Evgeniy Scherbina / Profilo

- Informazioni

|

10+ anni

esperienza

|

28

prodotti

|

614

versioni demo

|

|

0

lavori

|

0

segnali

|

0

iscritti

|

Amici

1002

Richieste

In uscita

Evgeniy Scherbina

Alright, we have 2 important events left in the coming week.

USD Rate Decision September 20, and

GBP Rate Decision September 21

The previous important event "Euro Rate Decision" was, as they say, counter-intuitive. Usually, a higher interest rate is good for the currency, so there should have been an up move in EURUSD. It did not happen because if they still need to increase the interest rate, it is because they fear an inflation-induced recession. Luckily for EUR-buyers, the US Fed may think likewise. And the traders will react likewise on Wednesday. I really do not think the EURozone is performing worse than the USD-zone. So I am betting on an up move for EURUSD.

GBP is different. Great Britain is in trouble because it has been in trouble. Tories cut off the nice ties with the EURozone, but have never given anything in return. Migrants are still coming. China is still crushing. Boris Johnson is still funny. My bet is GBP will continue falling.

I am posting these pics with different daily moving averages because I am reflecting on how they can help tell good moves from bad moves for the algorithm of "Neural Rabbit". As we can see in this pic, even if I believe the down move will roll back very soon, a short trade could have made a decent profit thus far after both crossings. So maybe it is a good idea to integrate an MA filter before training (not after of course) so that it can help distinguish what a move is. It would trade very differently, but it would substantially decrease the amount of possible trades. So most probably I will add 2 options to choose from - with filter and without it. And it will total to 4 different options because we now have a "Training By_Accuracy" and a "Training By_Loss"... I am reflecting on it because it is my best strategy so far.

USD Rate Decision September 20, and

GBP Rate Decision September 21

The previous important event "Euro Rate Decision" was, as they say, counter-intuitive. Usually, a higher interest rate is good for the currency, so there should have been an up move in EURUSD. It did not happen because if they still need to increase the interest rate, it is because they fear an inflation-induced recession. Luckily for EUR-buyers, the US Fed may think likewise. And the traders will react likewise on Wednesday. I really do not think the EURozone is performing worse than the USD-zone. So I am betting on an up move for EURUSD.

GBP is different. Great Britain is in trouble because it has been in trouble. Tories cut off the nice ties with the EURozone, but have never given anything in return. Migrants are still coming. China is still crushing. Boris Johnson is still funny. My bet is GBP will continue falling.

I am posting these pics with different daily moving averages because I am reflecting on how they can help tell good moves from bad moves for the algorithm of "Neural Rabbit". As we can see in this pic, even if I believe the down move will roll back very soon, a short trade could have made a decent profit thus far after both crossings. So maybe it is a good idea to integrate an MA filter before training (not after of course) so that it can help distinguish what a move is. It would trade very differently, but it would substantially decrease the amount of possible trades. So most probably I will add 2 options to choose from - with filter and without it. And it will total to 4 different options because we now have a "Training By_Accuracy" and a "Training By_Loss"... I am reflecting on it because it is my best strategy so far.

Evgeniy Scherbina

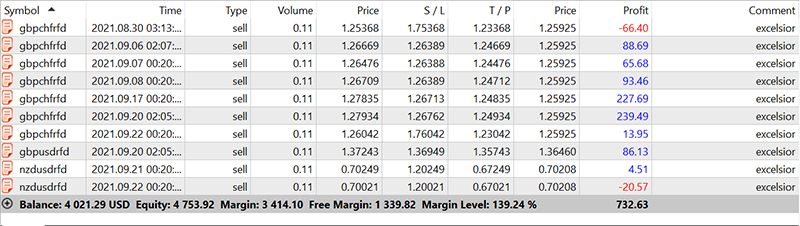

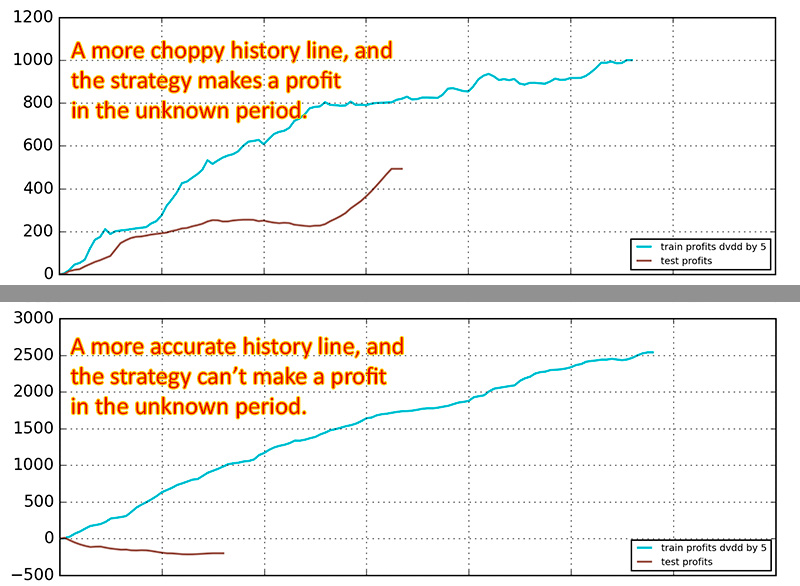

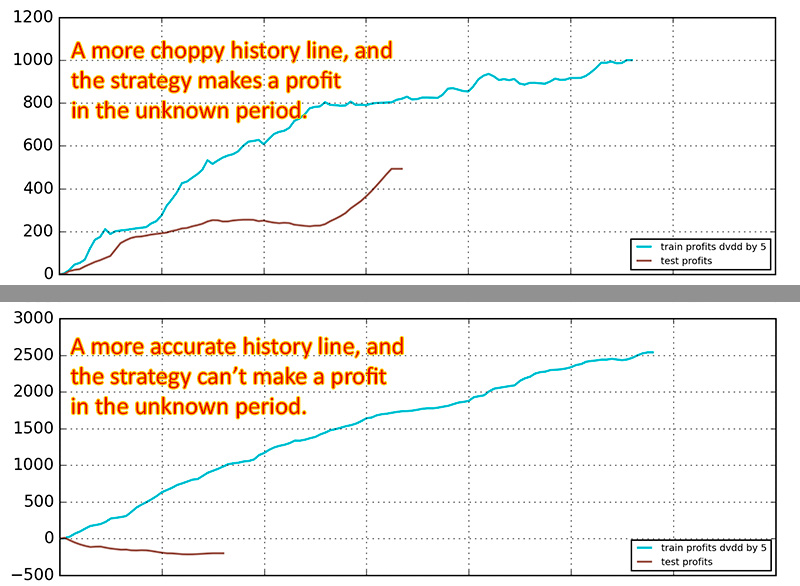

A huge amount of tests I did allowed to make one powerfull conclusion. A machine learning aimed at improving the forecast accuracy learns the history too fast. It actually learns every nervous tick of the market. Its accuracy in the unknown period may also be high, but, unfortunately, its loss is also very high.

If a strategy makes 7 good decisions out of 10, it is 70% of accuracy. Good? Bad! It is bad if the loss is high because any bad forecast may be so bad that it will eat away all hopes for profitability. Therefore, it is the strategy with training by loss that is capable to handle well the unknown period, even though its history result may be thinly over the satisfactory level.

And this is what my newest strategy "Neural Rabbit" is about.

If a strategy makes 7 good decisions out of 10, it is 70% of accuracy. Good? Bad! It is bad if the loss is high because any bad forecast may be so bad that it will eat away all hopes for profitability. Therefore, it is the strategy with training by loss that is capable to handle well the unknown period, even though its history result may be thinly over the satisfactory level.

And this is what my newest strategy "Neural Rabbit" is about.

Evgeniy Scherbina

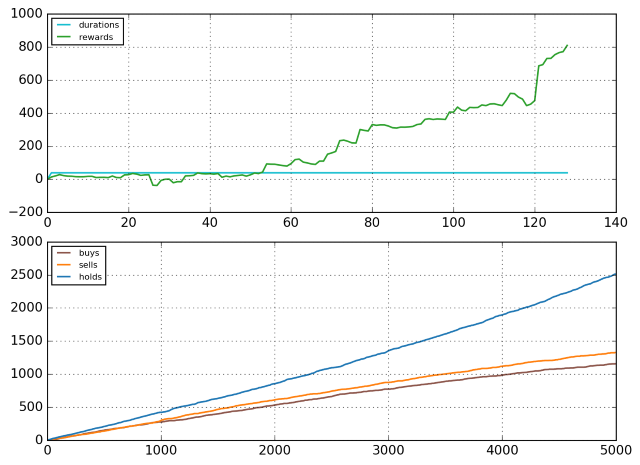

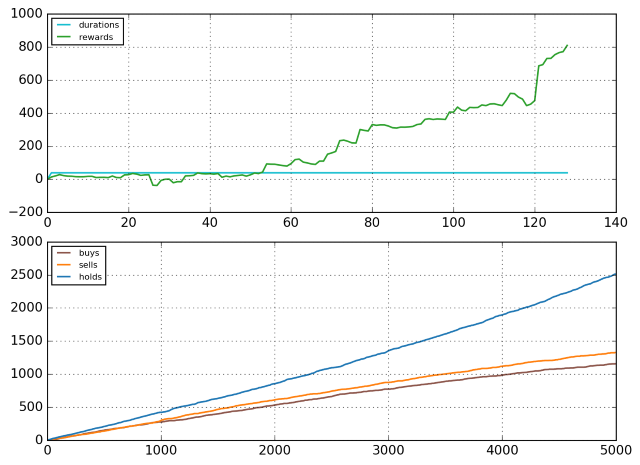

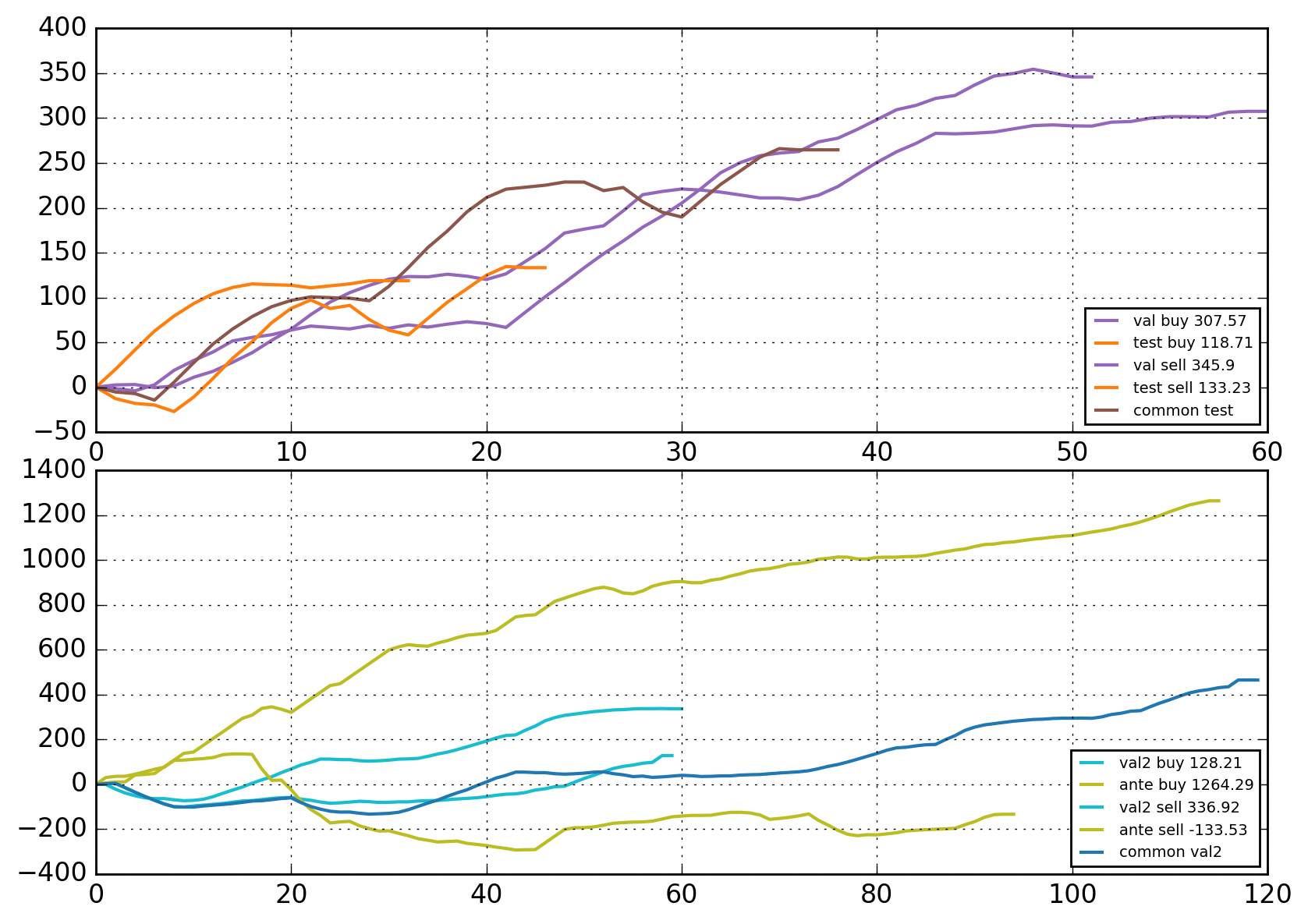

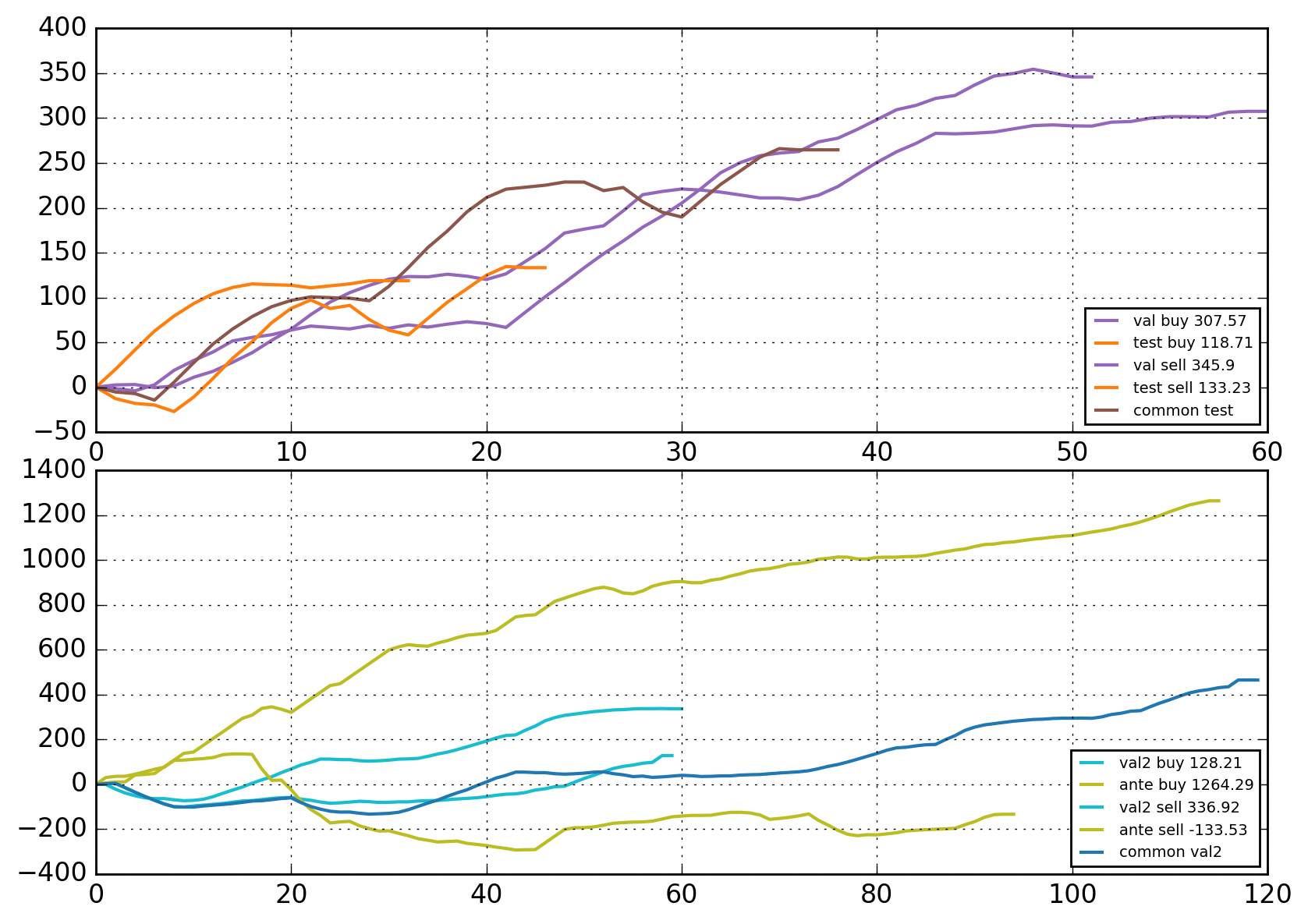

Folks, I think I have made the breakthrough! I have been fighting for quite a while with the "actor-critic" technique in Reinforcement Learning. It did not work well until I noticed another erroneous code example on GitHub. I always used a single trade as a game while the erroneous code used a number of days with different trades as a game. That's when I realized what was wrong with my code! The erroneous code did not bother about the validation and only performed one pass, which was ok because it was erroneous. But the idea was good. Suddenly, I started seeing positive dynamics in my tests.

Below are 2 pictures - one is training and the other is validation with a small part of test data (the profile does not allow 2 pictures so it is only the training, check the Comments section of "Fast Neurons" for the second picture). It is good, I did it! I am going to put it on the signal starting next week. If it shows no bugs I will publish it as an update to the strategy of "Fast Neurons". It is going to be the first strategy on the mql5 market, which uses the "actor-critic" technique in Reinforcement Learning (specifically "Advantage Actor Critic" or A2C).

Below are 2 pictures - one is training and the other is validation with a small part of test data (the profile does not allow 2 pictures so it is only the training, check the Comments section of "Fast Neurons" for the second picture). It is good, I did it! I am going to put it on the signal starting next week. If it shows no bugs I will publish it as an update to the strategy of "Fast Neurons". It is going to be the first strategy on the mql5 market, which uses the "actor-critic" technique in Reinforcement Learning (specifically "Advantage Actor Critic" or A2C).

Evgeniy Scherbina

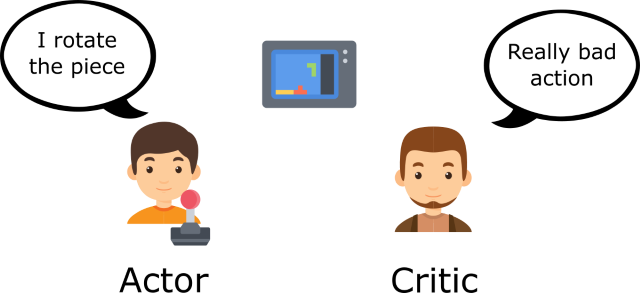

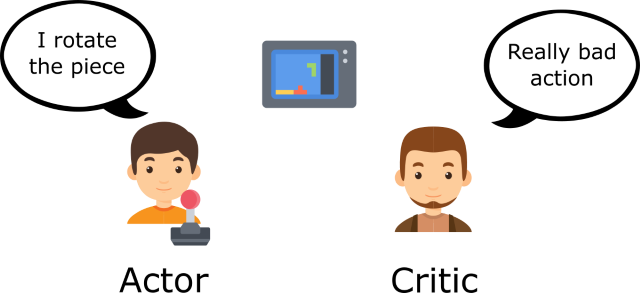

What is the best option among the many popular options in Reinforcement Learning? It is clearly "Actor Critic". They post a lot of code to demonstrate they understand what it is about on GitHub. It is usually a very complicated and ineffecient code or it is coded to play the famous Atari games. Most games are won by playing the longer the better. It is not the case for Forex trading. You do not win by holding an open position too long. I have found that the technique "Advantage Actor Critic" or A2C is very sensitive to rewards.

And then, a complicated technique should at least outperform simpler techniques, otherwise it is useless. Alright, I will try to understand why they insist on using the log function for probabilities just to make sure it does not overcomplicate things. If I get through, this will be my most advanced and sophisticated system for Forex trading yet.

And then, a complicated technique should at least outperform simpler techniques, otherwise it is useless. Alright, I will try to understand why they insist on using the log function for probabilities just to make sure it does not overcomplicate things. If I get through, this will be my most advanced and sophisticated system for Forex trading yet.

Evgeniy Scherbina

Hi, everyone!! Another year and I am still fighting for the best neural strategy ever. I have added an "ante" one-year test (a test which precedes the training period) and 2 validations, one to fit the training curve and the other to check the final result. Should I call it a triple validation?! I have also started using 3 charts - monthly, weekly, and daily.

All of this is being added to my strategies right now. "New York" is currently the most advanced strategy which balances wins and loses. "Multiq" combines data from multiple symbols to train a single neural network. And the ever-lasting "Excelsior" uses 2 competing neural networks. Check them out!

I am also working over a strategy for intraday trading, which will include 4 charts - monthly, weekly, daily, and 6-hourly! I am thinking to call it "Fast Neurons", check it out soon, too!

All of this is being added to my strategies right now. "New York" is currently the most advanced strategy which balances wins and loses. "Multiq" combines data from multiple symbols to train a single neural network. And the ever-lasting "Excelsior" uses 2 competing neural networks. Check them out!

I am also working over a strategy for intraday trading, which will include 4 charts - monthly, weekly, daily, and 6-hourly! I am thinking to call it "Fast Neurons", check it out soon, too!

Evgeniy Scherbina

Hi, everyone. I published recently the newest update for Excelsior. The important difference is that it uses more information (relative price changes) in addition to MACD. It may also close negative trades.

But we are not there yet.

The biggest jump will be using 4 threshold values instead of 2 as it is now.

Right now 2 networks in this strategy use 2 threshold values to open and close trades. For example, any signal over 0.8 is to open a trade, while any signal below the oppositve value of 0.2 is to close that opened trade. There is a very long run between 0.8 and 0.2, and the strategy loses time and does not close when it should. So I thought any signal over 0.8 to open and below 0.6 to close would be better.

It takes time to test this new approach. For the previous approach, it was 4 x 4 = 16 total options. Now it is 4 x 4 x 4 x 4 = 256 possible options to be tested to see if it performs better. I am doing it and when I am done with it we shall triumph!

This month of September I guess.

But we are not there yet.

The biggest jump will be using 4 threshold values instead of 2 as it is now.

Right now 2 networks in this strategy use 2 threshold values to open and close trades. For example, any signal over 0.8 is to open a trade, while any signal below the oppositve value of 0.2 is to close that opened trade. There is a very long run between 0.8 and 0.2, and the strategy loses time and does not close when it should. So I thought any signal over 0.8 to open and below 0.6 to close would be better.

It takes time to test this new approach. For the previous approach, it was 4 x 4 = 16 total options. Now it is 4 x 4 x 4 x 4 = 256 possible options to be tested to see if it performs better. I am doing it and when I am done with it we shall triumph!

This month of September I guess.

William Tiberius Patrice Schulz

2022.10.14

Very nice, please keep posting about your progress and let us know when its done. Its mid of october by now.

Evgeniy Scherbina

Hi, everyone. I have made this nice table to summarize similarities and difference of the 3 new strategies I created. While these strategies are already available or will be available soon, I would like to explain how I developed them.

It was "Excelsior" that pushed me into the realm of possibilities offered by recurrent neural networks. As none of the standard approaches produced a robust result, I decided to experiment and combine two competing neural networks to make one trading decision. It did work in some periods, and it did not work so well in other periods.

Then I read "Reinforcement Learning: An Introduction" by Sutton and Barto and, after months of experiments and tests, I came up with a nice strategy called "Pipsovar". The one difference of reinforcement learning from recurrent networks is that it does not know its decisions and outcomes from the start. Instead, it explores the future by making all possible decisions on the go.

And finally, I created "Arsene Lupin", a strategy that brushes off the complexity forced by indicators and uses only relative prices changes. "Arsene Lupin" leverages my newest techniques to train and verify recurrent neural networks.

It was "Excelsior" that pushed me into the realm of possibilities offered by recurrent neural networks. As none of the standard approaches produced a robust result, I decided to experiment and combine two competing neural networks to make one trading decision. It did work in some periods, and it did not work so well in other periods.

Then I read "Reinforcement Learning: An Introduction" by Sutton and Barto and, after months of experiments and tests, I came up with a nice strategy called "Pipsovar". The one difference of reinforcement learning from recurrent networks is that it does not know its decisions and outcomes from the start. Instead, it explores the future by making all possible decisions on the go.

And finally, I created "Arsene Lupin", a strategy that brushes off the complexity forced by indicators and uses only relative prices changes. "Arsene Lupin" leverages my newest techniques to train and verify recurrent neural networks.

William Tiberius Patrice Schulz

2022.07.11

I like the progress a lot,but hwave you considered applying reinforcement learning for buy/sell/none directly on the symbols instead of optimizing a NN?

Evgeniy Scherbina

Argomento aggiunto Controllo automatico del mercato

Il controllo automatico del mercato non funziona nei fine settimana? Dice "non riuscito" e "non disponibile" nella finestra aggiuntiva. Così triste, volevo finire quest'anno

Evgeniy Scherbina

Hi, everyone.

Excelsior is going to be updated this week. I have found a way to combine data from weekly and daily charts into one multivariate training.

Live trading has shown the drawbacks of separate training on weekly and daily charts. Week trading seems to be lagging too much behind. While day trading does not have enough of past perspective to rely on and to make correct trading decisions. It will now be 30 weekly bars + 30 daily bars combined into one multivariate thread of 30 states to forecast 1 (or 2) week ahead.

The tests I have made so far show a more reliable trading in the future in the past. We shall see if it can outperform itself in the real future!

I have recently started working on a new strategy using a reinforcement learning... For now, it cannot even reproduce its historical trading, but I am determined to find a good solution one way or another...

Excelsior is going to be updated this week. I have found a way to combine data from weekly and daily charts into one multivariate training.

Live trading has shown the drawbacks of separate training on weekly and daily charts. Week trading seems to be lagging too much behind. While day trading does not have enough of past perspective to rely on and to make correct trading decisions. It will now be 30 weekly bars + 30 daily bars combined into one multivariate thread of 30 states to forecast 1 (or 2) week ahead.

The tests I have made so far show a more reliable trading in the future in the past. We shall see if it can outperform itself in the real future!

I have recently started working on a new strategy using a reinforcement learning... For now, it cannot even reproduce its historical trading, but I am determined to find a good solution one way or another...

Evgeniy Scherbina

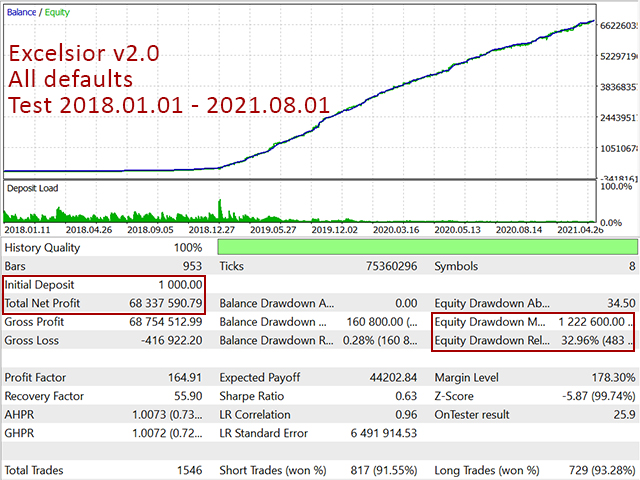

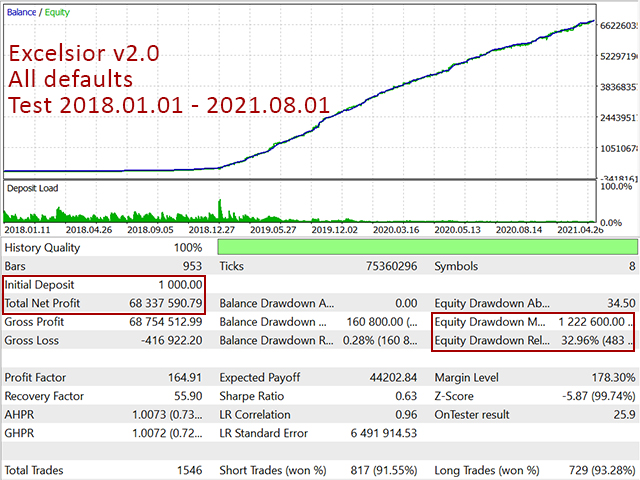

Hi, everyone.

I have recently came accross "The Motley Fool Investing Philosophy":

1) Buy 25+ Companies Over Time

2) Hold Stocks for 5+ Years

3) Add New Savings Regularly

4) Hold Through Market Volatility

5) Let Winners Run

6) Target Long-Term Returns

I guess all of it is applicable to Forex trading and, in particular, to my newest advisor "Excelsior". It uses 8 symbols all traded from one chart. It trades in both weekly and daily charts. It can compensate losing trades if market volatility rises. And it uses a dynamic trail to get the bigget profit possible from trending winning trades. I am sure the advisor "Excelsior" can get the job done!

And may this clear-cut and well-designed approach from the Motley Fool help us get the profit in the coming year 2022!!

I have recently came accross "The Motley Fool Investing Philosophy":

1) Buy 25+ Companies Over Time

2) Hold Stocks for 5+ Years

3) Add New Savings Regularly

4) Hold Through Market Volatility

5) Let Winners Run

6) Target Long-Term Returns

I guess all of it is applicable to Forex trading and, in particular, to my newest advisor "Excelsior". It uses 8 symbols all traded from one chart. It trades in both weekly and daily charts. It can compensate losing trades if market volatility rises. And it uses a dynamic trail to get the bigget profit possible from trending winning trades. I am sure the advisor "Excelsior" can get the job done!

And may this clear-cut and well-designed approach from the Motley Fool help us get the profit in the coming year 2022!!

Evgeniy Scherbina

Hi, everyone.

The next update of Excelsior is for the next week, with ever more options in the training to make it an ever more stable and profitable system. Nothing guarantees a profit but I am sure I have made yet another step towards defeating the market noise.

I will publish a signal at that point, which has been running for about 2 months and has made over 50% of profit.

And the price for Excelsior will double up.

The next update of Excelsior is for the next week, with ever more options in the training to make it an ever more stable and profitable system. Nothing guarantees a profit but I am sure I have made yet another step towards defeating the market noise.

I will publish a signal at that point, which has been running for about 2 months and has made over 50% of profit.

And the price for Excelsior will double up.

enjoy trader

2021.10.14

nice.. already update and run it.. Sir, do you have Montecarlo Test for Excelsior EA? if you have, it will be nice to share in here..

Evgeniy Scherbina

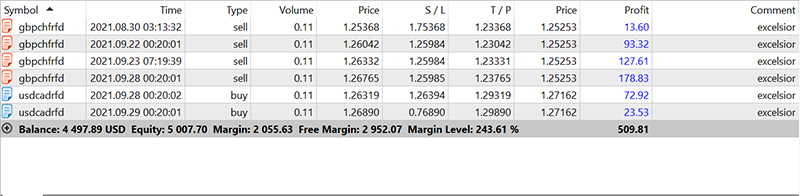

Evgeniy Scherbina

2021.09.30

Trades may differ with neural networks. Overall results are similar in the long run.

Evgeniy Scherbina

enjoy trader

2021.09.24

mine also sell gbpchf .. but it enter at 1.26036 and 1.2670 so it still floating loss.. hope market will move down soon.. i also agree it bearish at daily TF

Evgeniy Scherbina

Hi, everyone.

If you thought I was done with ANT after a few negative reviews, you were wrong! The truth is TensorFlow and Python have tremendous potential and provide quite a bunch of possibilities to train Forex strategies. As I said earlier, I found a way to speed up the training process 4000 times. This was not talking. There are many articles out there that explore how to optimize iterations by using NumPy arrays with floats and indices instead of clumsy Pandas arrays. And then I finally understood how to appease the retracing error in TensorFlow. So this is real!

With a much faster training, I can clinch more options into the training to see if it can outperform its previous results. And finally, here it comes - my newest technical test with the future in the past! It shows what works and what doesn't and why. I am currently testing a linear activation against a sigmoid activation for ANT. I see that the "cc" trades are unstable while the "c" and "r-in" trades can be way more profitable. The new version of ANT has been delayed somewhat but it is coming this month and it is sure to have gorgeous improvements! So stay tuned!

If you thought I was done with ANT after a few negative reviews, you were wrong! The truth is TensorFlow and Python have tremendous potential and provide quite a bunch of possibilities to train Forex strategies. As I said earlier, I found a way to speed up the training process 4000 times. This was not talking. There are many articles out there that explore how to optimize iterations by using NumPy arrays with floats and indices instead of clumsy Pandas arrays. And then I finally understood how to appease the retracing error in TensorFlow. So this is real!

With a much faster training, I can clinch more options into the training to see if it can outperform its previous results. And finally, here it comes - my newest technical test with the future in the past! It shows what works and what doesn't and why. I am currently testing a linear activation against a sigmoid activation for ANT. I see that the "cc" trades are unstable while the "c" and "r-in" trades can be way more profitable. The new version of ANT has been delayed somewhat but it is coming this month and it is sure to have gorgeous improvements! So stay tuned!

Evgeniy Scherbina

Hi, everyone.

I have done a few more tests with the newest advisor Excelsior. And I think I have come to an almost perfect configuration of options.

Below is a picture of 2 trainings: one with the current version 2.1 and the other with the next version 2.2. Both charts contain the top 20 rows with profits for training, validation, and test periods. Over a 150 thousand rows for each training were sorted by the validation profit.

What we can clearly see, is that the current version 2.1 produces a few configurations that secured a modest profit in the test period (passes 6, 12, 16, 17, 18, and 19). But the next version 2.2 has a much better performance in the unknown test period. While it is still a history test and nothing guarantees a profit on the volatile Forex market, it is a very clear indication that this system of 2 competing networks, that I am tuning right now, is absolutely wonderful.

I have done a few more tests with the newest advisor Excelsior. And I think I have come to an almost perfect configuration of options.

Below is a picture of 2 trainings: one with the current version 2.1 and the other with the next version 2.2. Both charts contain the top 20 rows with profits for training, validation, and test periods. Over a 150 thousand rows for each training were sorted by the validation profit.

What we can clearly see, is that the current version 2.1 produces a few configurations that secured a modest profit in the test period (passes 6, 12, 16, 17, 18, and 19). But the next version 2.2 has a much better performance in the unknown test period. While it is still a history test and nothing guarantees a profit on the volatile Forex market, it is a very clear indication that this system of 2 competing networks, that I am tuning right now, is absolutely wonderful.

Evgeniy Scherbina

Hi, everyone. So far, I have created these 3 strategies which utilize the power of neural networks.

1. Ain't No Trend (or "ANT" for a short name) was my first attempt to understand how neural networks may help evaluate the market noise. It was initially developed completely in MQL, and then I transported the training part to Python. All the various configurations of fully-connected neural networks have enabled this strategy to produce a ridiculously low number of trades. It should be considered as the most conservative and least profitable.

Number of symbols: 6

Timeframes: H4

Trading strategy: MACD indicator

Training strategy: fully-connected neural network

Number of trades in real-time: less than 10 per month

A major upgrade is due in August.

2. Neural Bar Predictor (or "NBP" for a short name) was made with a more sophisticated approach and super-tricky-complicated recurrent neural networks. I spent 2 hours figuring out a way to transport the weights from a TensorFlow fully-connected neural network of ANT, and it took me 2 weeks to finally do it the right way for the recurrent neural network of NBP. It was various configurations of training, too, with very many options still to be explored. The basic idea for NBP was to make it generate by far much more trades than ANT did. I got to it by packing 5 timeframes and different types of signals together. The next big step for this strategy will be to introduce more fine-tuning and exclude tons of unrealistic trading results in order to achieve a more stable version and keep a decent number of trades.

Number of symbols: 6

Timeframes: D1, H12, H8, H6, H4

Trading strategy: ADX indicator

Training strategy: recurrent neural network

Number of trades in real-time: over 40 per month

A major upgrade is due in August.

3. Excelsior (no short name this time) is currently my best and most advanced effort at harnessing a popular variant of the recurrent neural networks and making it forecast the most reliable daily charts of 8 symbols. With this approach, I understood that recurrent networks could forecast any time series. To make it a stable system, it should be 2 independent competing networks. The trading strategy relies simply on daily bars so all trading decisions are made by a combination of the recurrent neural networks. Also, this enables the advisor to reconsider its trading decisions on every new day and even during a day! To overcome all the new obstacles of this approach, I had to find a way to speed up training and validation calculations about 4000 times.

Number of symbols: 8

Timeframes: D1

Trading strategy: daily bars

Training strategy: 2 competing recurrent neural networks

Number of trades in real-time: stat expected soon

The latest version 2.0 has recently been published.

1. Ain't No Trend (or "ANT" for a short name) was my first attempt to understand how neural networks may help evaluate the market noise. It was initially developed completely in MQL, and then I transported the training part to Python. All the various configurations of fully-connected neural networks have enabled this strategy to produce a ridiculously low number of trades. It should be considered as the most conservative and least profitable.

Number of symbols: 6

Timeframes: H4

Trading strategy: MACD indicator

Training strategy: fully-connected neural network

Number of trades in real-time: less than 10 per month

A major upgrade is due in August.

2. Neural Bar Predictor (or "NBP" for a short name) was made with a more sophisticated approach and super-tricky-complicated recurrent neural networks. I spent 2 hours figuring out a way to transport the weights from a TensorFlow fully-connected neural network of ANT, and it took me 2 weeks to finally do it the right way for the recurrent neural network of NBP. It was various configurations of training, too, with very many options still to be explored. The basic idea for NBP was to make it generate by far much more trades than ANT did. I got to it by packing 5 timeframes and different types of signals together. The next big step for this strategy will be to introduce more fine-tuning and exclude tons of unrealistic trading results in order to achieve a more stable version and keep a decent number of trades.

Number of symbols: 6

Timeframes: D1, H12, H8, H6, H4

Trading strategy: ADX indicator

Training strategy: recurrent neural network

Number of trades in real-time: over 40 per month

A major upgrade is due in August.

3. Excelsior (no short name this time) is currently my best and most advanced effort at harnessing a popular variant of the recurrent neural networks and making it forecast the most reliable daily charts of 8 symbols. With this approach, I understood that recurrent networks could forecast any time series. To make it a stable system, it should be 2 independent competing networks. The trading strategy relies simply on daily bars so all trading decisions are made by a combination of the recurrent neural networks. Also, this enables the advisor to reconsider its trading decisions on every new day and even during a day! To overcome all the new obstacles of this approach, I had to find a way to speed up training and validation calculations about 4000 times.

Number of symbols: 8

Timeframes: D1

Trading strategy: daily bars

Training strategy: 2 competing recurrent neural networks

Number of trades in real-time: stat expected soon

The latest version 2.0 has recently been published.

Evgeniy Scherbina

Hi, everyone.

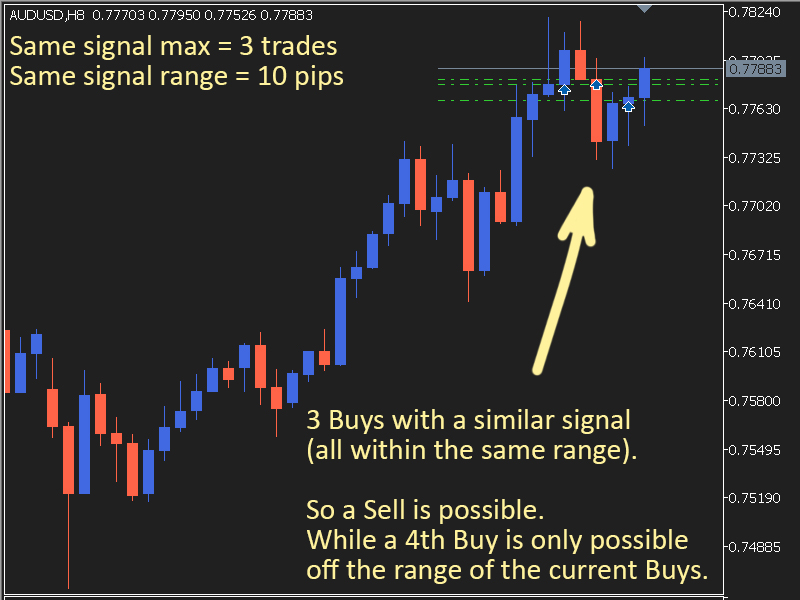

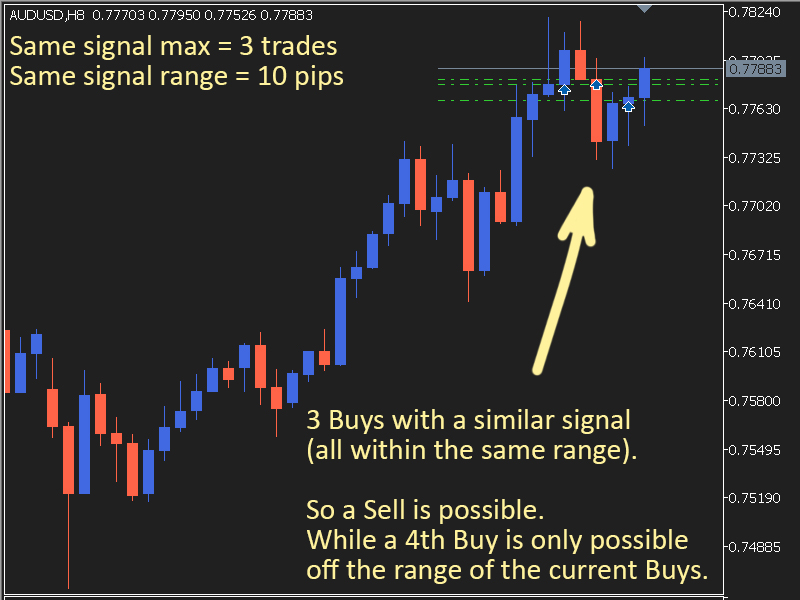

I think I need to elaborate on the 2 new properties - "Same signal max" and "Same signal range" for the Neural Bar Predictor.

These two are related and control the number of trades that can open when signals repeat. A signal repeats after any number of bars, and it repeats because it is very close to any current open trade. A Buy and a Sell do not have a similar signal. Buys compete with Buys, Sells compete with Sells.

While a signal is gathering its momentum to make a move it may be fluctuating in an area. So the advisor may think at this time that we have a very strong signal which may have several trades. However, signals do not repeat because the current price is stuck in an area. The recurrent neural networks of the advisor make totally isolated estimations of each signal.

What happens if the price reverses after several trades open? This is a risk that we have to take on because it is the only way to make a profit on Forex. The recurrent neural networks of the advisor have been trained on 20 years of history so there should be a high probability of success.

The risk may be optimized using historical tests. Any value between 1 and 5 for the Same signal max makes a big difference. While 0 or 10 or higher make no sense.

Any value between 0 and 100 for the Same signal range is fine, but you should use a big step like 10. So values 30, 31, 32, 33 do not show any difference, while values 20, 30, 40, 50 etc should produce different results. The value of 0 for the Same signal range turns off this checking so any number of trades with a similar signal is possible.

Finally, I have to admit that the versions prior 3.0 were not successful. This new version 3.0 is very much different because I used a new binary classification to train it instead of the categorical classification I had used earlier. I noticed right away that the binary classification performed significantly better in my technical tests. So I do encourage you all to give a totally new try to this version 3.0.

May profit come our way frequently and lavishly!

I think I need to elaborate on the 2 new properties - "Same signal max" and "Same signal range" for the Neural Bar Predictor.

These two are related and control the number of trades that can open when signals repeat. A signal repeats after any number of bars, and it repeats because it is very close to any current open trade. A Buy and a Sell do not have a similar signal. Buys compete with Buys, Sells compete with Sells.

While a signal is gathering its momentum to make a move it may be fluctuating in an area. So the advisor may think at this time that we have a very strong signal which may have several trades. However, signals do not repeat because the current price is stuck in an area. The recurrent neural networks of the advisor make totally isolated estimations of each signal.

What happens if the price reverses after several trades open? This is a risk that we have to take on because it is the only way to make a profit on Forex. The recurrent neural networks of the advisor have been trained on 20 years of history so there should be a high probability of success.

The risk may be optimized using historical tests. Any value between 1 and 5 for the Same signal max makes a big difference. While 0 or 10 or higher make no sense.

Any value between 0 and 100 for the Same signal range is fine, but you should use a big step like 10. So values 30, 31, 32, 33 do not show any difference, while values 20, 30, 40, 50 etc should produce different results. The value of 0 for the Same signal range turns off this checking so any number of trades with a similar signal is possible.

Finally, I have to admit that the versions prior 3.0 were not successful. This new version 3.0 is very much different because I used a new binary classification to train it instead of the categorical classification I had used earlier. I noticed right away that the binary classification performed significantly better in my technical tests. So I do encourage you all to give a totally new try to this version 3.0.

May profit come our way frequently and lavishly!

Evgeniy Scherbina

Hi, everyone. I have added more tuning properties to the "Neural Bar Predictor" to make it a more aggressive strategy. I have replaced the categorical classification of training with a binary classification. I have also extended the validation period to 2 years. It is so many changes that I have decided to make it version 3.0 right away. This new version should be ready end of next week. This will be the end of expecting profits and the start of grabbing profits!

Evgeniy Scherbina

Hi, everyone.

The python multi procceses have allowed to speed up the training process 12 times. So here we go.

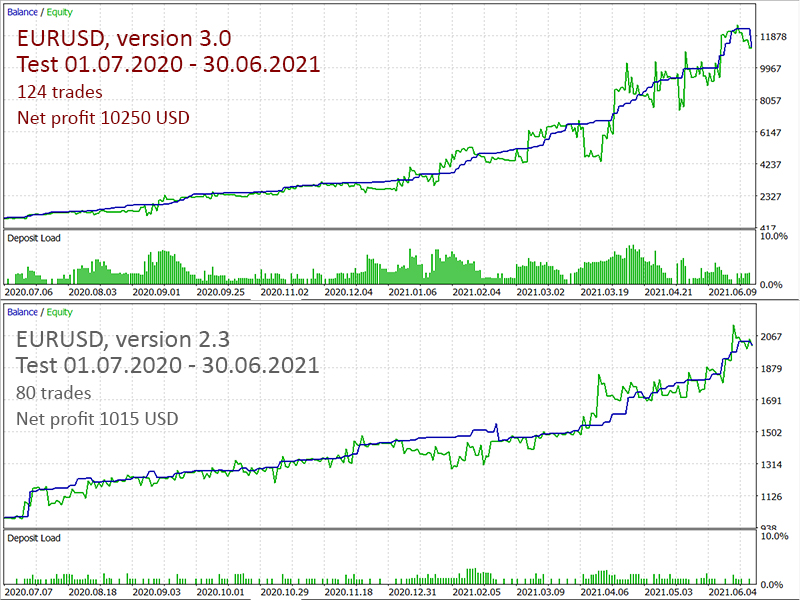

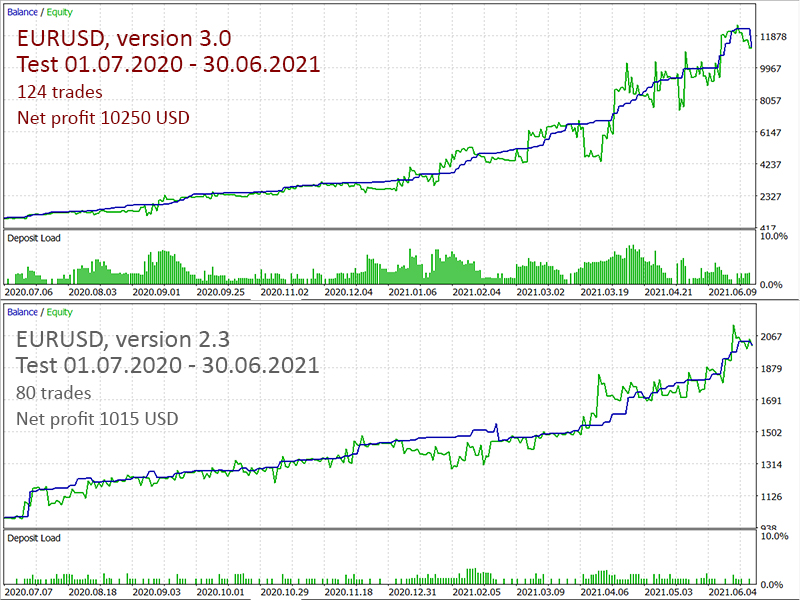

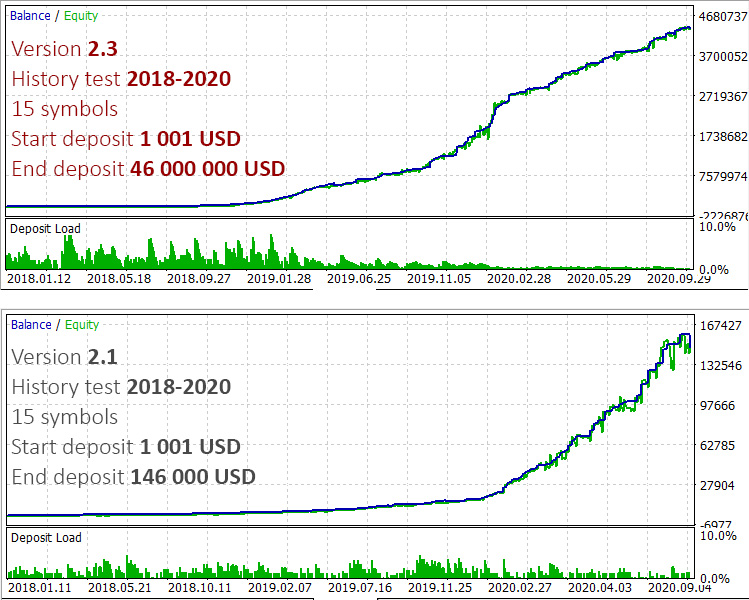

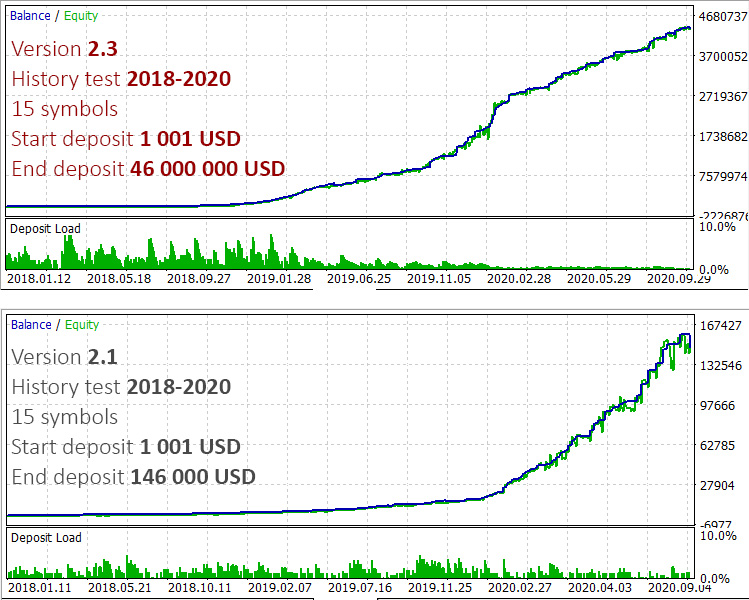

I have made a comparison picture between the old version 2.1 and the newest version 2.3. It is for all 15 symbols. This enourmous difference has become possible only recently thanks to the great machine learning library "TensorFlow" developed by Google.

I have been working hard over my neural strategy for about 2 years. I have bumped into pitfalls and made a number of bad decisions in the process. This is what they call "learning the hard way". But unlike many developpers out there, I understand that the training of a neural network includes 3 periods: training, test, and validation. The validation for the version 2.3 starts on July 1st 2020, check it out, it works just great!!

Forex is risky and volatile. Nothing guarantees profits 100%. But we know machine learning can do it up to 99%. I will keep working to improve this strategy and make it even more stable and profitable. I plan to add a new indicator ADX very soon.

This is the newest neural strategy "Ain't No Trend". And this is happening right now!!

The python multi procceses have allowed to speed up the training process 12 times. So here we go.

I have made a comparison picture between the old version 2.1 and the newest version 2.3. It is for all 15 symbols. This enourmous difference has become possible only recently thanks to the great machine learning library "TensorFlow" developed by Google.

I have been working hard over my neural strategy for about 2 years. I have bumped into pitfalls and made a number of bad decisions in the process. This is what they call "learning the hard way". But unlike many developpers out there, I understand that the training of a neural network includes 3 periods: training, test, and validation. The validation for the version 2.3 starts on July 1st 2020, check it out, it works just great!!

Forex is risky and volatile. Nothing guarantees profits 100%. But we know machine learning can do it up to 99%. I will keep working to improve this strategy and make it even more stable and profitable. I plan to add a new indicator ADX very soon.

This is the newest neural strategy "Ain't No Trend". And this is happening right now!!

Mostra tutti i commenti (6)

Marco Montemari

2020.12.07

Hi Evgeniy, it looks great but i would like to understand more. You trained the network with some data and after that you test it on another different period right? Where does this second part begin?

Evgeniy Scherbina

2020.12.07

Hi. It the advised 10% of all data. So 1 or 1.5 years before July 1st 2020. It is 14 years all training data.

Evgeniy Scherbina

Hi, everyone.

I have finally found my way to the ML library of TensorFlow and mastered the fancy Sparse Categorical Cross Entropy. So now I have a neural network of 64x64x3, which has proved to be a much better performing solution.

I still cannot figure out a way to create a custom function for calculating profits and losses as indicators in the training process. Primarily because those Google geeks are too focused on recognizing images and evaluating the survival rate of the Titanic passengers. So this will be the objective for me to crush in the coming weeks.

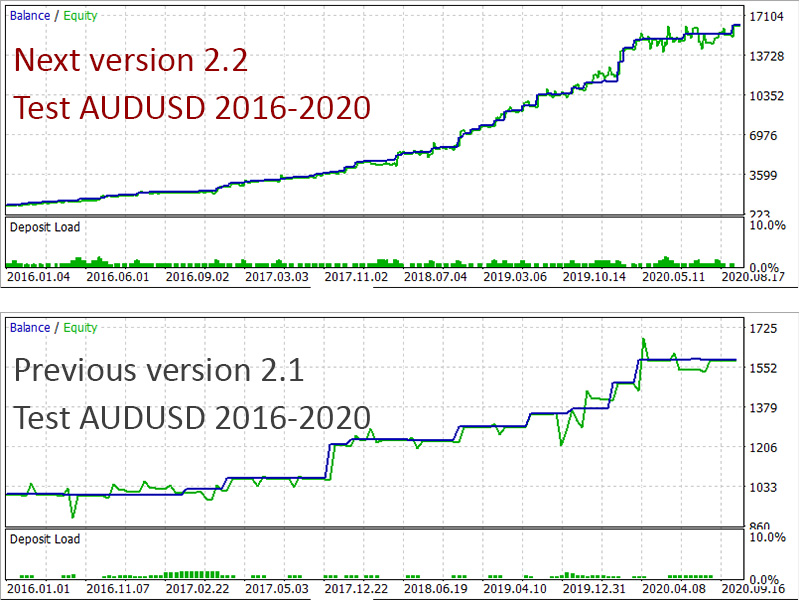

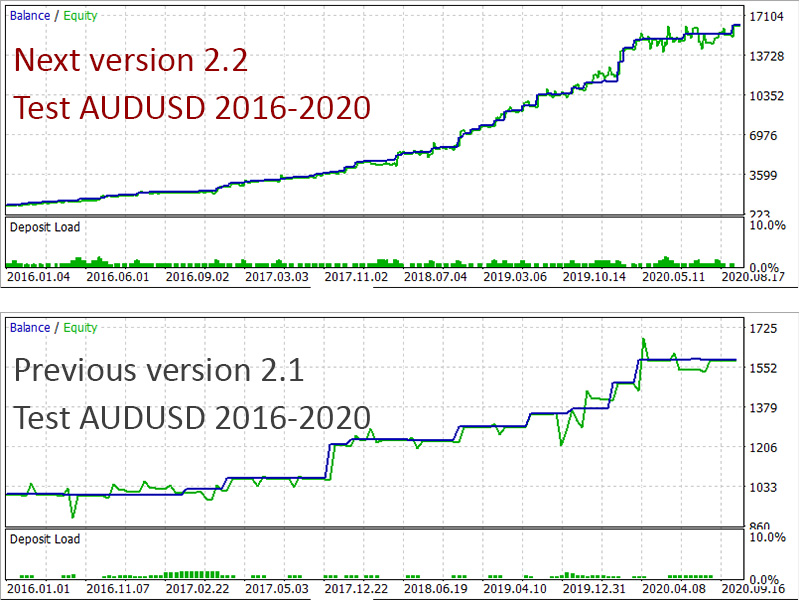

Right now I want to share with you a picture of the AUDUSD test in 2016-2020 with previous version 2.1 and this next version 2.2. As you can see, it is a 10-times difference. And it is only for one symbol. This is the game-changer!!

Oh yes, I forgot to mention. The little disadvantage of this new version 2.2 is that it takes 1 month to train. After 1 week of collecting all data.

So I think I should split the training into 3 parts. I am going to publish this next version 2.2 with only 5 symbols no later than next Monday. Then, a new version will have all 15 symbols. And finally, I will publish another new version with a new indicator ADX by the end of December. So we can all start a new year with totally incredible profits!!

I have finally found my way to the ML library of TensorFlow and mastered the fancy Sparse Categorical Cross Entropy. So now I have a neural network of 64x64x3, which has proved to be a much better performing solution.

I still cannot figure out a way to create a custom function for calculating profits and losses as indicators in the training process. Primarily because those Google geeks are too focused on recognizing images and evaluating the survival rate of the Titanic passengers. So this will be the objective for me to crush in the coming weeks.

Right now I want to share with you a picture of the AUDUSD test in 2016-2020 with previous version 2.1 and this next version 2.2. As you can see, it is a 10-times difference. And it is only for one symbol. This is the game-changer!!

Oh yes, I forgot to mention. The little disadvantage of this new version 2.2 is that it takes 1 month to train. After 1 week of collecting all data.

So I think I should split the training into 3 parts. I am going to publish this next version 2.2 with only 5 symbols no later than next Monday. Then, a new version will have all 15 symbols. And finally, I will publish another new version with a new indicator ADX by the end of December. So we can all start a new year with totally incredible profits!!

: