Sergey Golubev / Profilo

- your profile here as the focal point for your business

- there is payment system here so you can use Job for example

- you can sell some versions of your tools using the Market here

- you can use the Signals just to proof that your products may be profitable for example.

So, there is infrastructure for startup. Besides, all the services (Job, Market and Signals) are visible by millions people from inside Metatrader 5. And your profile is visible to all.

Questa è la continuazione di un altro articolo sulla classe OOP MQL5 che ha mostrato come costruire un semplice EA OO da zero, dando alcuni suggerimenti sulla programmazione orientata agli oggetti. Oggi vi mostro le basi tecniche necessarie per sviluppare un EA in grado di scambiare le notizie. Il mio obiettivo è quello di continuare a darti idee su OOP e anche coprire un nuovo argomento in questa serie di articoli, lavorando con il file system.

Quando comunicavo in vari forum, usavo spesso esempi dei risultati dei miei test visualizzati come schermate di grafici di Microsoft Excel. Molte volte mi è stato chiesto di spiegare come tali grafici possono essere creati. Infine, ora ho un po 'di tempo per spiegare tutto in questo articolo.

We are united because we are different !

Il sito MQL5.com ricorda tutti voi abbastanza bene! Quanti dei tuoi thread sono epici, quanto sono popolari i tuoi articoli e quanto spesso vengono scaricati i tuoi programmi nella Code Base: questa è solo una piccola parte di ciò che viene ricordato su MQL5.com. I tuoi risultati sono disponibili nel tuo profilo, ma per quanto riguarda il quadro generale? In questo articolo mostreremo il quadro generale di tutti i risultati dei membri della MQL5.community.

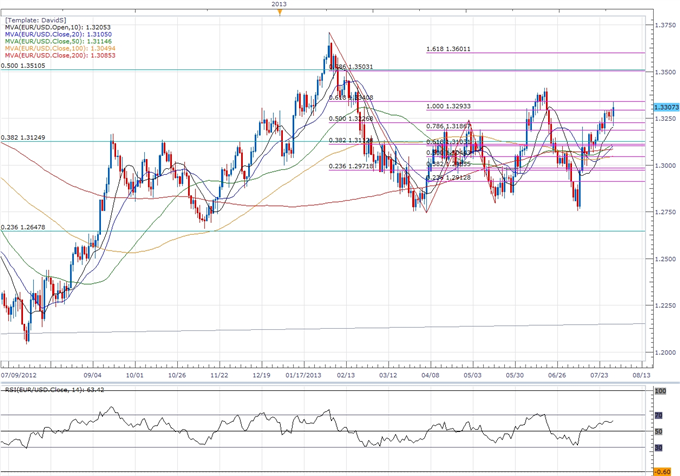

Schaff Trend Cycle with EMA 100

1. Time Frame: 15 min and above

2. Pairs: Any

3. Indicators:

Schaff Trend Cycle

Ema 100

Stochastich (21, 9,9)

Rules to enter a long trade

The 100 exponential moving average is sloping up.

Wait for the Schaff Trend Cycle to reach oversold territory on the chart (-10 +10), go long when the Schaff Trend Cycle turns back above 10, and Stocastich crosses line up

Place stop 10 pips below the most recent level of support.

Take profit: Close the trade if the Schaff Trend Cycle indicator goes below 90

Rules to enter a short trade

The 100 exponential moving average is sloping down

Wait for the Schaff Trend Cycle to reach overbought territory on the chart (90-110), go short when the Schaff Trend Cycle turns back below 90, and Stocastich crosses line down.

Place stop 3 pips above the most recent level of resistance.

Take profit: Close the trade if the Schaff Trend Cycle indicator moves down to -10 and then rises back above +10

BIPS, a Europe-based Bitcoin service provider, has announced that though it has been using Mt. Gox to convert between fiat currency and Bitcoin, the latter is darn slow in processing the transactions.

The largest provider of Bitcoin payments in Europe, BIPS claimed that though the number of sell orders has increased recently, there has not been any improvement in Mt. Gox’s processing speed.

Recently, we also published news that Bitstamp surpassed Mt. Gox (http://www.forexminute.com/bitcoin/bitstamp-giving-neck-to-neck-competition-to-mt-gox-8805). Now, this new decision on the part of BIPS is another opportunity for Bitstamp and another loss for Mt. Gox, which is facing huge problems.

BIPS which was launched in 2013 was designed to perform Bitcoin tasks. Currently, it serves more than 10,000 customers globally. Operating from Denmark and Canada, BIPS has a lot of experience in creating Bitcoin payment solutions in the world and for that matter is trusted a lot by customers.

BIPS is PCI-DSS ready. Customers can trust its knowledgeable team which ensures Bitcoin is integrated effectively and efficiently. Now that the organization is signing in with Bitstamp, the efficiency will increase further as the latter is also known for effective and efficient services as well as great customer care services.

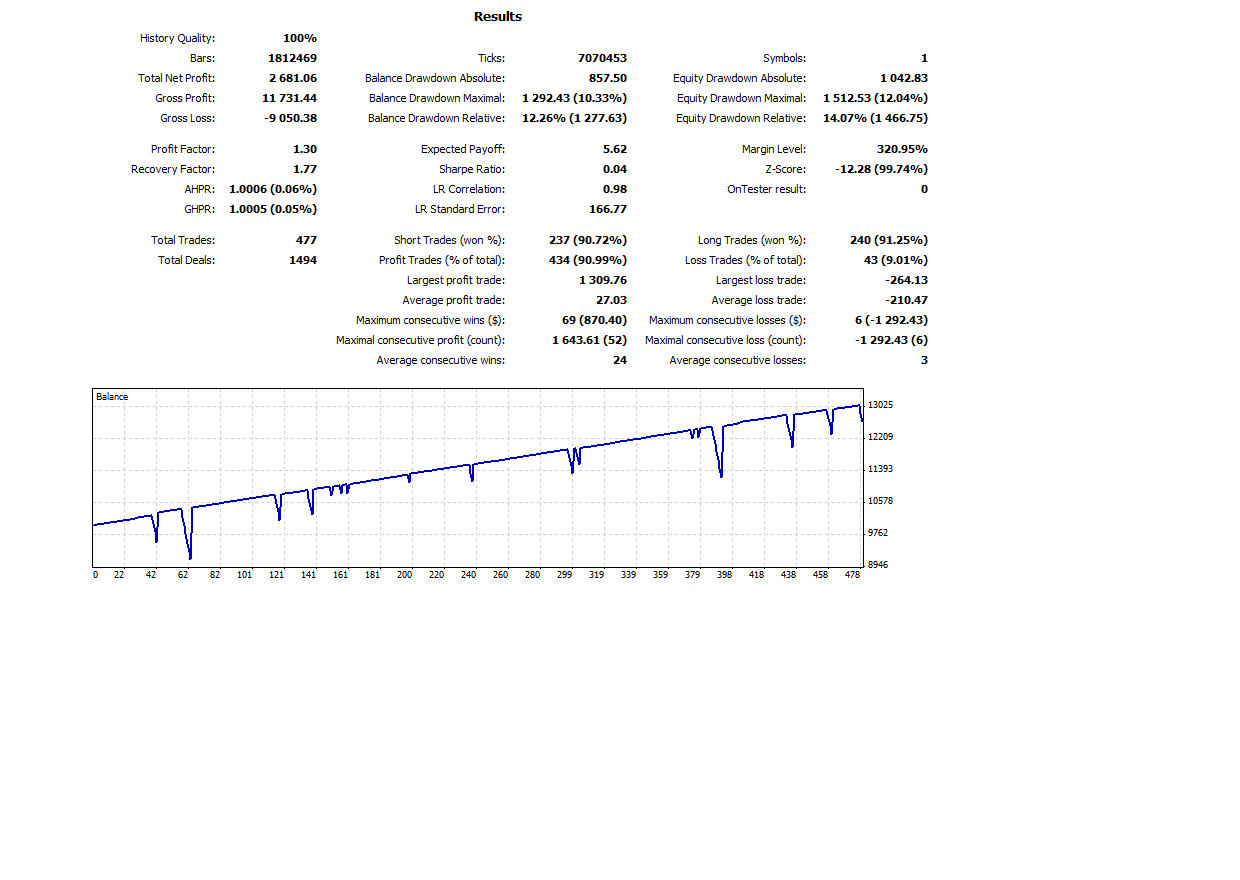

"Description: The UbzenA_20130725 is a system which places random_trades. Adds to negative trades when the number of -pips exceeds the bollinger_bands pips. I would consider it a scalper. Includes a stoploss using actual deposit currency $. The take profit is also actual currency $. The volume_size uses a time_passage to increase the volume (if system still negative). I like this volume_sizing because you can dial-up or dial-down the aggression depending upon your appetite.

-Pros: Ability to survive multiple years of testing and market conditions.

-Cons: No get rich quick. Requires a relatively large investment capital.

There's no optimization done to this system. Any suggestion for improvement, positive or negative (just don't be rude about it)."