Lahcene Ouled Moussa / Profilo

- Informazioni

|

9+ anni

esperienza

|

0

prodotti

|

0

versioni demo

|

|

0

lavori

|

0

segnali

|

0

iscritti

|

Dear freind

iam very happy to join this site ifind it great iam Lahcene from Algeria iam partner and trader withe fxclub.bie this is my link below

http://www.forexclub.biz/reg_real_account/?partner_code=DZA001IPB

since 2 years ago iam very happy withe my job and iam maried withe four children ihave learned withe the MOOC in yale university finacial markets my professor was Mer Robert

Best Regards

Lahcene

iam very happy to join this site ifind it great iam Lahcene from Algeria iam partner and trader withe fxclub.bie this is my link below

http://www.forexclub.biz/reg_real_account/?partner_code=DZA001IPB

since 2 years ago iam very happy withe my job and iam maried withe four children ihave learned withe the MOOC in yale university finacial markets my professor was Mer Robert

Best Regards

Lahcene

Amici

207

Richieste

In uscita

Lahcene Ouled Moussa

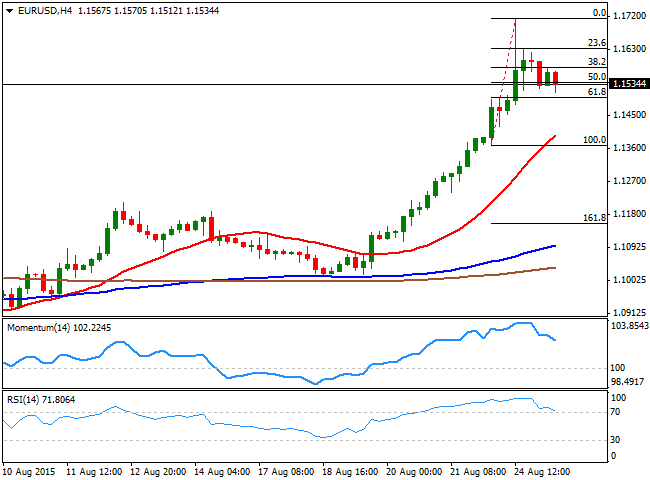

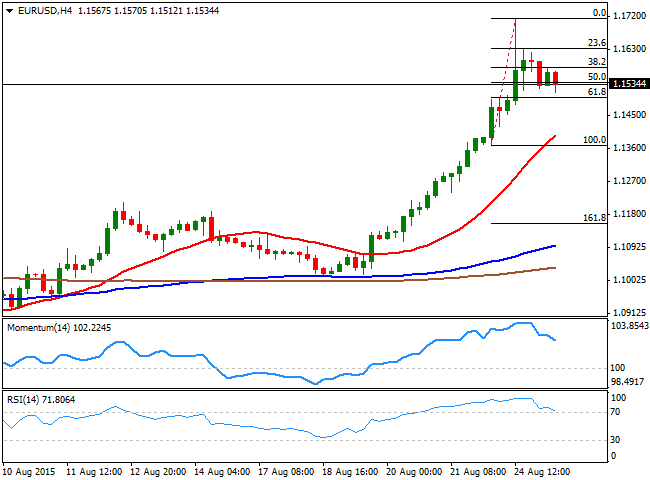

Post pubblicati euro/usd

EUR/USD has moved closer to the upper-side of its daily range but overall continues to trade very quietly given the US Labour Day holiday. EUR/USD recovered some ground and has continued to move away from last week’s lows but lacked...

Lahcene Ouled Moussa

EUR/USD Forecast: bearish correction to extend below 1.1500The American dollar recovered some ground during the Asian session, as despite the China stock market plummeted by another 5%, the rest of the local indexes make strong come-backs. European stocks are also in recovery mode, albeit far from erasing their latest losses.

Lahcene Ouled Moussa

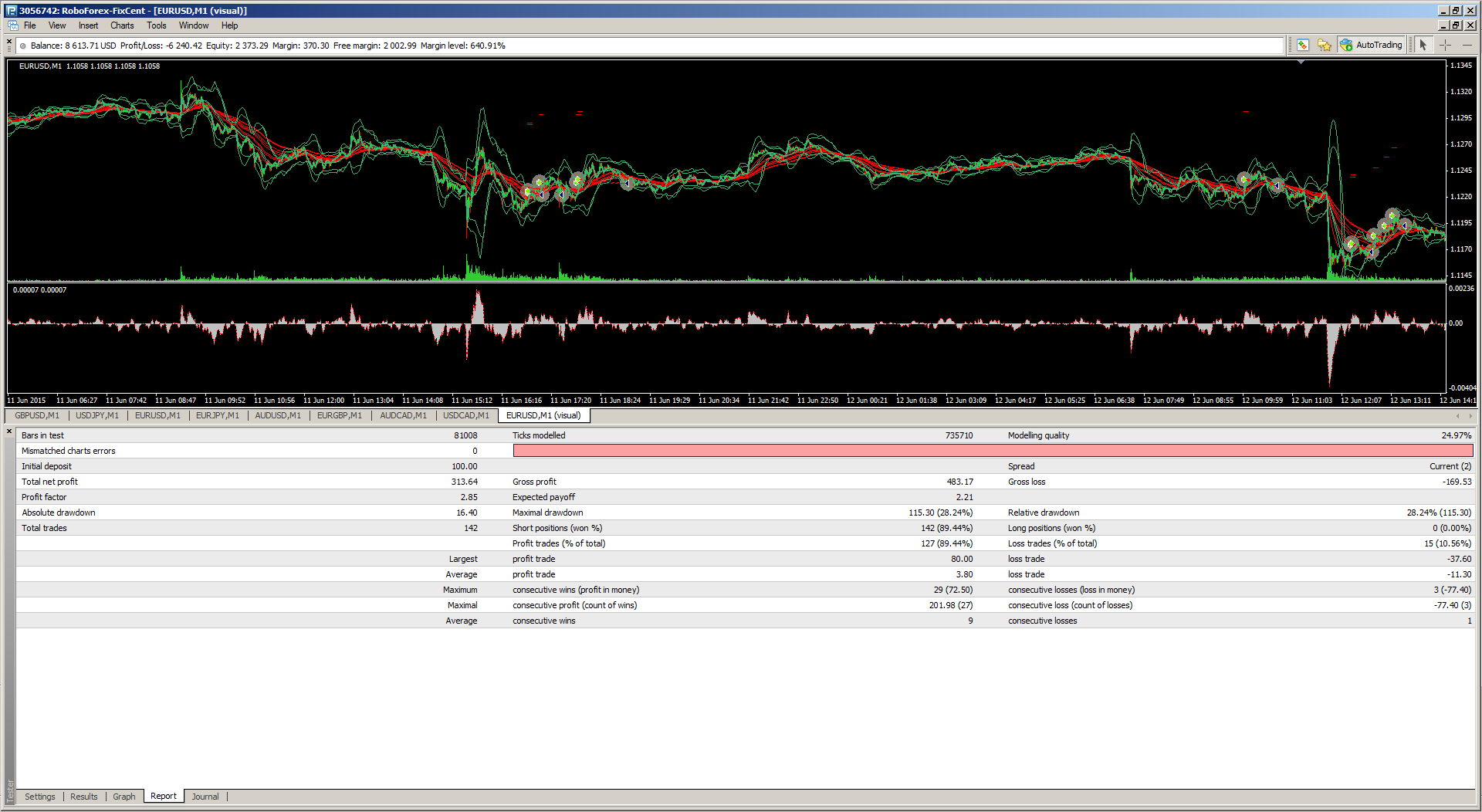

how find quality when trade withe more indicator guidelines and other...

Condividi sui social network · 2

51

Lahcene Ouled Moussa

see indicator systeme by this chart what it tells us...

Condividi sui social network · 2

48

Lahcene Ouled Moussa

Hello all,

i need an indicator based on square of nine indicator, first of all, this indicator need to scan on market watch

the following options are necessary:

sq9 level selectable, for example, i want indicator scan all pairs and when one or more go to level 90 an alert on screen appear

the time frame must be selectable. from M1 to MONTHLY

the pairs must be selectable too, if i want scan only some pairs i can specify on tab which pairs i need to scan

indicator need to spot the last low or the last high in selected timeframe and

i need an indicator based on square of nine indicator, first of all, this indicator need to scan on market watch

the following options are necessary:

sq9 level selectable, for example, i want indicator scan all pairs and when one or more go to level 90 an alert on screen appear

the time frame must be selectable. from M1 to MONTHLY

the pairs must be selectable too, if i want scan only some pairs i can specify on tab which pairs i need to scan

indicator need to spot the last low or the last high in selected timeframe and

Lahcene Ouled Moussa

Jewel Resorts Sale from $130 pp/pn

Summer Fun has begun! Stay from $130 pp/pn or up to 45% off on your 2015 vacation!

Summer Fun has begun! Stay from $130 pp/pn or up to 45% off on your 2015 vacation!

Lahcene Ouled Moussa

Crude oil below $45 as concerns over glut persist

6 August 2015, 14:48

On Thursday crude oil declined below the $45 level on lingering concerns over glut in the market.

Brent crude dropped 3 cents to $49.56 a barrel on London’s ICE Futures exchange, trading near levels not seen since January.

On the New York Mercantile Exchange, West Texas Intermediate futures dipped 26 cents, or 0.6%, to $44.89 a barrel, on track for its lowest settlement price since March.

Resilient U.S. output came together with high production from other major suppliers and concerns over China’s economy have dampened investor sentiment in recent weeks. Moreover, investors became more bearish with Iranian officials asserting that they aimed to quickly increase crude oil production, once the international sanctions are removed following the nuclear deal with Tehran. A day earlier, U.S. President Barack Obama gave a speech in support of the Iran deal, which is currently under review by U.S. lawmakers.

The latest weekly data indicated a drop in U.S. crude oil inventories — usually a bullish sign of strong demand — but the positive effect was overshadowed by an increase in stockpiles of gasoline and other finished products.

U.S. oil production, meanwhile, rose last week by 52,000 barrels a day to 9.5 million barrels a day.

“Shale oil producers are lowering costs swifter-than-expected, proving their superior competitiveness within the industry, and consequently surprising with resilient production,” Norbert Ruecker, head of commodities research at private bank Julius Baer.

“Taking further into account that we are at the peak of the summer demand season and entering the shoulder autumn months, fundamental support to prices has softened but not the extent the selloff implies,” he said.

Julius Baer slashed its forecasts for Brent prices to a range between $55-$60 per barrel “in the near term, but even lower longer term.”

6 August 2015, 14:48

On Thursday crude oil declined below the $45 level on lingering concerns over glut in the market.

Brent crude dropped 3 cents to $49.56 a barrel on London’s ICE Futures exchange, trading near levels not seen since January.

On the New York Mercantile Exchange, West Texas Intermediate futures dipped 26 cents, or 0.6%, to $44.89 a barrel, on track for its lowest settlement price since March.

Resilient U.S. output came together with high production from other major suppliers and concerns over China’s economy have dampened investor sentiment in recent weeks. Moreover, investors became more bearish with Iranian officials asserting that they aimed to quickly increase crude oil production, once the international sanctions are removed following the nuclear deal with Tehran. A day earlier, U.S. President Barack Obama gave a speech in support of the Iran deal, which is currently under review by U.S. lawmakers.

The latest weekly data indicated a drop in U.S. crude oil inventories — usually a bullish sign of strong demand — but the positive effect was overshadowed by an increase in stockpiles of gasoline and other finished products.

U.S. oil production, meanwhile, rose last week by 52,000 barrels a day to 9.5 million barrels a day.

“Shale oil producers are lowering costs swifter-than-expected, proving their superior competitiveness within the industry, and consequently surprising with resilient production,” Norbert Ruecker, head of commodities research at private bank Julius Baer.

“Taking further into account that we are at the peak of the summer demand season and entering the shoulder autumn months, fundamental support to prices has softened but not the extent the selloff implies,” he said.

Julius Baer slashed its forecasts for Brent prices to a range between $55-$60 per barrel “in the near term, but even lower longer term.”

Lahcene Ouled Moussa

Sterling regains ground after BOE's Carney remarks; U.S. data

6 August 2015, 17:34

On Thursday the pound pulled back from session lows against the dollar after Bank of England Governor Mark Carney said the time for a rate hike is drawing closer, but added that the timing could not be predicted in advance.

GBP/USD was last at 1.5514, off 0.56% for the day, up from session lows of 1.5468.

The Bank of England pointed to a possible increase in interest rates in early 2016, after only one of its top policymakers supported an immediate move and the Bank forecast a slow rise in inflation from zero thanks to a strong pound.

Sterling turned broadly lower before regaining ground after BoE Governor Mark Carney said the time for the Bank to start undoing its stimulus for Britain's economy is approaching.

Carney also warned markets not to be too lax in the path or 'curve' that it predicts for rates.

"The market curve does not deliver a sustainable return of inflation to target, because there is an overshoot," Carney told a news conference.

The BoE trimmed interest rates to 0.5 percent in the depths of the financial crisis in 2009 and has not changed them since that time. With the economy now recovering strongly and wages finally rising quickly, speculation is growing about when it might decide to start weaning Britain off low rates.

The Bank said it expected inflation to be back to target in two years' time. That was matching its previous forecast, made in May, despite a fresh plunge in oil prices and a jump of sterling since then.

In the U.S., the Labor Department reported earlier that the number of Americans filing new applications for unemployment benefits climbed less than expected last week, suggesting labor market conditions are continuing to tighten.

Initial claims for state unemployment benefits increased 3,000 to a seasonally adjusted 270,000 for the week ended Aug. 1. Claims for the prior week were unrevized.

It was the 22nd consecutive week that claims held below the 300,000 threshold, which is associated with a strengthening labor market. Economists had expected claims to rise to 273,000 last week.

Claims are volatile during the summer when automakers usually shut assembly plants for annual retooling. Some firms keep production lines running, which can throw off a model the government uses to smooth the data for seasonal variations.

However, an analyst from the Department said there were no special factors influencing the data and no states had been calculated.

The greenback has been generally higher with EUR/USD trading last at 1.0917, higher 0.11%.

The dollar index rose 0.03% to 98.00.

Investors were now eyeing the upcoming U.S. nonfarm payrolls report due on Friday, which could reinforce expectations for higher interest rates by the Federal Reserve.

6 August 2015, 17:34

On Thursday the pound pulled back from session lows against the dollar after Bank of England Governor Mark Carney said the time for a rate hike is drawing closer, but added that the timing could not be predicted in advance.

GBP/USD was last at 1.5514, off 0.56% for the day, up from session lows of 1.5468.

The Bank of England pointed to a possible increase in interest rates in early 2016, after only one of its top policymakers supported an immediate move and the Bank forecast a slow rise in inflation from zero thanks to a strong pound.

Sterling turned broadly lower before regaining ground after BoE Governor Mark Carney said the time for the Bank to start undoing its stimulus for Britain's economy is approaching.

Carney also warned markets not to be too lax in the path or 'curve' that it predicts for rates.

"The market curve does not deliver a sustainable return of inflation to target, because there is an overshoot," Carney told a news conference.

The BoE trimmed interest rates to 0.5 percent in the depths of the financial crisis in 2009 and has not changed them since that time. With the economy now recovering strongly and wages finally rising quickly, speculation is growing about when it might decide to start weaning Britain off low rates.

The Bank said it expected inflation to be back to target in two years' time. That was matching its previous forecast, made in May, despite a fresh plunge in oil prices and a jump of sterling since then.

In the U.S., the Labor Department reported earlier that the number of Americans filing new applications for unemployment benefits climbed less than expected last week, suggesting labor market conditions are continuing to tighten.

Initial claims for state unemployment benefits increased 3,000 to a seasonally adjusted 270,000 for the week ended Aug. 1. Claims for the prior week were unrevized.

It was the 22nd consecutive week that claims held below the 300,000 threshold, which is associated with a strengthening labor market. Economists had expected claims to rise to 273,000 last week.

Claims are volatile during the summer when automakers usually shut assembly plants for annual retooling. Some firms keep production lines running, which can throw off a model the government uses to smooth the data for seasonal variations.

However, an analyst from the Department said there were no special factors influencing the data and no states had been calculated.

The greenback has been generally higher with EUR/USD trading last at 1.0917, higher 0.11%.

The dollar index rose 0.03% to 98.00.

Investors were now eyeing the upcoming U.S. nonfarm payrolls report due on Friday, which could reinforce expectations for higher interest rates by the Federal Reserve.

: