Ireneusz Myszker / Profilo

- Informazioni

|

9+ anni

esperienza

|

3

prodotti

|

109

versioni demo

|

|

1

lavori

|

0

segnali

|

0

iscritti

|

Ireneusz Myszker

Hello, The first WCK Trading product is now available. Semi-automatic system that opens the position at the time of breaking out of the channel. I encourage you to buy and test.

https://www.mql5.com/en/market/product/27838

https://www.mql5.com/en/market/product/27838

Ireneusz Myszker

Prodotto pubblicato

The EA automatically opens the orders when price crossing/touching lines, which were drawn by the user. Two scenarios are possible. When you expect the price to stay in the channel. When you expect that the price will not remain in the channel after the break off it. If you want use first scenario - you must set in settings Trade mode = “False_Breaking_Channel”. If you want use second scenario - you must set in settings Trade mode = “Breaking_Channel”. When you run EA, you must draw two trend

Ireneusz Myszker

Soon, the first product of WCK Trading Sp. z o.o.

The product is helpful in situations of breaking the trend line in the direction of breaking and so-called breakthrough fake. Expert Advisor can be used on many currency pairs, in any period of time. The basis of EA's operation is drawing two trend lines on the graph and identifying just a few settings (activation rules and others). EA gives very good results in the case of the formation of breaking the price of a triangle.

The product is helpful in situations of breaking the trend line in the direction of breaking and so-called breakthrough fake. Expert Advisor can be used on many currency pairs, in any period of time. The basis of EA's operation is drawing two trend lines on the graph and identifying just a few settings (activation rules and others). EA gives very good results in the case of the formation of breaking the price of a triangle.

Ireneusz Myszker

Hai lasciato un feedback allo sviluppatore per il lavoro Modyfication to EA panel

Best coder

Ireneusz Myszker

Hai lasciato un feedback al cliente per il lavoro I need create trade panel as this image. Panel should do nothing. Just template. Source code need to be provided

Very good employer :-)

Ireneusz Myszker

Hai lasciato un feedback allo sviluppatore per il lavoro Modyfication to EA panel

Best coder ever

Ireneusz Myszker

Hai lasciato un feedback allo sviluppatore per il lavoro Mod panel

You need professional implementation - I recommend.

Ireneusz Myszker

Hai lasciato un feedback allo sviluppatore per il lavoro Mod panel

I sincerely recommend

Ireneusz Myszker

Hai lasciato un feedback allo sviluppatore per il lavoro ST indicator

Very ambitious and inquisitive programmer

Ireneusz Myszker

Hai lasciato un feedback allo sviluppatore per il lavoro Add friends

Very good developer despite the lack of implementation.

Large commitment.

Ireneusz Myszker

Hai lasciato un feedback allo sviluppatore per il lavoro Mod EA SAR

The best programmer I know

[Eliminato]

2017.03.27

[Eliminato]

Ireneusz Myszker

Hai lasciato un feedback allo sviluppatore per il lavoro Panel update

I sincerely recommend

Ireneusz Myszker

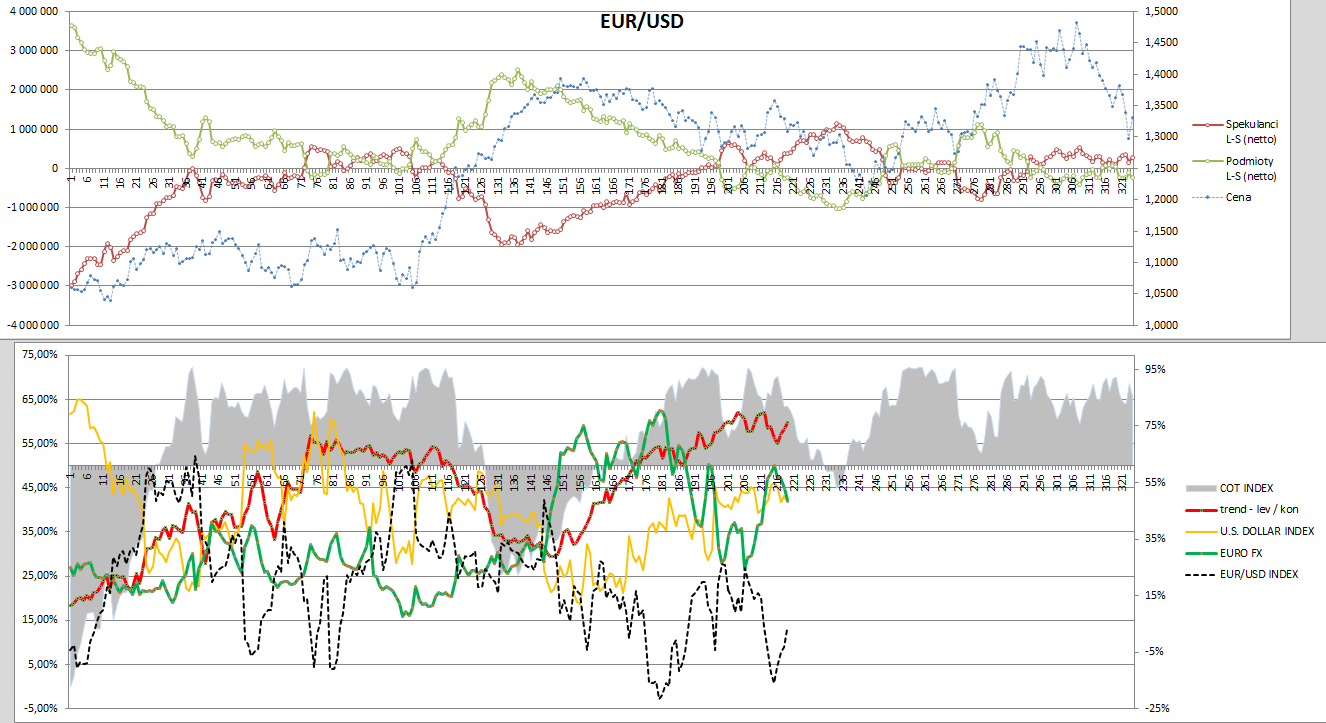

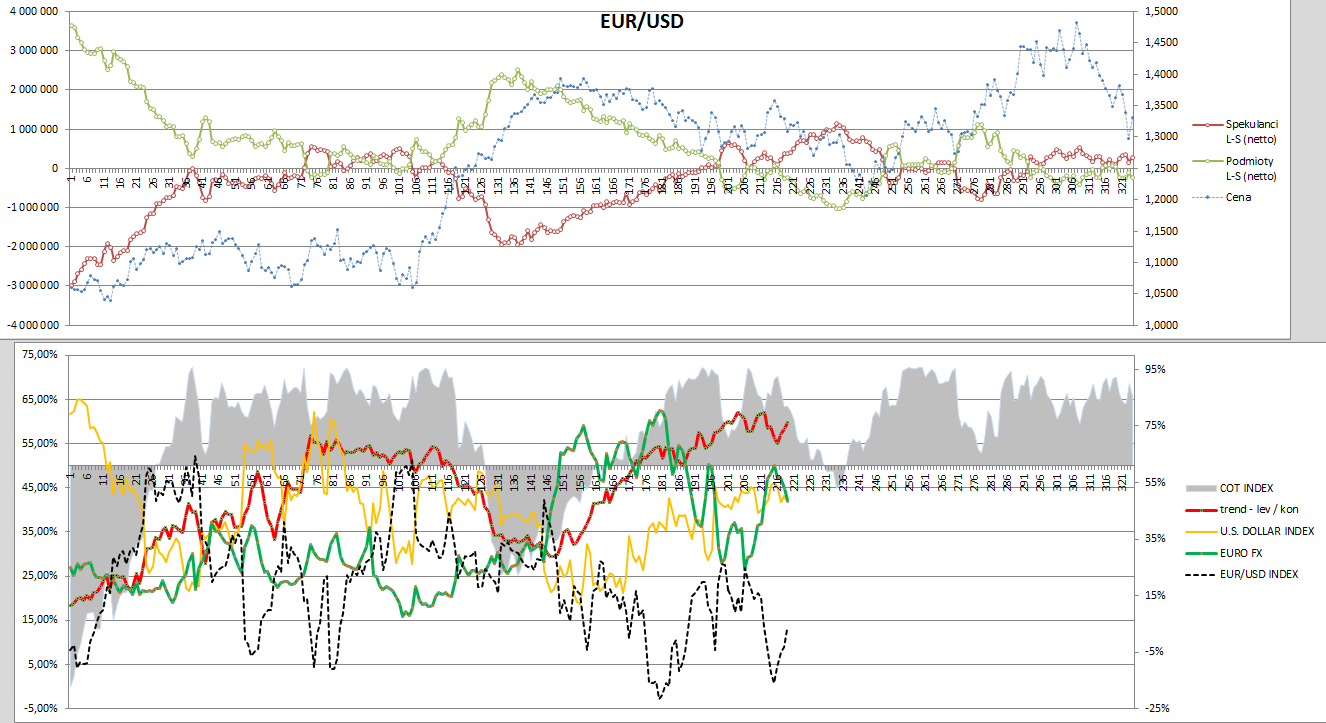

COT report / CFTC as at 14 March 2017 / currency pair EUR / USD.

The size of the position of large speculators and traders looking without major changes in terms of percentage, but on Tuesday she became a very big change in the number of contracts LONG (for growth) and SHORT (to drop) in the category of traders.

Last week, the amount of LONG is 9,751,776 pcs. Of contracts in relation to 6,164,185 units. SHORT contracts. The current level is respectively 9,125,250 pcs., And 5,495,916 pieces. What this means speaking as simple as possible - operators, before the meeting of the Federal Reserve (http://bossafx.pl/index.jsp?layout=fx_calendariumDay&page=0&news_cat_id= 3793 & dayT = 2017-03-15 & FILTERNAME = USA), where one was to raise interest rates, closes their short positions and long in the amount of 1 million contracts !!!

We are dealing with the so-called. the phenomenon of short covering. A simple example below:

The investor has a short position of 50 contracts of EUR / USD at 1.0566, believing the price will fall. Instead, the price rises to 1.0608 for EUR / USD. The investor has a significant exposure to loss, so buy 50 contracts of EUR / USD at 1.0608 to cover losses short positions. Thus, the number of contracts of inheritance and growth is reduced.

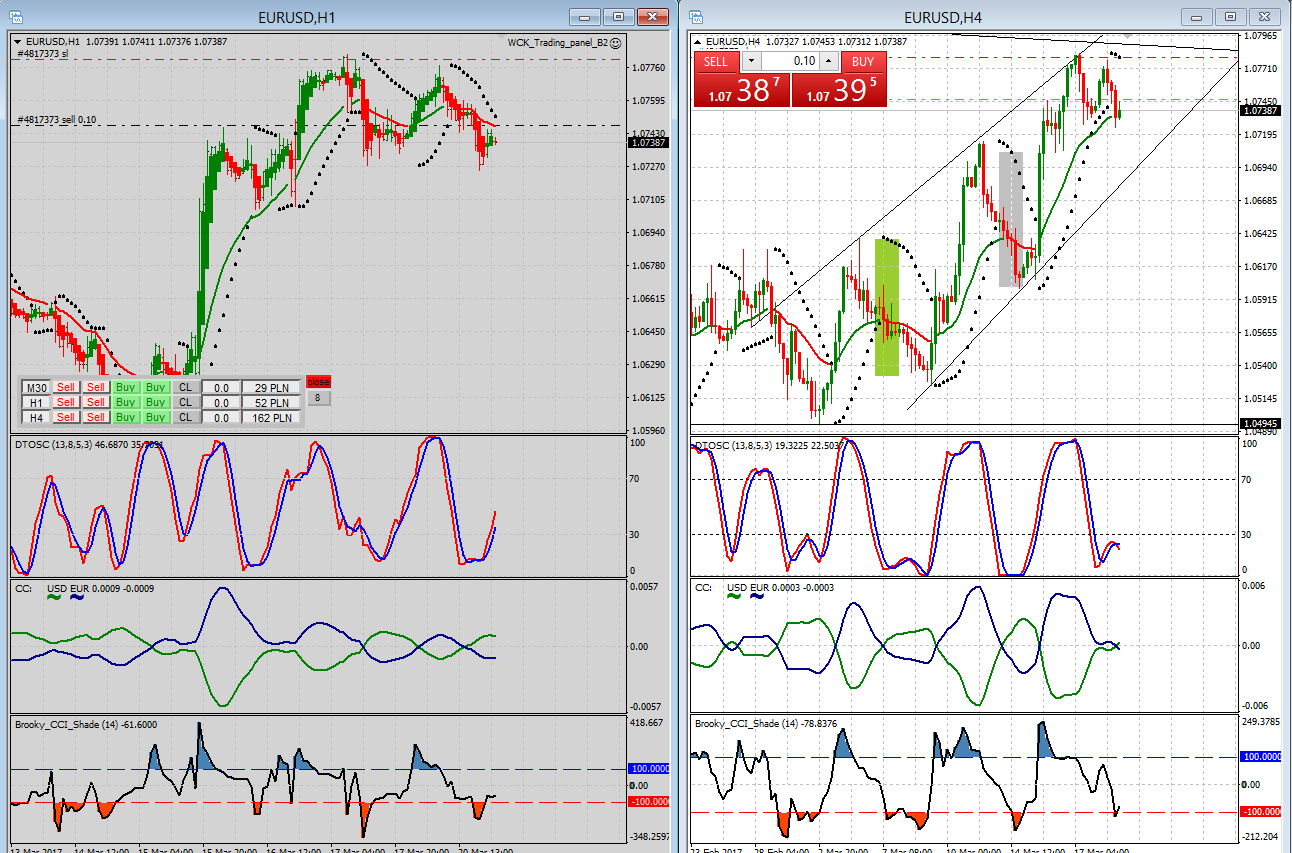

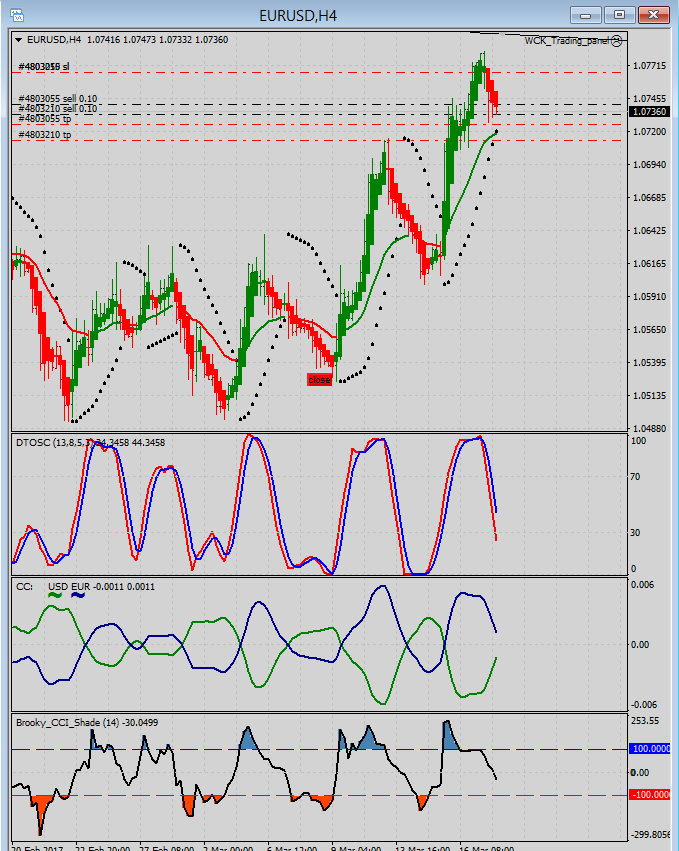

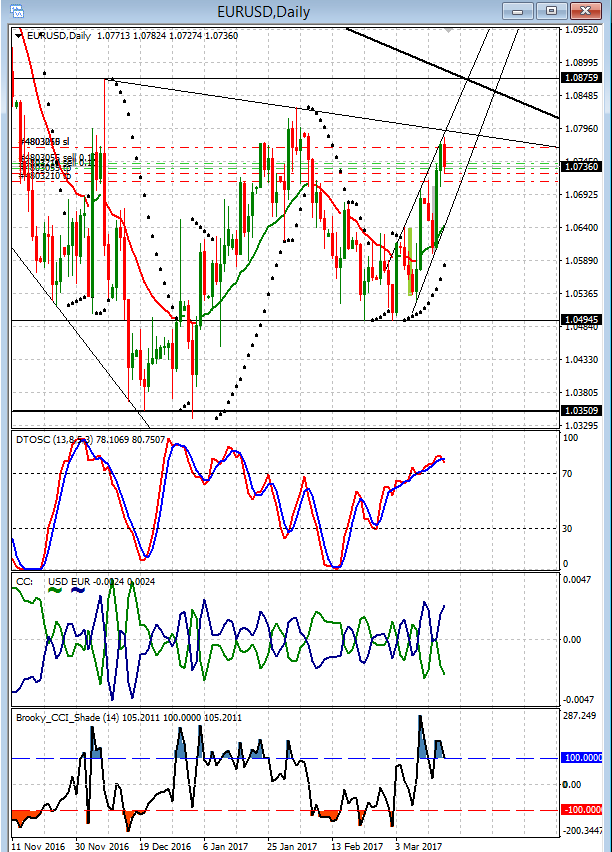

The following graphics COT (read from left to right) + graph EUR / USD H4 timeframe (trendowy) and D1 indicating the date of the report (gray) and the previous week (green).

Have a good analysis.

The size of the position of large speculators and traders looking without major changes in terms of percentage, but on Tuesday she became a very big change in the number of contracts LONG (for growth) and SHORT (to drop) in the category of traders.

Last week, the amount of LONG is 9,751,776 pcs. Of contracts in relation to 6,164,185 units. SHORT contracts. The current level is respectively 9,125,250 pcs., And 5,495,916 pieces. What this means speaking as simple as possible - operators, before the meeting of the Federal Reserve (http://bossafx.pl/index.jsp?layout=fx_calendariumDay&page=0&news_cat_id= 3793 & dayT = 2017-03-15 & FILTERNAME = USA), where one was to raise interest rates, closes their short positions and long in the amount of 1 million contracts !!!

We are dealing with the so-called. the phenomenon of short covering. A simple example below:

The investor has a short position of 50 contracts of EUR / USD at 1.0566, believing the price will fall. Instead, the price rises to 1.0608 for EUR / USD. The investor has a significant exposure to loss, so buy 50 contracts of EUR / USD at 1.0608 to cover losses short positions. Thus, the number of contracts of inheritance and growth is reduced.

The following graphics COT (read from left to right) + graph EUR / USD H4 timeframe (trendowy) and D1 indicating the date of the report (gray) and the previous week (green).

Have a good analysis.

: