Evgeniy Piskachev / Profilo

- Informazioni

|

12+ anni

esperienza

|

0

prodotti

|

0

versioni demo

|

|

0

lavori

|

0

segnali

|

0

iscritti

|

In the forex market for over 5 years . In trade used technical analysis indicators , as well as economic and political news. If you are interested in more conservative and lucrative trade might trust.

Amici

3563

Richieste

In uscita

Evgeniy Piskachev

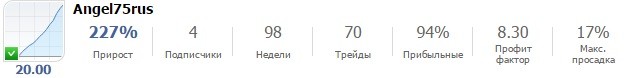

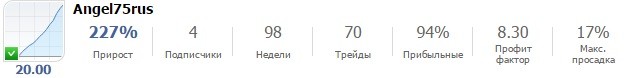

Join! ! ! Stablly 15-20% a month! ! !

Присоединяйтесь!!! Стабильно 15-20% в месяц!!!

https://www.mql5.com/ru/signals/64999

Присоединяйтесь!!! Стабильно 15-20% в месяц!!!

https://www.mql5.com/ru/signals/64999

[Eliminato]

2014.11.09

[Eliminato]

Evgeniy Piskachev

Join! ! ! Stablly 15-20% a month! ! !

Присоединяйтесь!!! Стабильно 15-20% в месяц!!!

https://www.mql5.com/ru/signals/52212

Присоединяйтесь!!! Стабильно 15-20% в месяц!!!

https://www.mql5.com/ru/signals/52212

Evgeniy Piskachev

Join! ! ! Stablly 15-20% a month! ! !

Присоединяйтесь!!! Стабильно 15-20% в месяц!!!

https://www.mql5.com/ru/signals/6922

Присоединяйтесь!!! Стабильно 15-20% в месяц!!!

https://www.mql5.com/ru/signals/6922

Evgeniy Piskachev

Post pubblicati Рынок ждёт трудовую статистику из США

На торгах в Европе евро/доллар скорректировался до отметки 1,2407. Фунт/доллар стабилизировался на уровне 1,5831 после выхода слабого торгового баланса в Великобритании. Доллар просел в преддверии релиза NFP, но по-прежнему удерживает сильные позиции...

Condividi sui social network · 8

252

Evgeniy Piskachev

Japan's Economy Minister Akira Amari said on Saturday he saw progress in Asia-Pacific regional trade negotiations, although it would be difficult to reach an agreement by the end of the year, according to Jiji press.

Japan economy minister says TPP agreement difficult by year-end: reportJapan economy minister says TPP agreement difficult by year-end: report

Trade ministers from the 12 nations participating in the Trans-Pacific Partnership (TPP) pact held talks on the sidelines of an annual Asia-Pacific Economic Cooperation Forum (APEC) meeting in Beijing.

The regional trade pact was stalled in September, as the U.S. and Japan, the two biggest economies participating in the trade deal, blamed the other for a stalemate over tariffs on farm products.

© Reuters. Japan's Economics Minister Akira Amari arrives at Prime Minister Shinzo Abe's official residence in Tokyo© Reuters. Japan's Economics Minister Akira Amari arrives at Prime Minister Shinzo Abe's official residence in Tokyo

Japan wants to protect sensitive goods, including beef, pork, rice and dairy, which are important to its farming sector, while the United States seeks to protect U.S. carmakers from increased Japanese competition. The United States insists that Japan lower barriers to agricultural imports.

Japan economy minister says TPP agreement difficult by year-end: reportJapan economy minister says TPP agreement difficult by year-end: report

Trade ministers from the 12 nations participating in the Trans-Pacific Partnership (TPP) pact held talks on the sidelines of an annual Asia-Pacific Economic Cooperation Forum (APEC) meeting in Beijing.

The regional trade pact was stalled in September, as the U.S. and Japan, the two biggest economies participating in the trade deal, blamed the other for a stalemate over tariffs on farm products.

© Reuters. Japan's Economics Minister Akira Amari arrives at Prime Minister Shinzo Abe's official residence in Tokyo© Reuters. Japan's Economics Minister Akira Amari arrives at Prime Minister Shinzo Abe's official residence in Tokyo

Japan wants to protect sensitive goods, including beef, pork, rice and dairy, which are important to its farming sector, while the United States seeks to protect U.S. carmakers from increased Japanese competition. The United States insists that Japan lower barriers to agricultural imports.

[Eliminato]

2014.11.09

[Eliminato]

Evgeniy Piskachev

Evgeniy Piskachev

Join! ! ! Stablly 15-20% a month! ! !

Присоединяйтесь!!! Стабильно 15-20% в месяц!!!

https://www.mql5.com/ru/signals/6922

https://www.mql5.com/ru/signals/52212

https://www.mql5.com/ru/signals/64999

Join! ! ! Stablly 15-20% a month! ! !

Присоединяйтесь!!! Стабильно 15-20% в месяц!!!

https://www.mql5.com/ru/signals/6922

https://www.mql5.com/ru/signals/52212

https://www.mql5.com/ru/signals/64999

Evgeniy Piskachev

Post pubblicati В ЕС приняли во внимание официальную реакцию РФ на выборы в ДНР и ЛНР

В Европейском союзе приняли во внимание реакцию России на выборы в самопровозглашенных Донецкой и Луганской народных республиках, заявила в пятницу "Интерфаксу" в Брюсселе Майя Коцьянчич, официальный представитель главы дипломатии ЕС Федерики Могерини...

Condividi sui social network · 7

182

1

Evgeniy Piskachev

Post pubblicati Раскорреляция ММВБ и РТС усиливается

На фоне ослабления рубля раскорреляция двух основных индексов российского фондового рынка усиливается. В то время как рублёвый индекс ММВБ растёт десятую сессию подряд (вновь превысив 1500 пунктов), долларовый индекс РТС сегодня утром впервые после кризиса 2009 года опустился ниже 1000 пунктов...

Condividi sui social network · 6

139

Evgeniy Piskachev

JPMorgan Chase & Co (N:JPM), the largest U.S. bank by assets, said it would cut 3,000 more jobs than previously expected in its retail banking division.

JPMorgan to cut 3,000 more retail banking jobsJPMorgan to cut 3,000 more retail banking jobs

The bank said it would reduce 4,000 jobs in its card, merchant services and auto unit, up from the 2,000 previously announced. The bank is also cutting 7,000 jobs in its mortgage banking unit, up from 6,000.

JPMorgan will have eliminated 27,000 jobs by the year-end from its consumer bank unit over two years, even after additions for more risk controls and regulatory compliance.

Some 18,000 jobs will have been taken out of mortgage banking, where the company has less work to do refinancing loans and handling troubled mortgages left from the financial crisis.

Many big banks, including Wells Fargo & Co (N:WFC) and Bank of America Corp (N:BAC), have been laying off mortgage workers as higher interest rates make refinancing less attractive to homeowners.

JPMorgan said it expects 146,000 Chase Bank jobs by the year-end, down by 11,000 from a year earlier.

The bank expects its 2016 retail banking expense base to be $2 billion lower than in 2014, JPMorgan's retail bank head Gordon Smith said in an investor conference on Friday.

JPMorgan to cut 3,000 more retail banking jobsJPMorgan to cut 3,000 more retail banking jobs

The bank said it would reduce 4,000 jobs in its card, merchant services and auto unit, up from the 2,000 previously announced. The bank is also cutting 7,000 jobs in its mortgage banking unit, up from 6,000.

JPMorgan will have eliminated 27,000 jobs by the year-end from its consumer bank unit over two years, even after additions for more risk controls and regulatory compliance.

Some 18,000 jobs will have been taken out of mortgage banking, where the company has less work to do refinancing loans and handling troubled mortgages left from the financial crisis.

Many big banks, including Wells Fargo & Co (N:WFC) and Bank of America Corp (N:BAC), have been laying off mortgage workers as higher interest rates make refinancing less attractive to homeowners.

JPMorgan said it expects 146,000 Chase Bank jobs by the year-end, down by 11,000 from a year earlier.

The bank expects its 2016 retail banking expense base to be $2 billion lower than in 2014, JPMorgan's retail bank head Gordon Smith said in an investor conference on Friday.

Evgeniy Piskachev

Post pubblicati US Jobs And More

The US dollar is narrowly mixed as the market awaits for North American jobs data to close out the week. It has been another good week for the greenback. It has appreciated against all the major and emerging market currencies. The US 10-year yield has edged higher this week...

Condividi sui social network · 5

119

Evgeniy Piskachev

The US dollar is narrowly mixed as the market awaits for North American jobs data to close out the week. It has been another good week for the greenback. It has appreciated against all the major and emerging market currencies.

The US 10-year yield has edged higher this week. The 5 bp increase puts the yield just below 2.40%, its highest since October 7. With the notable exception of Spanish bonos, European bond yields were unchanged to lower. Australian benchmark yield had been lower until today when yields rose almost 11 bp, despite the somber monetary policy statement. The continued fall in the Australian dollar, now at its lowest level in more than four years may be souring the appetite for the AAA-issuer.

The RBA warned that Japan’s monetary policy may spur flows into Australia, keeping the Australian dollar stronger than justified by economic fundamentals. Economists have traditionally understood that currencies should move to bring some macro-economic variable into balance, like prices, money supply, external accounts, or interest rates. The problem is that a “clearing price” for one is not necessarily the “clearing price” for another variable.

The fact of the matter is that the Australian dollar has been the second worst performing currency this week, just behind the Japanese yen. The yen has fallen 2.45% this week while the Aussie is off 2.25%, and that includes today’s 0.5% advance. While many observers have cried that the BOJ’s actions are another strike in the currency war, we are less sanguine. It takes two to tango. The response by other countries, including the US, the euro area, and China, have been noticeably absent.

Japanese stocks shine, with the Nikkei gaining 7.8% this week, helped by the BOJ/GPIF action at the end of last week. The latest MOF data shows that foreign investors stepped up their purchases of Japanese bonds (JPY640 bln or ~$6.6 bln) and Japanese stocks (JPY905 bln or ~$9.3 bln). Japanese investors also increased their foreign asset purchases. The JPY807 bln of foreign bonds is the most in three months. They also bought JPY326 bln of foreign stocks. Note that this report covers the sessions before the BOJ/GPIF announcement. Next week's MOF report will be even more telling.

The main focus today is on the US jobs report. The trend lower in weekly initial jobless claims (four-week average stands at new cyclical lows), the ADP report (230k) and the various surveys, including the service ISM that showed near record strength, all point to another robust report. As we have noted before, job growth in the US has been amazingly steady. The three-month average is 224k. The six-month average is 245k. The 12-month average stands at 221k. Other details of the report may be more mixed. Hourly earnings were flat in September and might have ticked up in October. The work week that ticked up in September might have slipped back in October.

However, given sentiment, even a mildly disappointing report will likely be shrugged off. The BOJ is ramping up its QQE, and the GPIF will lead a large scale portfolio re-allocation. Yesterday Draghi reaffirmed the ECB's commitment to increase its balance sheet considerably, and set the wheels more formally into motion to explore additional measures (assets?) as the risks remain decidedly on the downside.

Many pundits have seized Draghi's comments to claim that sovereign bond purchases are imminent. We remain less convinced, given the daunting legal, political and technical hurdles. References to textbook QE seems downright silly as no such thing exists. As we have noted, the Federal Reserve does not call its long-term asset purchases QE, but CE as in credit easing. The bottom line is that the ECB is increasing its balance sheet. There are other assets it can buy shy of sovereign bonds. These include supra-nationals, uncovered bank bonds and corporate bonds.

In Europe today, German industrial production was a bit softer than expected (1.4% rather than 2.0%), but France was a bit better (flat instead of -0.2%), and Spain was stronger than both. It's 1.0% increase year-over-year contrasts with Germany's decline of 0.1% and France's 0.3% decline.

There is an interesting discussion taking place in the EU today. The revisions to the national income accounts have translated into new funds that the UK and the Netherlands have to pay the EU. The money is due at the end of the month. Dutch Fin Min Dijsselbloem does not want to pay a lump sum, but rather set up a payment schedule over the next year. The UK’s Cameron is seeking a reduction in its payment, and also some kind of payment scheme.

Reportedly Cameron warned that sentiment in the UK was hardening against the EU (as if it has nothing to do with signals from his government and was all the EU’s fault). Merkel has made clear, over a different issue (immigration) that while Germany (unlike France) wants the UK to stay in the EU, it is not willing to ensure this at any cost. Moreover, other countries who are on the receiving end want their funds. Poland, for example, says that the 317 mln euros its is to receive would put the 2015 deficit below the EC’s 3% target.

The US 10-year yield has edged higher this week. The 5 bp increase puts the yield just below 2.40%, its highest since October 7. With the notable exception of Spanish bonos, European bond yields were unchanged to lower. Australian benchmark yield had been lower until today when yields rose almost 11 bp, despite the somber monetary policy statement. The continued fall in the Australian dollar, now at its lowest level in more than four years may be souring the appetite for the AAA-issuer.

The RBA warned that Japan’s monetary policy may spur flows into Australia, keeping the Australian dollar stronger than justified by economic fundamentals. Economists have traditionally understood that currencies should move to bring some macro-economic variable into balance, like prices, money supply, external accounts, or interest rates. The problem is that a “clearing price” for one is not necessarily the “clearing price” for another variable.

The fact of the matter is that the Australian dollar has been the second worst performing currency this week, just behind the Japanese yen. The yen has fallen 2.45% this week while the Aussie is off 2.25%, and that includes today’s 0.5% advance. While many observers have cried that the BOJ’s actions are another strike in the currency war, we are less sanguine. It takes two to tango. The response by other countries, including the US, the euro area, and China, have been noticeably absent.

Japanese stocks shine, with the Nikkei gaining 7.8% this week, helped by the BOJ/GPIF action at the end of last week. The latest MOF data shows that foreign investors stepped up their purchases of Japanese bonds (JPY640 bln or ~$6.6 bln) and Japanese stocks (JPY905 bln or ~$9.3 bln). Japanese investors also increased their foreign asset purchases. The JPY807 bln of foreign bonds is the most in three months. They also bought JPY326 bln of foreign stocks. Note that this report covers the sessions before the BOJ/GPIF announcement. Next week's MOF report will be even more telling.

The main focus today is on the US jobs report. The trend lower in weekly initial jobless claims (four-week average stands at new cyclical lows), the ADP report (230k) and the various surveys, including the service ISM that showed near record strength, all point to another robust report. As we have noted before, job growth in the US has been amazingly steady. The three-month average is 224k. The six-month average is 245k. The 12-month average stands at 221k. Other details of the report may be more mixed. Hourly earnings were flat in September and might have ticked up in October. The work week that ticked up in September might have slipped back in October.

However, given sentiment, even a mildly disappointing report will likely be shrugged off. The BOJ is ramping up its QQE, and the GPIF will lead a large scale portfolio re-allocation. Yesterday Draghi reaffirmed the ECB's commitment to increase its balance sheet considerably, and set the wheels more formally into motion to explore additional measures (assets?) as the risks remain decidedly on the downside.

Many pundits have seized Draghi's comments to claim that sovereign bond purchases are imminent. We remain less convinced, given the daunting legal, political and technical hurdles. References to textbook QE seems downright silly as no such thing exists. As we have noted, the Federal Reserve does not call its long-term asset purchases QE, but CE as in credit easing. The bottom line is that the ECB is increasing its balance sheet. There are other assets it can buy shy of sovereign bonds. These include supra-nationals, uncovered bank bonds and corporate bonds.

In Europe today, German industrial production was a bit softer than expected (1.4% rather than 2.0%), but France was a bit better (flat instead of -0.2%), and Spain was stronger than both. It's 1.0% increase year-over-year contrasts with Germany's decline of 0.1% and France's 0.3% decline.

There is an interesting discussion taking place in the EU today. The revisions to the national income accounts have translated into new funds that the UK and the Netherlands have to pay the EU. The money is due at the end of the month. Dutch Fin Min Dijsselbloem does not want to pay a lump sum, but rather set up a payment schedule over the next year. The UK’s Cameron is seeking a reduction in its payment, and also some kind of payment scheme.

Reportedly Cameron warned that sentiment in the UK was hardening against the EU (as if it has nothing to do with signals from his government and was all the EU’s fault). Merkel has made clear, over a different issue (immigration) that while Germany (unlike France) wants the UK to stay in the EU, it is not willing to ensure this at any cost. Moreover, other countries who are on the receiving end want their funds. Poland, for example, says that the 317 mln euros its is to receive would put the 2015 deficit below the EC’s 3% target.

Evgeniy Piskachev

Post pubblicati О девальвации, манипуляциях и утках СМИ

Как обвалить евро, палец о палец не ударив? Нужно создать иллюзию его роста – и тут же разочаровать рынки, разбив их надежды...

Condividi sui social network · 4

148

Evgeniy Piskachev

Is what happens in China important to the rest of the world? I would guess a few would say 'yes'. What about stock-market performance? Is China important to the S&P 500 and other global markets? Again, I think a few would say 'yes'.

Over the past 5 years, the Shanghai Composite index and the S&P 500 have been heading in different directions to say the least. The Shanghai index finds itself worth almost a third less than it was 5 years ago while the S&P 500 is up nearly 100%. Needless to say, that's one of the largest performance-spread differences in years.

At this time, the Shanghai index is facing dual resistance at (1) in the chart above with momentum at lofty levels -- actually the highest since its 2009 highs.

If the Shanghai Index breaks above that resistance, it should be considered a positive breakout, which could become a positive global influence.

And the Shanghai index isn't the only index up against multi-year resistance: check out the price situation in Japan right now (see here).

Is it worth keeping a close eye on the Shanghai and Nikkei 225 as an indicator as to where other global stock markets are headed?

Absolutely.

Over the past 5 years, the Shanghai Composite index and the S&P 500 have been heading in different directions to say the least. The Shanghai index finds itself worth almost a third less than it was 5 years ago while the S&P 500 is up nearly 100%. Needless to say, that's one of the largest performance-spread differences in years.

At this time, the Shanghai index is facing dual resistance at (1) in the chart above with momentum at lofty levels -- actually the highest since its 2009 highs.

If the Shanghai Index breaks above that resistance, it should be considered a positive breakout, which could become a positive global influence.

And the Shanghai index isn't the only index up against multi-year resistance: check out the price situation in Japan right now (see here).

Is it worth keeping a close eye on the Shanghai and Nikkei 225 as an indicator as to where other global stock markets are headed?

Absolutely.

Evgeniy Piskachev

Post pubblicati Торговый план на 7 ноября

EUR/USD провалилась к новому минимальному уровню с августа 2012 г. в 1.2395 после голубиной пресс-конференции ЕЦБ в четверг. Хотя Марио Драги и не заявил о новых конкретных мерах стимулирования, но убедительно заявил, что члены ЕЦБ единодушно поддержат новое смягчение в случае необходимости...

Condividi sui social network · 6

177

Evgeniy Piskachev

Join! ! ! Stablly 15-20% a month! ! !

Присоединяйтесь!!! Стабильно 15-20% в месяц!!!

https://www.mql5.com/ru/signals/6922

https://www.mql5.com/ru/signals/52212

Присоединяйтесь!!! Стабильно 15-20% в месяц!!!

https://www.mql5.com/ru/signals/6922

https://www.mql5.com/ru/signals/52212

Evgeniy Piskachev

Join! ! ! Stablly 15-20% a month! ! !

Присоединяйтесь!!! Стабильно 15-20% в месяц!!!

https://www.mql5.com/ru/signals/6922

https://www.mql5.com/ru/signals/52212

Присоединяйтесь!!! Стабильно 15-20% в месяц!!!

https://www.mql5.com/ru/signals/6922

https://www.mql5.com/ru/signals/52212

Evgeniy Piskachev

Post pubblicati Банк Англии и ЕЦБ не будут менять ставки - прогноз

Европейский центральный банк (ЕЦБ) на заседании, которое пройдет в четверг, сохранит значение базовой процентной ставки по кредитам на уровне 0,05%, прогнозируют аналитики, опрошенные агентством Bloomberg...

Condividi sui social network · 5

152

Evgeniy Piskachev

Post pubblicati Нефть снижается накануне итогов встречи ЕЦБ

В четверг фьючерсы на нефть WTI снижаются, поскольку инвесторы осторожничают в преддверии сегодняшних итогов ежемесячного политического заседания Европейского центрального банка...

Condividi sui social network · 5

119

Evgeniy Piskachev

U.S. soybean and corn futures edged lower on Thursday, amid speculation beneficial weather in the U.S. Midwest will speed up the pace of the harvest.

Soybeans, corn edge lower on ideal U.S. crop weatherSoybeans edge lower as ideal U.S. crop weather weighs

On the Chicago Mercantile Exchange, US soybeans for January delivery fell 3.27 cents, or 0.32%, to trade at $10.1513 a bushel during U.S. morning hours.

Day earlier, prices of the oilseed fell by as much as 2.35% to hit $9.9520 a bushel, the weakest level since October 27, before turning higher to end at $10.1920, up 9.4 cents, or 0.94%.

Updated weather forecasting models called for mostly dry conditions across the U.S. Midwest over the next 10 days, which should allow farmers to accelerate the pace of the harvest.

According to the U.S. Department of Agriculture, approximately 83% of the U.S. soy harvest was completed as of November 2, compared to 70% a week earlier and in line with the five-year average for this time of year.

Meanwhile, US corn for December delivery traded at $3.6863 a bushel, down 1.38 cents, or 0.37%.

Corn futures lost as much as 1.5% on Wednesday to touch $3.5900 a bushel, the lowest since October 27, before rallying to settle at $3.7020, up 5.6 cents, or 1.58%.

Nearly 65% of the U.S. corn harvest was completed as of last week, up from 46% in the preceding week and just 8% below the five-year average of 73% for this time of year, according to the USDA.

Elsewhere on the CBOT, US wheat for December delivery shed 2.12 cents, or 0.41%, to trade at $5.2188 a bushel.

Prices of the grain slumped 5.6 cents, or 1.08%, on Wednesday to close at $5.2460 a bushel.

Corn is the biggest U.S. crop, followed by soybeans, government figures show. Wheat was fourth, behind hay.

Soybeans, corn edge lower on ideal U.S. crop weatherSoybeans edge lower as ideal U.S. crop weather weighs

On the Chicago Mercantile Exchange, US soybeans for January delivery fell 3.27 cents, or 0.32%, to trade at $10.1513 a bushel during U.S. morning hours.

Day earlier, prices of the oilseed fell by as much as 2.35% to hit $9.9520 a bushel, the weakest level since October 27, before turning higher to end at $10.1920, up 9.4 cents, or 0.94%.

Updated weather forecasting models called for mostly dry conditions across the U.S. Midwest over the next 10 days, which should allow farmers to accelerate the pace of the harvest.

According to the U.S. Department of Agriculture, approximately 83% of the U.S. soy harvest was completed as of November 2, compared to 70% a week earlier and in line with the five-year average for this time of year.

Meanwhile, US corn for December delivery traded at $3.6863 a bushel, down 1.38 cents, or 0.37%.

Corn futures lost as much as 1.5% on Wednesday to touch $3.5900 a bushel, the lowest since October 27, before rallying to settle at $3.7020, up 5.6 cents, or 1.58%.

Nearly 65% of the U.S. corn harvest was completed as of last week, up from 46% in the preceding week and just 8% below the five-year average of 73% for this time of year, according to the USDA.

Elsewhere on the CBOT, US wheat for December delivery shed 2.12 cents, or 0.41%, to trade at $5.2188 a bushel.

Prices of the grain slumped 5.6 cents, or 1.08%, on Wednesday to close at $5.2460 a bushel.

Corn is the biggest U.S. crop, followed by soybeans, government figures show. Wheat was fourth, behind hay.

Evgeniy Piskachev

Lenovo Group Ltd (HK:0992) reported quarterly revenue that missed analyst estimates, with a decline in smartphone sales curbing investor optimism about the world's biggest maker of personal computers (PCs) turning into a force in mobile devices.

Lenovo's earnings came at a time of unprecedented competition in China's smartphone market, with rivals including fast-growing Xiaomi Inc, now the world's No. 3 handset maker. At the same time, the company is pulling ahead in the global PC industry.

The Beijing-based company now has a PC market share of 20 percent and has extended its lead over Hewlett-Packard Co (N:HPQ) and Dell Inc [DI.UL], according to IDC research.

Sales of laptop and desktop computers rose 0.9 percent and 6.4 percent respectively in July-September, helping revenue rise 7 percent to $10.5 billion. That compared with an $11.35 billion estimate of 13 analysts according to Thomson Reuters SmartEstimate, which gives greater emphasis to more accurate analysts.

But mobile device sales fell 6 percent to $1.4 billion in a rare stumble for Chief Executive Yang Yuanqing, who has been determined to muscle his way to the top of the global smartphone market.

"Smartphone revenue was not that exciting, it was a little bit of a problem," Yang told Reuters in an interview after the results. He attributed the fall primarily to an accounting procedure pushing revenue from a significant shipment of phones in late September to the following quarter.

Shares of Lenovo shed 5.1 percent after the results, compared with a 0.2 percent fall in the benchmark Hang Seng index (HSI).

Nomura analyst Leping Huang said a reduction in handset subsidies from Chinese mobile phone networks have adversely affected Lenovo's home market.

"All the smartphone vendors suffer from it," Huang said. "But Lenovo fundamentally looks quite good."

Lenovo said net profit rose 19 percent to $262 million in the second quarter, exceeding the $260 million analyst estimate. It also announced a dividend payment of HK$0.06 ($0.0077) per share.

SMARTPHONES AND SERVERS

The PC market has been shrinking since the advent of tablet computers and smartphones. Lenovo has responded by diversifying, making two multi-billion-dollar acquisitions in quick succession for Google Inc's (O:GOOGL) Motorola handset unit and IBM's (N:IBM) low-end server business.

Last week Lenovo closed its $2.91 billion deal for Motorola, gaining an iconic albeit faded brand that still has a presence in North America and Europe, two markets Lenovo covets.

Speaking on an earnings conference call on Thursday, Yang pledged to prioritize sales growth at Motorola without looking to cut expenses. He said he expected Motorola to turn a profit in four to six quarters, and that margins in Lenovo's smartphone business will be higher after integrating the U.S. unit.

The company also on Thursday named Yahoo! Inc (O:YHOO) co-founder Jerry Yang to its board of directors. Yang, who is also a director at Alibaba Group Holding Ltd (N:BABA), formerly served as a Lenovo board observer.

Lenovo's earnings came at a time of unprecedented competition in China's smartphone market, with rivals including fast-growing Xiaomi Inc, now the world's No. 3 handset maker. At the same time, the company is pulling ahead in the global PC industry.

The Beijing-based company now has a PC market share of 20 percent and has extended its lead over Hewlett-Packard Co (N:HPQ) and Dell Inc [DI.UL], according to IDC research.

Sales of laptop and desktop computers rose 0.9 percent and 6.4 percent respectively in July-September, helping revenue rise 7 percent to $10.5 billion. That compared with an $11.35 billion estimate of 13 analysts according to Thomson Reuters SmartEstimate, which gives greater emphasis to more accurate analysts.

But mobile device sales fell 6 percent to $1.4 billion in a rare stumble for Chief Executive Yang Yuanqing, who has been determined to muscle his way to the top of the global smartphone market.

"Smartphone revenue was not that exciting, it was a little bit of a problem," Yang told Reuters in an interview after the results. He attributed the fall primarily to an accounting procedure pushing revenue from a significant shipment of phones in late September to the following quarter.

Shares of Lenovo shed 5.1 percent after the results, compared with a 0.2 percent fall in the benchmark Hang Seng index (HSI).

Nomura analyst Leping Huang said a reduction in handset subsidies from Chinese mobile phone networks have adversely affected Lenovo's home market.

"All the smartphone vendors suffer from it," Huang said. "But Lenovo fundamentally looks quite good."

Lenovo said net profit rose 19 percent to $262 million in the second quarter, exceeding the $260 million analyst estimate. It also announced a dividend payment of HK$0.06 ($0.0077) per share.

SMARTPHONES AND SERVERS

The PC market has been shrinking since the advent of tablet computers and smartphones. Lenovo has responded by diversifying, making two multi-billion-dollar acquisitions in quick succession for Google Inc's (O:GOOGL) Motorola handset unit and IBM's (N:IBM) low-end server business.

Last week Lenovo closed its $2.91 billion deal for Motorola, gaining an iconic albeit faded brand that still has a presence in North America and Europe, two markets Lenovo covets.

Speaking on an earnings conference call on Thursday, Yang pledged to prioritize sales growth at Motorola without looking to cut expenses. He said he expected Motorola to turn a profit in four to six quarters, and that margins in Lenovo's smartphone business will be higher after integrating the U.S. unit.

The company also on Thursday named Yahoo! Inc (O:YHOO) co-founder Jerry Yang to its board of directors. Yang, who is also a director at Alibaba Group Holding Ltd (N:BABA), formerly served as a Lenovo board observer.

: