Recently, the yen has been steadily depreciating at a gradual pace. Following two suspected covert interventions, USD/JPY has gradually risen to the 157 level. EUR/JPY is stabilizing around 170, and GBP/JPY around 200.

Yesterday, statements from Minneapolis Fed President Kashkari that "nobody has taken a rate hike off the table" and a significant increase in the US Conference Board Consumer Confidence Index from the previous 97.5 to 102.0 (forecast 96.0) added pressure for dollar buying.

Meanwhile, the yield on Japan's 10-year government bonds briefly rose to around 1.08% today. However, US bond yields are also rising, so expectations for a narrowing of the US-Japan interest rate differential have not increased. The rise in Japanese bond yields is also seen as pushing for additional rate hikes by the Bank of Japan (BoJ).

Additionally, concerns about government and BoJ intervention in the forex market have eased following US Treasury Secretary Janet Yellen's remarks that such interventions should be rare. The yen showed a sensitive reaction to BoJ board member Adachi's recent comment that "we will respond to the exchange rate if it impacts prices." Clearly, any move towards yen appreciation will require heightened market expectations for BoJ rate hikes.

Upcoming economic indicators to watch in the overseas markets include:

US MBA Mortgage Applications (May 18 - May 24)

US Richmond Fed Manufacturing Index (May)

Germany Preliminary Consumer Price Index (May)

Scheduled speeches and events include:

Governor Villeroy de Galhau of the French Central Bank

New York Fed President Williams

US Federal Reserve Beige Book

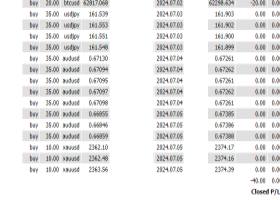

This week continues to exhibit range-bound tendencies, but USD/JPY has risen to a highly sensitive price range. Sell orders exist at 157.60-80, and at 158.00, along with options. Therefore, this level is expected to provide resistance. If the price approaches these levels, I am considering entering sell positions.