USD: Dollar/Yen Breaks Below 150, Watching for Opportunities to Ride the Yen Appreciation Trend

📌 -69,802 USD: Dollar/Yen Breaks Below 150, Watching for Opportunities to Ride the Yen Appreciation Trend

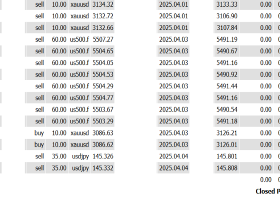

✅ Trade Results for February 17 - February 21: -69,802 USD

📌 Weekly Forex Outlook (Week of February 24, 2025)

🎯 Dollar/Yen (USD/JPY)

- Expected Range: 148.00-153.00 JPY

- Direction: Downside risk remains, potential for continued yen appreciation trend

- Key Points:

- February 24: U.S. January PCE Deflator

- Forecast: 2.6% YoY (Could strengthen expectations for a Fed rate cut)

- February 27: U.S. Q4 GDP Revised Figures

- Stronger revision could boost the dollar, weaker revision could lead to dollar selling

- Tokyo Metropolitan CPI for February:

- May boost expectations for additional rate hikes by the Bank of Japan

- February 24: U.S. January PCE Deflator

🎯 Euro/Dollar (EUR/USD)

- Expected Range: 1.0300-1.0700 USD

- Direction: Focus on additional rate cut expectations and Ukraine situation

- Key Points:

- ECB Meeting Minutes:

- If dovish signals emerge, euro selling could dominate

- Ukraine Ceasefire Negotiations:

- If no progress, risk-off sentiment may lead to euro selling

- EU-US Tariff Negotiations:

- Hawkish stance could pressure the euro; a conciliatory tone could support the euro

- ECB Meeting Minutes:

🎯 Gold (XAU/USD)

- Expected Range: 2920-3000 USD

- Direction: Steady upward trend, continued demand as a safe haven asset

- Key Points:

- U.S. Inflation Data:

- Weaker results could lower rate expectations, boosting gold

- Ukraine Situation:

- Geopolitical risk escalation could maintain upward momentum

- U.S. Inflation Data:

📌 Strategy for This Week

- Assess the Yen Appreciation Trend: If USD/JPY falls below 150, look for further yen appreciation opportunities.

- Be Cautious with Euro Shorts: With the German general election approaching, keep positions light.

- Buy Bitcoin on Dips: Aim for short-term rebounds.

- Stay Neutral on Gold: Avoid new entries until a clear direction emerges.

📌 Summary

- U.S. Dollar: Fed rate cut expectations may increase depending on inflation data.

- Euro: ECB rate cut expectations and the Ukraine situation are key.

- Yen: Strong Japanese CPI could lead to more rate hike expectations and yen appreciation.

- Bitcoin: Look for rebound opportunities with short-term trades.

- Gold: Stay on the sidelines until a clear signal emerges.

📈 This week, prioritize risk management and maintain cautious entries!

Final Thoughts

💪 "Core Strength" is Key in Both Trading and Fitness!

Just as building "core strength" in trading involves strengthening mental resilience and strategic foundations, enhancing your physical core is crucial for health and performance. A strong core supports posture, balance, and stability, benefiting everyday life, sports, and those long hours of trading.

🏋️♂️ What is the Core?

The core encompasses not just the abdominal muscles but also the back and pelvic area, including:

- Rectus Abdominis: The "six-pack" muscles, involved in forward bending.

- Obliques: Help with twisting and side bending.

- Transverse Abdominis: Deep core muscles that stabilize the trunk and maintain posture.

- Erector Spinae: Back muscles that support posture and back extension.

- Multifidus: Small muscles that support spinal stability.

- Pelvic Floor, Diaphragm, Glutes: Contribute to pelvic stability, breathing, and lower body support.

🧘♂️ Core Exercises for Different Levels

🟢 Beginner Level

- Bridge:

- Benefits: Strengthens glutes, thighs, and core stability.

- How-to:

- Lie on your back, knees bent, feet hip-width apart.

- Lift hips, keeping a straight line from knees to shoulders.

- Hold for 10-30 seconds, then slowly return to the floor.

- Repeat 3-5 times.

- Crunch:

- Benefits: Targets the rectus abdominis for defined abs.

- How-to:

- Lie on your back, knees bent at 90 degrees.

- Cross arms over chest or lightly support your head.

- Engage core, lift shoulders off the floor slightly.

- Lower slowly, repeat 8-12 times for 1-2 sets.

🟠 Intermediate Level

- Plank:

- Benefits: Engages core, back, shoulders, and legs.

- How-to:

- Start in a push-up position, forearms or hands on the floor.

- Maintain a straight line from head to feet.

- Hold for 10-30 seconds, repeat 3-5 times.

- Bird Dog:

- Benefits: Improves balance and core stability.

- How-to:

- Start on all fours, extend right arm and left leg straight.

- Hold balance, then switch sides.

- Repeat 8-12 times per side.

🔴 Advanced Level

- Mountain Climber:

- Benefits: Enhances cardio while strengthening the core and legs.

- How-to:

- From plank position, alternate bringing knees to chest quickly.

- Maintain steady rhythm, aim for 8-12 reps per set.

- Turkish Get-Up:

- Benefits: Boosts full-body strength, mobility, and core stability.

- How-to:

- Lie on your back holding a light dumbbell in your right hand.

- Rise to standing while keeping the weight overhead.

- Return to the starting position slowly.

- Perform 3-5 reps per side.

📝 Conclusion

Strengthening your "core" both mentally for trading and physically for everyday stability is vital. As market volatility increases, a strong mental and physical foundation will support calm decision-making and sustained performance. By reinforcing both your trading strategy and physical health, you can navigate market waves with confidence and stability.

Let's tackle the market with a solid core—physically and mentally—and build a steady and prosperous trading journey!