すべてのブログ

📊 Technical Analysis — March 6, 2026 Based on the latest data, the market has shifted into a clear trend-driven environment...

📊 FX Options Overview — March 6, 2026 Current option positioning suggests a typical NY cut “pinning” environment , where prices gravitate toward major option strikes rather than developing strong...

📊 FX Options Overview — March 5, 2026 Today’s option positioning suggests a strong NY cut “pinning” structure , meaning prices may gravitate toward major option strikes rather than trend strongly...

📊 Technical Analysis — March 4, 2026 “Weak USD × Strong Commodity Currencies × Precious Metals Trend × Short-Term Yen Rebound.”...

📊 FX Options Overview (March 4, 2026) Based on today’s option positioning, the market structure suggests strong “pin” dynamics toward key strike levels into the NY cut...

🗞️ Crisis Risk Persists — Stocks Plunge, Dollar Buying Continues but FX Turns Nervous...

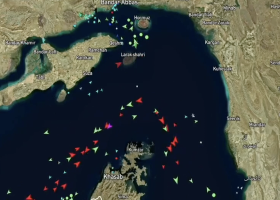

🗞️ Prolonged Middle East War Risk — Dollar Strong, FX Relatively Calm...

📊 Technical Analysis — March 2, 2026 ✔ USD/JPY Daily: Strong Buy continues ✔ Cross-yen pairs remain strong ✔ Gold, Silver, and WTI: Strong Buy on H1 and above ✔ EUR complex continues to weaken The...

🗞️ In the Midst of a Middle East Crisis — The Theme Is “Uncertainty”...

+178,420 USD | Reading the Market Through Four War Scenarios 📈 Weekly Performance Report February 23 – February 27 +178,420 USD...

📊 Technical Analysis — February 27, 2026 🧭 Market Structure ✔ Gold: Strong Buy across all timeframes ✔ BTC: Strong Sell across all timeframes ✔ USD/JPY: Short-term correction, Daily still strong...

📊 Technical Analysis — February 25, 2026 🧭 Market Structure “A full-fledged JPY-weak trend market. Cross-yen pairs are the main drivers...

🗞️ USD and JPY Both Weaken — Will the Trend Continue Overseas...