Young Ho Seo / Profilo

- Informazioni

|

10+ anni

esperienza

|

62

prodotti

|

1182

versioni demo

|

|

4

lavori

|

0

segnali

|

0

iscritti

|

Harmonic Pattern Indicator - Repainting + Japanese Candlestick Pattern Scanner + Automatic Channel + Many more

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

Non Repainting and Non Lagging Harmonic Pattern Indicator – Customizable Harmonic + Japanese Candlestic Pattern Scanner + Advanced Channel + Many more

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

Supply Demand Indicator – Multiple Timeframe Scanning Added + Non Repainting + Professional Indicator

https://www.mql5.com/en/market/product/40076

https://www.mql5.com/en/market/product/40075

https://algotrading-investment.com/portfolio-item/ace-supply-demand-zone/

Momentum Indicator – Path to Volume Spread Analysis

https://www.mql5.com/en/market/product/30641

https://www.mql5.com/en/market/product/30621

https://algotrading-investment.com/portfolio-item/excessive-momentum-indicator/

Elliott Wave Indicator for the Power User

https://www.mql5.com/en/market/product/16479

https://www.mql5.com/en/market/product/16472

https://algotrading-investment.com/portfolio-item/elliott-wave-trend/

Forex Prediction - Turn Support and Resistance to the Advanced Strategy

https://www.mql5.com/en/market/product/49170

https://www.mql5.com/en/market/product/49169

https://algotrading-investment.com/portfolio-item/fractal-pattern-scanner/

MetaTrader 4 and MetaTrader 5 Product Page: https://www.mql5.com/en/users/financeengineer/seller#products

Free Forex Prediction with Fibonacci Analysis: https://algotrading-investment.com/2020/10/23/forex-prediction-with-fibonacci-analysis/

Free Harmonic Pattern Signal: https://algotrading-investment.com/2020/12/17/harmonic-pattern-signal-for-forex-market/

============================================================================================================================

Here are the trading education books. We recommend reading these books if you are a trader or investor in Forex and Stock market. In the list below, we put the easy to read book on top. Try to read the easy to read book first and try to read the harder book later to improve your trading and investment.

First Link = amazon.com, Second Link = Google Play Books, Third Link = algotrading-investment.com, Fourth Link = Google Books

Technical Analysis in Forex and Stock Market (Supply Demand Analysis and Support Resistance)

https://www.amazon.com/dp/B09L55ZK4Z

https://play.google.com/store/books/details?id=pHlMEAAAQBAJ

https://algotrading-investment.com/portfolio-item/technical-analysis-in-forex-and-stock-market/

https://books.google.co.kr/books/about?id=pHlMEAAAQBAJ

Science Of Support, Resistance, Fibonacci Analysis, Harmonic Pattern, Elliott Wave and X3 Chart Pattern (In Forex and Stock Market Trading)

https://www.amazon.com/dp/B0993WZGZD

https://play.google.com/store/books/details?id=MME3EAAAQBAJ

https://algotrading-investment.com/portfolio-item/science-of-support-resistance-fibonacci-analysis-harmonic-pattern/

https://books.google.co.kr/books/about?id=MME3EAAAQBAJ

Profitable Chart Patterns in Forex and Stock Market (Fibonacci Analysis, Harmonic Pattern, Elliott Wave, and X3 Chart Pattern)

https://www.amazon.com/dp/B0B2KZH87K

https://play.google.com/store/books/details?id=7KrQDwAAQBAJ

https://algotrading-investment.com/portfolio-item/profitable-chart-patterns-in-forex-and-stock-market/

https://books.google.com/books/about?id=7KrQDwAAQBAJ

Guide to Precision Harmonic Pattern Trading (Mastering Turning Point Strategy for Financial Trading)

https://www.amazon.com/dp/B01MRI5LY6

https://play.google.com/store/books/details?id=8SbMDwAAQBAJ

http://algotrading-investment.com/portfolio-item/guide-precision-harmonic-pattern-trading/

https://books.google.com/books/about?id=8SbMDwAAQBAJ

Scientific Guide to Price Action and Pattern Trading (Wisdom of Trend, Cycle, and Fractal Wave)

https://www.amazon.com/dp/B073T3ZMBR

https://play.google.com/store/books/details?id=5prUDwAAQBAJ

https://algotrading-investment.com/portfolio-item/scientific-guide-to-price-action-and-pattern-trading/

https://books.google.com/books/about?id=5prUDwAAQBAJ

Predicting Forex and Stock Market with Fractal Pattern: Science of Price and Time

https://www.amazon.com/dp/B086YKM8BW

https://play.google.com/store/books/details?id=VJjiDwAAQBAJ

https://algotrading-investment.com/portfolio-item/predicting-forex-and-stock-market-with-fractal-pattern/

https://books.google.com/books/about?id=VJjiDwAAQBAJ

Trading Education Book 1 in Korean (Apple, Google Play Book, Google Book, Scribd, Kobo)

https://books.apple.com/us/book/id1565534211

https://play.google.com/store/books/details?id=HTgqEAAAQBAJ

https://books.google.co.kr/books/about?id=HTgqEAAAQBAJ

https://www.scribd.com/book/505583892

https://www.kobo.com/ww/en/ebook/8J-Eg58EDzKwlpUmADdp2g

Trading Education Book 2 in Korean (Apple, Google Play Book, Google Book, Scribd, Kobo)

https://books.apple.com/us/book/id1597112108

https://play.google.com/store/books/details?id=shRQEAAAQBAJ

https://books.google.co.kr/books/about?id=shRQEAAAQBAJ

https://www.scribd.com/book/542068528

https://www.kobo.com/ww/en/ebook/X8SmJdYCtDasOfQ1LQpCtg

About Young Ho Seo

Young Ho Seo is an Engineer, Financial Trader, and Quantitative Developer, working on Trading Science and Investment Engineering since 2011. He is the creator of many technical indicators, price patterns and trading strategies used in the financial market. He is also teaching the trading practice on how to use the Supply Demand Analysis, Support, Resistance, Trend line, Fibonacci Analysis, Harmonic Pattern, Elliott Wave Theory, Chart Patterns, and Probability for Forex and Stock Market. His works include developing scientific trading principle and mathematical algorithm in the work of Benjamin Graham, Everette S. Gardner, Benoit Mandelbrot, Ralph Nelson Elliott, Harold M. Gartley, Richard Shabacker, William Delbert Gann, Richard Wyckoff and Richard Dennis. You can find his dedicated works on www.algotrading-investment.com . His life mission is to connect financial traders and scientific community for better understanding of this world and crowd behaviour in the financial market. He wrote many books and articles, which are helpful for understanding the technology and application behind technical analysis, statistics, time series forecasting, fractal science, econometrics, and artificial intelligence in the financial market.

If you are interested in our software and training, just visit our main website: www.algotrading-investment.com

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

Non Repainting and Non Lagging Harmonic Pattern Indicator – Customizable Harmonic + Japanese Candlestic Pattern Scanner + Advanced Channel + Many more

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

Supply Demand Indicator – Multiple Timeframe Scanning Added + Non Repainting + Professional Indicator

https://www.mql5.com/en/market/product/40076

https://www.mql5.com/en/market/product/40075

https://algotrading-investment.com/portfolio-item/ace-supply-demand-zone/

Momentum Indicator – Path to Volume Spread Analysis

https://www.mql5.com/en/market/product/30641

https://www.mql5.com/en/market/product/30621

https://algotrading-investment.com/portfolio-item/excessive-momentum-indicator/

Elliott Wave Indicator for the Power User

https://www.mql5.com/en/market/product/16479

https://www.mql5.com/en/market/product/16472

https://algotrading-investment.com/portfolio-item/elliott-wave-trend/

Forex Prediction - Turn Support and Resistance to the Advanced Strategy

https://www.mql5.com/en/market/product/49170

https://www.mql5.com/en/market/product/49169

https://algotrading-investment.com/portfolio-item/fractal-pattern-scanner/

MetaTrader 4 and MetaTrader 5 Product Page: https://www.mql5.com/en/users/financeengineer/seller#products

Free Forex Prediction with Fibonacci Analysis: https://algotrading-investment.com/2020/10/23/forex-prediction-with-fibonacci-analysis/

Free Harmonic Pattern Signal: https://algotrading-investment.com/2020/12/17/harmonic-pattern-signal-for-forex-market/

============================================================================================================================

Here are the trading education books. We recommend reading these books if you are a trader or investor in Forex and Stock market. In the list below, we put the easy to read book on top. Try to read the easy to read book first and try to read the harder book later to improve your trading and investment.

First Link = amazon.com, Second Link = Google Play Books, Third Link = algotrading-investment.com, Fourth Link = Google Books

Technical Analysis in Forex and Stock Market (Supply Demand Analysis and Support Resistance)

https://www.amazon.com/dp/B09L55ZK4Z

https://play.google.com/store/books/details?id=pHlMEAAAQBAJ

https://algotrading-investment.com/portfolio-item/technical-analysis-in-forex-and-stock-market/

https://books.google.co.kr/books/about?id=pHlMEAAAQBAJ

Science Of Support, Resistance, Fibonacci Analysis, Harmonic Pattern, Elliott Wave and X3 Chart Pattern (In Forex and Stock Market Trading)

https://www.amazon.com/dp/B0993WZGZD

https://play.google.com/store/books/details?id=MME3EAAAQBAJ

https://algotrading-investment.com/portfolio-item/science-of-support-resistance-fibonacci-analysis-harmonic-pattern/

https://books.google.co.kr/books/about?id=MME3EAAAQBAJ

Profitable Chart Patterns in Forex and Stock Market (Fibonacci Analysis, Harmonic Pattern, Elliott Wave, and X3 Chart Pattern)

https://www.amazon.com/dp/B0B2KZH87K

https://play.google.com/store/books/details?id=7KrQDwAAQBAJ

https://algotrading-investment.com/portfolio-item/profitable-chart-patterns-in-forex-and-stock-market/

https://books.google.com/books/about?id=7KrQDwAAQBAJ

Guide to Precision Harmonic Pattern Trading (Mastering Turning Point Strategy for Financial Trading)

https://www.amazon.com/dp/B01MRI5LY6

https://play.google.com/store/books/details?id=8SbMDwAAQBAJ

http://algotrading-investment.com/portfolio-item/guide-precision-harmonic-pattern-trading/

https://books.google.com/books/about?id=8SbMDwAAQBAJ

Scientific Guide to Price Action and Pattern Trading (Wisdom of Trend, Cycle, and Fractal Wave)

https://www.amazon.com/dp/B073T3ZMBR

https://play.google.com/store/books/details?id=5prUDwAAQBAJ

https://algotrading-investment.com/portfolio-item/scientific-guide-to-price-action-and-pattern-trading/

https://books.google.com/books/about?id=5prUDwAAQBAJ

Predicting Forex and Stock Market with Fractal Pattern: Science of Price and Time

https://www.amazon.com/dp/B086YKM8BW

https://play.google.com/store/books/details?id=VJjiDwAAQBAJ

https://algotrading-investment.com/portfolio-item/predicting-forex-and-stock-market-with-fractal-pattern/

https://books.google.com/books/about?id=VJjiDwAAQBAJ

Trading Education Book 1 in Korean (Apple, Google Play Book, Google Book, Scribd, Kobo)

https://books.apple.com/us/book/id1565534211

https://play.google.com/store/books/details?id=HTgqEAAAQBAJ

https://books.google.co.kr/books/about?id=HTgqEAAAQBAJ

https://www.scribd.com/book/505583892

https://www.kobo.com/ww/en/ebook/8J-Eg58EDzKwlpUmADdp2g

Trading Education Book 2 in Korean (Apple, Google Play Book, Google Book, Scribd, Kobo)

https://books.apple.com/us/book/id1597112108

https://play.google.com/store/books/details?id=shRQEAAAQBAJ

https://books.google.co.kr/books/about?id=shRQEAAAQBAJ

https://www.scribd.com/book/542068528

https://www.kobo.com/ww/en/ebook/X8SmJdYCtDasOfQ1LQpCtg

About Young Ho Seo

Young Ho Seo is an Engineer, Financial Trader, and Quantitative Developer, working on Trading Science and Investment Engineering since 2011. He is the creator of many technical indicators, price patterns and trading strategies used in the financial market. He is also teaching the trading practice on how to use the Supply Demand Analysis, Support, Resistance, Trend line, Fibonacci Analysis, Harmonic Pattern, Elliott Wave Theory, Chart Patterns, and Probability for Forex and Stock Market. His works include developing scientific trading principle and mathematical algorithm in the work of Benjamin Graham, Everette S. Gardner, Benoit Mandelbrot, Ralph Nelson Elliott, Harold M. Gartley, Richard Shabacker, William Delbert Gann, Richard Wyckoff and Richard Dennis. You can find his dedicated works on www.algotrading-investment.com . His life mission is to connect financial traders and scientific community for better understanding of this world and crowd behaviour in the financial market. He wrote many books and articles, which are helpful for understanding the technology and application behind technical analysis, statistics, time series forecasting, fractal science, econometrics, and artificial intelligence in the financial market.

If you are interested in our software and training, just visit our main website: www.algotrading-investment.com

Young Ho Seo

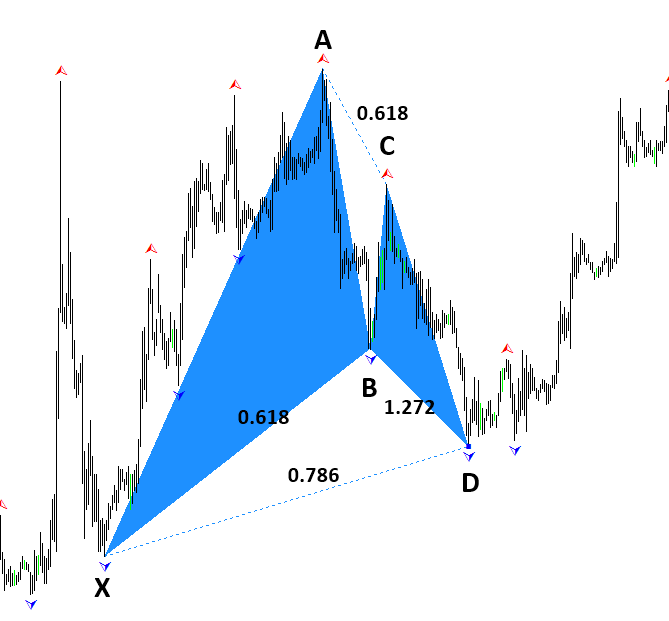

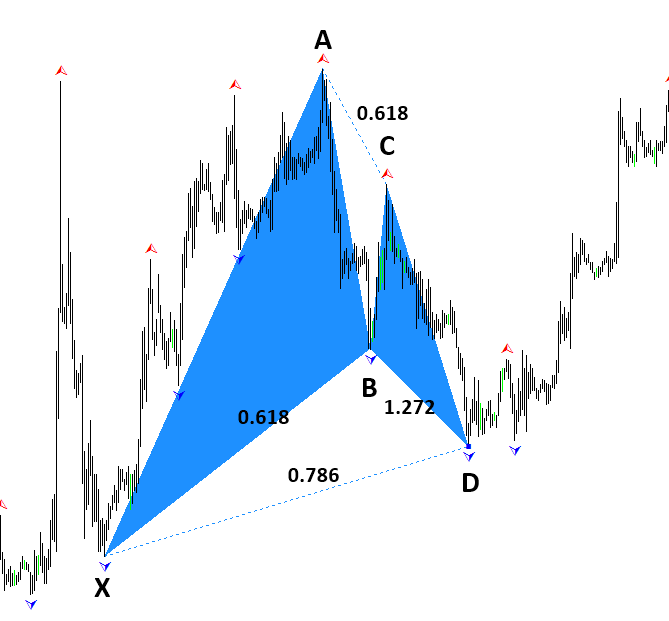

Harmonic Pattern Indicator Explained

In this article, we will explain the type of Harmonic Pattern Indicator used for Forex and Stock trading. Firstly, there are several variations of Harmonic pattern indicators used by the trading community. Not all the harmonic pattern indicators are the same. The main variations of Harmonic pattern indicators can be categorized as following three different types depending on the algorithm used inside the indicator. Each type of Harmonic Pattern Indicator has its own pros and cons. We will go through each type of Harmonic Pattern Indicator in this article one by one. In addition, we will also discuss the hybrid of these three variations, called non repainting and non lagging Harmonic Pattern Indicator at the end of this article for your information.

Type 1: Non lagging (fast signal) but repainting – option to enter from turning point. Indicator does not show the failed pattern in chart and last pattern can repaint.

Type 2: Lagging (slow signal) but non repainting – no option to enter at turning point. Indicator does not show the failed pattern but last pattern does not repaint.

Type 3: Detecting pattern at point C but repainting – option to enter at turning point. Indicator detect pattern too early and you have to wait until the point D. Pattern may not achieve point D. Indicator does not show the failed pattern and last pattern can repaint.

Type 1. Non lagging (fast signal) but repainting

First type is non lagging but repainting harmonic indicators. This sort of Harmonic pattern indicator is the typical harmonic pattern indicators used by many traders. The advantage is that you do get the signal early as possible. You have an opportunity to trade from the turning point all the ways down to the continued trend. The disadvantage is that you are not able to test your strategy in chart because this type of harmonic pattern indicator does not show the entry of the failed patterns in chart but only successful one. In fact, Harmonic Pattern Plus and Harmonic Pattern Scenario Planner are under this category. They would provide the fastest signal but you will not able to test your strategy in your chart because they do not show the failed entry in chart.

You can read everything about Harmonic Pattern Indicator from this original article.

https://algotrading-investment.com/2019/03/03/harmonic-pattern-indicator-explained/

We will introduce several Harmonic Pattern Indicator based on what we have discussed so far in this article.

X3 Chart Pattern Scanner (Non Repainting + Non Lagging)

Below is the link to X3 Chart Pattern Scanner in MetaTrader 4 and MetaTrader 5 platform. X3 Chart Pattern Scanner is non repainting and non lagging Harmonic Pattern Indicator. In addition, each Harmonic Pattern in X3 Chart Pattern Scanner can be customized to improve trading performance. With tons of powerful features toward the day trading, this is the next generation Harmonic Pattern Indicator.

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

In addition, we will introduce two Harmonic Pattern Indicator including Harmonic Pattern Plus and Harmonic Pattern Scenario planner. These Harmonic Pattern Indicator is repainting. However, they provide tons of powerful features at affordable price. Hence, if you do not mind the repainting Harmonic Pattern Indicator, then you can use these two tools. In addition, you can use X3 Chart Pattern Scanner together with Harmonic Pattern Plus or Harmonic Pattern Scenario Planner.

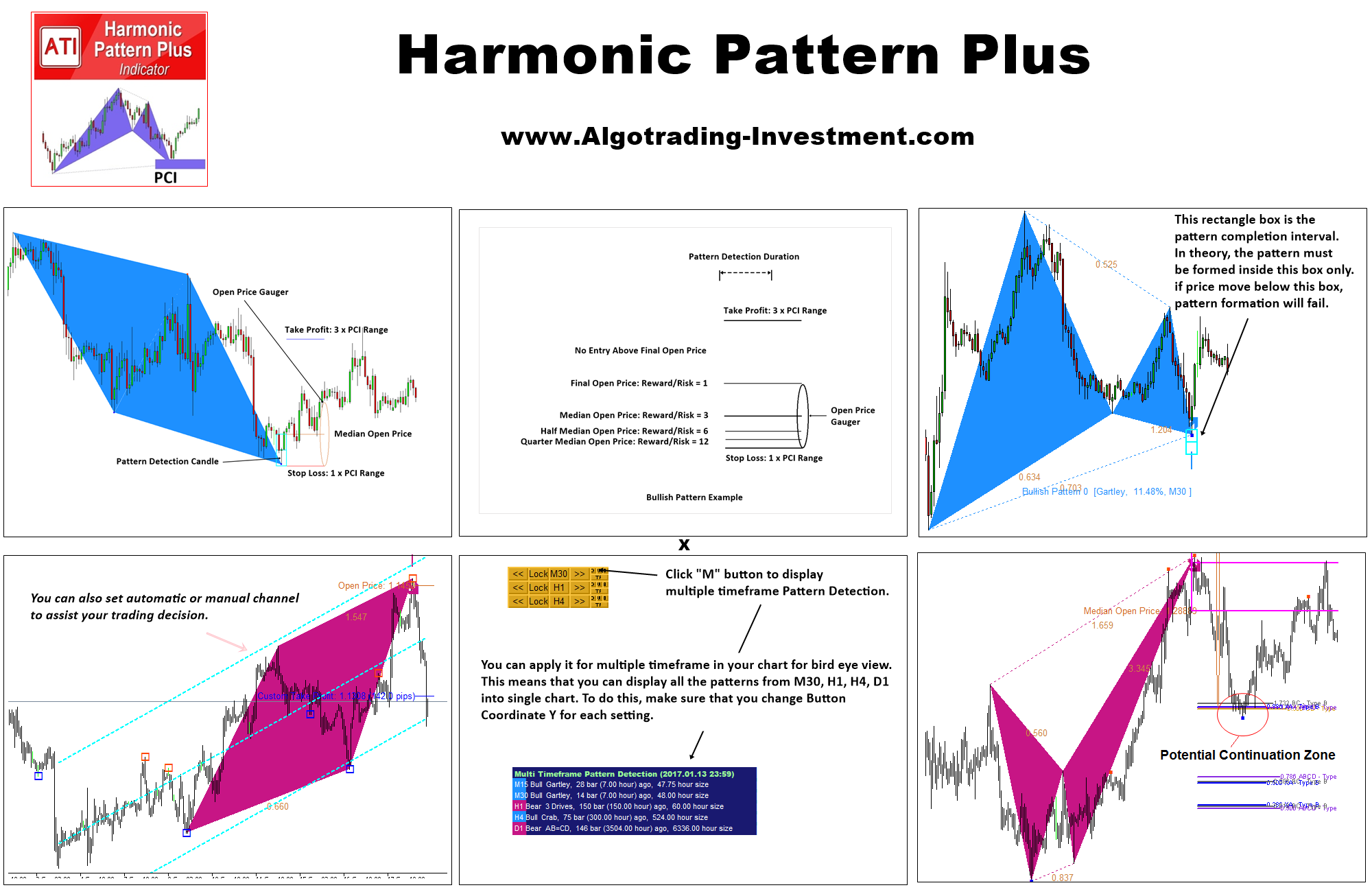

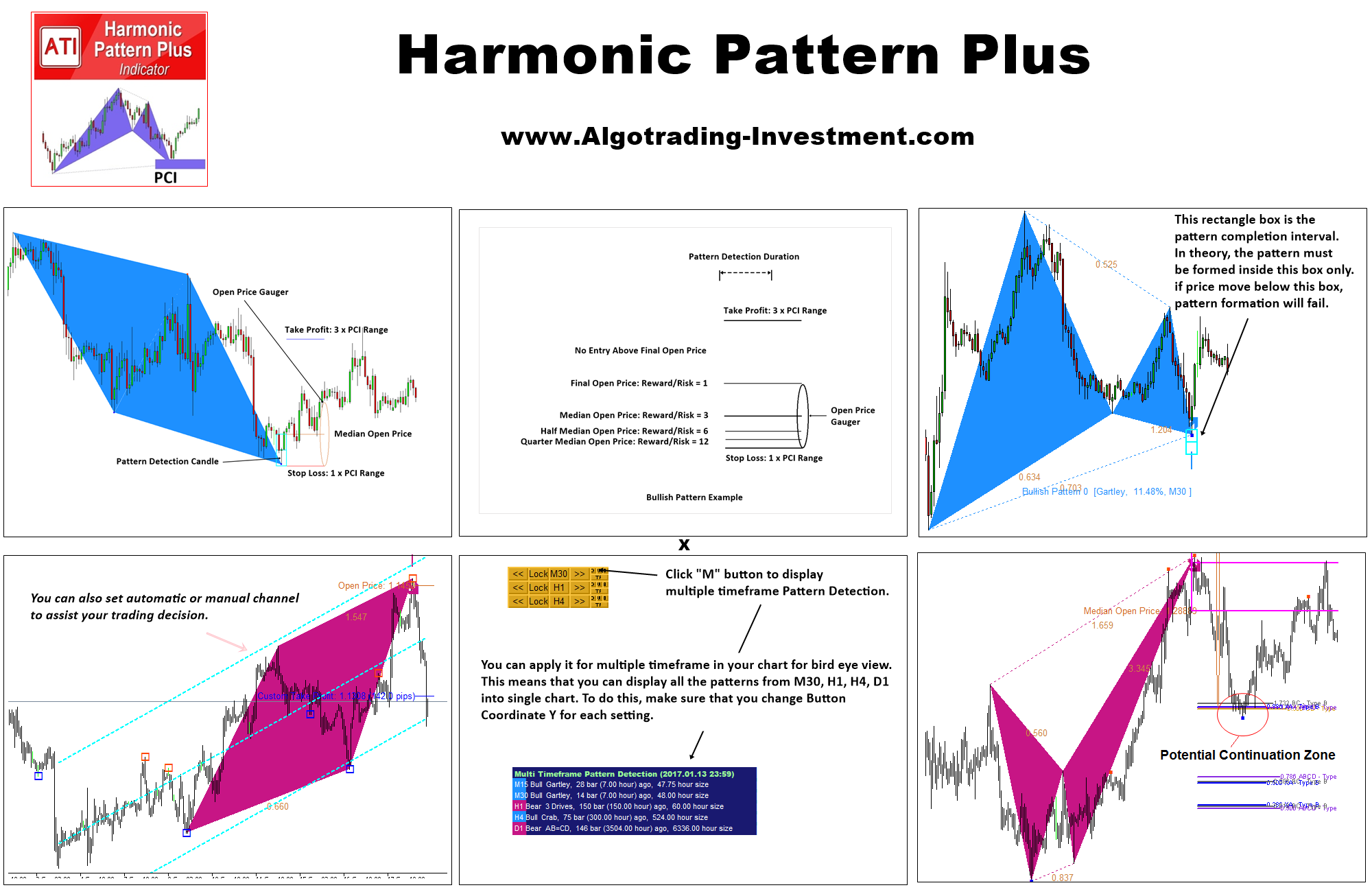

Harmonic Pattern Plus (Type 1)

Harmonic pattern plus is extremely good product for the price. With dozens of powerful features including Pattern Completion Interval, Potential Reversal Zone, Potential Continuation Zone, Automatic Stop loss and take profit sizing.

Below are the Links to Harmonic Pattern Plus

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

Harmonic Pattern Scenario Planner (Type 1 + Predictive feature)

With additional features of predicting future harmonic patterns, this is very tactical harmonic pattern indicator with advanced simulation capability on top of the powerful features of harmonic pattern plus.

Below are the Links to Harmonic Pattern Scenario Planner

https://www.mql5.com/en/market/product/6101

https://www.mql5.com/en/market/product/6240

https://algotrading-investment.com/portfolio-item/harmonic-pattern-scenario-planner/

In this article, we will explain the type of Harmonic Pattern Indicator used for Forex and Stock trading. Firstly, there are several variations of Harmonic pattern indicators used by the trading community. Not all the harmonic pattern indicators are the same. The main variations of Harmonic pattern indicators can be categorized as following three different types depending on the algorithm used inside the indicator. Each type of Harmonic Pattern Indicator has its own pros and cons. We will go through each type of Harmonic Pattern Indicator in this article one by one. In addition, we will also discuss the hybrid of these three variations, called non repainting and non lagging Harmonic Pattern Indicator at the end of this article for your information.

Type 1: Non lagging (fast signal) but repainting – option to enter from turning point. Indicator does not show the failed pattern in chart and last pattern can repaint.

Type 2: Lagging (slow signal) but non repainting – no option to enter at turning point. Indicator does not show the failed pattern but last pattern does not repaint.

Type 3: Detecting pattern at point C but repainting – option to enter at turning point. Indicator detect pattern too early and you have to wait until the point D. Pattern may not achieve point D. Indicator does not show the failed pattern and last pattern can repaint.

Type 1. Non lagging (fast signal) but repainting

First type is non lagging but repainting harmonic indicators. This sort of Harmonic pattern indicator is the typical harmonic pattern indicators used by many traders. The advantage is that you do get the signal early as possible. You have an opportunity to trade from the turning point all the ways down to the continued trend. The disadvantage is that you are not able to test your strategy in chart because this type of harmonic pattern indicator does not show the entry of the failed patterns in chart but only successful one. In fact, Harmonic Pattern Plus and Harmonic Pattern Scenario Planner are under this category. They would provide the fastest signal but you will not able to test your strategy in your chart because they do not show the failed entry in chart.

You can read everything about Harmonic Pattern Indicator from this original article.

https://algotrading-investment.com/2019/03/03/harmonic-pattern-indicator-explained/

We will introduce several Harmonic Pattern Indicator based on what we have discussed so far in this article.

X3 Chart Pattern Scanner (Non Repainting + Non Lagging)

Below is the link to X3 Chart Pattern Scanner in MetaTrader 4 and MetaTrader 5 platform. X3 Chart Pattern Scanner is non repainting and non lagging Harmonic Pattern Indicator. In addition, each Harmonic Pattern in X3 Chart Pattern Scanner can be customized to improve trading performance. With tons of powerful features toward the day trading, this is the next generation Harmonic Pattern Indicator.

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

In addition, we will introduce two Harmonic Pattern Indicator including Harmonic Pattern Plus and Harmonic Pattern Scenario planner. These Harmonic Pattern Indicator is repainting. However, they provide tons of powerful features at affordable price. Hence, if you do not mind the repainting Harmonic Pattern Indicator, then you can use these two tools. In addition, you can use X3 Chart Pattern Scanner together with Harmonic Pattern Plus or Harmonic Pattern Scenario Planner.

Harmonic Pattern Plus (Type 1)

Harmonic pattern plus is extremely good product for the price. With dozens of powerful features including Pattern Completion Interval, Potential Reversal Zone, Potential Continuation Zone, Automatic Stop loss and take profit sizing.

Below are the Links to Harmonic Pattern Plus

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

Harmonic Pattern Scenario Planner (Type 1 + Predictive feature)

With additional features of predicting future harmonic patterns, this is very tactical harmonic pattern indicator with advanced simulation capability on top of the powerful features of harmonic pattern plus.

Below are the Links to Harmonic Pattern Scenario Planner

https://www.mql5.com/en/market/product/6101

https://www.mql5.com/en/market/product/6240

https://algotrading-investment.com/portfolio-item/harmonic-pattern-scenario-planner/

Young Ho Seo

Advanced Supply Demand Zone Indicator

Here is the list of Advanced Supply Demand Zone Indicator. These supply and demand zone indicators are rich in features with many powerful features to help you to trade the right supply and demand zone to trading.

Mean Reversion Supply Demand

Mean Reversion Supply Demand indicator is our earliest supply demand zone indicator and loved by many trader all over the world. It is great to trade with reversal and breakout. You can also fully setup your trading with stop loss and take profit target.

Below are the links to the Mean Reversion Supply Demand indicator for MetaTrader 4/MetaTrader 5.

https://www.mql5.com/en/market/product/16823

https://www.mql5.com/en/market/product/16851

https://algotrading-investment.com/portfolio-item/mean-reversion-supply-demand/

Ace Supply Demand Zone

Ace Supply Demand Zone indicator is our next generation supply demand zone indicator. It was built in non repainting and non lagging algorithm. On top of many powerful features, you can also make use of archived supply and demand zone in your trading to find more accurate trading opportunity.

Below are the links to the Ace Supply Demand Zone indicator for MetaTrader 4/MetaTrader 5.

https://www.mql5.com/en/market/product/40076

https://www.mql5.com/en/market/product/40075

https://algotrading-investment.com/portfolio-item/ace-supply-demand-zone/

For your information, both mean reversion supply demand and Ace supply demand zone indicator uses completely different algorithm in detecting supply and demand zone.

Here is the list of Advanced Supply Demand Zone Indicator. These supply and demand zone indicators are rich in features with many powerful features to help you to trade the right supply and demand zone to trading.

Mean Reversion Supply Demand

Mean Reversion Supply Demand indicator is our earliest supply demand zone indicator and loved by many trader all over the world. It is great to trade with reversal and breakout. You can also fully setup your trading with stop loss and take profit target.

Below are the links to the Mean Reversion Supply Demand indicator for MetaTrader 4/MetaTrader 5.

https://www.mql5.com/en/market/product/16823

https://www.mql5.com/en/market/product/16851

https://algotrading-investment.com/portfolio-item/mean-reversion-supply-demand/

Ace Supply Demand Zone

Ace Supply Demand Zone indicator is our next generation supply demand zone indicator. It was built in non repainting and non lagging algorithm. On top of many powerful features, you can also make use of archived supply and demand zone in your trading to find more accurate trading opportunity.

Below are the links to the Ace Supply Demand Zone indicator for MetaTrader 4/MetaTrader 5.

https://www.mql5.com/en/market/product/40076

https://www.mql5.com/en/market/product/40075

https://algotrading-investment.com/portfolio-item/ace-supply-demand-zone/

For your information, both mean reversion supply demand and Ace supply demand zone indicator uses completely different algorithm in detecting supply and demand zone.

Young Ho Seo

Advanced Supply Demand Zone Indicator

Here is the list of Advanced Supply Demand Zone Indicator. These supply and demand zone indicators are rich in features with many powerful features to help you to trade the right supply and demand zone to trading.

Mean Reversion Supply Demand

Mean Reversion Supply Demand indicator is our earliest supply demand zone indicator and loved by many trader all over the world. It is great to trade with reversal and breakout. You can also fully setup your trading with stop loss and take profit target.

Below are the links to the Mean Reversion Supply Demand indicator for MetaTrader 4/MetaTrader 5.

https://www.mql5.com/en/market/product/16823

https://www.mql5.com/en/market/product/16851

https://algotrading-investment.com/portfolio-item/mean-reversion-supply-demand/

Ace Supply Demand Zone

Ace Supply Demand Zone indicator is our next generation supply demand zone indicator. It was built in non repainting and non lagging algorithm. On top of many powerful features, you can also make use of archived supply and demand zone in your trading to find more accurate trading opportunity.

Below are the links to the Ace Supply Demand Zone indicator for MetaTrader 4/MetaTrader 5.

https://www.mql5.com/en/market/product/40076

https://www.mql5.com/en/market/product/40075

https://algotrading-investment.com/portfolio-item/ace-supply-demand-zone/

For your information, both mean reversion supply demand and Ace supply demand zone indicator uses completely different algorithm in detecting supply and demand zone.

Here is the list of Advanced Supply Demand Zone Indicator. These supply and demand zone indicators are rich in features with many powerful features to help you to trade the right supply and demand zone to trading.

Mean Reversion Supply Demand

Mean Reversion Supply Demand indicator is our earliest supply demand zone indicator and loved by many trader all over the world. It is great to trade with reversal and breakout. You can also fully setup your trading with stop loss and take profit target.

Below are the links to the Mean Reversion Supply Demand indicator for MetaTrader 4/MetaTrader 5.

https://www.mql5.com/en/market/product/16823

https://www.mql5.com/en/market/product/16851

https://algotrading-investment.com/portfolio-item/mean-reversion-supply-demand/

Ace Supply Demand Zone

Ace Supply Demand Zone indicator is our next generation supply demand zone indicator. It was built in non repainting and non lagging algorithm. On top of many powerful features, you can also make use of archived supply and demand zone in your trading to find more accurate trading opportunity.

Below are the links to the Ace Supply Demand Zone indicator for MetaTrader 4/MetaTrader 5.

https://www.mql5.com/en/market/product/40076

https://www.mql5.com/en/market/product/40075

https://algotrading-investment.com/portfolio-item/ace-supply-demand-zone/

For your information, both mean reversion supply demand and Ace supply demand zone indicator uses completely different algorithm in detecting supply and demand zone.

Young Ho Seo

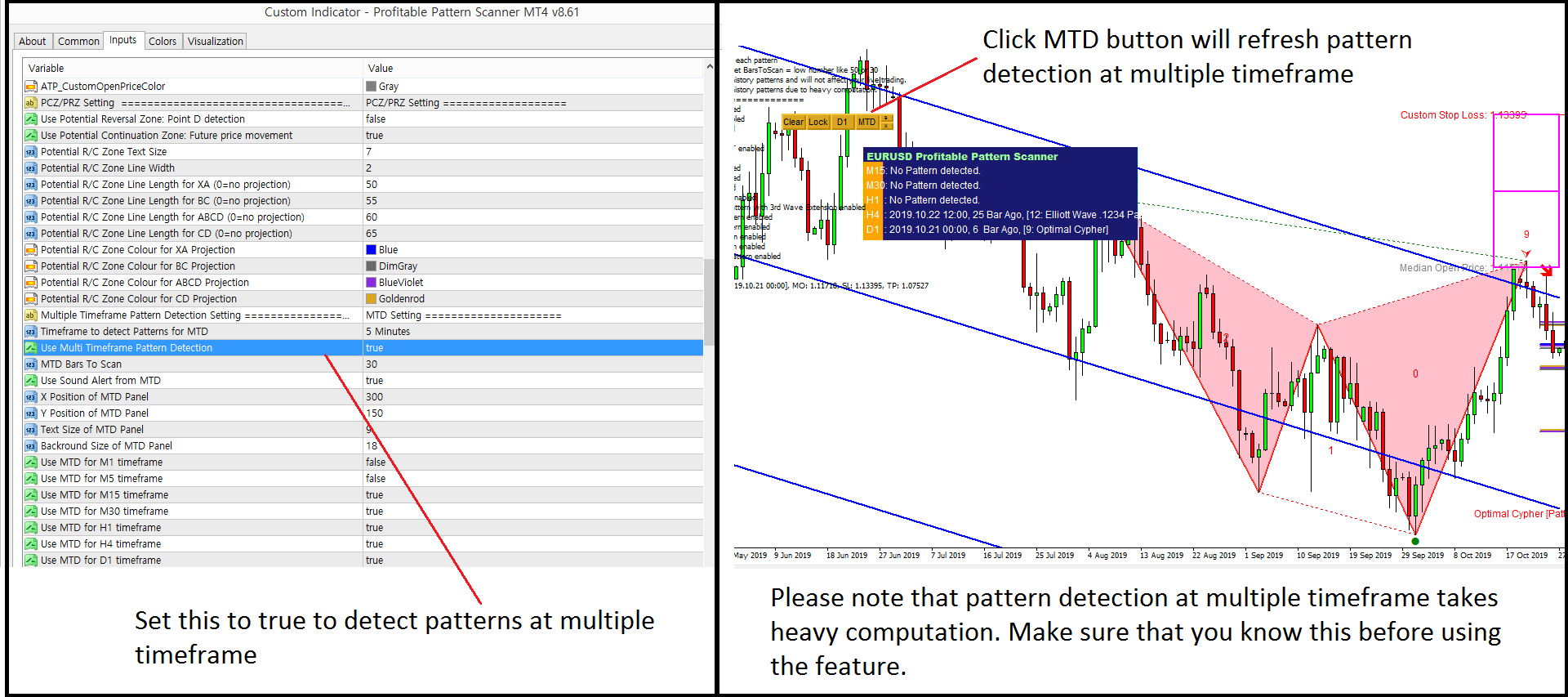

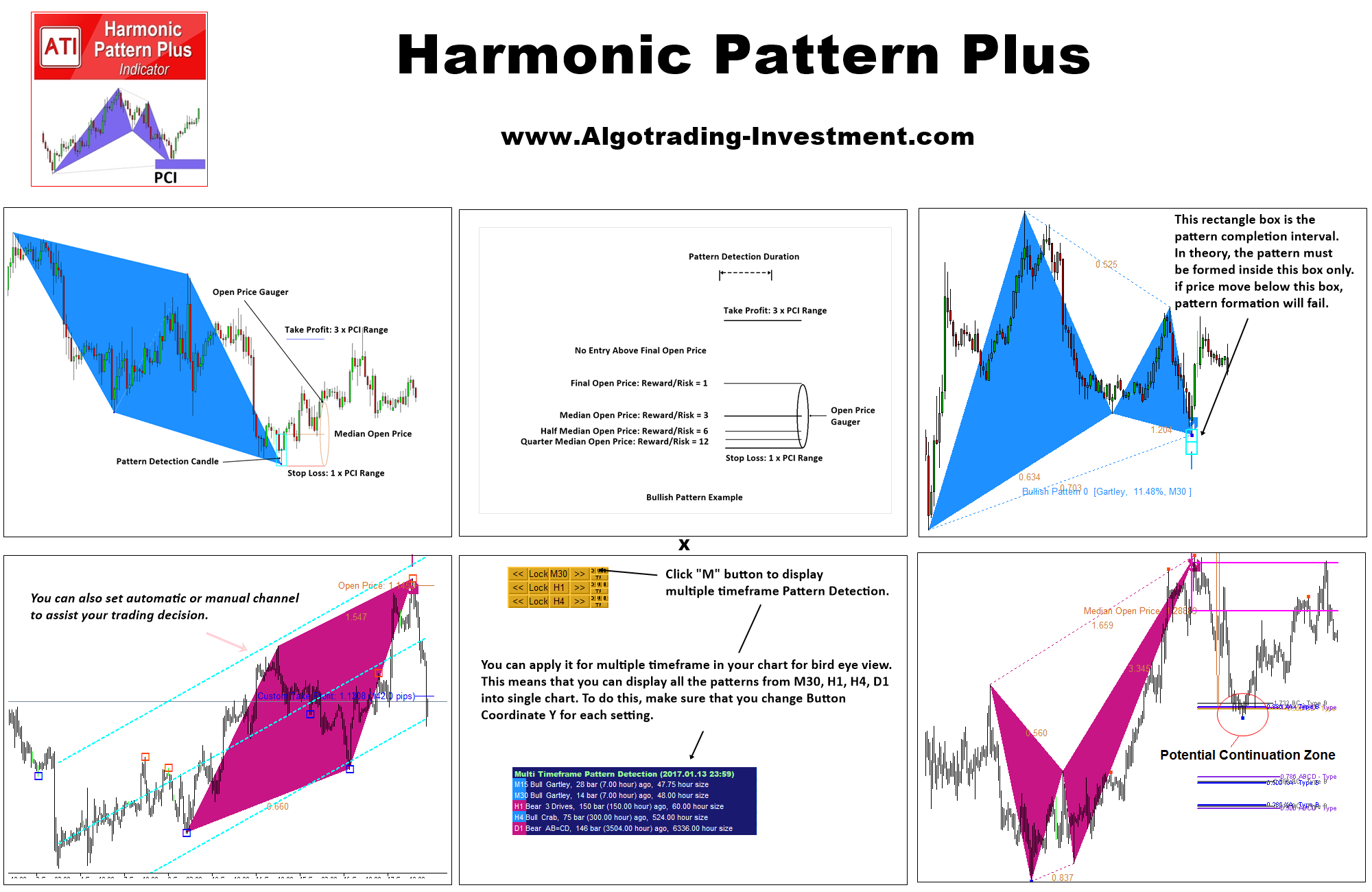

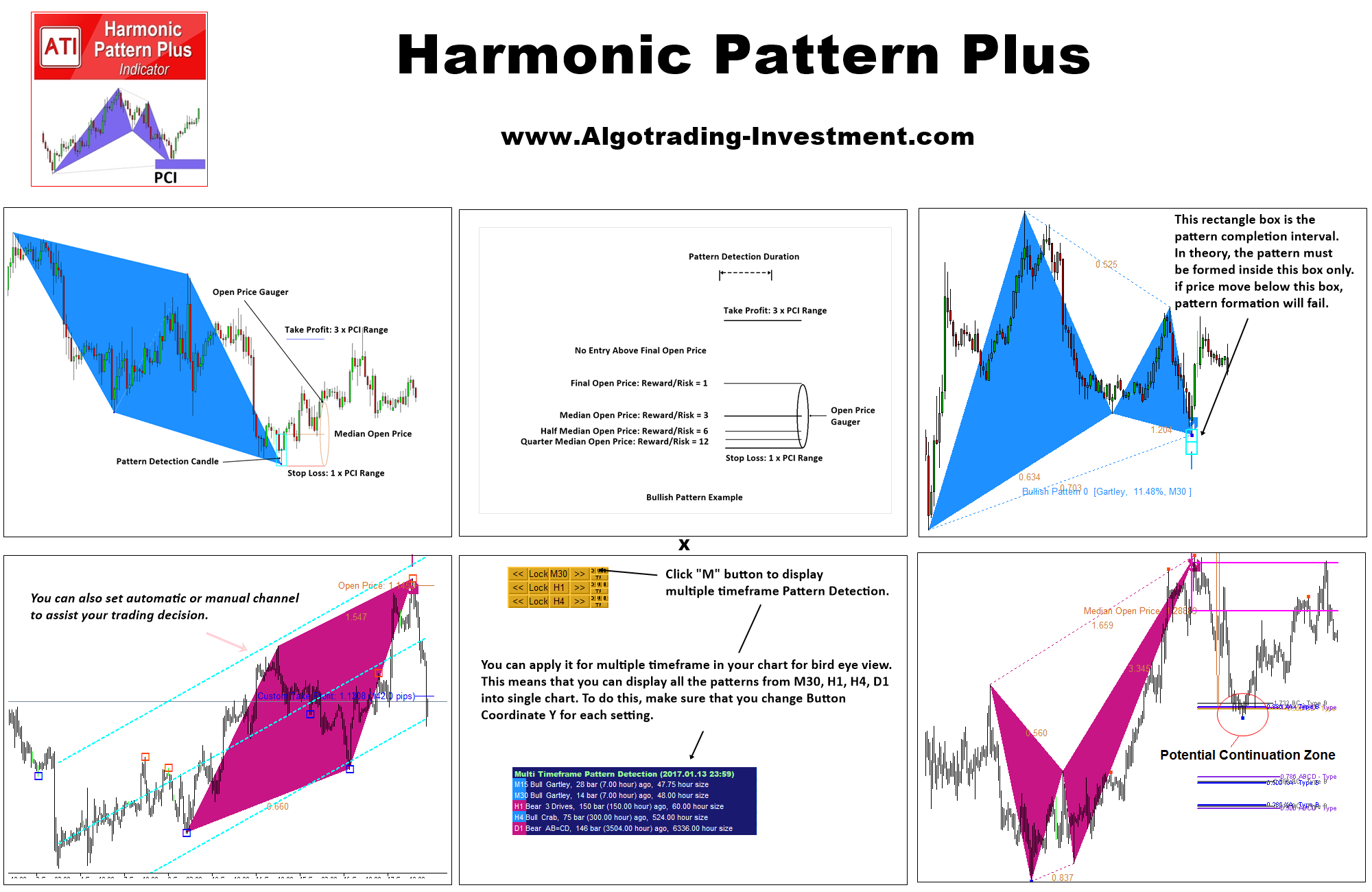

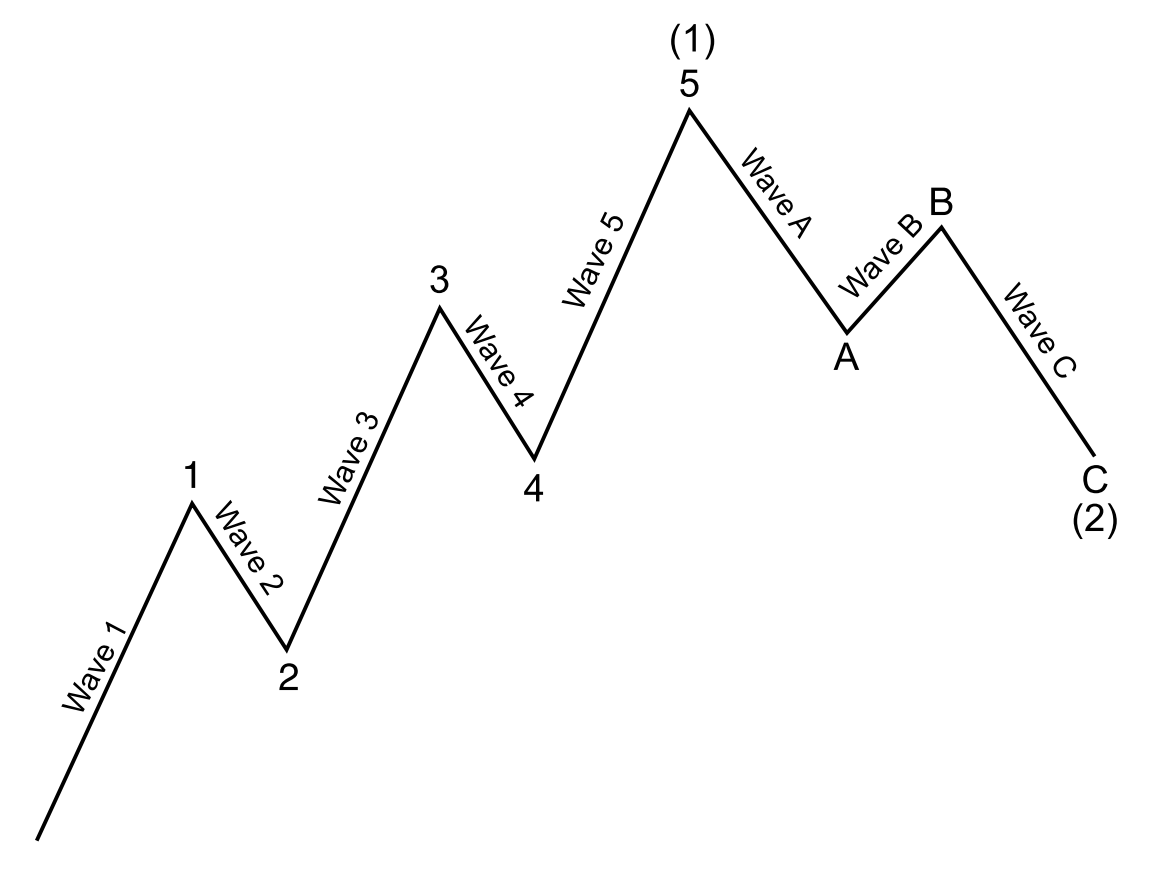

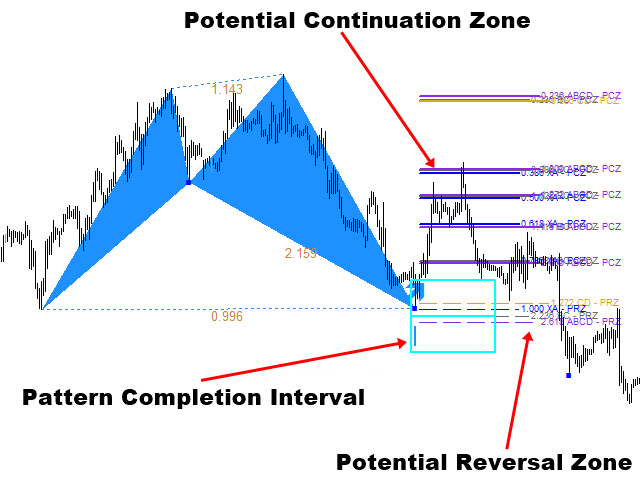

Harmonic Pattern Plus Introduction

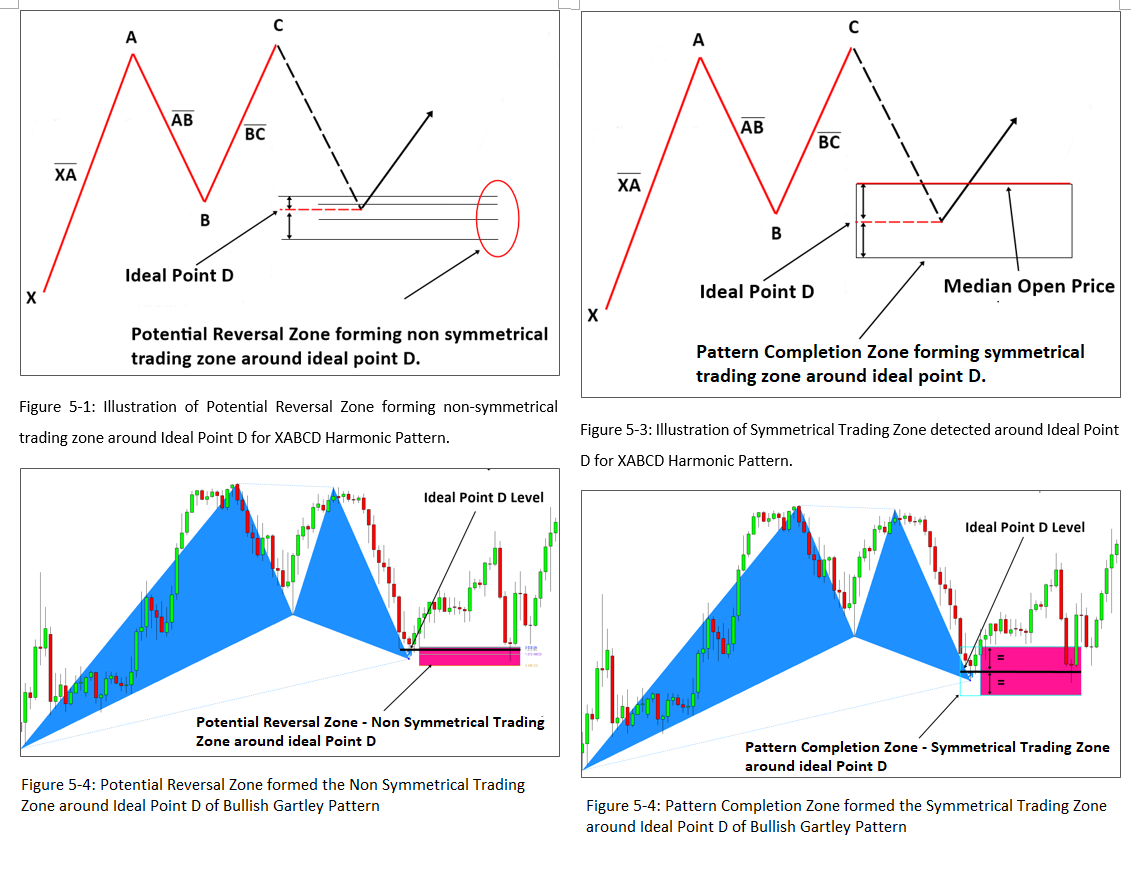

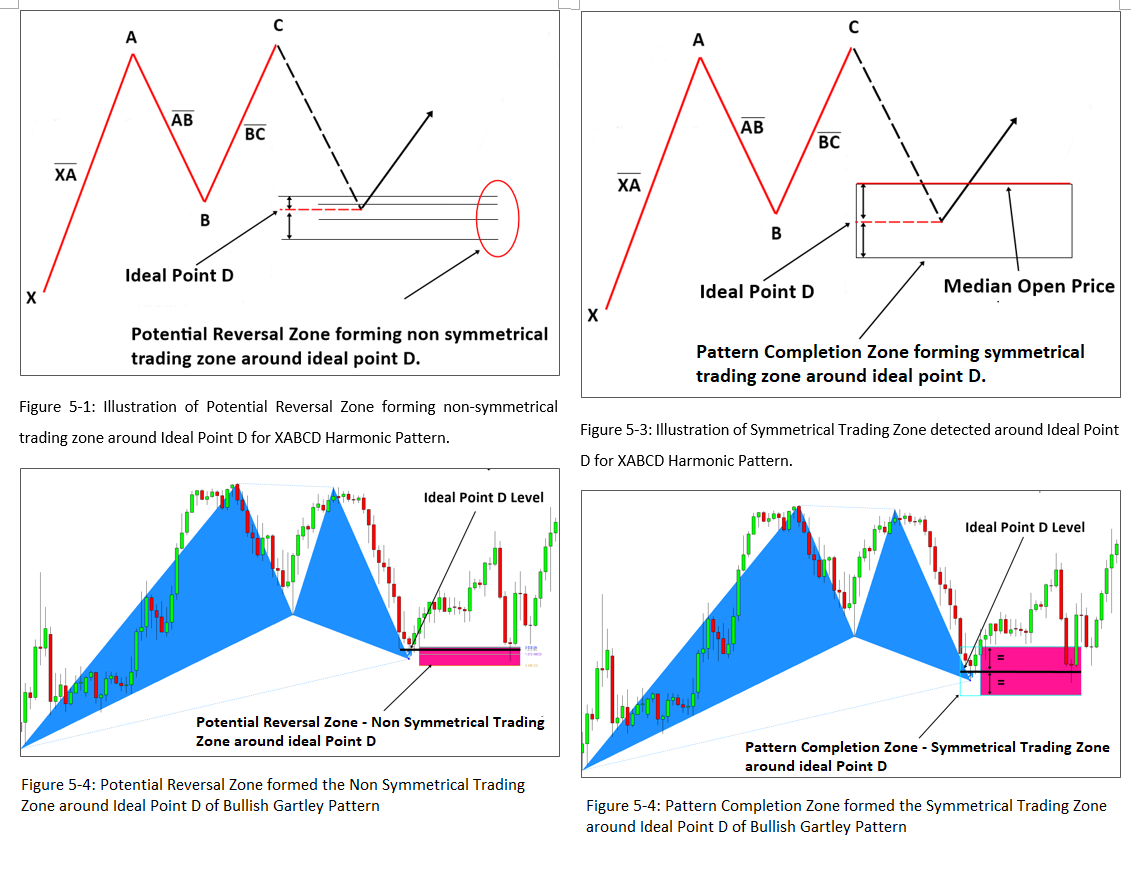

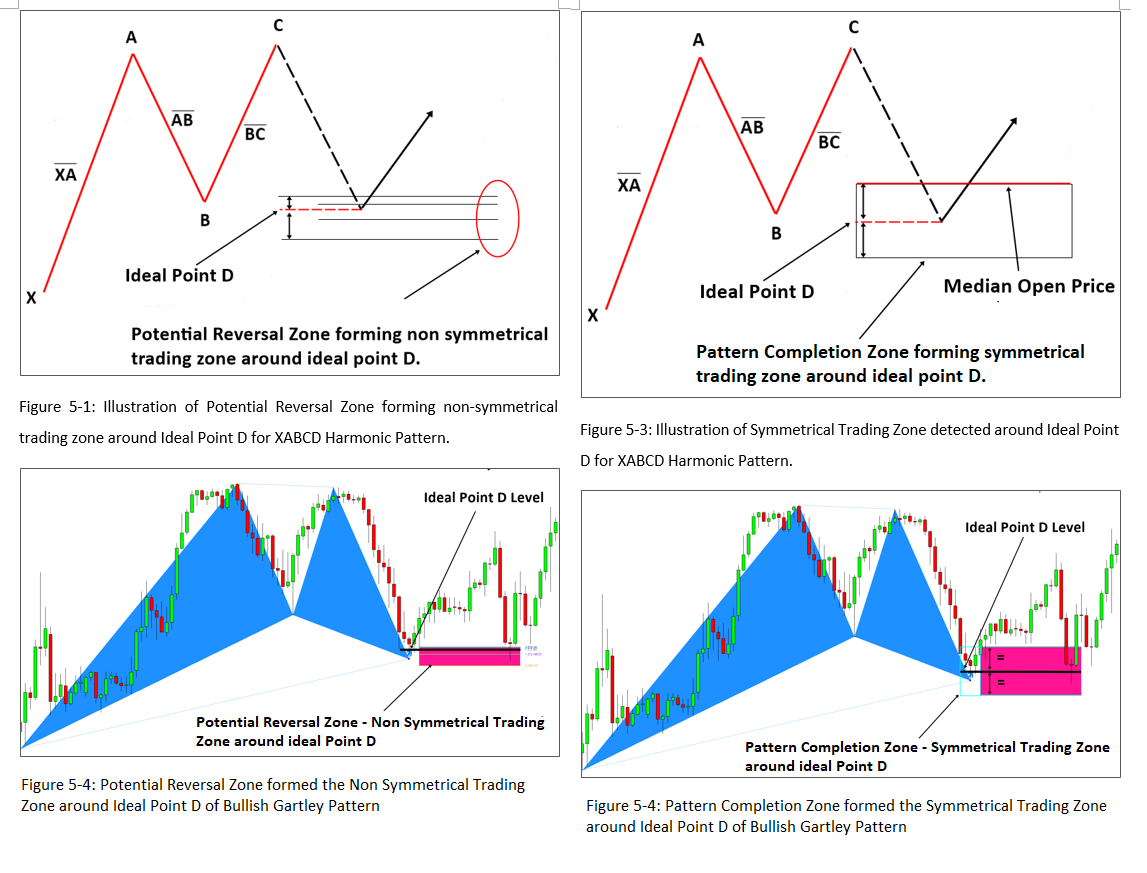

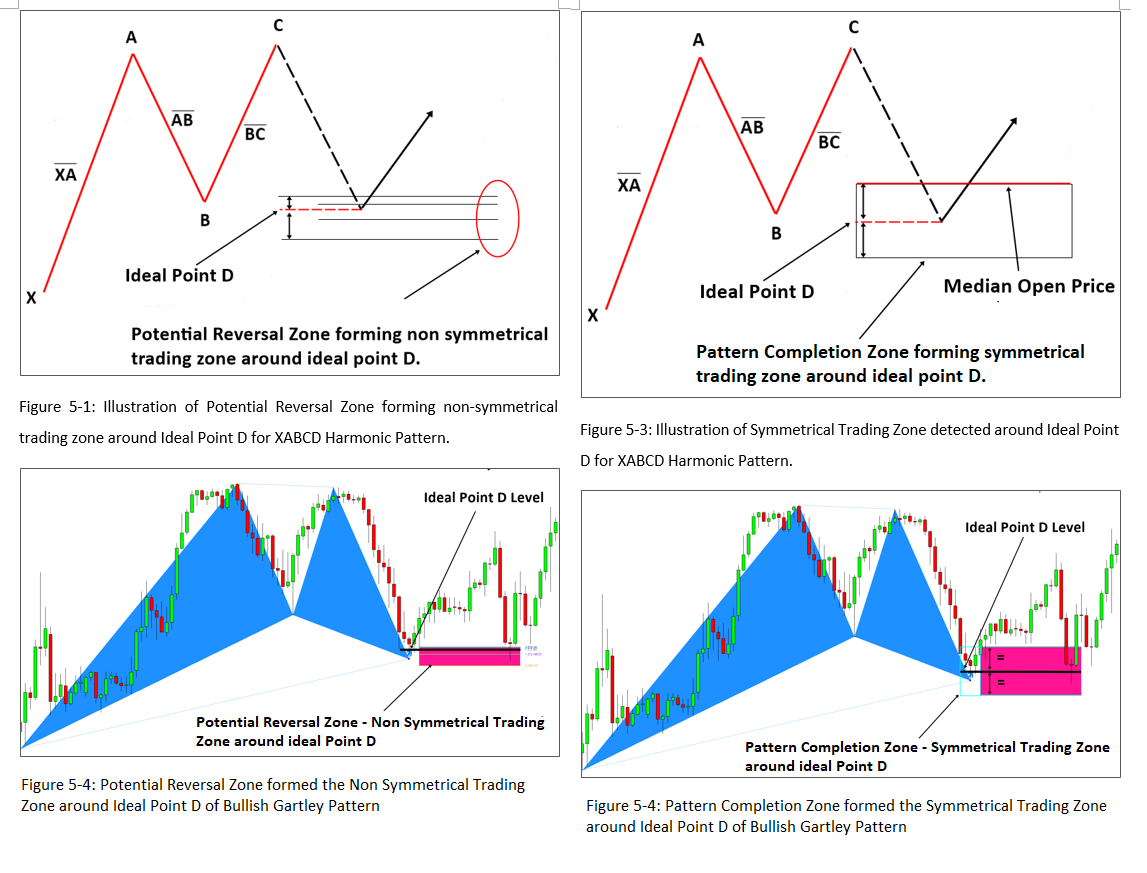

If you need to predict the turning point of the market, then Harmonic Pattern is the best tool in its kind. With our research, our Harmonic Pattern Plus uses the precision harmonic pattern trading as its default trading strategy with Pattern Completion Zone, Potential Continuation Zone and Potential Reversal Zone. Yet, there are many other powerful features built in together for your superb trading experience. This is a repainting Harmonic Pattern indicator but this one comes will tons of useful features to help you to make more accurate trading decision as well as manaing the trading risk.

11 Harmonic Pattern Detection

Automatic stop loss and take profit recognition for superb risk management

Pattern Completion Zone detection for precision trading

Potential Continuation Zone detection for future price prediction

Potential Reversal Zone detection for Point D identification

52 Japanese Candlestick Pattern Detection (optional to use, you can swtich on and off)

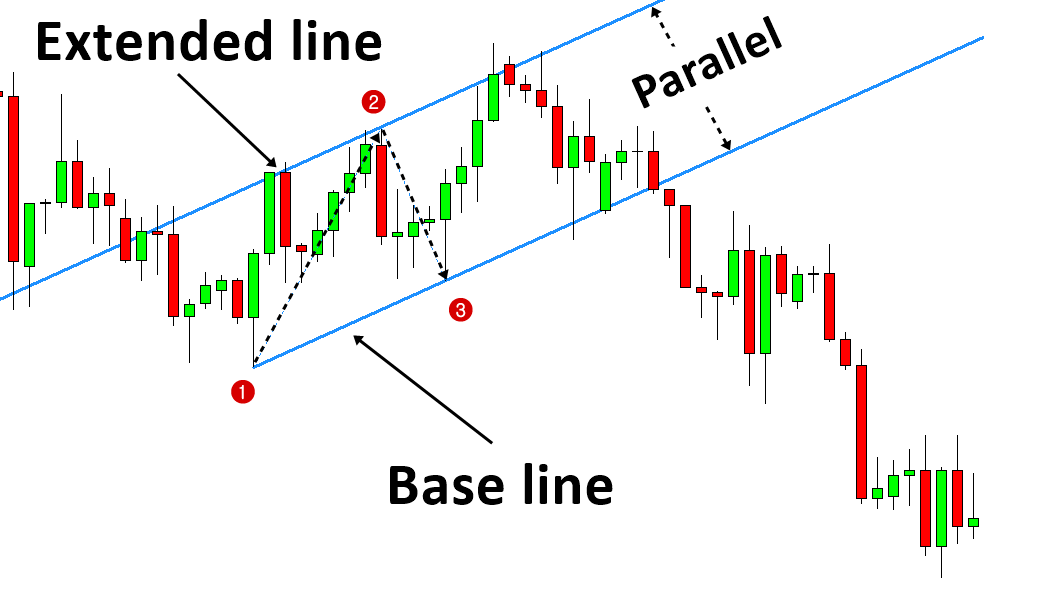

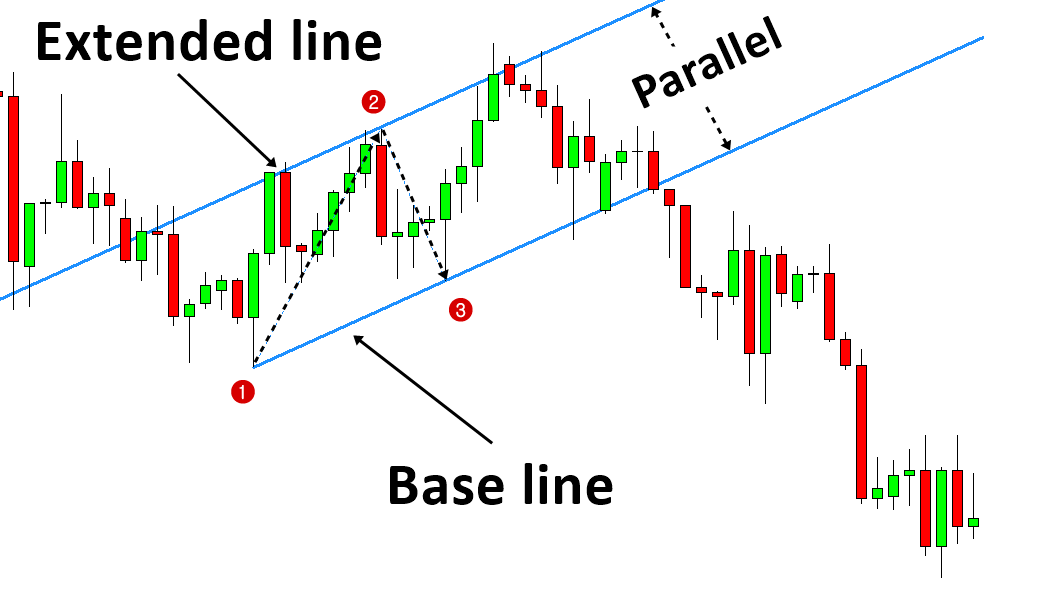

Automatic Channel Detection to go with Harmonic Pattern (Optional to use, you can switch on and off)

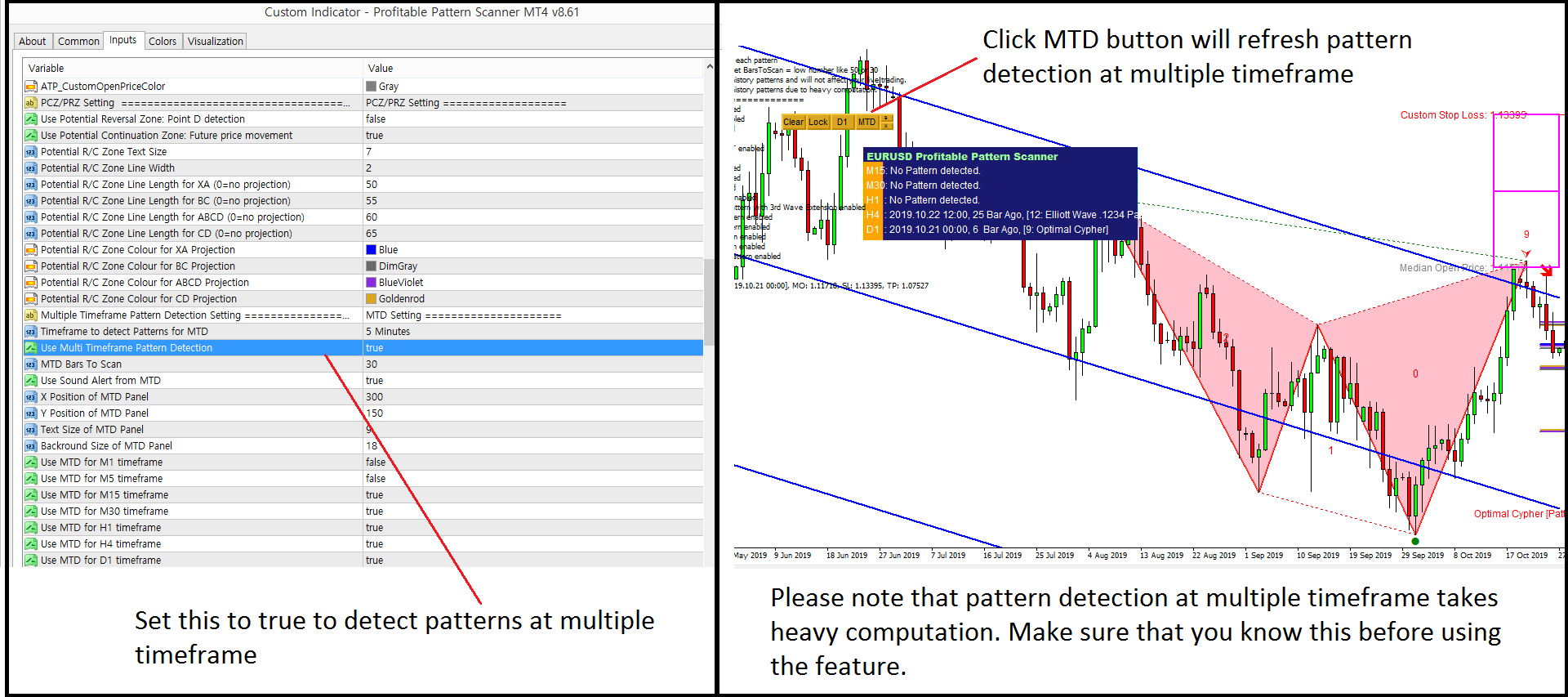

Multiple timeframe Pattern Detection across all timeframe

Guided Trading Instruction for professional traders

Pattern Locking and Unlocking feature in your chart

Even more, please find it out.

Below is the landing page for Harmonic Pattern Plus for MetaTrader 4 and MetaTrader 5.

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

You can find “Quick Guide for Harmonic Pattern” from the link below. This article will explain the following topics about Harmonic Pattern.

1. Automatic Reversal (turning point) Pattern Detection

2. Custom Take Profit and Stop Loss based on Pattern Completion Interval

3. Pattern Completion Interval Box (= Pattern Completion Zone)

4. Potential Reversal Zone (PRZ) and Potential Continuation Zone (PCZ)

5. Japanese Candlestick Patterns Detection

6. Automatic Channel

7. Multiple Timeframe Pattern Detection (alert)

8. Steps to improve Trading Performance with Harmonic Pattern Plus

9. Mean Absolute Percent Error (MAPE) in details

Please visit the link below to read the full article “Quick Guide for Harmonic Pattern”. This article is only quick quide though. We also have the book: “Guide to Precision Harmonic Pattern Trading” to explain the important knowedge to trade with Harmonic Pattern in Forex and Stock Market.

https://algotrading-investment.com/2018/10/21/quick-guide-for-harmonic-pattern-plus/

If you need to predict the turning point of the market, then Harmonic Pattern is the best tool in its kind. With our research, our Harmonic Pattern Plus uses the precision harmonic pattern trading as its default trading strategy with Pattern Completion Zone, Potential Continuation Zone and Potential Reversal Zone. Yet, there are many other powerful features built in together for your superb trading experience. This is a repainting Harmonic Pattern indicator but this one comes will tons of useful features to help you to make more accurate trading decision as well as manaing the trading risk.

11 Harmonic Pattern Detection

Automatic stop loss and take profit recognition for superb risk management

Pattern Completion Zone detection for precision trading

Potential Continuation Zone detection for future price prediction

Potential Reversal Zone detection for Point D identification

52 Japanese Candlestick Pattern Detection (optional to use, you can swtich on and off)

Automatic Channel Detection to go with Harmonic Pattern (Optional to use, you can switch on and off)

Multiple timeframe Pattern Detection across all timeframe

Guided Trading Instruction for professional traders

Pattern Locking and Unlocking feature in your chart

Even more, please find it out.

Below is the landing page for Harmonic Pattern Plus for MetaTrader 4 and MetaTrader 5.

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

You can find “Quick Guide for Harmonic Pattern” from the link below. This article will explain the following topics about Harmonic Pattern.

1. Automatic Reversal (turning point) Pattern Detection

2. Custom Take Profit and Stop Loss based on Pattern Completion Interval

3. Pattern Completion Interval Box (= Pattern Completion Zone)

4. Potential Reversal Zone (PRZ) and Potential Continuation Zone (PCZ)

5. Japanese Candlestick Patterns Detection

6. Automatic Channel

7. Multiple Timeframe Pattern Detection (alert)

8. Steps to improve Trading Performance with Harmonic Pattern Plus

9. Mean Absolute Percent Error (MAPE) in details

Please visit the link below to read the full article “Quick Guide for Harmonic Pattern”. This article is only quick quide though. We also have the book: “Guide to Precision Harmonic Pattern Trading” to explain the important knowedge to trade with Harmonic Pattern in Forex and Stock Market.

https://algotrading-investment.com/2018/10/21/quick-guide-for-harmonic-pattern-plus/

Young Ho Seo

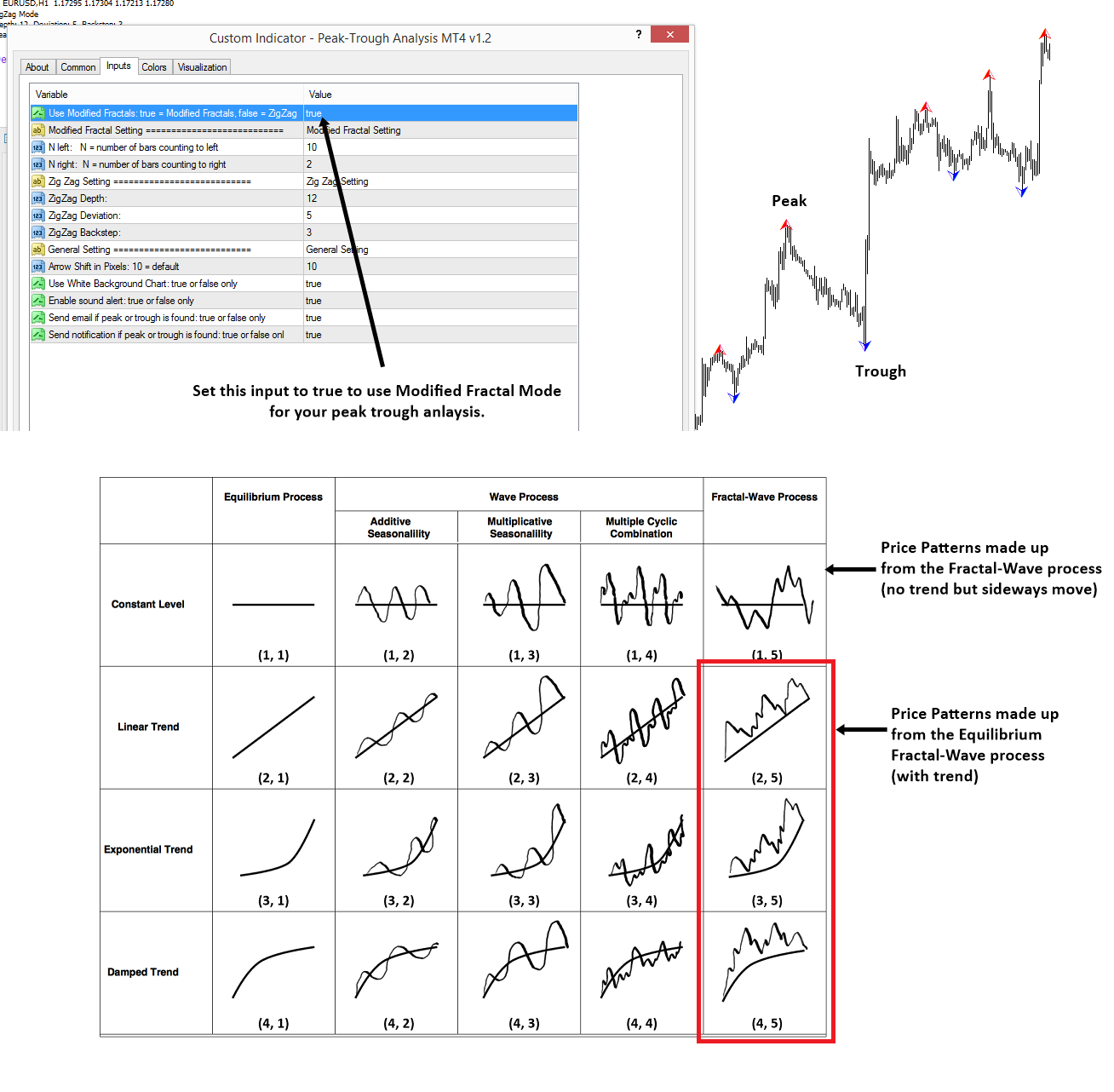

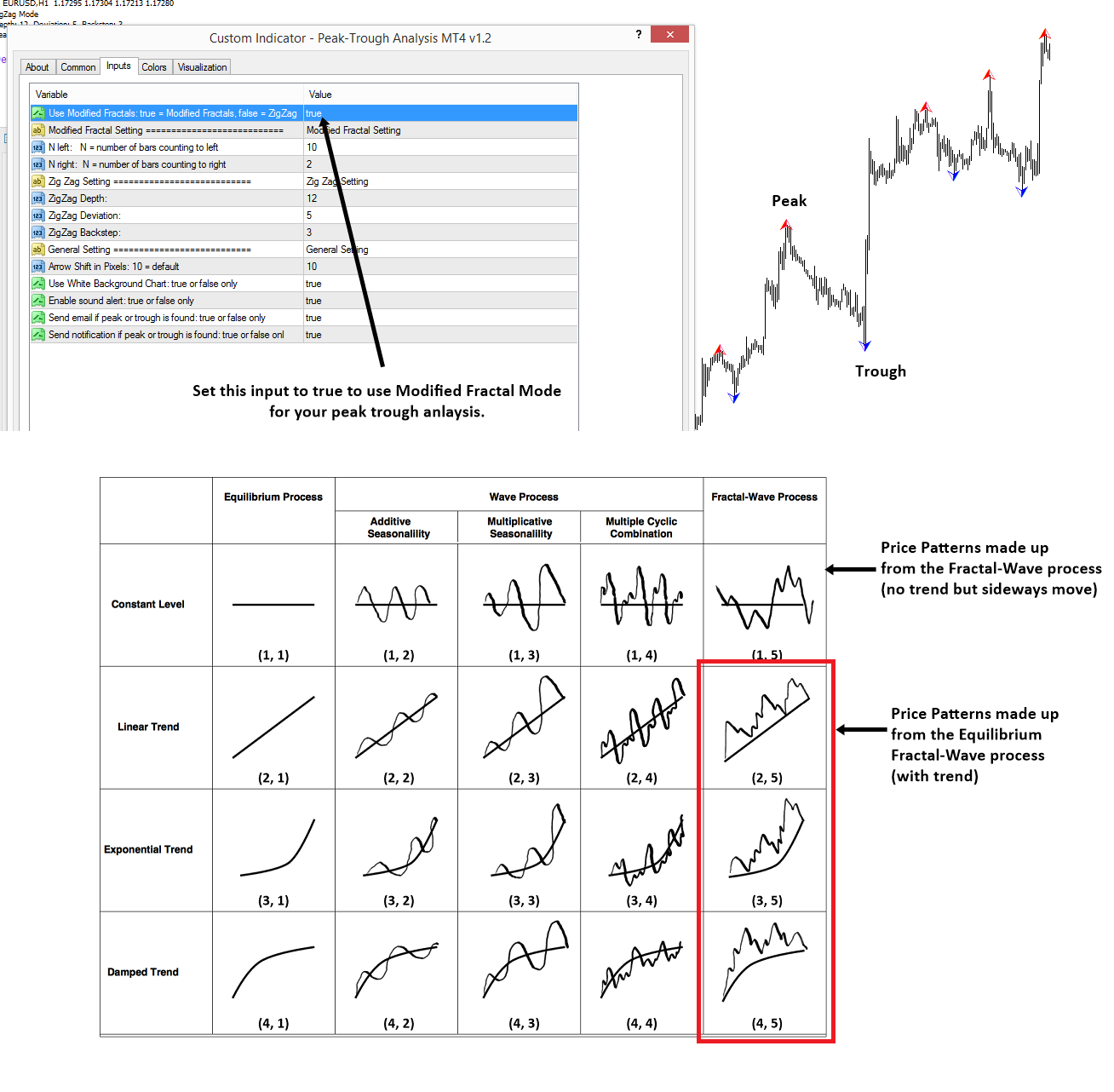

Introduction to Peak Trough Analysis for Trading

After we have released the Peak Trough Analysis indicator (free), we have many responses from traders about the usefulness of Peak Trough Analysis for their technical analysis. Yes, that is exactly why we have developed the peak trough analysis. Although it is free, it can be powerful for your trading, especially in detecting chart patterns like support resistance, supply demand zone, Harmonic Pattern, Elliott Wave, Triangle Pattern, Rising Wedge Pattern and Falling Wedge Pattern, Head and shoulder pattern and so on. In fact, the peak trough indicator provides the good connection between the peak trough analysis and how to reveal the structure of the Forex and Stock market dynamics. More precisely, the peak trough analysis helps to visualize the Fractal Wave in Forex and Stock chart. In practice, the peak trough analysis can advance your price action trading. This is not just intuitive for your trading but we have the formulated logical and reproducible ways for your trading. You can use the peak trough analysis tool without much explanation since they are very simple and easy to use.

However, if you really want to digger deeper and to have more performance with the peak trough analysis, then you can look into the book: Scientific Guide To Price Action and Pattern Trading: Wisdom of Trend, Cycle, and Fractal Wave.

https://play.google.com/store/books/details?id=5prUDwAAQBAJ

https://www.amazon.com/dp/B073T3ZMBR

https://www.scribd.com/book/394566377/Scientific-Guide-To-Price-Action-and-Pattern-Trading

We shows more comprehensive explanation and usage in the peak-trough analysis in this book. At the same time, in our website, the peak trough analysis is the most basic trading tool you can use. If you need more sophisticated but automated tools for your trading, then you can visit our website. You will find much more powerful trading system than the peak trough analysis indicator. As we have mentioned, the peak trough analysis indicator is the most basic one you can use among our products. For example, we provide the Harmonic Pattern Scanner, Elliott Wave Indicator, Chart Pattern Scanner, Volume Spread Analysis tools. Please visit the link below to find out more about the powerful technical analysis.

https://algotrading-investment.com

https://www.mql5.com/en/users/financeengineer/seller#products

Here are the free download link for Peak Trough Analysis for MetaTrader 4 (MT4):

https://www.mql5.com/en/market/product/23797

Here are the free download link for Peak Trough Analysis for MetaTrader 5 (MT5):

https://www.mql5.com/en/market/product/22420

You can also download it for free from Algotrading-Investment.com. Link is shown in the belwo.

https://algotrading-investment.com/portfolio-item/peak-trough-analysis-tool/

After we have released the Peak Trough Analysis indicator (free), we have many responses from traders about the usefulness of Peak Trough Analysis for their technical analysis. Yes, that is exactly why we have developed the peak trough analysis. Although it is free, it can be powerful for your trading, especially in detecting chart patterns like support resistance, supply demand zone, Harmonic Pattern, Elliott Wave, Triangle Pattern, Rising Wedge Pattern and Falling Wedge Pattern, Head and shoulder pattern and so on. In fact, the peak trough indicator provides the good connection between the peak trough analysis and how to reveal the structure of the Forex and Stock market dynamics. More precisely, the peak trough analysis helps to visualize the Fractal Wave in Forex and Stock chart. In practice, the peak trough analysis can advance your price action trading. This is not just intuitive for your trading but we have the formulated logical and reproducible ways for your trading. You can use the peak trough analysis tool without much explanation since they are very simple and easy to use.

However, if you really want to digger deeper and to have more performance with the peak trough analysis, then you can look into the book: Scientific Guide To Price Action and Pattern Trading: Wisdom of Trend, Cycle, and Fractal Wave.

https://play.google.com/store/books/details?id=5prUDwAAQBAJ

https://www.amazon.com/dp/B073T3ZMBR

https://www.scribd.com/book/394566377/Scientific-Guide-To-Price-Action-and-Pattern-Trading

We shows more comprehensive explanation and usage in the peak-trough analysis in this book. At the same time, in our website, the peak trough analysis is the most basic trading tool you can use. If you need more sophisticated but automated tools for your trading, then you can visit our website. You will find much more powerful trading system than the peak trough analysis indicator. As we have mentioned, the peak trough analysis indicator is the most basic one you can use among our products. For example, we provide the Harmonic Pattern Scanner, Elliott Wave Indicator, Chart Pattern Scanner, Volume Spread Analysis tools. Please visit the link below to find out more about the powerful technical analysis.

https://algotrading-investment.com

https://www.mql5.com/en/users/financeengineer/seller#products

Here are the free download link for Peak Trough Analysis for MetaTrader 4 (MT4):

https://www.mql5.com/en/market/product/23797

Here are the free download link for Peak Trough Analysis for MetaTrader 5 (MT5):

https://www.mql5.com/en/market/product/22420

You can also download it for free from Algotrading-Investment.com. Link is shown in the belwo.

https://algotrading-investment.com/portfolio-item/peak-trough-analysis-tool/

Young Ho Seo

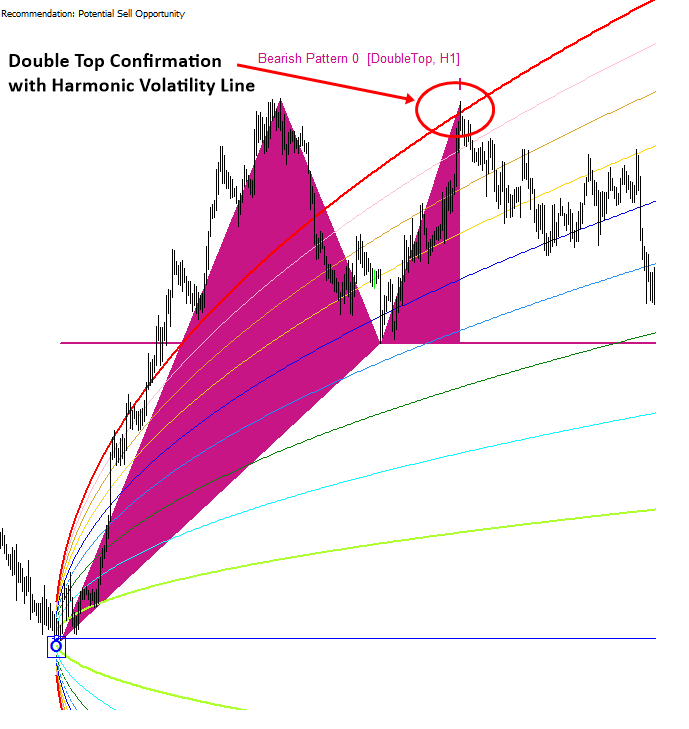

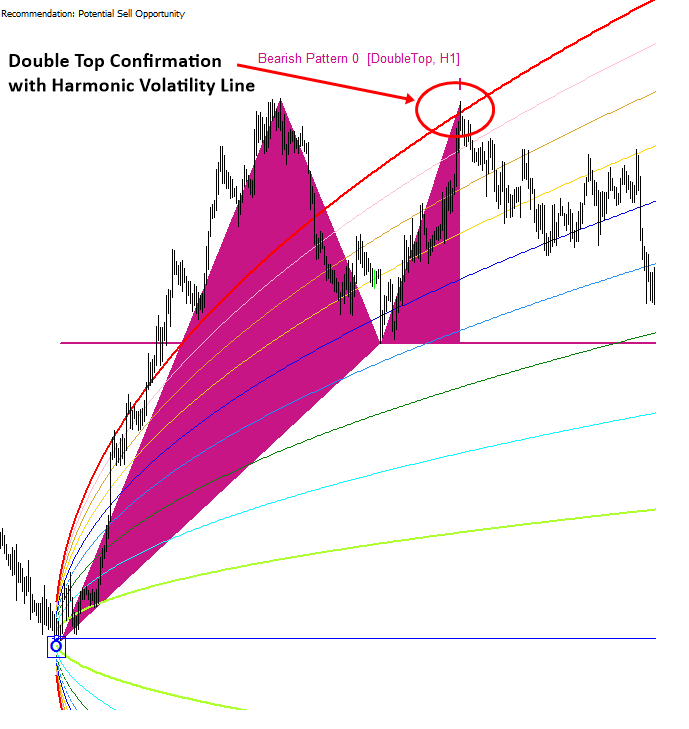

Next Generation Volatility Indicator

Introduction to Volatility

Volatility is the most watched variable among the institutional traders because the market volatility have a direct impact on their trading risk. It is not easy to meet up any successful traders without emphasizing the importance of the volatility for their trading. In addition, we can even find countless trading strategies or trading courses based on the market volatility around us. In spite of its high importance, unfortunately, the access to the volatility tools for average traders are not easy in general. It is partly true that the library of the price based technical analysis is ever growing whereas the development in the volatility based technical analysis is almost halt after the invention of Bollinger bands in 1980s by John Bollinger. In general, you can find fewer number of the technical analysis tools based on the volatility in the most of trading or charting platforms. Here is the list of some popular volatility indicators for traders.

• Standard Deviation indicator

• Average True Range indicator

• True Range Indicator

• Keltner Channel

• Bollinger bands indicator

Regardless of fewer tools available to analyse the market volatility for traders, the high importance of watching market volatility will never change in the future. Market can only move as much as the fuels available in the market. Therefore, watching the market volatility will never harm your trading but will do many good things for your trading.

Overview on the Harmonic Volatility Indicator

Harmonic Volatility Indicator was originally developed to overcome the limitation of Gann’s Angle, also known as Gann’s Fan. For this reason, trader can use Harmonic Volatility Indicator like Gann’s Angle (or Gann’s Fan). At the same time, the harmonic volatility indicator bases its core concept on the Volatility and Fibonacci analysis, which is distinctive from the Gann’s Angle. Therefore, the Harmonic Volatility Indicator can offer many other benefits, which are not offered by Gann’s Angle. In this article, we will talk about the Harmonic Volatility Indicator without comparing it to the Gann’s Angle because there are many traders who are not familiar with Gann’s technique.

You can read everything about volatility trading from this original article.

https://algotrading-investment.com/2018/10/29/next-generation-volatility-indicator/

Fibonacci Volatility Indicator

Fibonacci Volatility indicator can provide the market volatility in visual form in your chart for your trading. You can use Daily, Weekly, Monthly and Yearly Volatility for your trading. The most important application of this Volatility indicator is to detect the potential breakout area, potential bullish reversal area and potential bearish reversal area. When you want to visualize the Volatility for your trading, this is the best tool available in the market. Additionally, you can also use the Movable Volatility indicator and you can set the alert at low and high volatile area in your chart.

https://www.mql5.com/en/market/product/52671

https://www.mql5.com/en/market/product/52670

https://algotrading-investment.com/portfolio-item/fibonacci-volatility-indicator/

Harmonic Volatility Indicator

Harmonic Volatility indicator also provides the market volatility in visual form in your chart for your trading. This tool can be used to visualize the Daily, Weekly, Monthly and Yearly Volatility. The difference between Harmonic Volatility indicator and Fibonacci Volatility indicator is that you can only use Probability Configuration mode in the Harmonic Volatility indicator whereas in the Fibonacci Volatility indicator you can access both Probability Configuration and Z Score configuration. This is cheaper than Fibonacci Volatility indicator. Hence, this is the light version of the Fibonacci Volatility indicator.

https://www.mql5.com/en/market/product/29008

https://www.mql5.com/en/market/product/29004

https://algotrading-investment.com/portfolio-item/harmonic-volatility-indicator/

Introduction to Volatility

Volatility is the most watched variable among the institutional traders because the market volatility have a direct impact on their trading risk. It is not easy to meet up any successful traders without emphasizing the importance of the volatility for their trading. In addition, we can even find countless trading strategies or trading courses based on the market volatility around us. In spite of its high importance, unfortunately, the access to the volatility tools for average traders are not easy in general. It is partly true that the library of the price based technical analysis is ever growing whereas the development in the volatility based technical analysis is almost halt after the invention of Bollinger bands in 1980s by John Bollinger. In general, you can find fewer number of the technical analysis tools based on the volatility in the most of trading or charting platforms. Here is the list of some popular volatility indicators for traders.

• Standard Deviation indicator

• Average True Range indicator

• True Range Indicator

• Keltner Channel

• Bollinger bands indicator

Regardless of fewer tools available to analyse the market volatility for traders, the high importance of watching market volatility will never change in the future. Market can only move as much as the fuels available in the market. Therefore, watching the market volatility will never harm your trading but will do many good things for your trading.

Overview on the Harmonic Volatility Indicator

Harmonic Volatility Indicator was originally developed to overcome the limitation of Gann’s Angle, also known as Gann’s Fan. For this reason, trader can use Harmonic Volatility Indicator like Gann’s Angle (or Gann’s Fan). At the same time, the harmonic volatility indicator bases its core concept on the Volatility and Fibonacci analysis, which is distinctive from the Gann’s Angle. Therefore, the Harmonic Volatility Indicator can offer many other benefits, which are not offered by Gann’s Angle. In this article, we will talk about the Harmonic Volatility Indicator without comparing it to the Gann’s Angle because there are many traders who are not familiar with Gann’s technique.

You can read everything about volatility trading from this original article.

https://algotrading-investment.com/2018/10/29/next-generation-volatility-indicator/

Fibonacci Volatility Indicator

Fibonacci Volatility indicator can provide the market volatility in visual form in your chart for your trading. You can use Daily, Weekly, Monthly and Yearly Volatility for your trading. The most important application of this Volatility indicator is to detect the potential breakout area, potential bullish reversal area and potential bearish reversal area. When you want to visualize the Volatility for your trading, this is the best tool available in the market. Additionally, you can also use the Movable Volatility indicator and you can set the alert at low and high volatile area in your chart.

https://www.mql5.com/en/market/product/52671

https://www.mql5.com/en/market/product/52670

https://algotrading-investment.com/portfolio-item/fibonacci-volatility-indicator/

Harmonic Volatility Indicator

Harmonic Volatility indicator also provides the market volatility in visual form in your chart for your trading. This tool can be used to visualize the Daily, Weekly, Monthly and Yearly Volatility. The difference between Harmonic Volatility indicator and Fibonacci Volatility indicator is that you can only use Probability Configuration mode in the Harmonic Volatility indicator whereas in the Fibonacci Volatility indicator you can access both Probability Configuration and Z Score configuration. This is cheaper than Fibonacci Volatility indicator. Hence, this is the light version of the Fibonacci Volatility indicator.

https://www.mql5.com/en/market/product/29008

https://www.mql5.com/en/market/product/29004

https://algotrading-investment.com/portfolio-item/harmonic-volatility-indicator/

Young Ho Seo

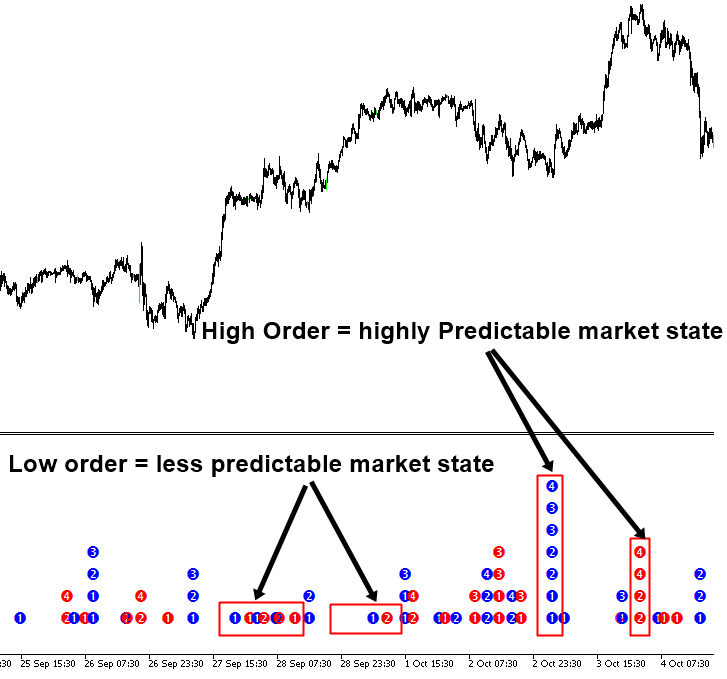

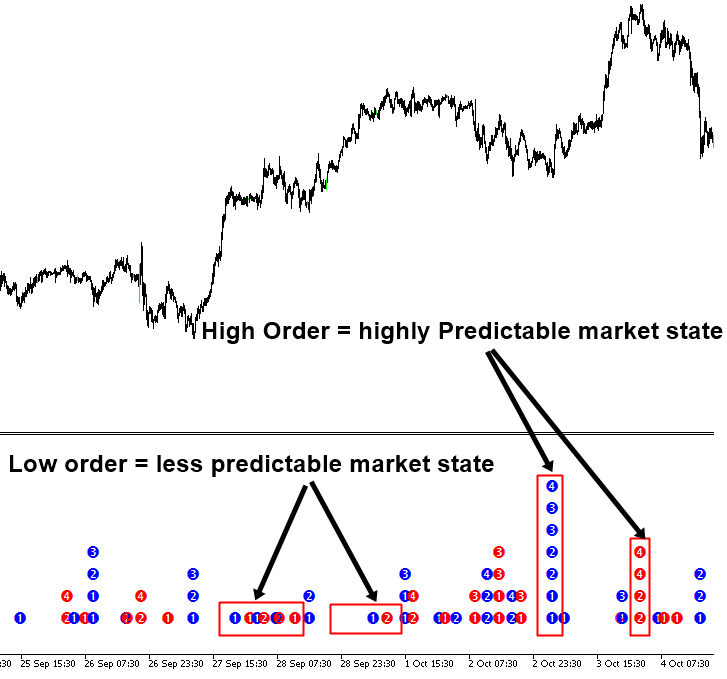

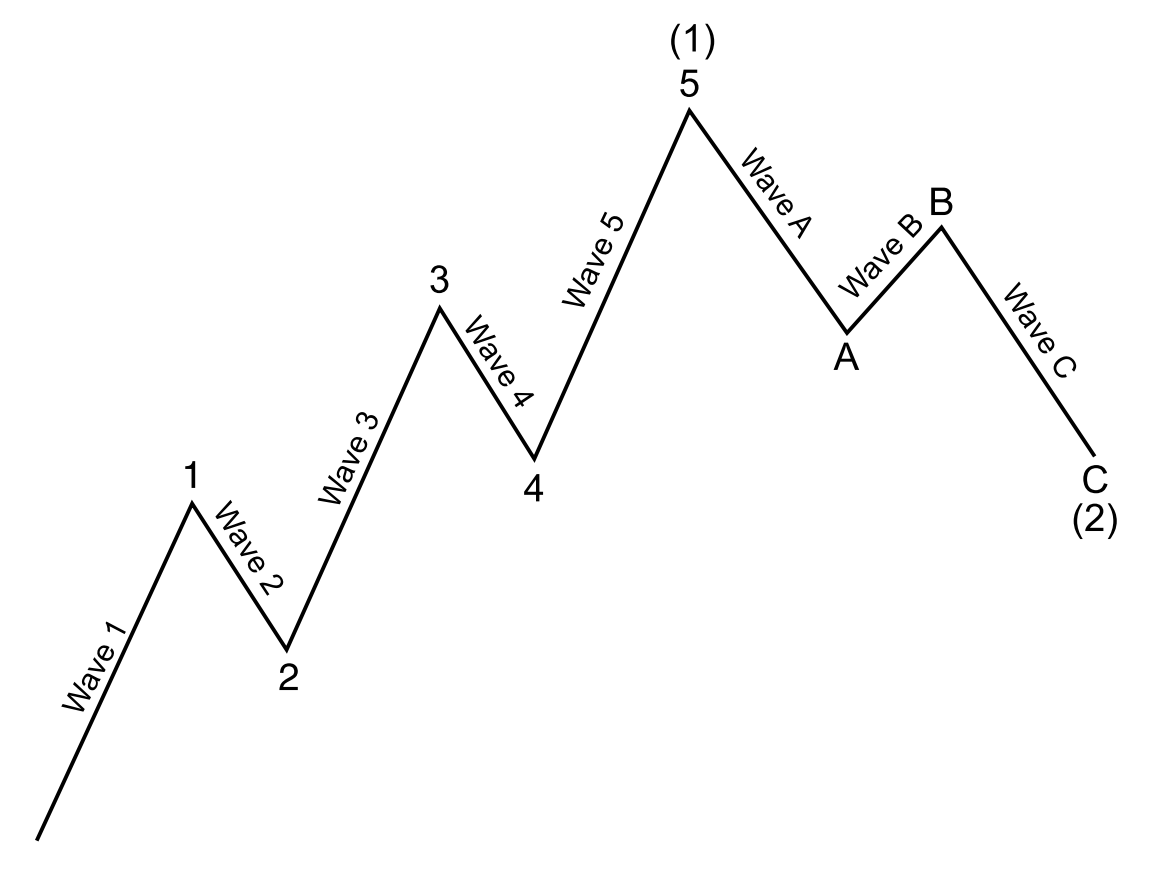

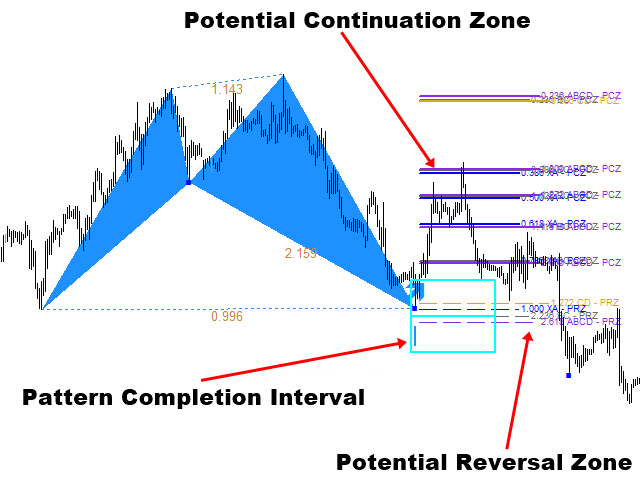

Identifying Order and Disorder in Chaotic Market with Elliott Wave

In this article, we will explain how to identify order and disorder in the chaotic market with Elliott Wave Analysis. As a trader, you will agree that scientific method can improve your profits. Whether you are using correlation, geometric patterns, or statistics, they are baesed on science. Even latency arbitrages are just a sort of computer science or engineering, one could dig deeper on how to fine-tune the algorithm, network and internet speed to beat others. If any trading strategy has persistent dynamics towards profitability, we can formulate or describe their working mechanism using known science and engineering principle. Hence, we can reproduce the same mechanism repeatedly for our trading. Most winning trading strategies are based on some sort of precise science and engineering. Profit will never come blindly or by just a chance.

Topic in this article is partly about chaos theory. As one knows, chaos theory as in nonlinear dynamics is a hard-core math topic. However, we will not touch the complex theory because this article is for average trader. The focus of this article is to provide some intuition over this hard science, chaos theory. Chaos theory reveals several characteristic for some dynamic system like stock or currency market. Here is the list of four important characteristics:

Highly sensitive to initial condition (i.e. Butterfly effect)

Feedback loop

Order/Disorder

Fractals (i.e. self-similarity)

Etc

Firstly, scientist often uses the term butterfly effect. This term describes the situation in which a butterfly flapping its wings in New Mexico cause a hurricane in China. A different way to express this is that small changes in the initial condition can lead to drastic changes in the results. We can meet full of similar examples in our life. One example of butterfly effect is that the rejection of an art application lead to World War Two. This is probably the most widely known butterfly effect. In 1905, Adolf Hitler applied to the Academy of Fine Arts in Vienna. He was rejected twice. After his rejection, he was forced to live in the slums of the city and his anti-Semitism grew. He joined the German Army instead of fulfilling his dreams as an artist. World would been changed a lot if Academy of Fine Arts accepted him.

You can read everything about Identifying Order and Disorder in Chaotic Market with Elliott Wave from this original article.

https://algotrading-investment.com/2018/10/29/identifying-order-and-disorder-in-chaotic-market-with-elliott-wave/

Finally, one might ask if they can go beyond 4 triangles like or 5 triangles or 8 triangles to calculate the density. From my empirical study, it is rare to see anything above 4 triangles. In this point, my empirical study and R. N. Elliott observation agrees. That is why Elliott comes up with Elliott Wave 12345 pattern and not Elliott Wave 12345678 pattern.

Final Note:

We hope this is useful for your profitable trading. Elliott Wave Trend has the following automatic features:

Detect the density of geometric patterns (identifying order and disorder of financial market.)

Automatic Elliott Wave Counting for trading.

Manual Elliott Wave Counting for trading.

Automatic Wave Structure Score calculation.

Here is the links to our Elliott Wave Trend for MetaTrader 4 and MetaTrader 5.

https://www.mql5.com/en/market/product/16479

https://www.mql5.com/en/market/product/16472

https://algotrading-investment.com/portfolio-item/elliott-wave-trend/

In this article, we will explain how to identify order and disorder in the chaotic market with Elliott Wave Analysis. As a trader, you will agree that scientific method can improve your profits. Whether you are using correlation, geometric patterns, or statistics, they are baesed on science. Even latency arbitrages are just a sort of computer science or engineering, one could dig deeper on how to fine-tune the algorithm, network and internet speed to beat others. If any trading strategy has persistent dynamics towards profitability, we can formulate or describe their working mechanism using known science and engineering principle. Hence, we can reproduce the same mechanism repeatedly for our trading. Most winning trading strategies are based on some sort of precise science and engineering. Profit will never come blindly or by just a chance.

Topic in this article is partly about chaos theory. As one knows, chaos theory as in nonlinear dynamics is a hard-core math topic. However, we will not touch the complex theory because this article is for average trader. The focus of this article is to provide some intuition over this hard science, chaos theory. Chaos theory reveals several characteristic for some dynamic system like stock or currency market. Here is the list of four important characteristics:

Highly sensitive to initial condition (i.e. Butterfly effect)

Feedback loop

Order/Disorder

Fractals (i.e. self-similarity)

Etc

Firstly, scientist often uses the term butterfly effect. This term describes the situation in which a butterfly flapping its wings in New Mexico cause a hurricane in China. A different way to express this is that small changes in the initial condition can lead to drastic changes in the results. We can meet full of similar examples in our life. One example of butterfly effect is that the rejection of an art application lead to World War Two. This is probably the most widely known butterfly effect. In 1905, Adolf Hitler applied to the Academy of Fine Arts in Vienna. He was rejected twice. After his rejection, he was forced to live in the slums of the city and his anti-Semitism grew. He joined the German Army instead of fulfilling his dreams as an artist. World would been changed a lot if Academy of Fine Arts accepted him.

You can read everything about Identifying Order and Disorder in Chaotic Market with Elliott Wave from this original article.

https://algotrading-investment.com/2018/10/29/identifying-order-and-disorder-in-chaotic-market-with-elliott-wave/

Finally, one might ask if they can go beyond 4 triangles like or 5 triangles or 8 triangles to calculate the density. From my empirical study, it is rare to see anything above 4 triangles. In this point, my empirical study and R. N. Elliott observation agrees. That is why Elliott comes up with Elliott Wave 12345 pattern and not Elliott Wave 12345678 pattern.

Final Note:

We hope this is useful for your profitable trading. Elliott Wave Trend has the following automatic features:

Detect the density of geometric patterns (identifying order and disorder of financial market.)

Automatic Elliott Wave Counting for trading.

Manual Elliott Wave Counting for trading.

Automatic Wave Structure Score calculation.

Here is the links to our Elliott Wave Trend for MetaTrader 4 and MetaTrader 5.

https://www.mql5.com/en/market/product/16479

https://www.mql5.com/en/market/product/16472

https://algotrading-investment.com/portfolio-item/elliott-wave-trend/

Young Ho Seo

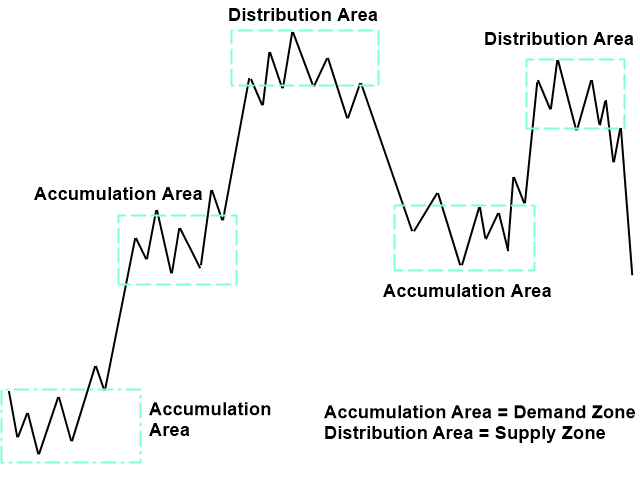

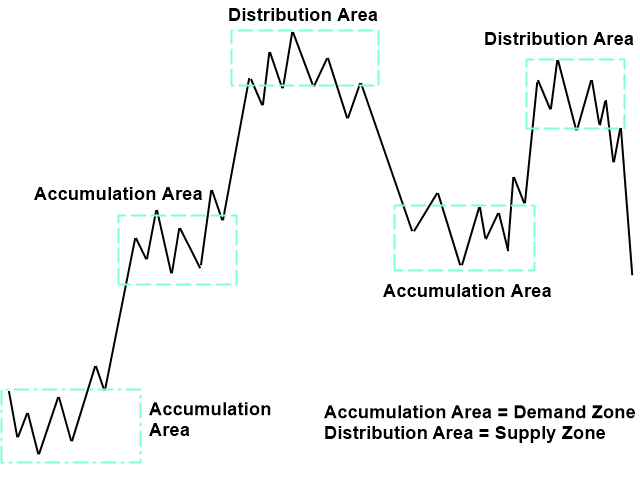

Introduction to Momentum Trading

Profitable Trading Idea

In this article, we will explain how to use Price Momentum in Forex and Stock trading. We will start it by sharing some idea behind the profitable trading strategy. First of all, trading is an applied science. The profit for day trader comes from the good discipline driven by fact and evidence. Likewise, the profit for any systematic trading is the fruits of the good market analysis driven by fundamental and technical knowledge. To access more profits as a trader, you will need an improved discipline and technological advancement together allowing you to see the predictable behavior of the financial market. Many traders will highly emphasize that the technology is the key to success. Many will agree that the good automated indicators and tools will provide the edge to the average trader. It is the growing trend in the modern electronic trading environment.

Then where the profit comes from ? Profit comes from the regular movement in the market. That is something we can analyze and can make use to predict the next movement of the financial market. These five regularities shown in the Figure 1 are typically what traders are looking to catch in their trading. We highly emphasize to look for or focus on the fifth regularity in your practical trading. The fifth regularity says that the price in the financial market will move in the zigzag path. Mathematically, this is described as fractal wave or repeating patterns. Fundamentally these happens to balance the supply and demand force.

Introduction to Excessive Momentum Trading

Excessive momentum is the technique to identify unusually strong supply or unusually strong demand by analyzing the price series. Why do we need to care about the unusually strong supply or unusually strong demand in our trading? It is because unusually strong supply or unusually strong demand are the sign of the end of the current trend ( or birth of new trend). As you probably guess, when the new trend is born, you can ride the highest profit as possible. Hence, the excessive momentum can provide you the attractive entries for your trading.

Now probably you are starting to make some sense. That is good. Your intuition will start to tell you that this excessive momentum can provide good trading opportunity. When the balance is broken marginally, we can consider it as the market anomaly. Two potential causes can drive the occurrences of Excessive momentum. Firstly, the excessive momentum could be caused by some irrational price reaction like the late comers buying stocks after the stock have gone up too much. Secondly, the excessive momentum could be caused by strong belief of the crowd that the price will continue to go in the same direction. Whichever scenario is driving the excessive momentum, it is where we can observe the crowd psychology clearly. Excessive momentum provides the good market timing. We will also confirm that with the volume spread analysis to make further sense with excessive momentum trading.

You can read everything about Momentum Trading from the original link below.

https://algotrading-investment.com/2018/10/29/introduction-to-momentum-trading/

Volume spread analysis and excessive momentum zone are not a rocket science although detection of excessive momentum requires the sophisticated algorithm. But we did a lot of work to provide you the automated tools for your trading. With the automated Excessive Momentum detection tool, you can easily detect the broken balance between supply and demand for your trading. With excessive momentum drawn in your chart, it is much easier to predict the timing of new trend and its direction.

Here is three important summary about the Excessive momentum, Accumulation and Distribution area.

1. Excessive momentum provides the important clue to detect accumulation and distribution area outlined by Wickoff Cycle. Other methodology of finding Accumulation and Distribution area is not as good as the Excessive momentum indicator.

2. Detected Accumulation and Distribution area can indicate the fresh price movement that will expand in full scale. This is often the best entry or exit for your trading with highest rewards and smallest risks.

3. Accumulation and distribution area do not come in alternating manner. It can come like accumulation – accumulation – distribution or distribution – distribution – distribution – accumulation. Hence, do not get confused it from the original Wickoff cycle screenshot.

Excessive Momentum Indicator can detect the final phase of the price momentum. This final phase of the price momentum usually provide the good place to identify the accumulation and distribution area in Volume Spread Analysis. At the same time, this final phase of the price momentum is a excellent place to identify the supply and demand unbalance in the market. Excessive Momentum Indicator is the excellent tool for the advanced momentum trading. Here is link to Excessive Momentum Indicator for MetaTrader 4 and MetaTrader 5.

https://algotrading-investment.com/portfolio-item/excessive-momentum-indicator/

https://www.mql5.com/en/market/product/30641

https://www.mql5.com/en/market/product/30621

Profitable Trading Idea

In this article, we will explain how to use Price Momentum in Forex and Stock trading. We will start it by sharing some idea behind the profitable trading strategy. First of all, trading is an applied science. The profit for day trader comes from the good discipline driven by fact and evidence. Likewise, the profit for any systematic trading is the fruits of the good market analysis driven by fundamental and technical knowledge. To access more profits as a trader, you will need an improved discipline and technological advancement together allowing you to see the predictable behavior of the financial market. Many traders will highly emphasize that the technology is the key to success. Many will agree that the good automated indicators and tools will provide the edge to the average trader. It is the growing trend in the modern electronic trading environment.

Then where the profit comes from ? Profit comes from the regular movement in the market. That is something we can analyze and can make use to predict the next movement of the financial market. These five regularities shown in the Figure 1 are typically what traders are looking to catch in their trading. We highly emphasize to look for or focus on the fifth regularity in your practical trading. The fifth regularity says that the price in the financial market will move in the zigzag path. Mathematically, this is described as fractal wave or repeating patterns. Fundamentally these happens to balance the supply and demand force.

Introduction to Excessive Momentum Trading

Excessive momentum is the technique to identify unusually strong supply or unusually strong demand by analyzing the price series. Why do we need to care about the unusually strong supply or unusually strong demand in our trading? It is because unusually strong supply or unusually strong demand are the sign of the end of the current trend ( or birth of new trend). As you probably guess, when the new trend is born, you can ride the highest profit as possible. Hence, the excessive momentum can provide you the attractive entries for your trading.

Now probably you are starting to make some sense. That is good. Your intuition will start to tell you that this excessive momentum can provide good trading opportunity. When the balance is broken marginally, we can consider it as the market anomaly. Two potential causes can drive the occurrences of Excessive momentum. Firstly, the excessive momentum could be caused by some irrational price reaction like the late comers buying stocks after the stock have gone up too much. Secondly, the excessive momentum could be caused by strong belief of the crowd that the price will continue to go in the same direction. Whichever scenario is driving the excessive momentum, it is where we can observe the crowd psychology clearly. Excessive momentum provides the good market timing. We will also confirm that with the volume spread analysis to make further sense with excessive momentum trading.

You can read everything about Momentum Trading from the original link below.

https://algotrading-investment.com/2018/10/29/introduction-to-momentum-trading/

Volume spread analysis and excessive momentum zone are not a rocket science although detection of excessive momentum requires the sophisticated algorithm. But we did a lot of work to provide you the automated tools for your trading. With the automated Excessive Momentum detection tool, you can easily detect the broken balance between supply and demand for your trading. With excessive momentum drawn in your chart, it is much easier to predict the timing of new trend and its direction.

Here is three important summary about the Excessive momentum, Accumulation and Distribution area.

1. Excessive momentum provides the important clue to detect accumulation and distribution area outlined by Wickoff Cycle. Other methodology of finding Accumulation and Distribution area is not as good as the Excessive momentum indicator.

2. Detected Accumulation and Distribution area can indicate the fresh price movement that will expand in full scale. This is often the best entry or exit for your trading with highest rewards and smallest risks.

3. Accumulation and distribution area do not come in alternating manner. It can come like accumulation – accumulation – distribution or distribution – distribution – distribution – accumulation. Hence, do not get confused it from the original Wickoff cycle screenshot.

Excessive Momentum Indicator can detect the final phase of the price momentum. This final phase of the price momentum usually provide the good place to identify the accumulation and distribution area in Volume Spread Analysis. At the same time, this final phase of the price momentum is a excellent place to identify the supply and demand unbalance in the market. Excessive Momentum Indicator is the excellent tool for the advanced momentum trading. Here is link to Excessive Momentum Indicator for MetaTrader 4 and MetaTrader 5.

https://algotrading-investment.com/portfolio-item/excessive-momentum-indicator/

https://www.mql5.com/en/market/product/30641

https://www.mql5.com/en/market/product/30621

Young Ho Seo

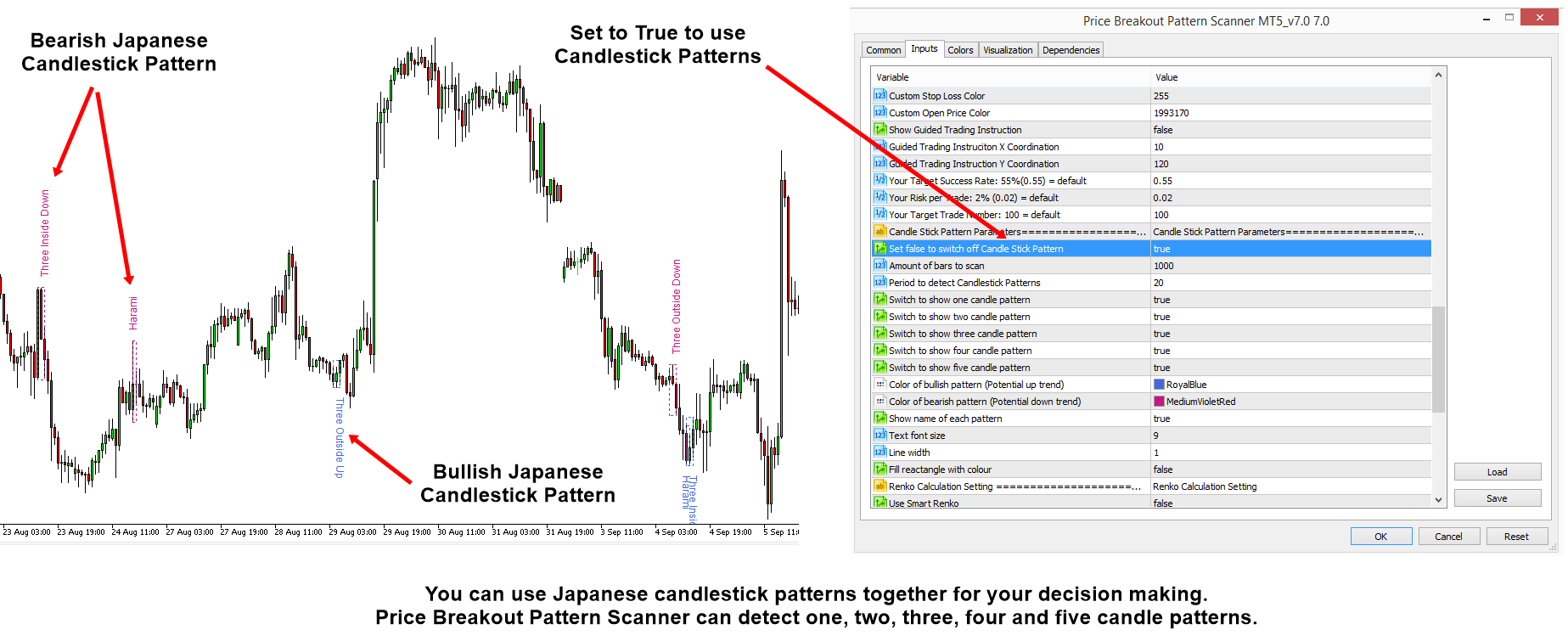

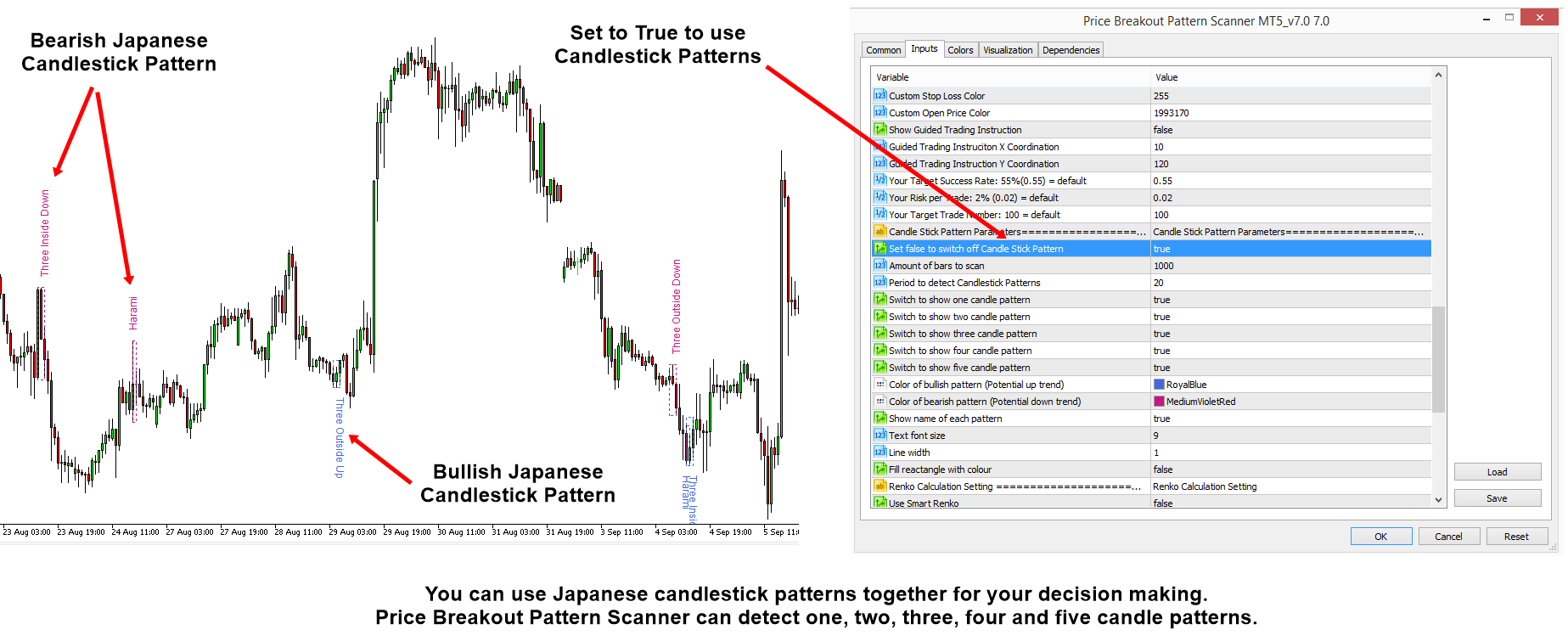

Japanese candlestick patterns with Price Breakout Pattern Scanner

Price Breakout Pattern Scanner can detect the important chart patterns like Triangle, Rising Wedge, Falling Wedge Pattern and so on. In addition, Price Breakout Pattern Scanner detects the Japanese candlestick patterns. Price Breakout Pattern Scanner can detect 52 different Japanese candlestick patterns. Properly used these provided chart patterns and Japanese Candlestick patterns, they can yield excellent trading results.

Japanese Candlestick patterns are categorized under five categories including one, two, three, four and five candlestick patterns. To use Japanese candlestick patterns, you can enable the candlestick pattern from Price Breakout Pattern Scanner input. See the attached screenshot for the purpose. If you wish, you can switch on and off the individual category of patterns according to your preferences. For example, you can only use two and three candlestick patterns if you wish. Japanese candlestick patterns are the supplementary tools when you trade with the chart patterns like Triangle, Rising Wedge, Falling Wedge Patterns. For example, you can use the Japanese candletick patterns as the secondary confirmation when you decide the trading direction of the chart patterns.

You can also receive sound alert, email and push notification when new Japanese candlestick patterns are detected. Here are the links to Price Breakout Pattern Scanner available in MetaTrader 4 and MetaTrader 5.

https://www.mql5.com/en/market/product/4859

https://www.mql5.com/en/market/product/4858

https://algotrading-investment.com/portfolio-item/price-breakout-pattern-scanner/

When you do not know how to use the chart patterns like Triangle, Falling Wedge, Rising Wedge Patterns, the quickest way to learn how to use them is to think them as the diasognal support and resistance. We have a lot of trading education to teach you how to trade with Triangle, Falling Wedge Pattern and Rising Wedge Pattern, Head and shoulder pattern and so on in our website. Below is the link to the Free Trading Education for Forex and Stock trading.

https://algotrading-investment.com/2019/07/23/trading-education/

Price Breakout Pattern Scanner can detect the important chart patterns like Triangle, Rising Wedge, Falling Wedge Pattern and so on. In addition, Price Breakout Pattern Scanner detects the Japanese candlestick patterns. Price Breakout Pattern Scanner can detect 52 different Japanese candlestick patterns. Properly used these provided chart patterns and Japanese Candlestick patterns, they can yield excellent trading results.

Japanese Candlestick patterns are categorized under five categories including one, two, three, four and five candlestick patterns. To use Japanese candlestick patterns, you can enable the candlestick pattern from Price Breakout Pattern Scanner input. See the attached screenshot for the purpose. If you wish, you can switch on and off the individual category of patterns according to your preferences. For example, you can only use two and three candlestick patterns if you wish. Japanese candlestick patterns are the supplementary tools when you trade with the chart patterns like Triangle, Rising Wedge, Falling Wedge Patterns. For example, you can use the Japanese candletick patterns as the secondary confirmation when you decide the trading direction of the chart patterns.

You can also receive sound alert, email and push notification when new Japanese candlestick patterns are detected. Here are the links to Price Breakout Pattern Scanner available in MetaTrader 4 and MetaTrader 5.

https://www.mql5.com/en/market/product/4859

https://www.mql5.com/en/market/product/4858

https://algotrading-investment.com/portfolio-item/price-breakout-pattern-scanner/

When you do not know how to use the chart patterns like Triangle, Falling Wedge, Rising Wedge Patterns, the quickest way to learn how to use them is to think them as the diasognal support and resistance. We have a lot of trading education to teach you how to trade with Triangle, Falling Wedge Pattern and Rising Wedge Pattern, Head and shoulder pattern and so on in our website. Below is the link to the Free Trading Education for Forex and Stock trading.

https://algotrading-investment.com/2019/07/23/trading-education/

Young Ho Seo

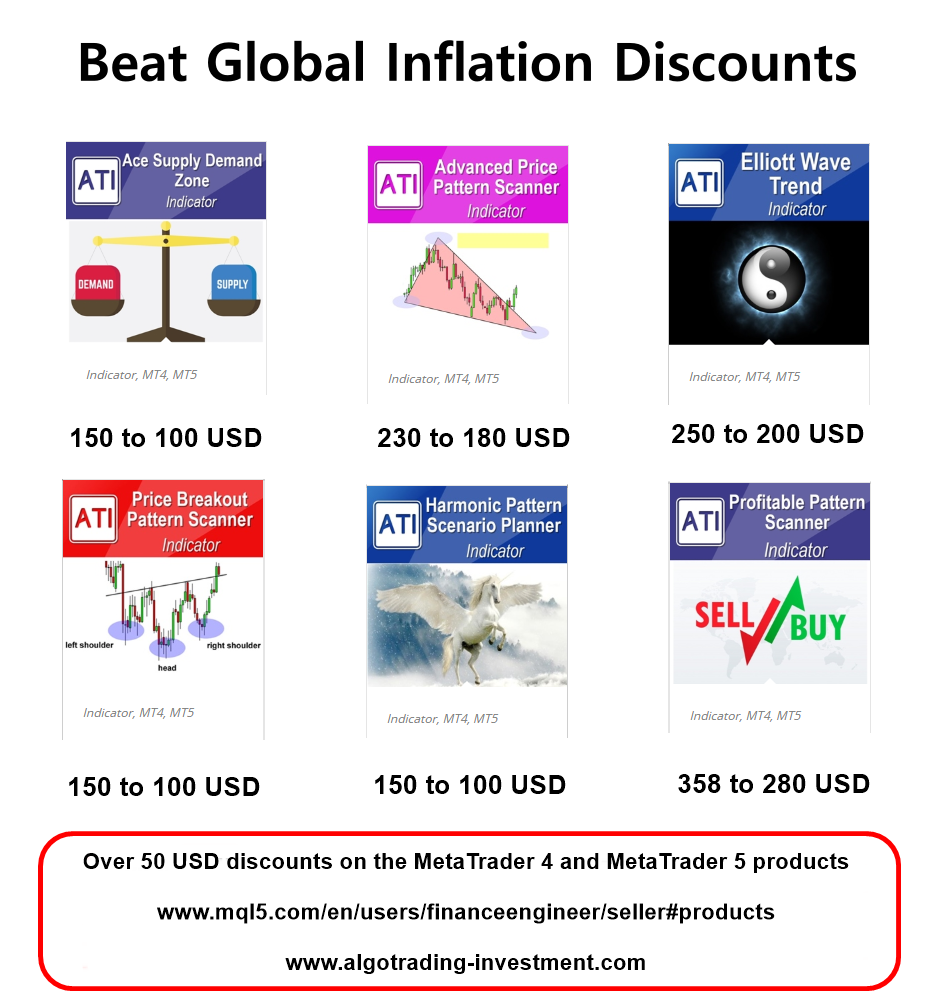

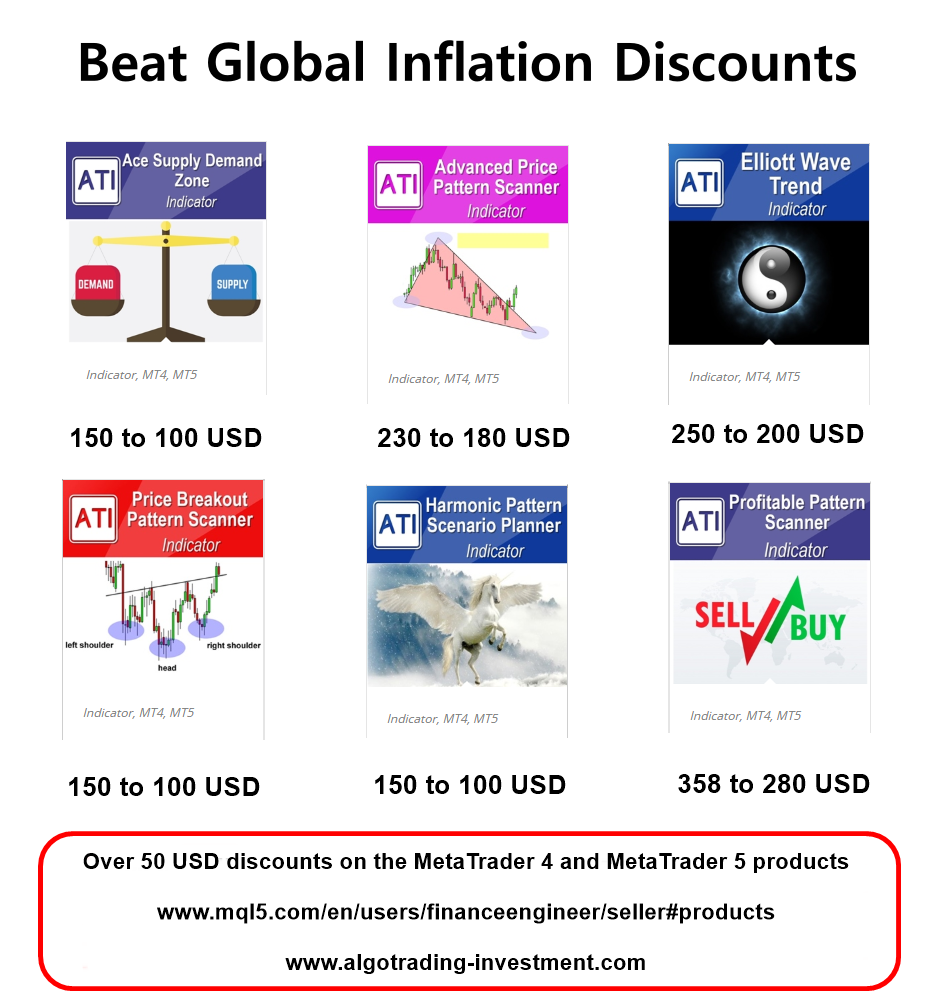

Beat Inflation Together Discounts for MetaTrader Indicator

Global Inflation, what now? We thought that we will enjoy some recovery from the COVID 19 crisis. However, soon there was a war. This affect the global economy increasing the uncertainity, inflation, and interest rate. This is not nice. Everything on the street are getting more and more expensive including energy, food, cloth, house and so on. We really deserve some good time after the two years of suffering from the Covid 19.

We know this global inflation affect the whole world. Hence, we provide 50 USD discounts on the six MetaTrader 4 and six MetaTrader 5 products. So we provide special discounts for 12 MetaTrader products all together.

Discounted price is shown in the screenshot for the following six products.

Ace Supply Demand Zone indicator

Advanced Price Pattern Scanner

Elliott Wave Trend

Price Breakout Pattern Scanner

Harmonic Pattern Scenario Planner

X3 Chart Pattern Scanner (=Profitable Pattern Scanner)

This discounted price is only available when you buy these products from mql5.com

The price will go back to the original price when the discounts ends. Please take the discounted price now while it last only.

https://www.mql5.com/en/users/financeengineer/seller#products

https://www.algotrading-investment.com/

On top of the special discounts for MetaTrader 4 and MetaTrader 5 products, we have another gift for you.

We are selling all our Books in special discount price. All our books are currently selling in just 3 dollar at the discount. The original price was 9.99 dollar for each book. Hence, you save 6 dollar per a book. We will keep this discounted price for these books until this campaign lasts. Get them now when they are cheap. Get the good self education towards the day trading and technical analysis to achieve financial freedom.

Below we provide the title of the books at the discounted price.

Science Of Support, Resistance, Fibonacci Analysis, Harmonic Pattern, Elliott Wave and X3 Chart Pattern (In Forex and Stock Market Trading)

Profitable Chart Patterns in Forex and Stock Market (Fibonacci Analysis, Harmonic Pattern, Elliott Wave, and X3 Chart Pattern)

Guide to Precision Harmonic Pattern Trading (Mastering Turning Point Strategy for Financial Trading)

Scientific Guide to Price Action and Pattern Trading (Wisdom of Trend, Cycle, and Fractal Wave)

Predicting Forex and Stock Market with Fractal Pattern: Science of Price and Time

Technical Analysis in Forex and Stock Market (Supply Demand Analysis and Support Resistance)

Below we provide the link of the Books at the discounted price.

https://algotrading-investment.com/portfolio-item/science-of-support-resistance-fibonacci-analysis-harmonic-pattern/

https://algotrading-investment.com/portfolio-item/profitable-chart-patterns-in-forex-and-stock-market/

https://algotrading-investment.com/portfolio-item/guide-precision-harmonic-pattern-trading/

https://algotrading-investment.com/portfolio-item/scientific-guide-to-price-action-and-pattern-trading/

https://algotrading-investment.com/portfolio-item/predicting-forex-and-stock-market-with-fractal-pattern/

https://algotrading-investment.com/portfolio-item/technical-analysis-in-forex-and-stock-market/

Global Inflation, what now? We thought that we will enjoy some recovery from the COVID 19 crisis. However, soon there was a war. This affect the global economy increasing the uncertainity, inflation, and interest rate. This is not nice. Everything on the street are getting more and more expensive including energy, food, cloth, house and so on. We really deserve some good time after the two years of suffering from the Covid 19.

We know this global inflation affect the whole world. Hence, we provide 50 USD discounts on the six MetaTrader 4 and six MetaTrader 5 products. So we provide special discounts for 12 MetaTrader products all together.

Discounted price is shown in the screenshot for the following six products.

Ace Supply Demand Zone indicator

Advanced Price Pattern Scanner

Elliott Wave Trend

Price Breakout Pattern Scanner

Harmonic Pattern Scenario Planner

X3 Chart Pattern Scanner (=Profitable Pattern Scanner)

This discounted price is only available when you buy these products from mql5.com

The price will go back to the original price when the discounts ends. Please take the discounted price now while it last only.

https://www.mql5.com/en/users/financeengineer/seller#products

https://www.algotrading-investment.com/

On top of the special discounts for MetaTrader 4 and MetaTrader 5 products, we have another gift for you.

We are selling all our Books in special discount price. All our books are currently selling in just 3 dollar at the discount. The original price was 9.99 dollar for each book. Hence, you save 6 dollar per a book. We will keep this discounted price for these books until this campaign lasts. Get them now when they are cheap. Get the good self education towards the day trading and technical analysis to achieve financial freedom.

Below we provide the title of the books at the discounted price.

Science Of Support, Resistance, Fibonacci Analysis, Harmonic Pattern, Elliott Wave and X3 Chart Pattern (In Forex and Stock Market Trading)

Profitable Chart Patterns in Forex and Stock Market (Fibonacci Analysis, Harmonic Pattern, Elliott Wave, and X3 Chart Pattern)

Guide to Precision Harmonic Pattern Trading (Mastering Turning Point Strategy for Financial Trading)

Scientific Guide to Price Action and Pattern Trading (Wisdom of Trend, Cycle, and Fractal Wave)

Predicting Forex and Stock Market with Fractal Pattern: Science of Price and Time

Technical Analysis in Forex and Stock Market (Supply Demand Analysis and Support Resistance)

Below we provide the link of the Books at the discounted price.

https://algotrading-investment.com/portfolio-item/science-of-support-resistance-fibonacci-analysis-harmonic-pattern/

https://algotrading-investment.com/portfolio-item/profitable-chart-patterns-in-forex-and-stock-market/

https://algotrading-investment.com/portfolio-item/guide-precision-harmonic-pattern-trading/

https://algotrading-investment.com/portfolio-item/scientific-guide-to-price-action-and-pattern-trading/

https://algotrading-investment.com/portfolio-item/predicting-forex-and-stock-market-with-fractal-pattern/

https://algotrading-investment.com/portfolio-item/technical-analysis-in-forex-and-stock-market/

Young Ho Seo

How Elliott Wave can Improve Your Trading Performance

In this article, we provide some guide to improve trading performance with Elliott Wave Analysis and Elliott Wave Counting. Elliott Wave is sophisticated. This sophistication makes it difficult to judge the trading performance of Elliott Wave in practice. Purely looking at the trading performance, Elliott Wave can introduce some subjectivity. It is true. However, many trader might agree that Elliott Wave can become a powerful tool when we can reduce or get rid of the subjectivity. The fact is that there are many seasoned traders using Elliott Wave successfully in practice. Some of them are high profile traders at the fund management level.

We have already suggested the way to reduce the subjectivity with Elliott Wave counting through the book and some other articles using the “template and pattern approach”.

Scientific Guide to Price Action and Pattern Trading (Wisdom of Trend, Cycle, and Fractal Wave)

Introduction on the Elliott Wave Trend with Wave Structural Score

The essence in the “Template and Pattern Approach” to count Elliott Wave is:

Building up wave counting using template (or patterns) first