LiteFinance / Profilo

The online ECN broker LiteFinance (ex. LiteForex) has been providing its clients access to Tier 1 liquidity in the currency, commodity, and stock market since 2005. All major currency pairs and cross rates, oil, precious metals, stock indexes, blue chips, and the largest set of cryptocurrency pairs can be traded at LiteFinance (ex. LiteForex).

Amici

376

Richieste

In uscita

LiteFinance

Yuan is strengthening. Forecast for 24.09.2020

Taking into account the sizes of the US and China’s economies, it is surprising that the renminbi plays a second role in Forex. I will analyze how the pandemic influences the yuan demand and offer a USDCNH trading plan.

Monthly fundamental forecast for yuan

Divergence in economic expansion is one of the key drivers for the Forex rates. It is like a car race. The GDP rate can be compared to car speed. If a country’s GDP is growing faster than that of the major competitors, the local currency is appreciating. However, the current recession has a unique feature. Unlike most global economies, China is going ahead. Other countries are trying to go back to the starting point after moving in the opposite direction. Is the winner identified?

Effective management in the fight against the pandemic is to help China get ahead of the US economy much earlier than anticipated. Bloomberg expects Chinese GDP to expand by 2% in 2020, OECD – by 1.8%. The US GDP is going to contract. The sizes of the two largest world’s economies are already comparable, so, it is strange that the renminbi plays a second role in Forex. According to the Bank for International Settlements, the greenback’s share in the Forex conversion operations was 88% in 2019, the renminbi accounts for 4.3%. The yen’s share was 17%, and the pound's share was 13%. However, the Chinese economy is almost three times bigger than the Japanese and it exceeds the UK economy by five times.

In 2020 the situation is different because of the pandemic. The HSBC notes that yuan is now more important in the foreign exchange rates of the G10 currencies. It is evident from both the rising correlation and more active than previously Asian Forex trading.

The USDCNH downtrend is supported by the growing demand for the renminbi and the expansion of the Chinese GDP. The Fed uses a huge monetary stimulus, and the PBOC doesn’t use any. Therefore, the gap between the yields on the US and China’s government bonds is widening to all-time highs. FTSE Russell intends to include Chinese securities in the calculation of its own indices. Beijing has issued debt obligations worth 9.62 trillion yuan since the beginning of the year, and the total volume of planned sales in 2020 significantly exceeds the indicators of 2019. The capital inflow in the largest Asian economy will support the USDCNH downtrend in the future.

The growing demand of the overseas investors for the Chinese assets could lead to bubbles in stock and real estate markets, which is a cause for PBoC concern. I do not think that the regulator’s attempts to put a barrier on the way of the RMB strengthening using a lower-than-expected fixing suggests the negative impact of the strong currency on foreign trade. In August, China’s exports increased by 9.5%. According to Capital Economics, China’s current account surplus in 2020 will reach 3% of GDP, the highest level in a decade.

Monthly USDCNH trading plan

I believe, the People’s Bank of China aims at smoothening the yuan growth rather than setting it back. The USDCNH correction up is a good chance to sell the pair. I recommend adding up to the shorts entered earlier with a target of at least 6.7.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/yuan-is-strengthening-forecast-for-24092020/?uid=285861726&cid=79634

Taking into account the sizes of the US and China’s economies, it is surprising that the renminbi plays a second role in Forex. I will analyze how the pandemic influences the yuan demand and offer a USDCNH trading plan.

Monthly fundamental forecast for yuan

Divergence in economic expansion is one of the key drivers for the Forex rates. It is like a car race. The GDP rate can be compared to car speed. If a country’s GDP is growing faster than that of the major competitors, the local currency is appreciating. However, the current recession has a unique feature. Unlike most global economies, China is going ahead. Other countries are trying to go back to the starting point after moving in the opposite direction. Is the winner identified?

Effective management in the fight against the pandemic is to help China get ahead of the US economy much earlier than anticipated. Bloomberg expects Chinese GDP to expand by 2% in 2020, OECD – by 1.8%. The US GDP is going to contract. The sizes of the two largest world’s economies are already comparable, so, it is strange that the renminbi plays a second role in Forex. According to the Bank for International Settlements, the greenback’s share in the Forex conversion operations was 88% in 2019, the renminbi accounts for 4.3%. The yen’s share was 17%, and the pound's share was 13%. However, the Chinese economy is almost three times bigger than the Japanese and it exceeds the UK economy by five times.

In 2020 the situation is different because of the pandemic. The HSBC notes that yuan is now more important in the foreign exchange rates of the G10 currencies. It is evident from both the rising correlation and more active than previously Asian Forex trading.

The USDCNH downtrend is supported by the growing demand for the renminbi and the expansion of the Chinese GDP. The Fed uses a huge monetary stimulus, and the PBOC doesn’t use any. Therefore, the gap between the yields on the US and China’s government bonds is widening to all-time highs. FTSE Russell intends to include Chinese securities in the calculation of its own indices. Beijing has issued debt obligations worth 9.62 trillion yuan since the beginning of the year, and the total volume of planned sales in 2020 significantly exceeds the indicators of 2019. The capital inflow in the largest Asian economy will support the USDCNH downtrend in the future.

The growing demand of the overseas investors for the Chinese assets could lead to bubbles in stock and real estate markets, which is a cause for PBoC concern. I do not think that the regulator’s attempts to put a barrier on the way of the RMB strengthening using a lower-than-expected fixing suggests the negative impact of the strong currency on foreign trade. In August, China’s exports increased by 9.5%. According to Capital Economics, China’s current account surplus in 2020 will reach 3% of GDP, the highest level in a decade.

Monthly USDCNH trading plan

I believe, the People’s Bank of China aims at smoothening the yuan growth rather than setting it back. The USDCNH correction up is a good chance to sell the pair. I recommend adding up to the shorts entered earlier with a target of at least 6.7.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/yuan-is-strengthening-forecast-for-24092020/?uid=285861726&cid=79634

LiteFinance

Four reasons for buying yen. Forecast for 16.09.20

Ahead of the Fed’s and Bank of Japan’s meetings, the Japanese yen is certainly worth discussing. Enjoy your popcorn and remember to check out the trading signals and trading plan for USDJPY and EURJPY for the nearest weeks at the end of this article.

Fundamental forecast for yen for today

Yoshihide Suga’s unconditional victory in the party race to become Japan’s next Prime Minister, the US-China trade war’s revival and the upcoming presidential elections in the USA redrew investors’ attention to the yen. USDJPY’s quotes have been falling for three days in a row and got close to the level of 105. Rumour has it that the Bank of Japan may get angry and intervene if that level is broken. The situation around EURJPY is interesting too.

If Shinzo Abe’s dismissal shocked the financial markets, the information about Yoshihide Suga’s appointment calmed them down. Let me remind you that Yoshihide Suga is Abe’s supporter and one of the authors of the “three arrows” strategy. The new Prime Minister isn’t going to put pressure on the BoJ in order to change monetary policy. He believes that there’s no need to raise taxes in the next 10 years, and that economic growth must improve the country’s financial state. He plans to shake up some sectors and bureaucratic mechanisms, but at the beginning of his term, he’ll need to recover GDP.

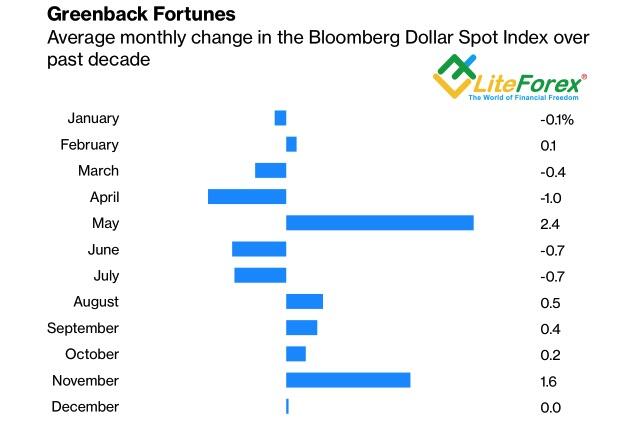

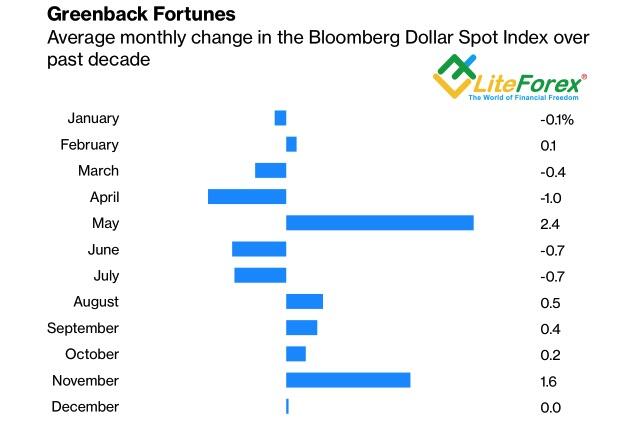

A clear political context is a boon for a national currency. The fact that Japan chose its PM, while the US has yet to choose its president, is beneficial to USDJPY bears. Still, their main trump is the divergence in the Fed’s and BoJ’s policies: the Fed’s response to recession was so fierce that the fall of the real US bond yields weakened the greenback and would probably continue weakening it.

The yen is growing on the WTO’s ruling that US tariffs on Chinese imports are illegal. Beijing approved of that. Washington got angry. I doubt that the conflict will escalate before the elections. However, it’s obvious that the trade war is a long-lasting subject no matter who takes the US president’s chair. In 2019, global investors thought it was the main factor in market pricing. In 2020, the trade war dropped to the 4th line: the pandemic, November’s US elections and payment default risks have become the number one priority topics.

I think the trade war subject has been undeservedly neglected. During a pandemic, imports and exports usually reduce proportionally, and the trade balance remains unchanged. It’s true of Canada, Japan, Britain and Germany. Alas, the US foreign trade deficit is growing and the Chinese one is reducing. China’s industrial sectors are recovering faster, and Beijing may face another round of clashes after the US election.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/four-reasons-for-buying-yen-forecast-as-of-160920/?uid=285861726&cid=79634

Ahead of the Fed’s and Bank of Japan’s meetings, the Japanese yen is certainly worth discussing. Enjoy your popcorn and remember to check out the trading signals and trading plan for USDJPY and EURJPY for the nearest weeks at the end of this article.

Fundamental forecast for yen for today

Yoshihide Suga’s unconditional victory in the party race to become Japan’s next Prime Minister, the US-China trade war’s revival and the upcoming presidential elections in the USA redrew investors’ attention to the yen. USDJPY’s quotes have been falling for three days in a row and got close to the level of 105. Rumour has it that the Bank of Japan may get angry and intervene if that level is broken. The situation around EURJPY is interesting too.

If Shinzo Abe’s dismissal shocked the financial markets, the information about Yoshihide Suga’s appointment calmed them down. Let me remind you that Yoshihide Suga is Abe’s supporter and one of the authors of the “three arrows” strategy. The new Prime Minister isn’t going to put pressure on the BoJ in order to change monetary policy. He believes that there’s no need to raise taxes in the next 10 years, and that economic growth must improve the country’s financial state. He plans to shake up some sectors and bureaucratic mechanisms, but at the beginning of his term, he’ll need to recover GDP.

A clear political context is a boon for a national currency. The fact that Japan chose its PM, while the US has yet to choose its president, is beneficial to USDJPY bears. Still, their main trump is the divergence in the Fed’s and BoJ’s policies: the Fed’s response to recession was so fierce that the fall of the real US bond yields weakened the greenback and would probably continue weakening it.

The yen is growing on the WTO’s ruling that US tariffs on Chinese imports are illegal. Beijing approved of that. Washington got angry. I doubt that the conflict will escalate before the elections. However, it’s obvious that the trade war is a long-lasting subject no matter who takes the US president’s chair. In 2019, global investors thought it was the main factor in market pricing. In 2020, the trade war dropped to the 4th line: the pandemic, November’s US elections and payment default risks have become the number one priority topics.

I think the trade war subject has been undeservedly neglected. During a pandemic, imports and exports usually reduce proportionally, and the trade balance remains unchanged. It’s true of Canada, Japan, Britain and Germany. Alas, the US foreign trade deficit is growing and the Chinese one is reducing. China’s industrial sectors are recovering faster, and Beijing may face another round of clashes after the US election.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/four-reasons-for-buying-yen-forecast-as-of-160920/?uid=285861726&cid=79634

LiteFinance

EUR/USD forecast: Dollar sends out an S.O.S.

Fundamental US dollar forecast for today

If the Fed calls for a fresh stimulus package, the US economy must be turning down

If the EURUSD bears are supported by ECB that doesn’t want the euro to appreciate, then the bulls follow the Fed. The US Federal Reserve doesn’t yet resort to verbal intervention, but all its actions weaken the US dollar. The EUR/USD is again at the top of figure 18, as investors worry that Jerome Powell will sound dovish at the press conference following the FOMC September meeting, and the global risk appetite has increased.

The Fed doesn’t like engaging in the political debates, so when it does, investors could see its call for a fresh stimulus package as a distress signal. The disputes between the Republicans and the Democrats, holding back the decision on the further financial aid programs, may completely destroy the US economy by the time when the COVID-19 vaccines are developed. So, the FOMC officials insist on a compromise for a boost in the US fiscal stimulus.

According to Columbia University, when certain sectors of the economy aren’t able to operate for non-economic reasons, a boost in government spending is a more effective tool than the interest rate cuts. Around half of economists surveyed by The Wall Street Journal don’t see the Fed raising rates before 2024. Futures markets show investors expect the first Fed rate increase in the second half of that year. The FOMC interest rate decision will hardly surprise the market. The two Fed’s hawks are likely to lower their forecasts for 2022 to zero.

I must admit the Fed has done a great job. It has stabilized the financial markets and sent the Treasury yield to the all-time low. The TIPS yield has gone negative, which makes investors increase the proportion of equities in their portfolios. So, the global risk appetite increases, and financial conditions improve.

While Treasuries stay still in the consolidation, asset managers have to focus on Forex if they want to make profits. The FX volatility is higher than it was twelve months ago. Nomura's example is indicative. The company bet on the rise of the Treasury yield amid the huge volume of the Treasuries issue in summer. However, when it became clear that the Fed’s purchases of the Treasuries will hinder the yield growth, so Nomura started selling the US dollar.

Therefore, even if the Fed says nothing about the greenback weakening, it doesn’t mean that it won’t try to do it. The Fed should keep the interest rates low for a long time, the Congress can’t agree on the additional government spending and the upcoming presidential elections are associated with political uncertainty. All of these factors should discourage EUR/USD bears. As I noted earlier, if the euro breaks out the resistance at $1.192, it can well continue the rally. The matter is whether the bulls will manage to break the strong level close to 1.2.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/eurusd-forecast-dollar-sends-out-an-sos/?uid=285861726&cid=79634

Fundamental US dollar forecast for today

If the Fed calls for a fresh stimulus package, the US economy must be turning down

If the EURUSD bears are supported by ECB that doesn’t want the euro to appreciate, then the bulls follow the Fed. The US Federal Reserve doesn’t yet resort to verbal intervention, but all its actions weaken the US dollar. The EUR/USD is again at the top of figure 18, as investors worry that Jerome Powell will sound dovish at the press conference following the FOMC September meeting, and the global risk appetite has increased.

The Fed doesn’t like engaging in the political debates, so when it does, investors could see its call for a fresh stimulus package as a distress signal. The disputes between the Republicans and the Democrats, holding back the decision on the further financial aid programs, may completely destroy the US economy by the time when the COVID-19 vaccines are developed. So, the FOMC officials insist on a compromise for a boost in the US fiscal stimulus.

According to Columbia University, when certain sectors of the economy aren’t able to operate for non-economic reasons, a boost in government spending is a more effective tool than the interest rate cuts. Around half of economists surveyed by The Wall Street Journal don’t see the Fed raising rates before 2024. Futures markets show investors expect the first Fed rate increase in the second half of that year. The FOMC interest rate decision will hardly surprise the market. The two Fed’s hawks are likely to lower their forecasts for 2022 to zero.

I must admit the Fed has done a great job. It has stabilized the financial markets and sent the Treasury yield to the all-time low. The TIPS yield has gone negative, which makes investors increase the proportion of equities in their portfolios. So, the global risk appetite increases, and financial conditions improve.

While Treasuries stay still in the consolidation, asset managers have to focus on Forex if they want to make profits. The FX volatility is higher than it was twelve months ago. Nomura's example is indicative. The company bet on the rise of the Treasury yield amid the huge volume of the Treasuries issue in summer. However, when it became clear that the Fed’s purchases of the Treasuries will hinder the yield growth, so Nomura started selling the US dollar.

Therefore, even if the Fed says nothing about the greenback weakening, it doesn’t mean that it won’t try to do it. The Fed should keep the interest rates low for a long time, the Congress can’t agree on the additional government spending and the upcoming presidential elections are associated with political uncertainty. All of these factors should discourage EUR/USD bears. As I noted earlier, if the euro breaks out the resistance at $1.192, it can well continue the rally. The matter is whether the bulls will manage to break the strong level close to 1.2.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/eurusd-forecast-dollar-sends-out-an-sos/?uid=285861726&cid=79634

LiteFinance

Fundamental Australian dollar forecast for today

Are the AUD/USD growth drivers exhausted?

In the second quarter, the Australian economy encountered the deepest downturn since the records started in 1959. Australia’s GDP contracted by 7% Q-o-Q and by 6.3% Y-o-Y. The RBA cut the interest rate to the record lo. The central bank has also bought AU$60 since March amid the QE program. The Aussie should have dropped in value, but the AUD/USD rate has been 32% up since the low hit in March. Doesn’t the major rule of the fundamental analysis “strong economy – strong currency” work here? Now, it perfectly works! The matter is that everything is relative in Forex!

A drop by 6.3% in Australian growth is nothing compared to the US GDP contraction by 32%. AUS$60 billion is very little compared with the trillions of dollars in the USA. In Australia, there are less than 30,000 of coronavirus cases, while there are more than six million of COVID-19 cases in the USA. Australia has managed the pandemic better than many other advanced economies, the economy is not critically weak, the RBA yield control policy allows it not to waste the monetary tools. Besides, China supports Australia’s foreign trade.

China is the largest market for Australian exports. Although the diplomatic relations between the two countries are tense, after Canberra accused China of COVID-19 laboratory origins, the trade relations are good. Since the beginning of the year, Australia’s exports to China have increased by 75% compared to the same period in 2016, when the last official meeting of the countries’ leaders took place. The core of the China-Australia trade is iron ore. Over the past twelve months, China has imported 700 million tons of iron ore from Australia. It is twice as much as it was in 2010 when the diplomatic relations between Australia and China were much better.

Therefore, the AUD/USD uptrend is strong for several reasons. Australia’s economy is stronger compared to others, China supports Australia’s foreign trade, the Fed’s monetary expansion is unprecedented, which weakens the US dollar. The matter is whether the major bullish drivers have exhausted? Will the Aussie continue its rally?

The analysts polled by Reuters believe the AUD/USD uptrend should slow down. The see the pair trading at 0.72 in one and three months. In six and twelve months, the exchange rate will be at 0.73 and 0.74, accordingly. These levels are close to the current one, which suggests a long consolidation period. In my opinion, it is still relevant to buy the Aussie. China has averted a new round of trade war with the US. The Australian government is working on the income tax reduction bill, which should support GDP growth. The greenback’s’ long-term outlook remains bearish. So, I recommend entering the AUD/USD longs if Australia’s job report for August is positive. The middle-term targets are at 0.75 and 0.763.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/audusd-forecast-aussie-wants-to-keep-the-party-going/?uid=285861726&cid=79634

Are the AUD/USD growth drivers exhausted?

In the second quarter, the Australian economy encountered the deepest downturn since the records started in 1959. Australia’s GDP contracted by 7% Q-o-Q and by 6.3% Y-o-Y. The RBA cut the interest rate to the record lo. The central bank has also bought AU$60 since March amid the QE program. The Aussie should have dropped in value, but the AUD/USD rate has been 32% up since the low hit in March. Doesn’t the major rule of the fundamental analysis “strong economy – strong currency” work here? Now, it perfectly works! The matter is that everything is relative in Forex!

A drop by 6.3% in Australian growth is nothing compared to the US GDP contraction by 32%. AUS$60 billion is very little compared with the trillions of dollars in the USA. In Australia, there are less than 30,000 of coronavirus cases, while there are more than six million of COVID-19 cases in the USA. Australia has managed the pandemic better than many other advanced economies, the economy is not critically weak, the RBA yield control policy allows it not to waste the monetary tools. Besides, China supports Australia’s foreign trade.

China is the largest market for Australian exports. Although the diplomatic relations between the two countries are tense, after Canberra accused China of COVID-19 laboratory origins, the trade relations are good. Since the beginning of the year, Australia’s exports to China have increased by 75% compared to the same period in 2016, when the last official meeting of the countries’ leaders took place. The core of the China-Australia trade is iron ore. Over the past twelve months, China has imported 700 million tons of iron ore from Australia. It is twice as much as it was in 2010 when the diplomatic relations between Australia and China were much better.

Therefore, the AUD/USD uptrend is strong for several reasons. Australia’s economy is stronger compared to others, China supports Australia’s foreign trade, the Fed’s monetary expansion is unprecedented, which weakens the US dollar. The matter is whether the major bullish drivers have exhausted? Will the Aussie continue its rally?

The analysts polled by Reuters believe the AUD/USD uptrend should slow down. The see the pair trading at 0.72 in one and three months. In six and twelve months, the exchange rate will be at 0.73 and 0.74, accordingly. These levels are close to the current one, which suggests a long consolidation period. In my opinion, it is still relevant to buy the Aussie. China has averted a new round of trade war with the US. The Australian government is working on the income tax reduction bill, which should support GDP growth. The greenback’s’ long-term outlook remains bearish. So, I recommend entering the AUD/USD longs if Australia’s job report for August is positive. The middle-term targets are at 0.75 and 0.763.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/audusd-forecast-aussie-wants-to-keep-the-party-going/?uid=285861726&cid=79634

LiteFinance

EUR/USD forecast: Euro doesn’t believe its luck

Fundamental euro forecast for today

EUR/USD bulls do not believe Christine Lagarde’s optimism

ECB is monitoring the euro exchange rate, but it is not willing to start a currency war now. Christine Lagarde expressed optimism about the euro-area economic recovery, the ECB president hasn’t signaled the further monetary easing in the near future. Lagarde’s speech should have encouraged the EUR/USD bulls, but they didn’t believe the good news, so they didn’t go ahead. It looks like a catch. The ECB officials express concerns about the euro strengthening ahead of the Governing Council meeting, and, next, the ECB president sounds hawkish.

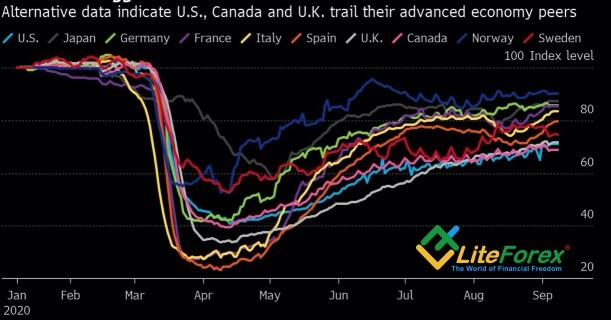

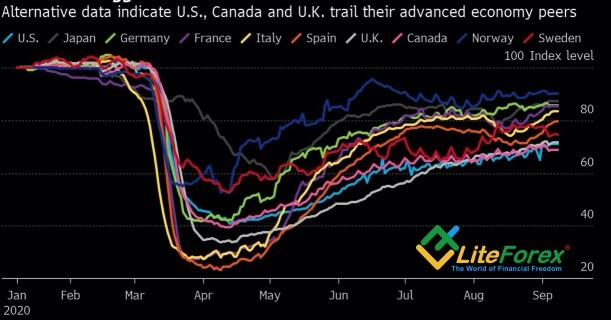

At the press conference, Christine Lagarde several times stressed that exchange rates and the euro appreciation were not the ECB policy target. However, the exchange rate was the most discussed topic at the Governing Council meeting in September. According to a Reuters source familiar with the matter, the ECB officials have agreed that the EUR/USD rally resulted from a faster economic rebound in the euro area compared to the US growth, the Fed’s easy monetary policy, the increased confidence in the currency bloc due to the management of the pandemic fallout. Moreover, the upcoming presidential election in the US weighs on the US dollar. Bloomberg’s leading indicators signal that the GDP recovery is the fastest in Germany. After a temporary downturn in France, Italy, and Spain on concern about the second wave of the COVID-19 outbreak, the economic activity is gradually increasing. The UK, US, and Canada persistently lag behind.

Four sources on the ECB's Governing Council told Reuters that the ECB acknowledges the negative effects of the euro's strength on inflation and growth, but the central bank is not willing to start a currency war. Speaking after the meeting, two sources said they saw $1.20 as not far from the equilibrium exchange rate at present. According to Citigroup, if the EUR/USD is up by another 5%, the European Central Bank will take active measures. In the meanwhile, the regulator is carefully monitoring the exchange rates of the regional currency. The Governing Council policymakers at the meeting considered adopting the language used to stem the euro's previous rally, in early 2018, when the former ECB President Mario Draghi described "volatility in the exchange rate" as "a source of uncertainty", according to Reuters.

The Reuters sources say the southern countries of the eurozone are much more concerned about the euro strengthening than the northern ones. The Governing Council hawks wanted Lagarde to note the great progress in the euro-area economic recovery. François Villeroy de Galhau, the governor of the French central bank, insisted on this especially strongly.

So, the EUR/USD bulls feared verbal interventions, signals of monetary easing, and the ECB willingness to follow the Fed’s example and target the average inflation. None of the fears came true. However, the euro hasn’t consolidated above $1.19. Are the buyers so weak? Or, they could feel a catch and will resume attacks after the ECB officials’ speeches. I suppose both scenarios should be considered. If the euro rises above $1.192, it will be relevant to buy. If it slides down below the support levels of $1.1795 and $1.1765, we should sell the euro versus the dollar.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/eurusd-forecast-euro-doesnt-believe-its-luck/?uid=285861726&cid=79634

Dynamics of the economic recovery

Fundamental euro forecast for today

EUR/USD bulls do not believe Christine Lagarde’s optimism

ECB is monitoring the euro exchange rate, but it is not willing to start a currency war now. Christine Lagarde expressed optimism about the euro-area economic recovery, the ECB president hasn’t signaled the further monetary easing in the near future. Lagarde’s speech should have encouraged the EUR/USD bulls, but they didn’t believe the good news, so they didn’t go ahead. It looks like a catch. The ECB officials express concerns about the euro strengthening ahead of the Governing Council meeting, and, next, the ECB president sounds hawkish.

At the press conference, Christine Lagarde several times stressed that exchange rates and the euro appreciation were not the ECB policy target. However, the exchange rate was the most discussed topic at the Governing Council meeting in September. According to a Reuters source familiar with the matter, the ECB officials have agreed that the EUR/USD rally resulted from a faster economic rebound in the euro area compared to the US growth, the Fed’s easy monetary policy, the increased confidence in the currency bloc due to the management of the pandemic fallout. Moreover, the upcoming presidential election in the US weighs on the US dollar. Bloomberg’s leading indicators signal that the GDP recovery is the fastest in Germany. After a temporary downturn in France, Italy, and Spain on concern about the second wave of the COVID-19 outbreak, the economic activity is gradually increasing. The UK, US, and Canada persistently lag behind.

Four sources on the ECB's Governing Council told Reuters that the ECB acknowledges the negative effects of the euro's strength on inflation and growth, but the central bank is not willing to start a currency war. Speaking after the meeting, two sources said they saw $1.20 as not far from the equilibrium exchange rate at present. According to Citigroup, if the EUR/USD is up by another 5%, the European Central Bank will take active measures. In the meanwhile, the regulator is carefully monitoring the exchange rates of the regional currency. The Governing Council policymakers at the meeting considered adopting the language used to stem the euro's previous rally, in early 2018, when the former ECB President Mario Draghi described "volatility in the exchange rate" as "a source of uncertainty", according to Reuters.

The Reuters sources say the southern countries of the eurozone are much more concerned about the euro strengthening than the northern ones. The Governing Council hawks wanted Lagarde to note the great progress in the euro-area economic recovery. François Villeroy de Galhau, the governor of the French central bank, insisted on this especially strongly.

So, the EUR/USD bulls feared verbal interventions, signals of monetary easing, and the ECB willingness to follow the Fed’s example and target the average inflation. None of the fears came true. However, the euro hasn’t consolidated above $1.19. Are the buyers so weak? Or, they could feel a catch and will resume attacks after the ECB officials’ speeches. I suppose both scenarios should be considered. If the euro rises above $1.192, it will be relevant to buy. If it slides down below the support levels of $1.1795 and $1.1765, we should sell the euro versus the dollar.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/eurusd-forecast-euro-doesnt-believe-its-luck/?uid=285861726&cid=79634

Dynamics of the economic recovery

LiteFinance

GBP/USD forecast: Pound stays calm

Fundamental Pound forecast for today

Sterling is focused on foreign factors and ignores domestic negative data

The GBP is still moving according to foreign factors because of the lack of important events in the economic calendar and expectations of the virtual gathering of the world’s central bankers in Jackson Hole. Investors pay no attention to the negative factors associated with Brexit, twin deficits (budget deficit and current account deficit), and the first-ever excess of the UK national debt over £2 trillion. Forex analysts suggest that if the euro breaks higher than $1.2 and moves on towards $1.25, the sterling will easily reach $1.35.

The options market is surprisingly stable without any response to Brexit issues. A year ago, the pound volatility will higher than that of the Mexican peso, and the market was shaken. The sterling volatility over the next 3 months is below the average for the last 5 years and slightly above the euro volatility. Taking into account that the EU-UK talks are close to the critical point, the market stability looks surprising. It suggests that either investors are confident in a soon Brexit deal or they do not expect that any of the parties will add uncertainty. However, a 60% likelihood of a Brexit deal doesn’t rule out a 40% chance of a no-deal divorce. It seems that after any failure in the previous negotiations, investors expect a breakthrough in each next round.

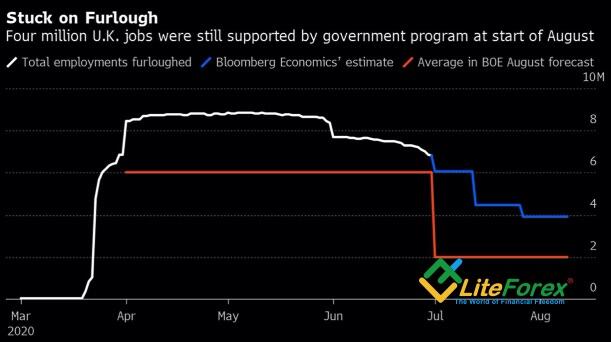

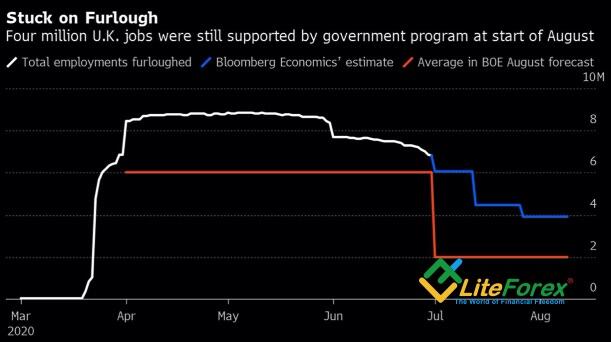

According to JP Morgan, a no-deal Brexit will contract the UK GDP by 5.5%, and the UK economy is already in a recession. There are several bearish drivers for the sterling. The twin deficits, the Conservatives’ discontent with the growth of the UK national debt, the second wave of COVID-19 in Europe, and the potentially vulnerable labor market due to the expiration of the financial aid package in October. According to Bloomberg, the programs, which have protected four million jobs should end in October. That could hit the labor market, slow down the GDP in the fourth quarter, and result in a boost of the UK QE by £100 billion.

So, the pound has many flaws. However, it has caught the tailwinds and responds to the increase in the global risk appetite and the Fed’s willingness to weaken the US dollar through the average inflation targeting. Nonetheless, Jerome Powell may not announce such a plan in Jackson Hole. Furthermore, the S&P500 may not be close to the all-time highs for a long time. According to the majority of 200 experts surveyed by Reuters, global stock indexes at the end of 2020 are likely to be lower than the levels hit in February, which means a correction down from the current levels.

In my opinion, investors ignore the UK's negative domestic factors because they are focused on Powell’s upcoming speech. If he announces the Fed’s average inflation targeting, the GBP/USD may break through the August highs and continue rallying up to 1.337 and 1.35. Otherwise, the sterling could go down below the support at 1.315.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/gbpusd-forecast-pound-stays-calm/?uid=285861726&cid=79634

Dynamics of UK jobs supported by state programs

Fundamental Pound forecast for today

Sterling is focused on foreign factors and ignores domestic negative data

The GBP is still moving according to foreign factors because of the lack of important events in the economic calendar and expectations of the virtual gathering of the world’s central bankers in Jackson Hole. Investors pay no attention to the negative factors associated with Brexit, twin deficits (budget deficit and current account deficit), and the first-ever excess of the UK national debt over £2 trillion. Forex analysts suggest that if the euro breaks higher than $1.2 and moves on towards $1.25, the sterling will easily reach $1.35.

The options market is surprisingly stable without any response to Brexit issues. A year ago, the pound volatility will higher than that of the Mexican peso, and the market was shaken. The sterling volatility over the next 3 months is below the average for the last 5 years and slightly above the euro volatility. Taking into account that the EU-UK talks are close to the critical point, the market stability looks surprising. It suggests that either investors are confident in a soon Brexit deal or they do not expect that any of the parties will add uncertainty. However, a 60% likelihood of a Brexit deal doesn’t rule out a 40% chance of a no-deal divorce. It seems that after any failure in the previous negotiations, investors expect a breakthrough in each next round.

According to JP Morgan, a no-deal Brexit will contract the UK GDP by 5.5%, and the UK economy is already in a recession. There are several bearish drivers for the sterling. The twin deficits, the Conservatives’ discontent with the growth of the UK national debt, the second wave of COVID-19 in Europe, and the potentially vulnerable labor market due to the expiration of the financial aid package in October. According to Bloomberg, the programs, which have protected four million jobs should end in October. That could hit the labor market, slow down the GDP in the fourth quarter, and result in a boost of the UK QE by £100 billion.

So, the pound has many flaws. However, it has caught the tailwinds and responds to the increase in the global risk appetite and the Fed’s willingness to weaken the US dollar through the average inflation targeting. Nonetheless, Jerome Powell may not announce such a plan in Jackson Hole. Furthermore, the S&P500 may not be close to the all-time highs for a long time. According to the majority of 200 experts surveyed by Reuters, global stock indexes at the end of 2020 are likely to be lower than the levels hit in February, which means a correction down from the current levels.

In my opinion, investors ignore the UK's negative domestic factors because they are focused on Powell’s upcoming speech. If he announces the Fed’s average inflation targeting, the GBP/USD may break through the August highs and continue rallying up to 1.337 and 1.35. Otherwise, the sterling could go down below the support at 1.315.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/gbpusd-forecast-pound-stays-calm/?uid=285861726&cid=79634

Dynamics of UK jobs supported by state programs

LiteFinance

EUR/USD forecast: Dollar is drifting

Fundamental US dollar forecast for today

Investors are staying aside ahead of Jerome Powell’s speech and the publications of the US important domestic data

People see what they want to see. The euro fans are so enthusiastic that they prefer to ignore the flaws of the single European currency. Is the US-China trade resumed? It is not a problem! In 2018-2019, the EUR/USD pair was falling amid the trade conflict escalation. In 2020, however, it will be rising in this case because of the diversification of the PBOC FX reserves in favor of the euro. Are there talks about the expansion of European QE? It is not a problem! The ECB just can’t ease its monetary policy as much as the Fed. Is there the second pandemic wave in Europe? It doesn’t matter; the illness is asymptomatic; there won’t be another lockdown.

Optimism grows stronger. However, people with accompanying pathologies most often die from COVID-19. If we transfer this metaphor to the global economic sense, the accompanying pathology of the export-led euro-area economy is a downturn of the international trade. The process started because of trade wars, and the pandemic intensified it. According to the CPB Netherlands Bureau for Economic Policy Analysis, flows of goods across borders were 12.5% lower in the second quarter than in the first quarter of the year. It is the worst drop since records started in 2000. In the three months through June, the US exports contracted by 24.8%, the euro-area exports were 19.2% down. However, the US exports account for 20% of the country’s GDP; in the Eurozone, they exceed 40%. The euro-area exporters will have a difficult time, taking into account the euro’s rapid growth.

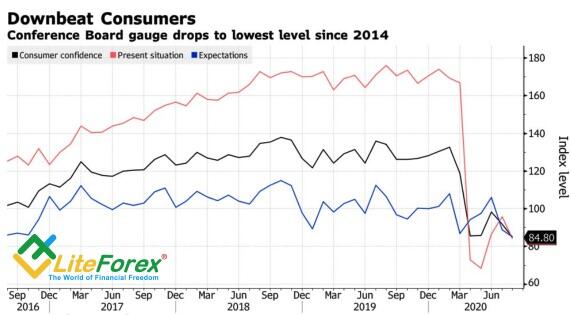

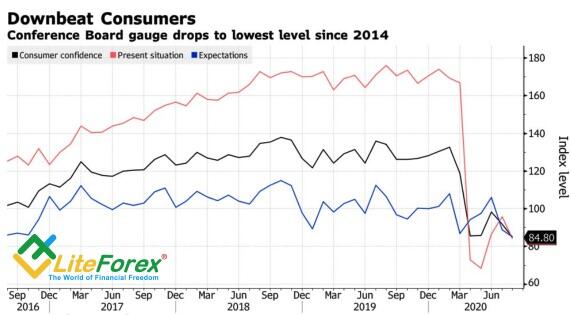

With this regard, the USA is in a better position, which allows the White House to repeat its mantra about the V-shaped economic recovery. People see what they want to see. Larry Kudlow, the chief economic advisor to Trump, ignores the problems of the US labor market and the drop in consumer confidence to the lowest level since 2014. He stresses the best new home sales over the past 14 years, industrial recovery, and the S&P500 record highs.

Unlike the White House, the Federal Reserve is more cautious. Jerome Powell has many times stressed the slow GDP recovery, the necessity to take control over OCVID-19, and fresh fiscal stimulus. The Republicans and Democrats can’t reach an agreement for a new financial aid package, and the Fed has to take the responsibility. So, investors anticipate Powell’s speech in Jackson Hole to get something meaningful.

According to MUFG Bank, Powell will focus on holding low interest rates, thereby weakening the greenback. Investors expect the Fed Chair to express the Fed’s willingness to “seek a moderate inflation overshoot” and reinforce its commitment to full employment. If so, there will be other evidence that the Fed is running out of monetary tools. If the number of Americans seeking unemployment benefits falls while durable goods orders rise, the EUR/USD bears can go ahead and try to break out the support levels of 1.178 and 1.1755. Otherwise, weak data and the Fed’s willingness to weaken the dollar can resume the greenback’s downtrend.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/eurusd-forecast-dollar-is-drifting/?uid=285861726&cid=79634

Dynamics of US consumer confidence

Fundamental US dollar forecast for today

Investors are staying aside ahead of Jerome Powell’s speech and the publications of the US important domestic data

People see what they want to see. The euro fans are so enthusiastic that they prefer to ignore the flaws of the single European currency. Is the US-China trade resumed? It is not a problem! In 2018-2019, the EUR/USD pair was falling amid the trade conflict escalation. In 2020, however, it will be rising in this case because of the diversification of the PBOC FX reserves in favor of the euro. Are there talks about the expansion of European QE? It is not a problem! The ECB just can’t ease its monetary policy as much as the Fed. Is there the second pandemic wave in Europe? It doesn’t matter; the illness is asymptomatic; there won’t be another lockdown.

Optimism grows stronger. However, people with accompanying pathologies most often die from COVID-19. If we transfer this metaphor to the global economic sense, the accompanying pathology of the export-led euro-area economy is a downturn of the international trade. The process started because of trade wars, and the pandemic intensified it. According to the CPB Netherlands Bureau for Economic Policy Analysis, flows of goods across borders were 12.5% lower in the second quarter than in the first quarter of the year. It is the worst drop since records started in 2000. In the three months through June, the US exports contracted by 24.8%, the euro-area exports were 19.2% down. However, the US exports account for 20% of the country’s GDP; in the Eurozone, they exceed 40%. The euro-area exporters will have a difficult time, taking into account the euro’s rapid growth.

With this regard, the USA is in a better position, which allows the White House to repeat its mantra about the V-shaped economic recovery. People see what they want to see. Larry Kudlow, the chief economic advisor to Trump, ignores the problems of the US labor market and the drop in consumer confidence to the lowest level since 2014. He stresses the best new home sales over the past 14 years, industrial recovery, and the S&P500 record highs.

Unlike the White House, the Federal Reserve is more cautious. Jerome Powell has many times stressed the slow GDP recovery, the necessity to take control over OCVID-19, and fresh fiscal stimulus. The Republicans and Democrats can’t reach an agreement for a new financial aid package, and the Fed has to take the responsibility. So, investors anticipate Powell’s speech in Jackson Hole to get something meaningful.

According to MUFG Bank, Powell will focus on holding low interest rates, thereby weakening the greenback. Investors expect the Fed Chair to express the Fed’s willingness to “seek a moderate inflation overshoot” and reinforce its commitment to full employment. If so, there will be other evidence that the Fed is running out of monetary tools. If the number of Americans seeking unemployment benefits falls while durable goods orders rise, the EUR/USD bears can go ahead and try to break out the support levels of 1.178 and 1.1755. Otherwise, weak data and the Fed’s willingness to weaken the dollar can resume the greenback’s downtrend.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/eurusd-forecast-dollar-is-drifting/?uid=285861726&cid=79634

Dynamics of US consumer confidence

LiteFinance

EUR/USD forecast: Euro is scared of heights

Fundamental Euro forecast for today

Isn’t EUR/USD trading too high?

The Forex market is always changing! In winter, the news about progress in the US-China would strengthen the euro. In spring, the US stock market rally would support the EUR/USD bulls. At the end of summer, however, the euro isn’t rising amid the US optimistic announcements about making a deal with China. It isn’t rising although the S&P500 has hit a fresh high on the news about the accelerated approval of vaccines and the use of blood plasma to treat critically ill COVID-19 patients. Isn’t the euro trading too high?

Although Donald Trump claims he does not want to talk with China and does not rule out a complete break in relations with this country, US and Chinese officials discussed the status of the trade deal. Chinese Vice-Premier Liu He spoke with US Trade Representative Robert Lighthizer and Treasury Secretary Steven Mnuchin to discuss further action needed to make progress on the trade deal. Such a tone suggests the White House still wants to reach an agreement with China.

Beijing has fallen behind its first-year commitment. Nonetheless, the recovery of China’s economy, growing domestic demand, and the unwillingness to inflame tensions with Washington suggest that there won’t be a new round of trade wars.

Donald Trump doesn’t want to resume the trade battle ahead of the US presidential election. Joe Biden has already accused him of the failure of his policy with Beijing, so he wouldn’t give his opponent another reason for criticism. China doesn’t want new tariffs. China’s economy, unlike most advanced economies, will expand in 2020. JP Morgan increased the forecast for the Chinese GDP in 2020 from 1.3% to 2.5%. The US GDP, for example, should contract by 8% this year.

The continuous rise of the US stock indexes and progress in US-China trade relations supported Trump’s approval ratings, which could be a reason for the EUR/USD correction. What is good for Trump is good for the US dollar.

But still, the primary reason for the euro drawdown is likely to be the second wave of the pandemic in Europe. The ratio of the COVID-19 cases in Europe and the US peaked in early August, but the situation has changed since then.

If the EUR/USD breaks out supports at 1.178 and 1.1755 could suggest entering short-term sell trades. One should not hold the shorts for too long, in my opinion. Many euro’s growth drivers still work out, and the deterioration of the euro-area epidemiological situation will hardly last for a long time.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/eurusd-forecast-euro-is-scared-of-heights/?uid=285861726&cid=79634

Fundamental Euro forecast for today

Isn’t EUR/USD trading too high?

The Forex market is always changing! In winter, the news about progress in the US-China would strengthen the euro. In spring, the US stock market rally would support the EUR/USD bulls. At the end of summer, however, the euro isn’t rising amid the US optimistic announcements about making a deal with China. It isn’t rising although the S&P500 has hit a fresh high on the news about the accelerated approval of vaccines and the use of blood plasma to treat critically ill COVID-19 patients. Isn’t the euro trading too high?

Although Donald Trump claims he does not want to talk with China and does not rule out a complete break in relations with this country, US and Chinese officials discussed the status of the trade deal. Chinese Vice-Premier Liu He spoke with US Trade Representative Robert Lighthizer and Treasury Secretary Steven Mnuchin to discuss further action needed to make progress on the trade deal. Such a tone suggests the White House still wants to reach an agreement with China.

Beijing has fallen behind its first-year commitment. Nonetheless, the recovery of China’s economy, growing domestic demand, and the unwillingness to inflame tensions with Washington suggest that there won’t be a new round of trade wars.

Donald Trump doesn’t want to resume the trade battle ahead of the US presidential election. Joe Biden has already accused him of the failure of his policy with Beijing, so he wouldn’t give his opponent another reason for criticism. China doesn’t want new tariffs. China’s economy, unlike most advanced economies, will expand in 2020. JP Morgan increased the forecast for the Chinese GDP in 2020 from 1.3% to 2.5%. The US GDP, for example, should contract by 8% this year.

The continuous rise of the US stock indexes and progress in US-China trade relations supported Trump’s approval ratings, which could be a reason for the EUR/USD correction. What is good for Trump is good for the US dollar.

But still, the primary reason for the euro drawdown is likely to be the second wave of the pandemic in Europe. The ratio of the COVID-19 cases in Europe and the US peaked in early August, but the situation has changed since then.

If the EUR/USD breaks out supports at 1.178 and 1.1755 could suggest entering short-term sell trades. One should not hold the shorts for too long, in my opinion. Many euro’s growth drivers still work out, and the deterioration of the euro-area epidemiological situation will hardly last for a long time.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/eurusd-forecast-euro-is-scared-of-heights/?uid=285861726&cid=79634

LiteFinance

EUR/USD forecast: Dollar generates a new idea

Fundamental US dollar forecast for today

Investors will focus on the US presidential election in autumn

Markets are driven by investment ideas, which are generated first, then investors open positions, and finally, close them if something goes wrong. In spring, everybody was tracking the global risk appetite and the changes in the S&P500 value, to buy or sell the dollar pairs. In summer, they were focused on the divergence in the economic expansion between the euro area and the US, which sent the EUR/USD to the highest level over the last two years. Once the market had had doubts about its efficiency, investors closed longs and sent the euro down.

The PMI report in August has ruined the idea of the leading performance of the euro-area GDP over the US growth. The PMI is thought to be a leading indicator for the GDP. The US composite PMI has been up to its eighteen-month high, and its European peer has fallen from 54.9 to 51.6, making the EUR/USD bulls exit longs. The US economy is being reopened after the lockdown introduced in the spring; it is surprisingly resilient to the coronavirus epidemic going in the country. The Eurozone’s growth is slowing down amid the rise in the number of new COVID-19 cases in Germany, France, and Spain to the levels recorded in May, and even in April.

Also, there are problems in the euro-area labor market. So, the Forex analysts say that the European economy is more likely to have a W-shaped recovery, rather than a V-shaped one. The programs of the population retention in the labor force existing in the euro area do not encourage people to find new jobs. The labor market is dynamic when it goes through the phases of rising and fall. If the fall is artificially averted, can we expect the employment boom in 2021-2022? The actual unemployment level may not be at the official level of 7.8% but is likely to be above 9%, and in Spain, it can be close 20%. What will happen when the assistance programs are over?

In my opinion, things are not that bad. The growth in the new coronavirus cases in Europe results from the holiday season. Mostly young people are sick, most often asymptomatic, which explains the low number of hospitalizations and mortality. The GDP recovery will be slow both in the US and in the euro area, the markets need a fresh investment idea. It can well be the US presidential election. What is good for Donald Trump is good for the US dollar. Hence, the growing risks of Trump’s defeat will weigh on the USD.

Therefore, the EUR/USD can roll down in the short-term. But, in the long-term, the euro uptrend is likely to resume. My idea about the middle-term consolidation in the range of 1.158-1.188 looks more and more promising. So, I still recommend buying the euro on the rebound from the supports at $1.173, $1.168, and $1.162.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/eurusd-forecast-dollar-generates-a-new-idea/?uid=285861726&cid=79634

Fundamental US dollar forecast for today

Investors will focus on the US presidential election in autumn

Markets are driven by investment ideas, which are generated first, then investors open positions, and finally, close them if something goes wrong. In spring, everybody was tracking the global risk appetite and the changes in the S&P500 value, to buy or sell the dollar pairs. In summer, they were focused on the divergence in the economic expansion between the euro area and the US, which sent the EUR/USD to the highest level over the last two years. Once the market had had doubts about its efficiency, investors closed longs and sent the euro down.

The PMI report in August has ruined the idea of the leading performance of the euro-area GDP over the US growth. The PMI is thought to be a leading indicator for the GDP. The US composite PMI has been up to its eighteen-month high, and its European peer has fallen from 54.9 to 51.6, making the EUR/USD bulls exit longs. The US economy is being reopened after the lockdown introduced in the spring; it is surprisingly resilient to the coronavirus epidemic going in the country. The Eurozone’s growth is slowing down amid the rise in the number of new COVID-19 cases in Germany, France, and Spain to the levels recorded in May, and even in April.

Also, there are problems in the euro-area labor market. So, the Forex analysts say that the European economy is more likely to have a W-shaped recovery, rather than a V-shaped one. The programs of the population retention in the labor force existing in the euro area do not encourage people to find new jobs. The labor market is dynamic when it goes through the phases of rising and fall. If the fall is artificially averted, can we expect the employment boom in 2021-2022? The actual unemployment level may not be at the official level of 7.8% but is likely to be above 9%, and in Spain, it can be close 20%. What will happen when the assistance programs are over?

In my opinion, things are not that bad. The growth in the new coronavirus cases in Europe results from the holiday season. Mostly young people are sick, most often asymptomatic, which explains the low number of hospitalizations and mortality. The GDP recovery will be slow both in the US and in the euro area, the markets need a fresh investment idea. It can well be the US presidential election. What is good for Donald Trump is good for the US dollar. Hence, the growing risks of Trump’s defeat will weigh on the USD.

Therefore, the EUR/USD can roll down in the short-term. But, in the long-term, the euro uptrend is likely to resume. My idea about the middle-term consolidation in the range of 1.158-1.188 looks more and more promising. So, I still recommend buying the euro on the rebound from the supports at $1.173, $1.168, and $1.162.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/eurusd-forecast-dollar-generates-a-new-idea/?uid=285861726&cid=79634

LiteFinance

EUR/USD forecast: Euro took up math

Fundamental Euro forecast for today

Open EUR/USD position according to the euro-area PMI data

Financial markets base on mathematics. The divergence in the economic growth, having supported the EUR/USD bulls during the summer, looked like an equation with one unknown. A better epidemiological situation in Europe than in the USA has almost convinced investors that the euro-area economy will be recovering faster than the US GDP. As a result, the rise of the major currency pair depended on the US economic data. A better economic performance, together with the Fed’s unwillingness to ease its monetary policy (which signals hidden optimism), sent the euro down to $1.18. However, once there appeared some negative, the euro bulls went ahead.

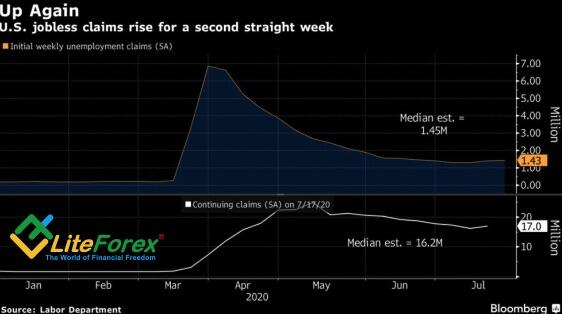

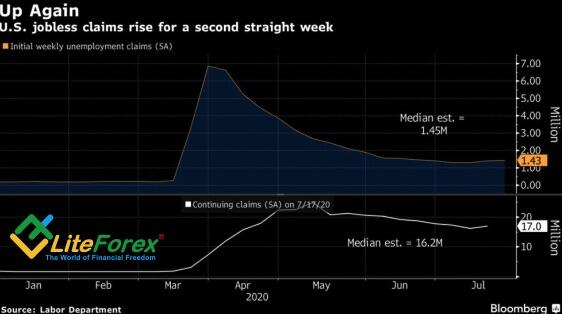

The US jobless claims are again back to a level of above 1 million, the manufacturing PMI data reported by the New York Fed and Philadelphia Fed are weak. These reports show that the US economy is not revering as rapidly as the dollar buyers would like. I have many times stressed that the market turns out to be more fundamental amid the interest rates of the world’s leading central banks, which are close to zero. Investors are quite responsive to the reports on the US domestic data, especially since the US economy has been that unknown in the growth- gap equation.

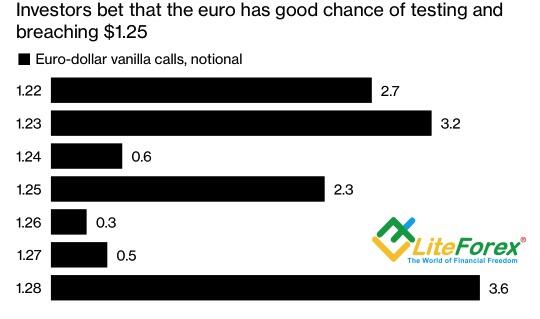

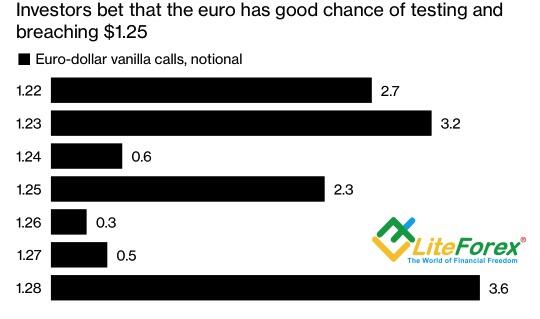

The experts’ projections for the euro-area economy have been optimistic. In my opinion, too optimistic. Since the French-German stimulus plan was adopted, the euro risk reversals have been up by 60-80 basis points. The indicator has increased so rapidly only three times since the records began in 2006, and each time, the EUR/USD was up by 5% and more in a few net months. There is an increased demand in the options market for call options with strikes of 1.22, 1.23, 1.25, and even 1.28.

Investors completely forgot that an equation with one unknown could transform at any moment into an equation with two unknowns. In Europe, the second wave of the pandemic unfolding. In Spain, about 4,800 new COVID-19 cases are registered per day, which is the highest since April; in France, the number of coronavirus cases has increased by 50% in a week, in Germany, the figure has exceeded 1,500, the highest since early May. Yes, European relative indicators still fall short of the US, where 150 cases for 1 million of the population (in problematic Spain, there are 110 cases for 1 million), Yes, most infected are young people. Hence, the number of hospitalizations and deaths is small, but who knows how the situation will develop further?

The difficulties will increase amid the expiration of programs to retain the non-working population in the labor force, which could result in a surge in unemployment and weigh on the consumer activity. The ECB stressed this problem at its July meeting, the central bank is willing to expand QE if necessary. It is a bearish factor for the EUR/USD, but traders ignored it. The euphoria about the euro is still present and could end up bad for the euro buyers. The uncertainty about the euro-area economic recovery increases the risk that the euro will roll down to $1.18 if the euro-area PMI data for August are weak.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/eurusd-forecast-euro-took-up-math/?uid=285861726&cid=79634

Demand for euro-dollar options

Fundamental Euro forecast for today

Open EUR/USD position according to the euro-area PMI data

Financial markets base on mathematics. The divergence in the economic growth, having supported the EUR/USD bulls during the summer, looked like an equation with one unknown. A better epidemiological situation in Europe than in the USA has almost convinced investors that the euro-area economy will be recovering faster than the US GDP. As a result, the rise of the major currency pair depended on the US economic data. A better economic performance, together with the Fed’s unwillingness to ease its monetary policy (which signals hidden optimism), sent the euro down to $1.18. However, once there appeared some negative, the euro bulls went ahead.

The US jobless claims are again back to a level of above 1 million, the manufacturing PMI data reported by the New York Fed and Philadelphia Fed are weak. These reports show that the US economy is not revering as rapidly as the dollar buyers would like. I have many times stressed that the market turns out to be more fundamental amid the interest rates of the world’s leading central banks, which are close to zero. Investors are quite responsive to the reports on the US domestic data, especially since the US economy has been that unknown in the growth- gap equation.

The experts’ projections for the euro-area economy have been optimistic. In my opinion, too optimistic. Since the French-German stimulus plan was adopted, the euro risk reversals have been up by 60-80 basis points. The indicator has increased so rapidly only three times since the records began in 2006, and each time, the EUR/USD was up by 5% and more in a few net months. There is an increased demand in the options market for call options with strikes of 1.22, 1.23, 1.25, and even 1.28.

Investors completely forgot that an equation with one unknown could transform at any moment into an equation with two unknowns. In Europe, the second wave of the pandemic unfolding. In Spain, about 4,800 new COVID-19 cases are registered per day, which is the highest since April; in France, the number of coronavirus cases has increased by 50% in a week, in Germany, the figure has exceeded 1,500, the highest since early May. Yes, European relative indicators still fall short of the US, where 150 cases for 1 million of the population (in problematic Spain, there are 110 cases for 1 million), Yes, most infected are young people. Hence, the number of hospitalizations and deaths is small, but who knows how the situation will develop further?

The difficulties will increase amid the expiration of programs to retain the non-working population in the labor force, which could result in a surge in unemployment and weigh on the consumer activity. The ECB stressed this problem at its July meeting, the central bank is willing to expand QE if necessary. It is a bearish factor for the EUR/USD, but traders ignored it. The euphoria about the euro is still present and could end up bad for the euro buyers. The uncertainty about the euro-area economic recovery increases the risk that the euro will roll down to $1.18 if the euro-area PMI data for August are weak.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/eurusd-forecast-euro-took-up-math/?uid=285861726&cid=79634

Demand for euro-dollar options

LiteFinance

EUR/USD forecast: bulls won’t let the euro burst

Fundamental Euro forecast for today

Which bubble is bigger? The stock or the Forex market?

Market bubbles suggest rapidly rising prices, which attract the buyer hoping to earn quick money. Such buyers do not express due diligence or worry about the long-term prospects of what they buy. They ignore standard gauges as irrelevant, and the bubble goes bigger through cheap money. It looks familiar, doesn’t it? The rallies of the US stock indexes and the EUR/USD more and more look like a bubble. The bulls, however, do not let it burst.

It took S&P500 just 126 trading days to go back to February highs and hit a new record high. It is the fastest stocks rally after the bear market, which, by the way, had lasted for 33 days, with an average value of 302 of the previous 22 downtrends since the 1920s. Besides, the P/E of the stocks included in the index is 22.6. It is the highest value since the dot-com crisis. But the standard gauges are ignored in bubbles, aren’t they? The market is far from reality. The US economic state is hardly the same as it was in February.

The S&P500 rally has, for a long time, supported the EUR/USD bulls, but, now, they have different drivers. The stock indexes are growing amid the Fed’s support, which the euro is strengthening because of the GDP growth gap between the euro-area and the US. Remarkably, the volatility of the equity market and the Forex are now diverging. The US stocks are growing because of the cheap liquidity; the currency market is currently pricing the risks of the possibilities of the COVID-19 second wave in the euro area, the presidential election in the US, and the escalation of trade wars.

The EUR/USD rally may also look like a bubble. The net longs on the euro held by the asset managers are the highest ever. The euro-area economy was hit by the pandemic stronger than the US, and the yields on the European securities is still low. After all, everything is relative. While Steven Mnuchin claims that the negotiations between the Democrats and the republicans are stalled, the EU governments are quick to implement mitigation measures. The spread between US and German real yields is as narrow as it was in 2014 last time. The appeal of the US securities is falling, and that of the euro-area assets is growing. Isn’t it a reason to buy the euro?

According to Scotiabank, speculative dollar shorts are not excessive; they haven’t reached the level of 2017. The market has just started shorting on the greenback, so there is room to open more shorts. Société Générale notes, the US dollar’s rate, in real terms, is still 25% higher than the levels of 2011, and the Fed is still willing to depreciate the dollar. Is the EUR/USD a bubble? I do not think so. My strategy is to hold the euro longs and add up on the price falls. While the price is above 1.183, bulls control the market.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/eurusd-forecast-bulls-wont-let-euro-burst/?uid=285861726&cid=79634

Fundamental Euro forecast for today

Which bubble is bigger? The stock or the Forex market?

Market bubbles suggest rapidly rising prices, which attract the buyer hoping to earn quick money. Such buyers do not express due diligence or worry about the long-term prospects of what they buy. They ignore standard gauges as irrelevant, and the bubble goes bigger through cheap money. It looks familiar, doesn’t it? The rallies of the US stock indexes and the EUR/USD more and more look like a bubble. The bulls, however, do not let it burst.

It took S&P500 just 126 trading days to go back to February highs and hit a new record high. It is the fastest stocks rally after the bear market, which, by the way, had lasted for 33 days, with an average value of 302 of the previous 22 downtrends since the 1920s. Besides, the P/E of the stocks included in the index is 22.6. It is the highest value since the dot-com crisis. But the standard gauges are ignored in bubbles, aren’t they? The market is far from reality. The US economic state is hardly the same as it was in February.

The S&P500 rally has, for a long time, supported the EUR/USD bulls, but, now, they have different drivers. The stock indexes are growing amid the Fed’s support, which the euro is strengthening because of the GDP growth gap between the euro-area and the US. Remarkably, the volatility of the equity market and the Forex are now diverging. The US stocks are growing because of the cheap liquidity; the currency market is currently pricing the risks of the possibilities of the COVID-19 second wave in the euro area, the presidential election in the US, and the escalation of trade wars.

The EUR/USD rally may also look like a bubble. The net longs on the euro held by the asset managers are the highest ever. The euro-area economy was hit by the pandemic stronger than the US, and the yields on the European securities is still low. After all, everything is relative. While Steven Mnuchin claims that the negotiations between the Democrats and the republicans are stalled, the EU governments are quick to implement mitigation measures. The spread between US and German real yields is as narrow as it was in 2014 last time. The appeal of the US securities is falling, and that of the euro-area assets is growing. Isn’t it a reason to buy the euro?

According to Scotiabank, speculative dollar shorts are not excessive; they haven’t reached the level of 2017. The market has just started shorting on the greenback, so there is room to open more shorts. Société Générale notes, the US dollar’s rate, in real terms, is still 25% higher than the levels of 2011, and the Fed is still willing to depreciate the dollar. Is the EUR/USD a bubble? I do not think so. My strategy is to hold the euro longs and add up on the price falls. While the price is above 1.183, bulls control the market.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/eurusd-forecast-bulls-wont-let-euro-burst/?uid=285861726&cid=79634

LiteFinance

XAU/USD forecast: Gold market will face a turmoil

Fundamental gold price forecast for today

Coronavirus vaccines will hold XAU/USD bulls back

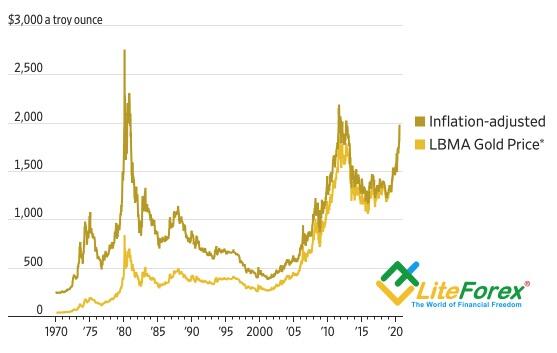

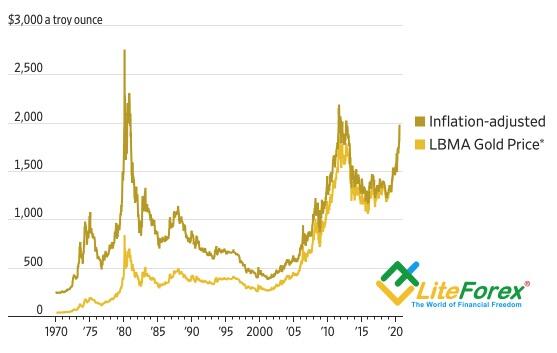

Mass gold sell-offs in the mid-August discouraged the gold bulls. However, a quick rebound above $2000 per ounce allowed large banks to resume their recommendations to buy. According to Credit Suisse forecasts, gold prices will grow to $2500 in 2021. Standard Chartered Bank believes investors will use any price decline to open long positions amid the weak dollar, low bond rates, and substantial fiscal stimuli. There are enough bulls in the gold market, and this fact alone raises concerns in the extended rally of the XAU/USD. Can there be turmoil?

Many bullish factors have already been priced in the XAUUSD, and there are not so many growth drivers left. I mean the long-term dollar weakness and the Fed’s willingness to put up with the inflation above its 2% target for as long as it is necessary. The problem is whether consumer prices will grow. The inflation level, expected by the bond market, returned to the January level in five years; but it is still below the Fed’s target. Inflation-adjusted five-year options suggest a little chance that the indicator will be above 3%. It is more likely to slide below 1%. The story of 2009-2011 can repeat in the gold market. Then, the gold price, having reached its all-time high, crashed, as investors didn’t nay more believe that the fiscal stimulus could accelerate the PCE.

In my opinion, the bond market can give a clue on the future gold trends. Gold price correlates with the Treasury Inflation-Protected Securities (TIPS). The increase in the TIPS yields on August 11-12 triggered an XAU/USD correction.

The gold rally takes place ahead of auctions and amid talks about the Russian vaccine. The more is fiscal stimulus, the more money needs Treasury. The initial public offering makes investors sell securities in the secondary market, which pushes up the yields. Taking into account vast scales of the state funding, such a situation could repeat, which increases the risks of instability in the gold market.

Still, the most significant danger for the gold buyers could result from good news about the COVID-19 vaccine. The Treasury yields are quite responsive to the pandemic. Positive information about vaccines will support the economy, but, at the same time, it will weigh on gold. Purchasing managers think the glass is half-full, and the continuous rally of the US PMI must support the growth of the global bond market rates.

Therefore, gold bulls still have two big advantages. They are the greenback weakness and the Fed’s willingness to put up with a high inflation rate. Nonetheless, unless the consumer price growth accelerates and the USD crashes, the XAU/USD will hardly continue to rally. On the contrary, an increase in the Treasury yields looks more likely, which suggests the relevance of the gold sales on the rise to $2050-2055 and $2130-2135.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/xauusd-forecast-gold-market-will-face-a-turmoil/?uid=285861726&cid=79634

Dynamics of gold and TIPS yields

Fundamental gold price forecast for today

Coronavirus vaccines will hold XAU/USD bulls back

Mass gold sell-offs in the mid-August discouraged the gold bulls. However, a quick rebound above $2000 per ounce allowed large banks to resume their recommendations to buy. According to Credit Suisse forecasts, gold prices will grow to $2500 in 2021. Standard Chartered Bank believes investors will use any price decline to open long positions amid the weak dollar, low bond rates, and substantial fiscal stimuli. There are enough bulls in the gold market, and this fact alone raises concerns in the extended rally of the XAU/USD. Can there be turmoil?

Many bullish factors have already been priced in the XAUUSD, and there are not so many growth drivers left. I mean the long-term dollar weakness and the Fed’s willingness to put up with the inflation above its 2% target for as long as it is necessary. The problem is whether consumer prices will grow. The inflation level, expected by the bond market, returned to the January level in five years; but it is still below the Fed’s target. Inflation-adjusted five-year options suggest a little chance that the indicator will be above 3%. It is more likely to slide below 1%. The story of 2009-2011 can repeat in the gold market. Then, the gold price, having reached its all-time high, crashed, as investors didn’t nay more believe that the fiscal stimulus could accelerate the PCE.

In my opinion, the bond market can give a clue on the future gold trends. Gold price correlates with the Treasury Inflation-Protected Securities (TIPS). The increase in the TIPS yields on August 11-12 triggered an XAU/USD correction.

The gold rally takes place ahead of auctions and amid talks about the Russian vaccine. The more is fiscal stimulus, the more money needs Treasury. The initial public offering makes investors sell securities in the secondary market, which pushes up the yields. Taking into account vast scales of the state funding, such a situation could repeat, which increases the risks of instability in the gold market.

Still, the most significant danger for the gold buyers could result from good news about the COVID-19 vaccine. The Treasury yields are quite responsive to the pandemic. Positive information about vaccines will support the economy, but, at the same time, it will weigh on gold. Purchasing managers think the glass is half-full, and the continuous rally of the US PMI must support the growth of the global bond market rates.

Therefore, gold bulls still have two big advantages. They are the greenback weakness and the Fed’s willingness to put up with a high inflation rate. Nonetheless, unless the consumer price growth accelerates and the USD crashes, the XAU/USD will hardly continue to rally. On the contrary, an increase in the Treasury yields looks more likely, which suggests the relevance of the gold sales on the rise to $2050-2055 and $2130-2135.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/xauusd-forecast-gold-market-will-face-a-turmoil/?uid=285861726&cid=79634

Dynamics of gold and TIPS yields

LiteFinance

Brent forecast: Oil has been trading in the corridor for too long

Oil price fundamental forecast for today

The longer lasts consolidation, the more likely is the trend to start

The longer consolidation lasts, the more likely is the trend start

Beginner traders like to join strong trends. Experienced traders know that it is more beneficial to monitor the assets that have been trading flat for a long time. The consolidation period will end sooner or later, being followed by new trends. The longer is the market trading in a narrow range, the more chances are that a sharp movement should start. With this regard, oil is quite a promising asset.

At first sight, the oil market should be moving down. The OPEC+ is gradually increasing oil production, international organizations lower their forecasts for oil global demand amid the difficult epidemiological situation in the US and the world. Besides, judging by the past experience, the US oil producers should be increasing the output as the prices grow. Unfortunately for the oil bears, the oil price is not falling. It is a reason to think that, if the market doesn’t go where it should, it is likely to go in the opposite direction.

To the surprise of many investors, the United States is the main reason for optimism. According to Baker Hughes data, the number of the US oil rig has dropped to the lowest level since 2005. It is the leading indicator of US oil production. According to The U.S. Energy Information Administration (EIA) forecasts, the US crude oil production will be 11.26 million barrels per day in 2020. It is far less than the production before the pandemic.