すべてのブログ

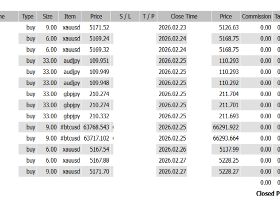

+178,420 USD | Reading the Market Through Four War Scenarios 📈 Weekly Performance Report February 23 – February 27 +178,420 USD...

📊 Technical Analysis — February 27, 2026 🧭 Market Structure ✔ Gold: Strong Buy across all timeframes ✔ BTC: Strong Sell across all timeframes ✔ USD/JPY: Short-term correction, Daily still strong...

📊 Technical Analysis — February 25, 2026 🧭 Market Structure “A full-fledged JPY-weak trend market. Cross-yen pairs are the main drivers...

🗞️ USD and JPY Both Weaken — Will the Trend Continue Overseas...

🗞️ Dollar Selling Dominates as Trump Tariff Uncertainty Weighs on Markets...

📊 Technical Analysis — February 20, 2026 🧭 Market Structure “Short-term risk-on rebound. Higher timeframes still at a crossroads...

🗞️ Will USD strength and JPY weakness continue? U.S. GDP and PCE are the pivot 🎯 Today’s focus Confirm whether the USD-up / JPY-down trend can hold via the advance U.S. GDP and PCE inflation data...

🧲 FX Option Expiries Overview – February 19, 2026 📍 Spot Levels EUR/USD: 1.1798 USD/JPY: 155.04 GBP/USD: 1.3496 USD/CHF: 0.7721 USD/CAD: 1.3687 AUD/USD: 0.7064 NZD/USD: 0.5979 EUR/GBP: 0.8737...

🗓️ Dollar Buying Continues but Pauses in London – Middle East Risk and U.S. Data in Focus...

🗞️ Tokyo Sees Dollar Strength and Yen Weakness — The Question Is Whether It Holds Overseas...