Flavio Javier Jarabeck / Profilo

- Informazioni

|

5+ anni

esperienza

|

87

prodotti

|

80

versioni demo

|

|

0

lavori

|

0

segnali

|

0

iscritti

|

Our Motto: Disrupt. All Ways. Always.

🇳🇪🇼🇸 & 🇹🇪🇨🇭🇳🇮🇨🇦🇱 🇸🇺🇵🇵🇴🇷🇹

If you want to follow our latest additions to the MQL5 Marketplace or ask for Support on our products, follow and reach us on Telegram (English/Portuguese/Spanish language group):

https://t.me/MinionsLabsOfficial

Or, choose the way you can follow us in your own environment, at your own pace:

🇼🇪🇧 www.MinionsLabs.com

🇮🇳🇸🇹🇦🇬🇷🇦🇲 www.instagram.com/MinionsLabs

🇾🇴🇺🇹🇺🇧🇪 www.youtube.com/c/MinionsLabs

🇱🇮🇳🇰🇪🇩🇮🇳 www.linkedin.com/in/jarabeck

🇫🇦🇨🇪🇧🇴🇴🇰 www.facebook.com/MinionsLabs

🇹🇼🇮🇹🇹🇪🇷 www.twitter.com/MinionsLabs

🇷🇪🇩🇩🇮🇹 www.reddit.com/r/MinionsLabs/

🇻🇰 www.vk.com/MinionsLabs

🇲🇪🇩🇮🇺🇲 https://medium.com/@MinionsLabs

🇹🇺🇲🇧🇱🇷 http://minionslabs.tumblr.com/

🇹🇪🇱🇪🇬🇷🇦🇲 https://t.me/MinionsLabsOfficial

🇵🇮🇳🇹🇪🇷🇪🇸🇹 https://br.pinterest.com/MinionsLabs/news-from-minions-labs/

Live Long and Prosper.

Breakouts with strong momentum are challenging to catch. The purpose of the Super Breakouts Monitor is to identify such market conditions. This indicator is inspired by a concept from renowned Technical Analyst Tushar Chande, who combines two highly adaptive indicators, VIDYA and the Dynamic Momentum Index (both his creations), to capture the early stages of a successful breakout. At Minions Labs, we've added our unique enhancements to adapt these great ideas for modern markets like stocks

Big Player Candles... Know when the game is changing... FREE Indicator!

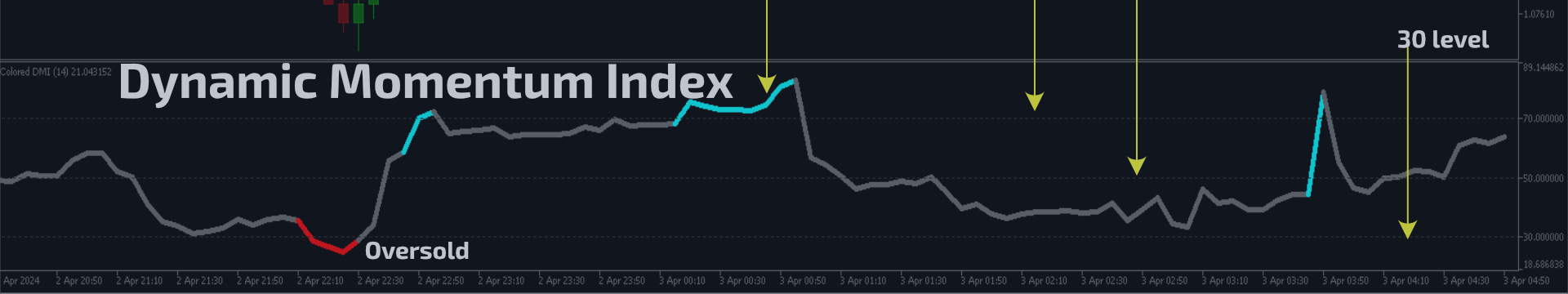

If you are (or were) a fan of the RSI indicator will love Tushar Chande's Dynamic Momentum Index indicator, that simply put is a dynamic variable lenght RSI, so it is more powerful. The DMI indicator internally uses a variable number of bars in its calculations, taking into consideration the volatility levels of the current market you are analyzing. This way, the DMI indicator will use more bars as volatility decreases and less bars when volatility increases, giving you a more powerfull analysis

Imagine a way to automatically and clearly recognize the direction of the current market. Uptrend or Downtrend? Forget about moving averages, there is a simple way to determine that. Welcome to the world of statistics. Welcome to the simple yet powerful world of Linear Regression. Just a complicated name for a genius and simple measurement. Calibrating this indicator is pretty clear and obvious since the degree of freedom is total and deep. Once calibrated to your desired Symbol/Asset, you can

The concept of Fractals is everywhere in the respected Technical Analysis teaching and for a good reason: It Makes Sense! It is not a "self-fulfilling prophecy" like Fibonacci levels which we totally respect but we didn't explore yet, but this concept of Fractals can only be seen visually on your chart if we really SHOW that to you on your chart, right? There are dozens of Zig-zag and Swing Legs indicators out there so you probably would be wondering: Why our indicator is different? Because we

The idea of a Value Chart indicator was presented in the very good book I read back in 2020 , " Dynamic Trading Indicators: Winning with Value Charts and Price Action Profile ", from the authors Mark Helweg and David Stendahl. The idea is simple and the result is pure genius: Present candlestick Price analysis in a detrended way! HOW TO READ THIS INDICATOR Look for Overbought and Oversold levels. Of course, you will need to test the settings a lot to find the "correct" one for your approach. It

John Bollinger created this indicator in 2010 as a way to read the original indicator (Bollinger Bands) in a more "technical" way, shown as an oscillator. The typical range of the Bollinger Bands %B is 0 - 0.5 - 1.0, where "0" represents the lower band, the "0.5" the middle band, and "1" the upper band. The line on the indicator represents the Closing prices. As simple as that. SETTINGS Bollinger Bands period of analysis Standard Deviation multiplier Shift Price type to be analyzed If you like

Once again, We Nailed It! Imagine a faster and smoother way to recalibrate ANY Indicator using just obvious and intuitive mouse clicks, realtime, real fast, real results on your chart just right after the Click... Instead of the boring "Open Settings dialog / Change one setting / Click OK / See what happens on Chart...", then repeat this process endlessly until you kill yourself! Well... No More... Welcome to the Minions Labs Recalibrator tool! Now you can Study, Trial, Experiment and Play

It is the very same classic Stochastic indicator, but with a little twist: we changed the Signal Line with a 2-color line, so we can use it with EAs as a filtering system. And that's it! I know it could seem stupid but I needed that, so I created it. The original formula is right from Metaquote's chest, no additions, no subtractions, it is Stochastics in its core. So I will not publish here the Stochastics parameters as they are all the same as always... Enjoy! If you like this indicator, all I

The Supertrend indicator was originally created by a french fellow named Olivier Seban , and its goal is to identify the Primary Trend of prices . Its calculation is easy and based on the average of Highs and Lows and then we add the volatility of a custom period, plus a multiplier. This way we get the Supertrend Line. You can find in the web several approaches and trading strategies using this very useful indicator. HOW TO "READ" THIS INDICATOR If the closing prices are above Supertrend Line

Seeing and interpreting a sequence of Candlesticks is easy to spot when you are a human... Higher Highs, Higher Lows, are the panorama of a Buying trend, at least in a short period of time... Seeing a current candlestick higher high and a lower candlestick low, as a human, you can immediately spot a "divergence", an "alert", a "starting range", but in the end and based on other analysis a human trader can understand and behave accordingly to this kind of candlestick data... But what about EAs

Developed by Jack Hutson in the 80's, the Triple Exponential Moving Average (a.k.a. TRIX ) is a Momentum technical indicator that shows the percentage of change in a moving average that has been smoothed exponentially 3 times. The smoothing process was put in place in order to filter out price movements that are considered insignificant for the analysis period chosen. We at Minions Labs found hard to follow the smoothness of the original TRIX line, so we colored the TRIX line with BUY and SELL