Young Ho Seo / Profilo

- Informazioni

|

10+ anni

esperienza

|

62

prodotti

|

1182

versioni demo

|

|

4

lavori

|

0

segnali

|

0

iscritti

|

Harmonic Pattern Indicator - Repainting + Japanese Candlestick Pattern Scanner + Automatic Channel + Many more

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

Non Repainting and Non Lagging Harmonic Pattern Indicator – Customizable Harmonic + Japanese Candlestic Pattern Scanner + Advanced Channel + Many more

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

Supply Demand Indicator – Multiple Timeframe Scanning Added + Non Repainting + Professional Indicator

https://www.mql5.com/en/market/product/40076

https://www.mql5.com/en/market/product/40075

https://algotrading-investment.com/portfolio-item/ace-supply-demand-zone/

Momentum Indicator – Path to Volume Spread Analysis

https://www.mql5.com/en/market/product/30641

https://www.mql5.com/en/market/product/30621

https://algotrading-investment.com/portfolio-item/excessive-momentum-indicator/

Elliott Wave Indicator for the Power User

https://www.mql5.com/en/market/product/16479

https://www.mql5.com/en/market/product/16472

https://algotrading-investment.com/portfolio-item/elliott-wave-trend/

Forex Prediction - Turn Support and Resistance to the Advanced Strategy

https://www.mql5.com/en/market/product/49170

https://www.mql5.com/en/market/product/49169

https://algotrading-investment.com/portfolio-item/fractal-pattern-scanner/

MetaTrader 4 and MetaTrader 5 Product Page: https://www.mql5.com/en/users/financeengineer/seller#products

Free Forex Prediction with Fibonacci Analysis: https://algotrading-investment.com/2020/10/23/forex-prediction-with-fibonacci-analysis/

Free Harmonic Pattern Signal: https://algotrading-investment.com/2020/12/17/harmonic-pattern-signal-for-forex-market/

============================================================================================================================

Here are the trading education books. We recommend reading these books if you are a trader or investor in Forex and Stock market. In the list below, we put the easy to read book on top. Try to read the easy to read book first and try to read the harder book later to improve your trading and investment.

First Link = amazon.com, Second Link = Google Play Books, Third Link = algotrading-investment.com, Fourth Link = Google Books

Technical Analysis in Forex and Stock Market (Supply Demand Analysis and Support Resistance)

https://www.amazon.com/dp/B09L55ZK4Z

https://play.google.com/store/books/details?id=pHlMEAAAQBAJ

https://algotrading-investment.com/portfolio-item/technical-analysis-in-forex-and-stock-market/

https://books.google.co.kr/books/about?id=pHlMEAAAQBAJ

Science Of Support, Resistance, Fibonacci Analysis, Harmonic Pattern, Elliott Wave and X3 Chart Pattern (In Forex and Stock Market Trading)

https://www.amazon.com/dp/B0993WZGZD

https://play.google.com/store/books/details?id=MME3EAAAQBAJ

https://algotrading-investment.com/portfolio-item/science-of-support-resistance-fibonacci-analysis-harmonic-pattern/

https://books.google.co.kr/books/about?id=MME3EAAAQBAJ

Profitable Chart Patterns in Forex and Stock Market (Fibonacci Analysis, Harmonic Pattern, Elliott Wave, and X3 Chart Pattern)

https://www.amazon.com/dp/B0B2KZH87K

https://play.google.com/store/books/details?id=7KrQDwAAQBAJ

https://algotrading-investment.com/portfolio-item/profitable-chart-patterns-in-forex-and-stock-market/

https://books.google.com/books/about?id=7KrQDwAAQBAJ

Guide to Precision Harmonic Pattern Trading (Mastering Turning Point Strategy for Financial Trading)

https://www.amazon.com/dp/B01MRI5LY6

https://play.google.com/store/books/details?id=8SbMDwAAQBAJ

http://algotrading-investment.com/portfolio-item/guide-precision-harmonic-pattern-trading/

https://books.google.com/books/about?id=8SbMDwAAQBAJ

Scientific Guide to Price Action and Pattern Trading (Wisdom of Trend, Cycle, and Fractal Wave)

https://www.amazon.com/dp/B073T3ZMBR

https://play.google.com/store/books/details?id=5prUDwAAQBAJ

https://algotrading-investment.com/portfolio-item/scientific-guide-to-price-action-and-pattern-trading/

https://books.google.com/books/about?id=5prUDwAAQBAJ

Predicting Forex and Stock Market with Fractal Pattern: Science of Price and Time

https://www.amazon.com/dp/B086YKM8BW

https://play.google.com/store/books/details?id=VJjiDwAAQBAJ

https://algotrading-investment.com/portfolio-item/predicting-forex-and-stock-market-with-fractal-pattern/

https://books.google.com/books/about?id=VJjiDwAAQBAJ

Trading Education Book 1 in Korean (Apple, Google Play Book, Google Book, Scribd, Kobo)

https://books.apple.com/us/book/id1565534211

https://play.google.com/store/books/details?id=HTgqEAAAQBAJ

https://books.google.co.kr/books/about?id=HTgqEAAAQBAJ

https://www.scribd.com/book/505583892

https://www.kobo.com/ww/en/ebook/8J-Eg58EDzKwlpUmADdp2g

Trading Education Book 2 in Korean (Apple, Google Play Book, Google Book, Scribd, Kobo)

https://books.apple.com/us/book/id1597112108

https://play.google.com/store/books/details?id=shRQEAAAQBAJ

https://books.google.co.kr/books/about?id=shRQEAAAQBAJ

https://www.scribd.com/book/542068528

https://www.kobo.com/ww/en/ebook/X8SmJdYCtDasOfQ1LQpCtg

About Young Ho Seo

Young Ho Seo is an Engineer, Financial Trader, and Quantitative Developer, working on Trading Science and Investment Engineering since 2011. He is the creator of many technical indicators, price patterns and trading strategies used in the financial market. He is also teaching the trading practice on how to use the Supply Demand Analysis, Support, Resistance, Trend line, Fibonacci Analysis, Harmonic Pattern, Elliott Wave Theory, Chart Patterns, and Probability for Forex and Stock Market. His works include developing scientific trading principle and mathematical algorithm in the work of Benjamin Graham, Everette S. Gardner, Benoit Mandelbrot, Ralph Nelson Elliott, Harold M. Gartley, Richard Shabacker, William Delbert Gann, Richard Wyckoff and Richard Dennis. You can find his dedicated works on www.algotrading-investment.com . His life mission is to connect financial traders and scientific community for better understanding of this world and crowd behaviour in the financial market. He wrote many books and articles, which are helpful for understanding the technology and application behind technical analysis, statistics, time series forecasting, fractal science, econometrics, and artificial intelligence in the financial market.

If you are interested in our software and training, just visit our main website: www.algotrading-investment.com

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

Non Repainting and Non Lagging Harmonic Pattern Indicator – Customizable Harmonic + Japanese Candlestic Pattern Scanner + Advanced Channel + Many more

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

Supply Demand Indicator – Multiple Timeframe Scanning Added + Non Repainting + Professional Indicator

https://www.mql5.com/en/market/product/40076

https://www.mql5.com/en/market/product/40075

https://algotrading-investment.com/portfolio-item/ace-supply-demand-zone/

Momentum Indicator – Path to Volume Spread Analysis

https://www.mql5.com/en/market/product/30641

https://www.mql5.com/en/market/product/30621

https://algotrading-investment.com/portfolio-item/excessive-momentum-indicator/

Elliott Wave Indicator for the Power User

https://www.mql5.com/en/market/product/16479

https://www.mql5.com/en/market/product/16472

https://algotrading-investment.com/portfolio-item/elliott-wave-trend/

Forex Prediction - Turn Support and Resistance to the Advanced Strategy

https://www.mql5.com/en/market/product/49170

https://www.mql5.com/en/market/product/49169

https://algotrading-investment.com/portfolio-item/fractal-pattern-scanner/

MetaTrader 4 and MetaTrader 5 Product Page: https://www.mql5.com/en/users/financeengineer/seller#products

Free Forex Prediction with Fibonacci Analysis: https://algotrading-investment.com/2020/10/23/forex-prediction-with-fibonacci-analysis/

Free Harmonic Pattern Signal: https://algotrading-investment.com/2020/12/17/harmonic-pattern-signal-for-forex-market/

============================================================================================================================

Here are the trading education books. We recommend reading these books if you are a trader or investor in Forex and Stock market. In the list below, we put the easy to read book on top. Try to read the easy to read book first and try to read the harder book later to improve your trading and investment.

First Link = amazon.com, Second Link = Google Play Books, Third Link = algotrading-investment.com, Fourth Link = Google Books

Technical Analysis in Forex and Stock Market (Supply Demand Analysis and Support Resistance)

https://www.amazon.com/dp/B09L55ZK4Z

https://play.google.com/store/books/details?id=pHlMEAAAQBAJ

https://algotrading-investment.com/portfolio-item/technical-analysis-in-forex-and-stock-market/

https://books.google.co.kr/books/about?id=pHlMEAAAQBAJ

Science Of Support, Resistance, Fibonacci Analysis, Harmonic Pattern, Elliott Wave and X3 Chart Pattern (In Forex and Stock Market Trading)

https://www.amazon.com/dp/B0993WZGZD

https://play.google.com/store/books/details?id=MME3EAAAQBAJ

https://algotrading-investment.com/portfolio-item/science-of-support-resistance-fibonacci-analysis-harmonic-pattern/

https://books.google.co.kr/books/about?id=MME3EAAAQBAJ

Profitable Chart Patterns in Forex and Stock Market (Fibonacci Analysis, Harmonic Pattern, Elliott Wave, and X3 Chart Pattern)

https://www.amazon.com/dp/B0B2KZH87K

https://play.google.com/store/books/details?id=7KrQDwAAQBAJ

https://algotrading-investment.com/portfolio-item/profitable-chart-patterns-in-forex-and-stock-market/

https://books.google.com/books/about?id=7KrQDwAAQBAJ

Guide to Precision Harmonic Pattern Trading (Mastering Turning Point Strategy for Financial Trading)

https://www.amazon.com/dp/B01MRI5LY6

https://play.google.com/store/books/details?id=8SbMDwAAQBAJ

http://algotrading-investment.com/portfolio-item/guide-precision-harmonic-pattern-trading/

https://books.google.com/books/about?id=8SbMDwAAQBAJ

Scientific Guide to Price Action and Pattern Trading (Wisdom of Trend, Cycle, and Fractal Wave)

https://www.amazon.com/dp/B073T3ZMBR

https://play.google.com/store/books/details?id=5prUDwAAQBAJ

https://algotrading-investment.com/portfolio-item/scientific-guide-to-price-action-and-pattern-trading/

https://books.google.com/books/about?id=5prUDwAAQBAJ

Predicting Forex and Stock Market with Fractal Pattern: Science of Price and Time

https://www.amazon.com/dp/B086YKM8BW

https://play.google.com/store/books/details?id=VJjiDwAAQBAJ

https://algotrading-investment.com/portfolio-item/predicting-forex-and-stock-market-with-fractal-pattern/

https://books.google.com/books/about?id=VJjiDwAAQBAJ

Trading Education Book 1 in Korean (Apple, Google Play Book, Google Book, Scribd, Kobo)

https://books.apple.com/us/book/id1565534211

https://play.google.com/store/books/details?id=HTgqEAAAQBAJ

https://books.google.co.kr/books/about?id=HTgqEAAAQBAJ

https://www.scribd.com/book/505583892

https://www.kobo.com/ww/en/ebook/8J-Eg58EDzKwlpUmADdp2g

Trading Education Book 2 in Korean (Apple, Google Play Book, Google Book, Scribd, Kobo)

https://books.apple.com/us/book/id1597112108

https://play.google.com/store/books/details?id=shRQEAAAQBAJ

https://books.google.co.kr/books/about?id=shRQEAAAQBAJ

https://www.scribd.com/book/542068528

https://www.kobo.com/ww/en/ebook/X8SmJdYCtDasOfQ1LQpCtg

About Young Ho Seo

Young Ho Seo is an Engineer, Financial Trader, and Quantitative Developer, working on Trading Science and Investment Engineering since 2011. He is the creator of many technical indicators, price patterns and trading strategies used in the financial market. He is also teaching the trading practice on how to use the Supply Demand Analysis, Support, Resistance, Trend line, Fibonacci Analysis, Harmonic Pattern, Elliott Wave Theory, Chart Patterns, and Probability for Forex and Stock Market. His works include developing scientific trading principle and mathematical algorithm in the work of Benjamin Graham, Everette S. Gardner, Benoit Mandelbrot, Ralph Nelson Elliott, Harold M. Gartley, Richard Shabacker, William Delbert Gann, Richard Wyckoff and Richard Dennis. You can find his dedicated works on www.algotrading-investment.com . His life mission is to connect financial traders and scientific community for better understanding of this world and crowd behaviour in the financial market. He wrote many books and articles, which are helpful for understanding the technology and application behind technical analysis, statistics, time series forecasting, fractal science, econometrics, and artificial intelligence in the financial market.

If you are interested in our software and training, just visit our main website: www.algotrading-investment.com

Young Ho Seo

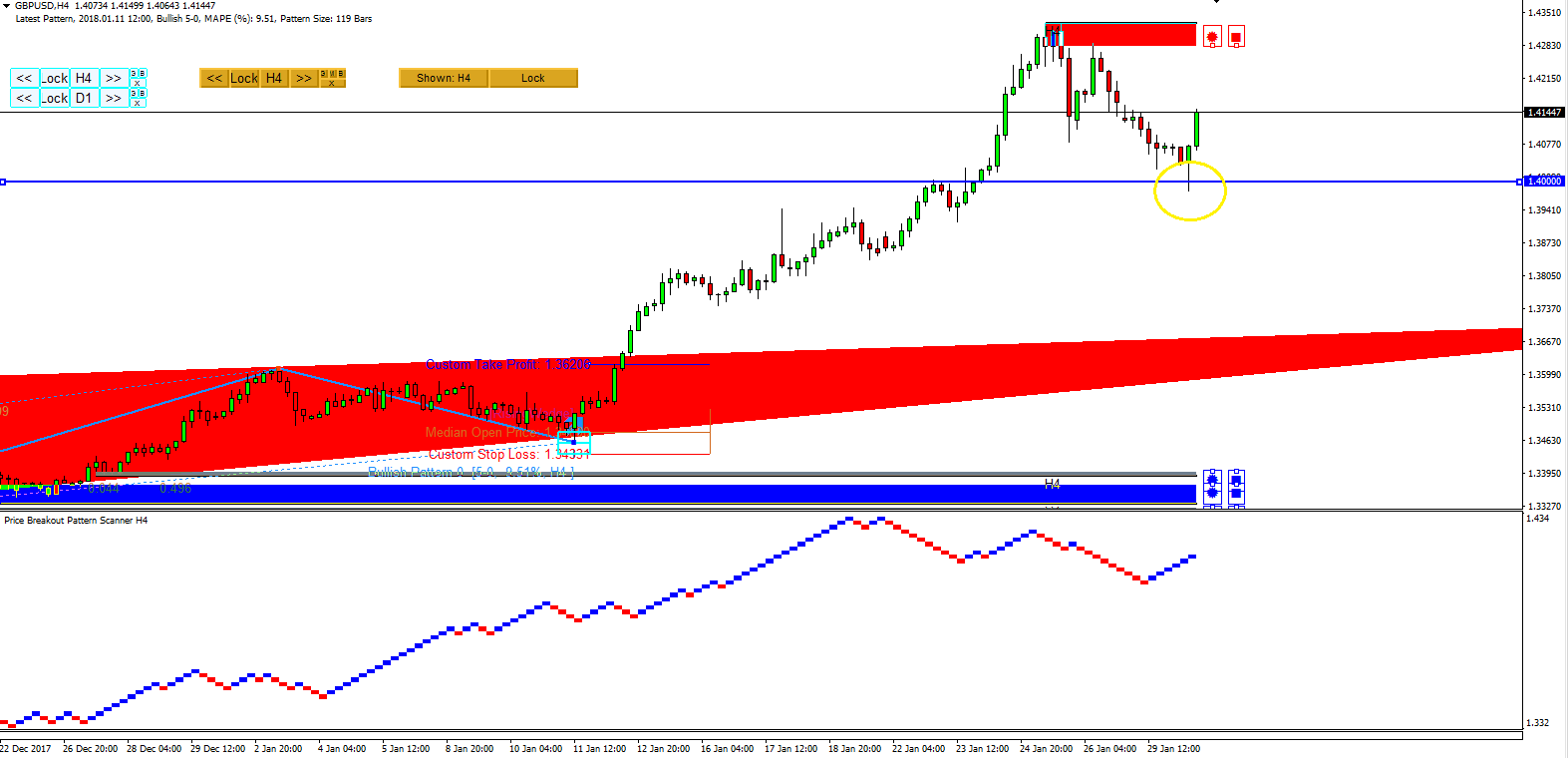

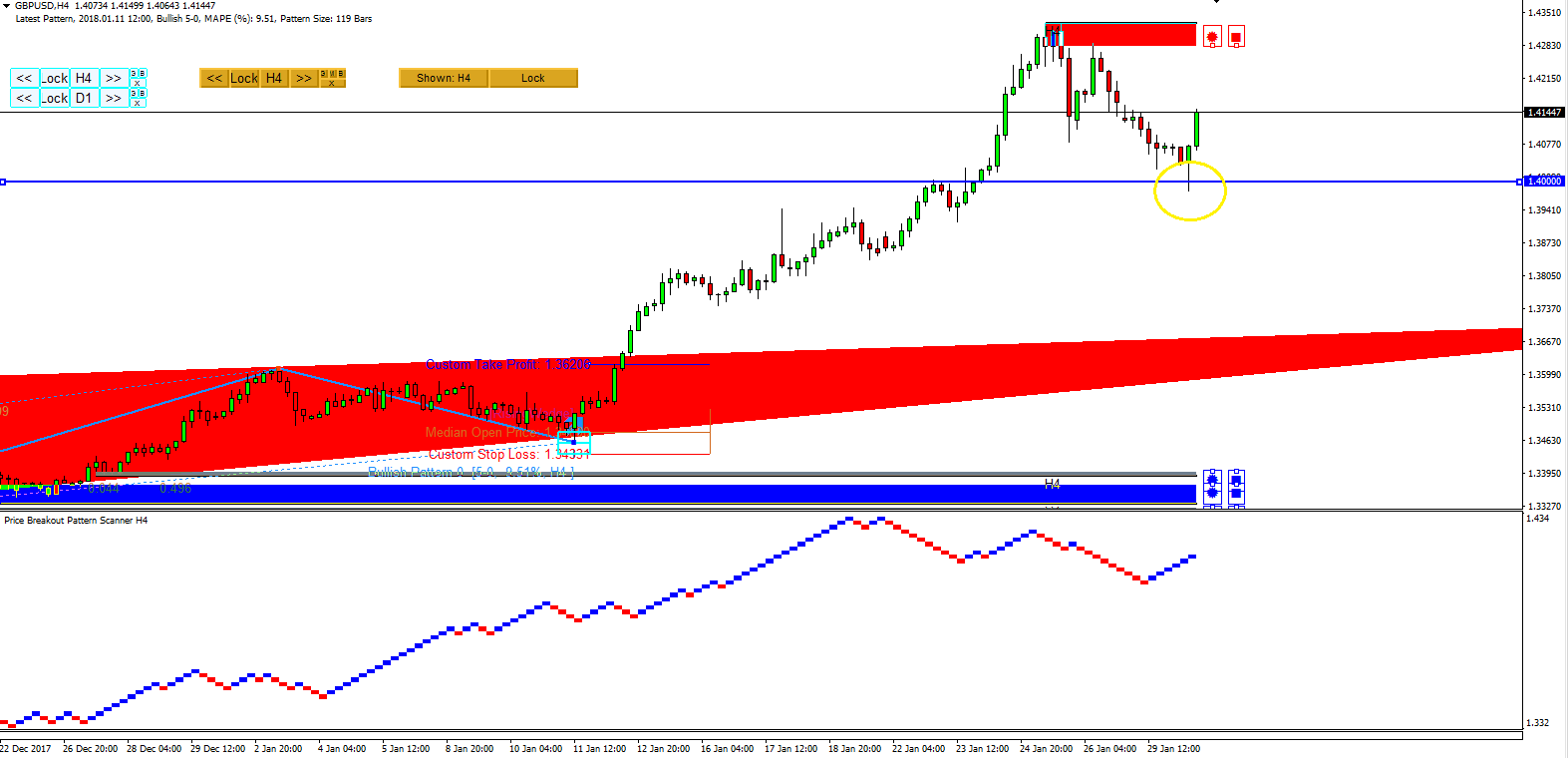

GBPUSD Market Outlook 30 Jan 2018

In our last analysis on GBPUSD, we have recommended to watch out 1.4000 level for GBPUSD. Ok, it did not take long to see the action. Indeed, GBPUSD have a reversal around 1.4000 level. Currently GBPUSD is up by around 60 pips. Around 1.4200, we could have another resistance before the supply zone. However, this resistance can be slight lower than 1.4200 like 1.4180 or something. After that we have a supply zone to watch out.

http://algotrading-investment.com/

https://www.mql5.com/en/users/financeengineer/seller#products

In our last analysis on GBPUSD, we have recommended to watch out 1.4000 level for GBPUSD. Ok, it did not take long to see the action. Indeed, GBPUSD have a reversal around 1.4000 level. Currently GBPUSD is up by around 60 pips. Around 1.4200, we could have another resistance before the supply zone. However, this resistance can be slight lower than 1.4200 like 1.4180 or something. After that we have a supply zone to watch out.

http://algotrading-investment.com/

https://www.mql5.com/en/users/financeengineer/seller#products

Young Ho Seo

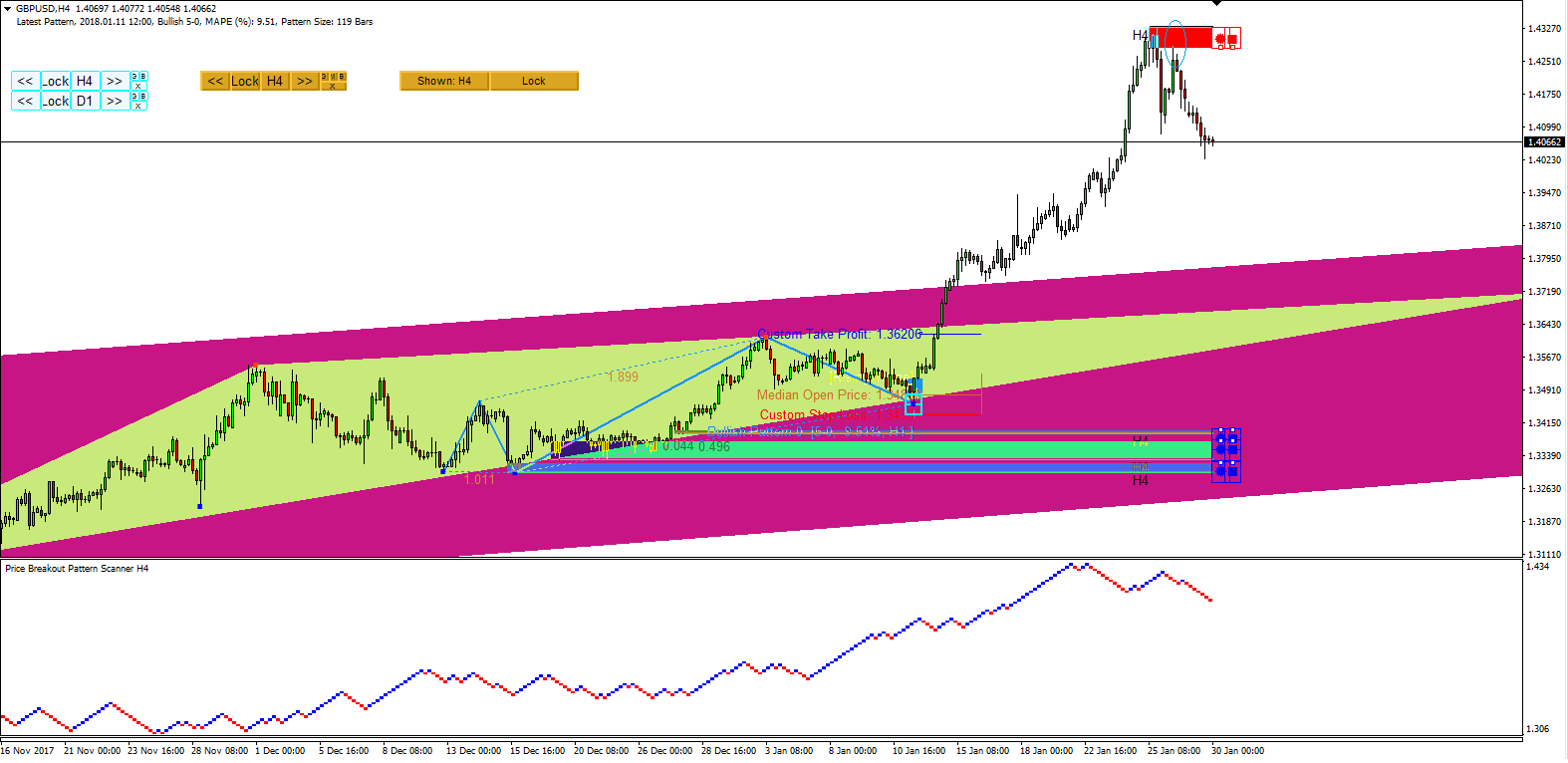

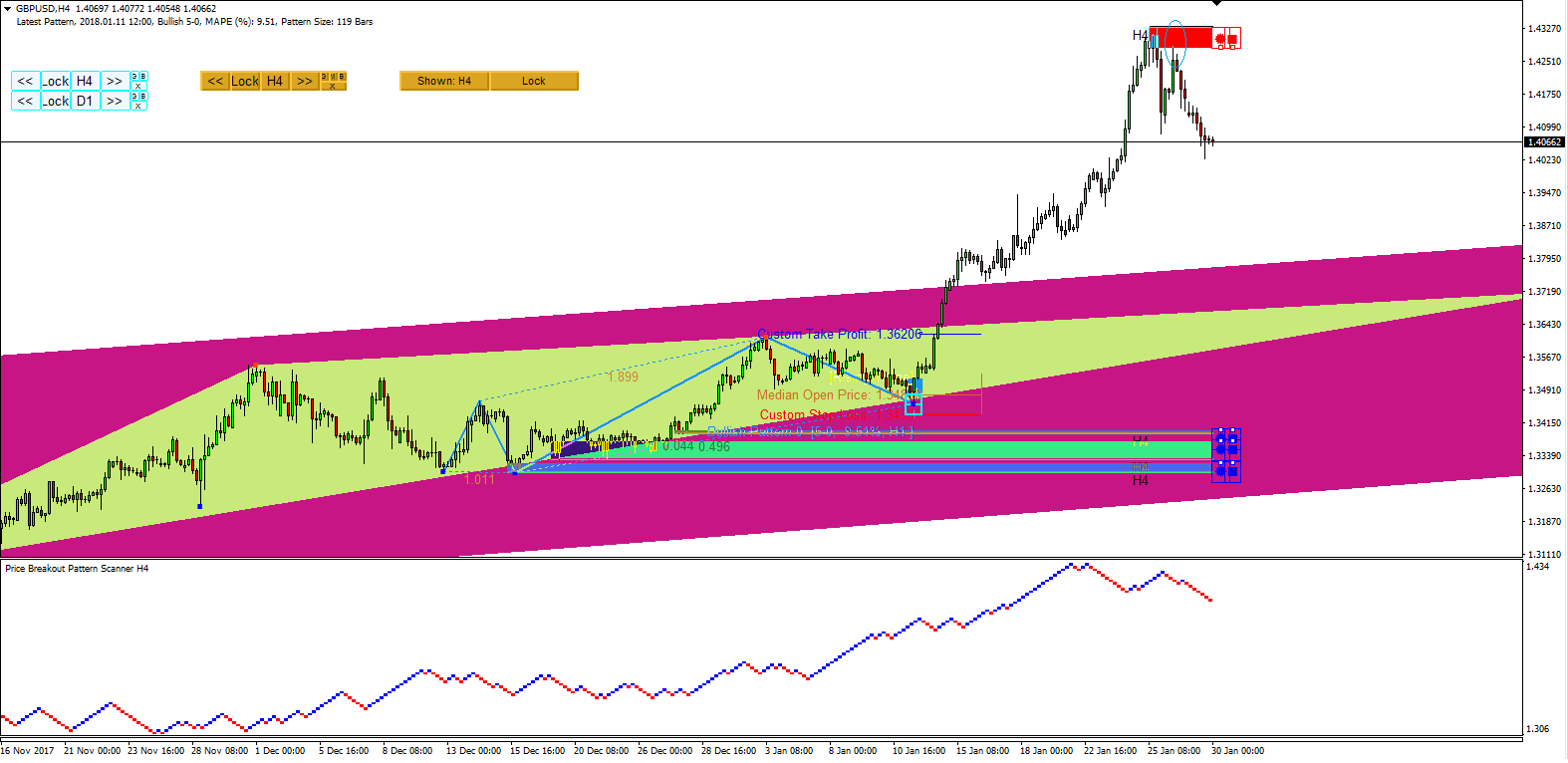

GBPUSD Market Outlook – 29 Jan 2018

GBPUSD made a sharp fall after it touched the supply zone (H4 Mean Reversion Supply Demand). It literally just dipped by 1 pip on the supply zone and it went down nearly 250 pips. Currently it is resting in the Asian session. Watch out the level at 1.4000 for your trading. There could be possible high volatility around this level.

Here are the links for our website:

http://algotrading-investment.com/

https://www.mql5.com/en/users/financeengineer/seller#products

GBPUSD made a sharp fall after it touched the supply zone (H4 Mean Reversion Supply Demand). It literally just dipped by 1 pip on the supply zone and it went down nearly 250 pips. Currently it is resting in the Asian session. Watch out the level at 1.4000 for your trading. There could be possible high volatility around this level.

Here are the links for our website:

http://algotrading-investment.com/

https://www.mql5.com/en/users/financeengineer/seller#products

Young Ho Seo

Book Update to 15.5 (Financial Trading with Five Regularities of Nature)

Financial Trading with Five Regularities of Nature (Scientific Guide to Price Action and Pattern Trading).

In the version 15.5, we have introduced the concept of powerful trading system for your winning trading:

•equilibrium fractal wave index

•shape ratio trading

•equilibrium fractal wave (EFW) channel

We share the winning trading recipes in depth in the new version of our book. These new trading techniques are brand new trading system available only to the book reader. No matter how many hours you spend in google, you will not simply able to find the similar stuffs like our book.

Why not? Because we are the creator of the unified but scientific trading framework of Five Regularities, which explains several thousands trading strategies and system under just five categories. Would five categories difficult to digest for you? No it is easy. You can only make profit when you know what you are materializing from the market. Have you blindly traded before, then do not miss to read this book.

Imagine you have one logic explains the mechanism of thousands of different trading strategies. How fast would you be able to accelerate your trading and investment education? Very fast, I guess. If you are learning bits and pieces from website, you have to learn the trading strategies with confusing and conflicting voices. That take a lot of time to learn some simple thing plus you have a risk of getting bad habits. This is no good. We provide one unified and scientific framework for all trading strategies in just one book.

Especially we have drilled down the Price Action and Pattern Trading in details. You will see that this advanced version of price action trading course will advance your trading performance. We really mean this. Open the box and see the difference with your own eyes, it only take reading of one book. Many practical trading recipes and essential trainings are included in the book for the first time.

Here are what to do for many of you less technical. The book have several scientific language but if you want to avoid them, you can read them in following orders. You can skip the chapter 4, 5, 6, 7, 8 and 9 (from chapter 4 to 9) because they are not directly related to Price Action and Pattern Trading. However, you have to read thoroughly chapter 3, 10, 11, 12 and 13 before you go on to the 2nd training in Price Action and Pattern Trading. Since 2nd training in Price Action and Pattern Trading is all about the practical trading strategies, you should read them all. Here are the link for the book:

http://algotrading-investment.com/portfolio-item/financial-trading-five-regularities-nature/

https://www.amazon.com/dp/B073T3ZMBR

If you are an existing customers, then feel free to download this new version 15.5. Upgrade is always free with us. Also when you buy our package products, you can get these book for free too. Here is more information.

http://algotrading-investment.com/latest-offer/

1st Training in Price Action and Pattern Trading.

Introduction to Five Regularities in the Financial Market 8

1. Introduction to Technical Analysis 8

2. Introduction to Charting Techniques 24

3. The Five Regularities in the Financial Market 34

Skip Chapter 4 to chapter 9 (if you are less technical)

10. Equilibrium Fractal-Wave Process 90

11. Choice of trading strategy and Price Patterns 107

12. Peak Trough Analysis to visualize equilibrium fractal wave 113

13. Using Equilibrium Fractal Wave Index to Select Your Trading Strategy 128

14. Appendix-Equilibrium Fractal Wave Derived Patterns 141

15. References 148

2nd Training in Price Action and Pattern Trading.

Price Action and Pattern Trading 156

Overview on Practical Trading with the Fifth Regularity 157

1. Support and Resistance 160

1.1 Horizontal Support and Resistance 161

1.2 Diagonal Support and Resistance 170

1.3 Identification of Support and Resistance with the Template and Pattern Approach 180

2. Trading with Equilibrium Fractal Wave 187

2.1 Introduction to EFW Index for trading 187

2.2 Trading with the shape ratio of equilibrium fractal wave 191

2.3 Introduction to Equilibrium Fractal Wave (EFW) Channel 196

2.4 Practical trading with Equilibrium Fractal Wave (EFW) Channel 199

2.5 Combining the shape ratio trading and (EFW) Channel 206

3. Harmonic Pattern 210

3.1 Introduction to Harmonic Pattern 210

3.2 Harmonic Pattern Trading 214

3.3 Pattern Matching Accuracy and Pattern Completion Interval 223

3.4 Potential Reversal Zone 232

4. Elliott Wave Trading 240

4.1 Introduction to the Wave Principle 240

4.2 Scientific Wave Counting with the Template and Pattern Approach 243

4.3 Impulse Wave Structural Score and Corrective Wave Structural Score 257

4.4 Channelling Techniques 262

5. Triangle and Wedge Patterns 266

5.1 Introduction to Triangle and Wedge patterns 266

5.2 Classic Perspective of Triangle and Wedge Patterns 269

5.3 Diagonal Support and Resistance Perspective of Triangle and Wedge Pattern 277

5.4 Elliott Wave Perspective of Triangle and Wedge Pattern 280

6. References 284

3rd Training in Price Action and Pattern Trading.

Trading Management 286

1. Risk Management 287

1.1 Various Risks in Trading and Investment 287

1.2 Position Sizing Techniques 293

1.3 Reward/Risk Ratio in your trading 297

1.4 Breakeven Success Rate 298

1.5 Know your profit goal before your trading 300

1.6 Compounding Profits 304

1.7 Trading Performance and Cost Metrics 304

2. Portfolio Management 309

2.1 Combining different trading strategy 309

2.2 Hedging 318

2.3 Portfolio Diversification 319

3. References 323

Financial Trading with Five Regularities of Nature (Scientific Guide to Price Action and Pattern Trading).

In the version 15.5, we have introduced the concept of powerful trading system for your winning trading:

•equilibrium fractal wave index

•shape ratio trading

•equilibrium fractal wave (EFW) channel

We share the winning trading recipes in depth in the new version of our book. These new trading techniques are brand new trading system available only to the book reader. No matter how many hours you spend in google, you will not simply able to find the similar stuffs like our book.

Why not? Because we are the creator of the unified but scientific trading framework of Five Regularities, which explains several thousands trading strategies and system under just five categories. Would five categories difficult to digest for you? No it is easy. You can only make profit when you know what you are materializing from the market. Have you blindly traded before, then do not miss to read this book.

Imagine you have one logic explains the mechanism of thousands of different trading strategies. How fast would you be able to accelerate your trading and investment education? Very fast, I guess. If you are learning bits and pieces from website, you have to learn the trading strategies with confusing and conflicting voices. That take a lot of time to learn some simple thing plus you have a risk of getting bad habits. This is no good. We provide one unified and scientific framework for all trading strategies in just one book.

Especially we have drilled down the Price Action and Pattern Trading in details. You will see that this advanced version of price action trading course will advance your trading performance. We really mean this. Open the box and see the difference with your own eyes, it only take reading of one book. Many practical trading recipes and essential trainings are included in the book for the first time.

Here are what to do for many of you less technical. The book have several scientific language but if you want to avoid them, you can read them in following orders. You can skip the chapter 4, 5, 6, 7, 8 and 9 (from chapter 4 to 9) because they are not directly related to Price Action and Pattern Trading. However, you have to read thoroughly chapter 3, 10, 11, 12 and 13 before you go on to the 2nd training in Price Action and Pattern Trading. Since 2nd training in Price Action and Pattern Trading is all about the practical trading strategies, you should read them all. Here are the link for the book:

http://algotrading-investment.com/portfolio-item/financial-trading-five-regularities-nature/

https://www.amazon.com/dp/B073T3ZMBR

If you are an existing customers, then feel free to download this new version 15.5. Upgrade is always free with us. Also when you buy our package products, you can get these book for free too. Here is more information.

http://algotrading-investment.com/latest-offer/

1st Training in Price Action and Pattern Trading.

Introduction to Five Regularities in the Financial Market 8

1. Introduction to Technical Analysis 8

2. Introduction to Charting Techniques 24

3. The Five Regularities in the Financial Market 34

Skip Chapter 4 to chapter 9 (if you are less technical)

10. Equilibrium Fractal-Wave Process 90

11. Choice of trading strategy and Price Patterns 107

12. Peak Trough Analysis to visualize equilibrium fractal wave 113

13. Using Equilibrium Fractal Wave Index to Select Your Trading Strategy 128

14. Appendix-Equilibrium Fractal Wave Derived Patterns 141

15. References 148

2nd Training in Price Action and Pattern Trading.

Price Action and Pattern Trading 156

Overview on Practical Trading with the Fifth Regularity 157

1. Support and Resistance 160

1.1 Horizontal Support and Resistance 161

1.2 Diagonal Support and Resistance 170

1.3 Identification of Support and Resistance with the Template and Pattern Approach 180

2. Trading with Equilibrium Fractal Wave 187

2.1 Introduction to EFW Index for trading 187

2.2 Trading with the shape ratio of equilibrium fractal wave 191

2.3 Introduction to Equilibrium Fractal Wave (EFW) Channel 196

2.4 Practical trading with Equilibrium Fractal Wave (EFW) Channel 199

2.5 Combining the shape ratio trading and (EFW) Channel 206

3. Harmonic Pattern 210

3.1 Introduction to Harmonic Pattern 210

3.2 Harmonic Pattern Trading 214

3.3 Pattern Matching Accuracy and Pattern Completion Interval 223

3.4 Potential Reversal Zone 232

4. Elliott Wave Trading 240

4.1 Introduction to the Wave Principle 240

4.2 Scientific Wave Counting with the Template and Pattern Approach 243

4.3 Impulse Wave Structural Score and Corrective Wave Structural Score 257

4.4 Channelling Techniques 262

5. Triangle and Wedge Patterns 266

5.1 Introduction to Triangle and Wedge patterns 266

5.2 Classic Perspective of Triangle and Wedge Patterns 269

5.3 Diagonal Support and Resistance Perspective of Triangle and Wedge Pattern 277

5.4 Elliott Wave Perspective of Triangle and Wedge Pattern 280

6. References 284

3rd Training in Price Action and Pattern Trading.

Trading Management 286

1. Risk Management 287

1.1 Various Risks in Trading and Investment 287

1.2 Position Sizing Techniques 293

1.3 Reward/Risk Ratio in your trading 297

1.4 Breakeven Success Rate 298

1.5 Know your profit goal before your trading 300

1.6 Compounding Profits 304

1.7 Trading Performance and Cost Metrics 304

2. Portfolio Management 309

2.1 Combining different trading strategy 309

2.2 Hedging 318

2.3 Portfolio Diversification 319

3. References 323

Young Ho Seo

Book Update to 15.5 (Financial Trading with Five Regularities of Nature)

Financial Trading with Five Regularities of Nature (Scientific Guide to Price Action and Pattern Trading).

In the version 15.5, we have introduced the concept of powerful trading system for your winning trading:

•equilibrium fractal wave index

•shape ratio trading

•equilibrium fractal wave (EFW) channel

We share the winning trading recipes in depth in the new version of our book. These new trading techniques are brand new trading system available only to the book reader. No matter how many hours you spend in google, you will not simply able to find the similar stuffs like our book.

Why not? Because we are the creator of the unified but scientific trading framework of Five Regularities, which explains several thousands trading strategies and system under just five categories. Would five categories difficult to digest for you? No it is easy. You can only make profit when you know what you are materializing from the market. Have you blindly traded before, then do not miss to read this book.

Imagine you have one logic explains the mechanism of thousands of different trading strategies. How fast would you be able to accelerate your trading and investment education? Very fast, I guess. If you are learning bits and pieces from website, you have to learn the trading strategies with confusing and conflicting voices. That take a lot of time to learn some simple thing plus you have a risk of getting bad habits. This is no good. We provide one unified and scientific framework for all trading strategies in just one book.

Especially we have drilled down the Price Action and Pattern Trading in details. You will see that this advanced version of price action trading course will advance your trading performance. We really mean this. Open the box and see the difference with your own eyes, it only take reading of one book. Many practical trading recipes and essential trainings are included in the book for the first time.

Here are what to do for many of you less technical. The book have several scientific language but if you want to avoid them, you can read them in following orders. You can skip the chapter 4, 5, 6, 7, 8 and 9 (from chapter 4 to 9) because they are not directly related to Price Action and Pattern Trading. However, you have to read thoroughly chapter 3, 10, 11, 12 and 13 before you go on to the 2nd training in Price Action and Pattern Trading. Since 2nd training in Price Action and Pattern Trading is all about the practical trading strategies, you should read them all. Here are the link for the book:

http://algotrading-investment.com/portfolio-item/financial-trading-five-regularities-nature/

https://www.amazon.com/dp/B073T3ZMBR

If you are an existing customers, then feel free to download this new version 15.5. Upgrade is always free with us.

1st Training in Price Action and Pattern Trading.

Introduction to Five Regularities in the Financial Market 8

1. Introduction to Technical Analysis 8

2. Introduction to Charting Techniques 24

3. The Five Regularities in the Financial Market 34

Skip Chapter 4 to chapter 9 (if you are less technical)

10. Equilibrium Fractal-Wave Process 90

11. Choice of trading strategy and Price Patterns 107

12. Peak Trough Analysis to visualize equilibrium fractal wave 113

13. Using Equilibrium Fractal Wave Index to Select Your Trading Strategy 128

14. Appendix-Equilibrium Fractal Wave Derived Patterns 141

15. References 148

2nd Training in Price Action and Pattern Trading.

Price Action and Pattern Trading 156

Overview on Practical Trading with the Fifth Regularity 157

1. Support and Resistance 160

1.1 Horizontal Support and Resistance 161

1.2 Diagonal Support and Resistance 170

1.3 Identification of Support and Resistance with the Template and Pattern Approach 180

2. Trading with Equilibrium Fractal Wave 187

2.1 Introduction to EFW Index for trading 187

2.2 Trading with the shape ratio of equilibrium fractal wave 191

2.3 Introduction to Equilibrium Fractal Wave (EFW) Channel 196

2.4 Practical trading with Equilibrium Fractal Wave (EFW) Channel 199

2.5 Combining the shape ratio trading and (EFW) Channel 206

3. Harmonic Pattern 210

3.1 Introduction to Harmonic Pattern 210

3.2 Harmonic Pattern Trading 214

3.3 Pattern Matching Accuracy and Pattern Completion Interval 223

3.4 Potential Reversal Zone 232

4. Elliott Wave Trading 240

4.1 Introduction to the Wave Principle 240

4.2 Scientific Wave Counting with the Template and Pattern Approach 243

4.3 Impulse Wave Structural Score and Corrective Wave Structural Score 257

4.4 Channelling Techniques 262

5. Triangle and Wedge Patterns 266

5.1 Introduction to Triangle and Wedge patterns 266

5.2 Classic Perspective of Triangle and Wedge Patterns 269

5.3 Diagonal Support and Resistance Perspective of Triangle and Wedge Pattern 277

5.4 Elliott Wave Perspective of Triangle and Wedge Pattern 280

6. References 284

3rd Training in Price Action and Pattern Trading.

Trading Management 286

1. Risk Management 287

1.1 Various Risks in Trading and Investment 287

1.2 Position Sizing Techniques 293

1.3 Reward/Risk Ratio in your trading 297

1.4 Breakeven Success Rate 298

1.5 Know your profit goal before your trading 300

1.6 Compounding Profits 304

1.7 Trading Performance and Cost Metrics 304

2. Portfolio Management 309

2.1 Combining different trading strategy 309

2.2 Hedging 318

2.3 Portfolio Diversification 319

3. References 323

Financial Trading with Five Regularities of Nature (Scientific Guide to Price Action and Pattern Trading).

In the version 15.5, we have introduced the concept of powerful trading system for your winning trading:

•equilibrium fractal wave index

•shape ratio trading

•equilibrium fractal wave (EFW) channel

We share the winning trading recipes in depth in the new version of our book. These new trading techniques are brand new trading system available only to the book reader. No matter how many hours you spend in google, you will not simply able to find the similar stuffs like our book.

Why not? Because we are the creator of the unified but scientific trading framework of Five Regularities, which explains several thousands trading strategies and system under just five categories. Would five categories difficult to digest for you? No it is easy. You can only make profit when you know what you are materializing from the market. Have you blindly traded before, then do not miss to read this book.

Imagine you have one logic explains the mechanism of thousands of different trading strategies. How fast would you be able to accelerate your trading and investment education? Very fast, I guess. If you are learning bits and pieces from website, you have to learn the trading strategies with confusing and conflicting voices. That take a lot of time to learn some simple thing plus you have a risk of getting bad habits. This is no good. We provide one unified and scientific framework for all trading strategies in just one book.

Especially we have drilled down the Price Action and Pattern Trading in details. You will see that this advanced version of price action trading course will advance your trading performance. We really mean this. Open the box and see the difference with your own eyes, it only take reading of one book. Many practical trading recipes and essential trainings are included in the book for the first time.

Here are what to do for many of you less technical. The book have several scientific language but if you want to avoid them, you can read them in following orders. You can skip the chapter 4, 5, 6, 7, 8 and 9 (from chapter 4 to 9) because they are not directly related to Price Action and Pattern Trading. However, you have to read thoroughly chapter 3, 10, 11, 12 and 13 before you go on to the 2nd training in Price Action and Pattern Trading. Since 2nd training in Price Action and Pattern Trading is all about the practical trading strategies, you should read them all. Here are the link for the book:

http://algotrading-investment.com/portfolio-item/financial-trading-five-regularities-nature/

https://www.amazon.com/dp/B073T3ZMBR

If you are an existing customers, then feel free to download this new version 15.5. Upgrade is always free with us.

1st Training in Price Action and Pattern Trading.

Introduction to Five Regularities in the Financial Market 8

1. Introduction to Technical Analysis 8

2. Introduction to Charting Techniques 24

3. The Five Regularities in the Financial Market 34

Skip Chapter 4 to chapter 9 (if you are less technical)

10. Equilibrium Fractal-Wave Process 90

11. Choice of trading strategy and Price Patterns 107

12. Peak Trough Analysis to visualize equilibrium fractal wave 113

13. Using Equilibrium Fractal Wave Index to Select Your Trading Strategy 128

14. Appendix-Equilibrium Fractal Wave Derived Patterns 141

15. References 148

2nd Training in Price Action and Pattern Trading.

Price Action and Pattern Trading 156

Overview on Practical Trading with the Fifth Regularity 157

1. Support and Resistance 160

1.1 Horizontal Support and Resistance 161

1.2 Diagonal Support and Resistance 170

1.3 Identification of Support and Resistance with the Template and Pattern Approach 180

2. Trading with Equilibrium Fractal Wave 187

2.1 Introduction to EFW Index for trading 187

2.2 Trading with the shape ratio of equilibrium fractal wave 191

2.3 Introduction to Equilibrium Fractal Wave (EFW) Channel 196

2.4 Practical trading with Equilibrium Fractal Wave (EFW) Channel 199

2.5 Combining the shape ratio trading and (EFW) Channel 206

3. Harmonic Pattern 210

3.1 Introduction to Harmonic Pattern 210

3.2 Harmonic Pattern Trading 214

3.3 Pattern Matching Accuracy and Pattern Completion Interval 223

3.4 Potential Reversal Zone 232

4. Elliott Wave Trading 240

4.1 Introduction to the Wave Principle 240

4.2 Scientific Wave Counting with the Template and Pattern Approach 243

4.3 Impulse Wave Structural Score and Corrective Wave Structural Score 257

4.4 Channelling Techniques 262

5. Triangle and Wedge Patterns 266

5.1 Introduction to Triangle and Wedge patterns 266

5.2 Classic Perspective of Triangle and Wedge Patterns 269

5.3 Diagonal Support and Resistance Perspective of Triangle and Wedge Pattern 277

5.4 Elliott Wave Perspective of Triangle and Wedge Pattern 280

6. References 284

3rd Training in Price Action and Pattern Trading.

Trading Management 286

1. Risk Management 287

1.1 Various Risks in Trading and Investment 287

1.2 Position Sizing Techniques 293

1.3 Reward/Risk Ratio in your trading 297

1.4 Breakeven Success Rate 298

1.5 Know your profit goal before your trading 300

1.6 Compounding Profits 304

1.7 Trading Performance and Cost Metrics 304

2. Portfolio Management 309

2.1 Combining different trading strategy 309

2.2 Hedging 318

2.3 Portfolio Diversification 319

3. References 323

Young Ho Seo

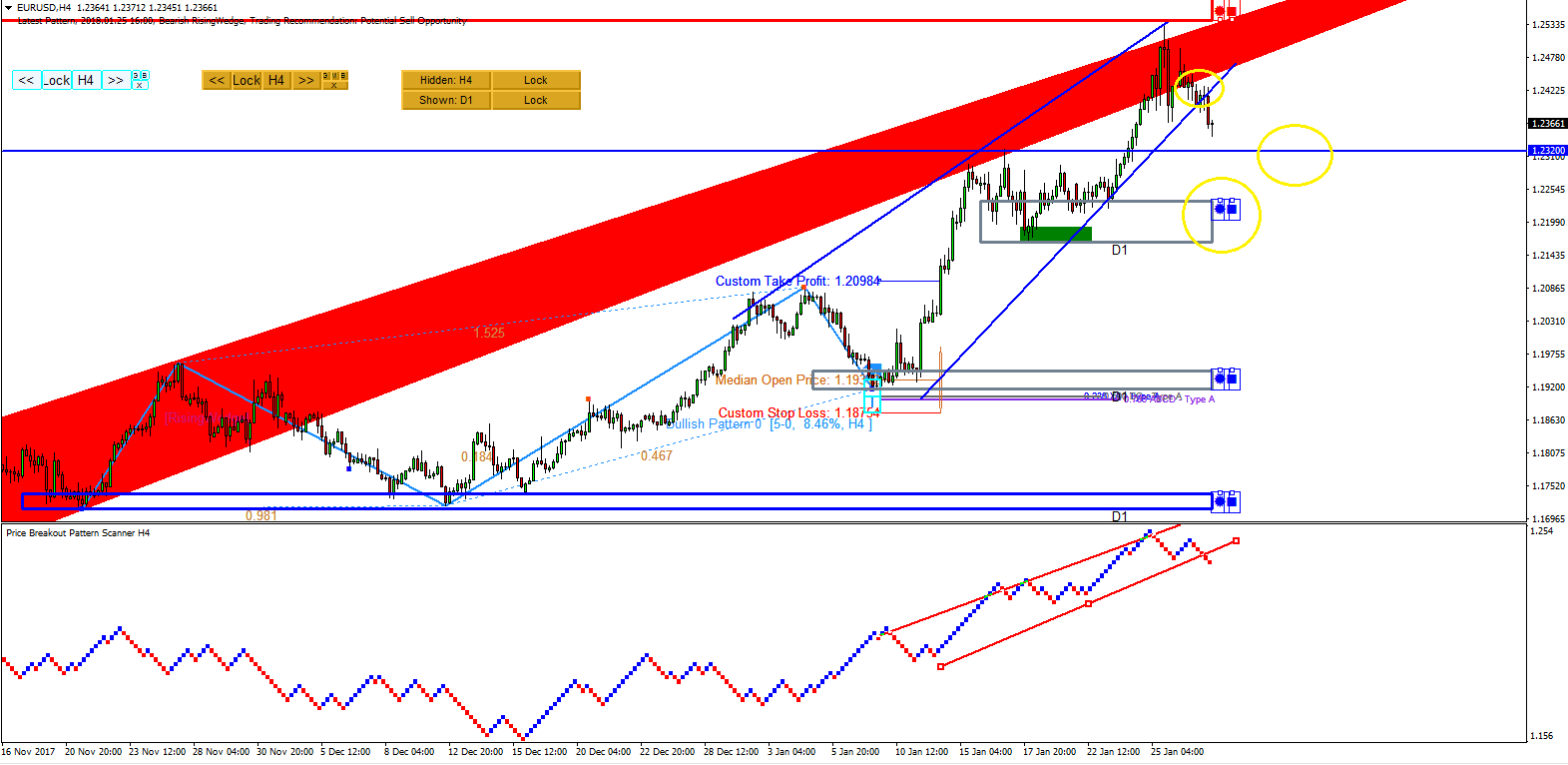

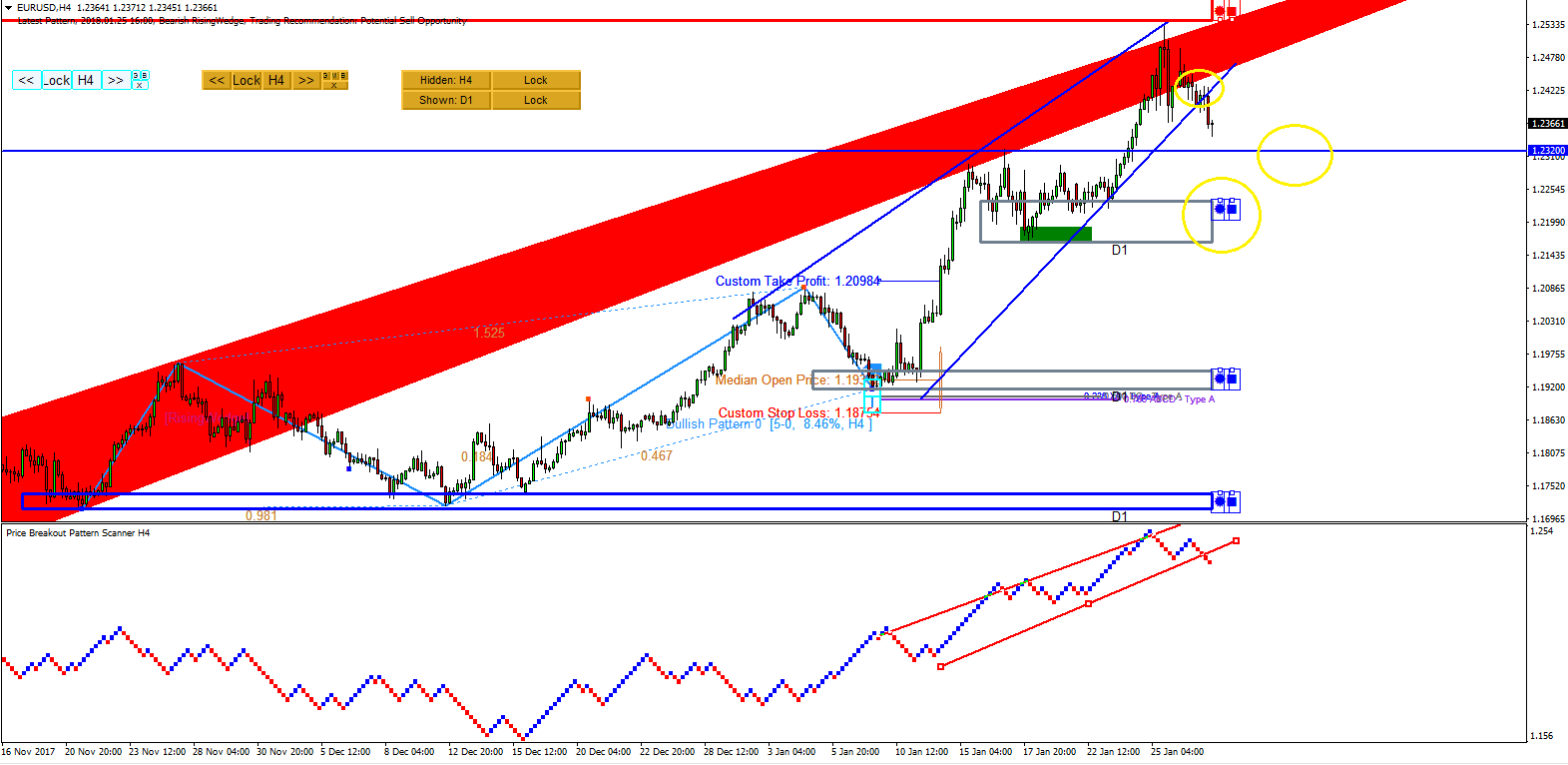

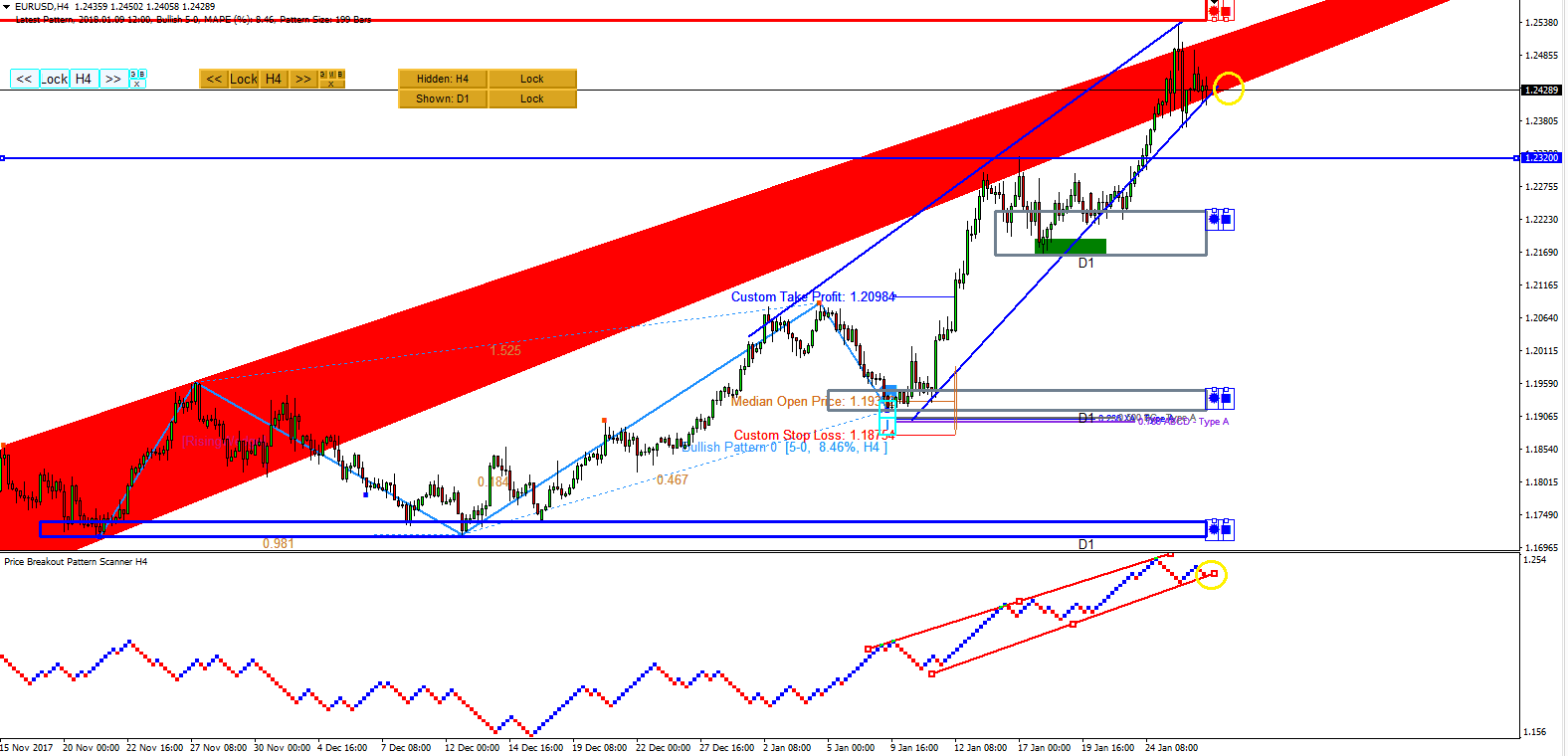

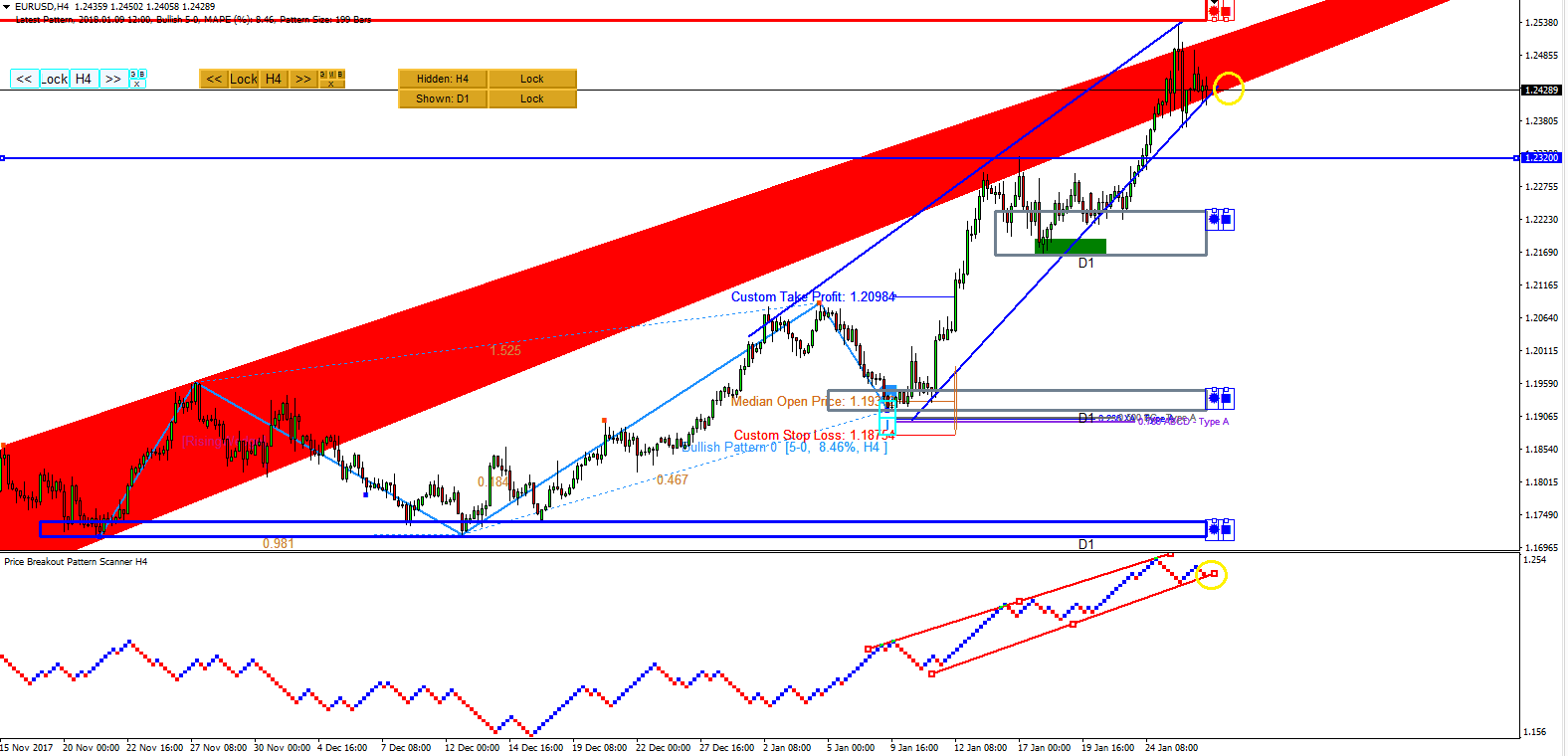

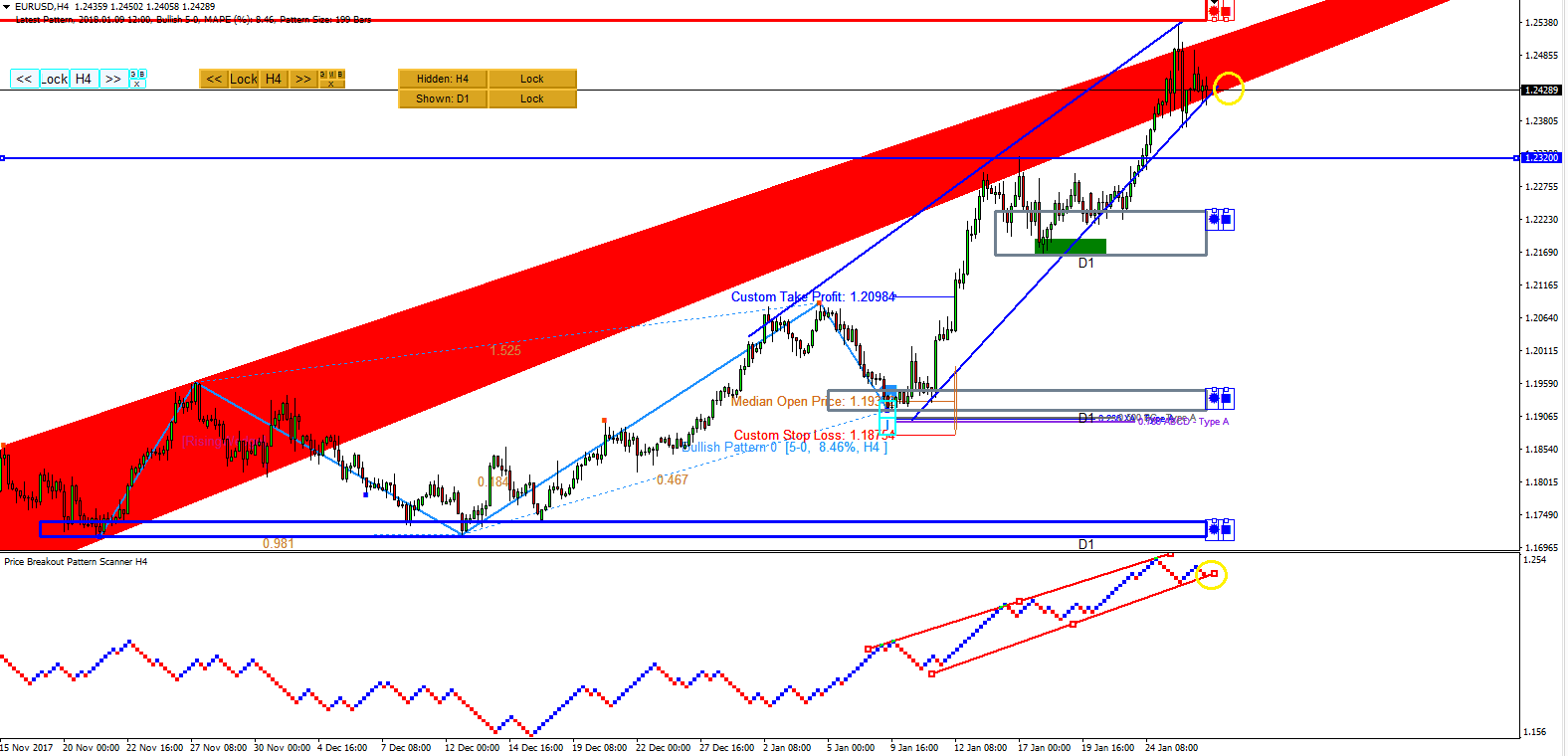

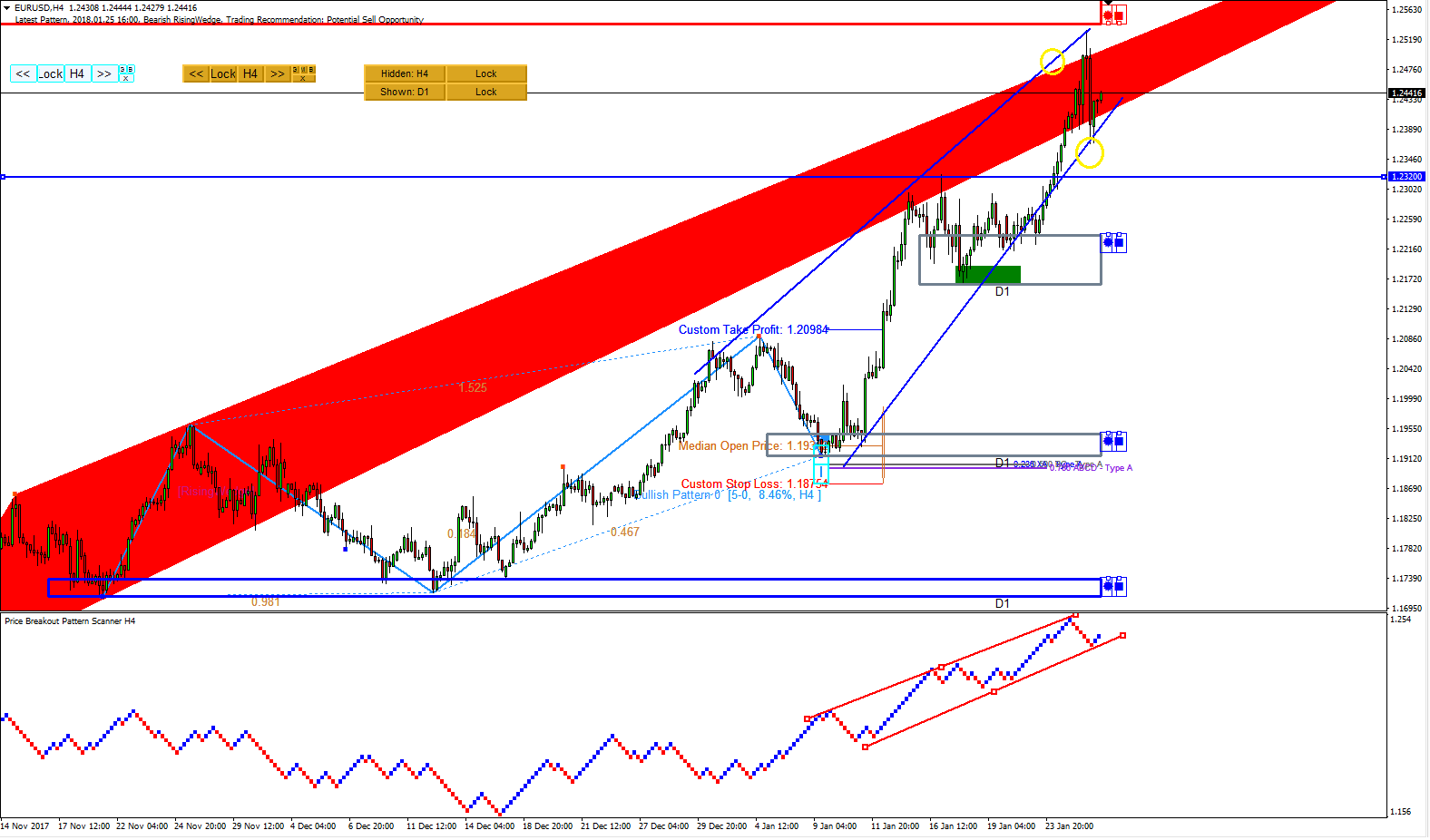

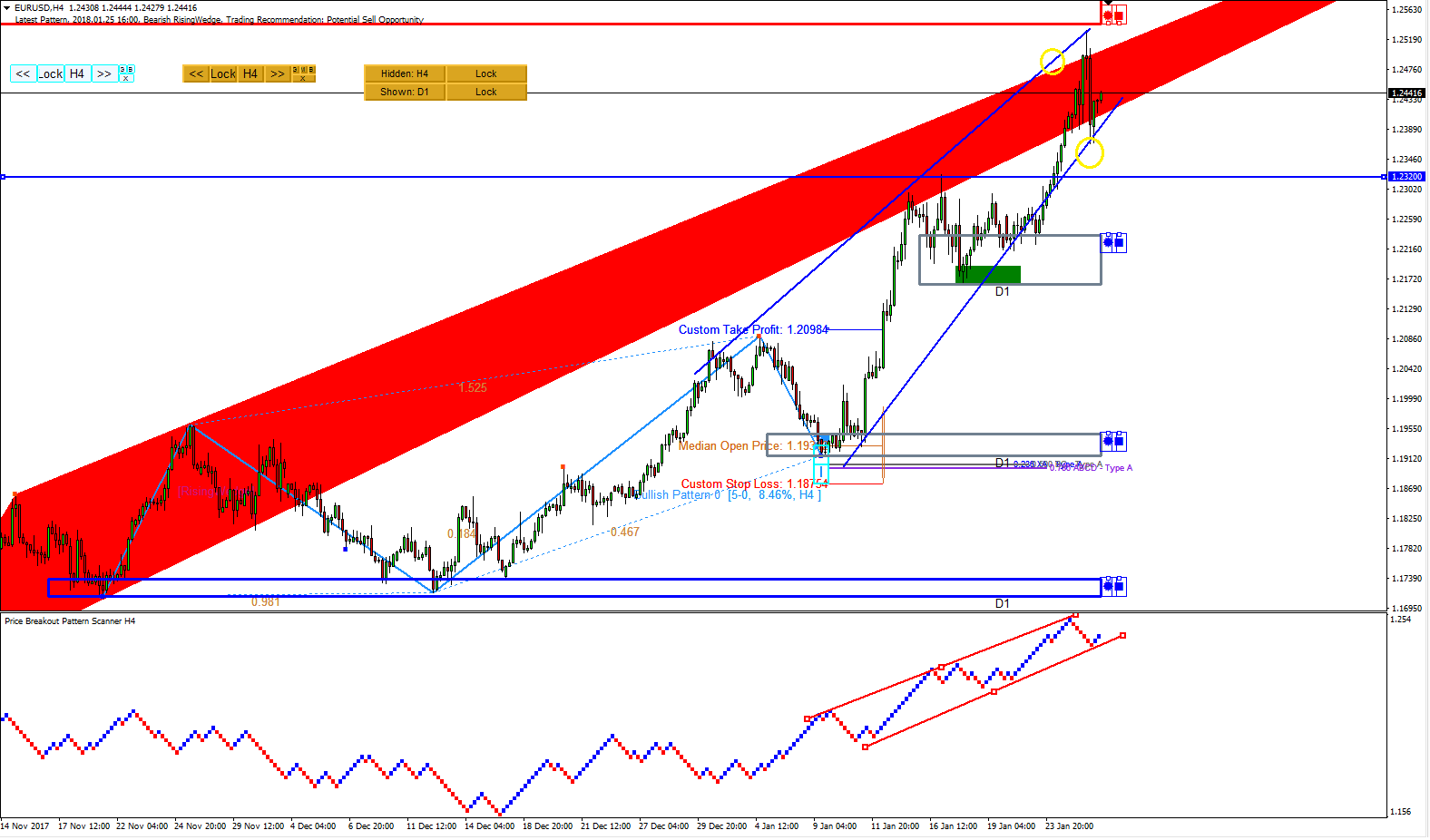

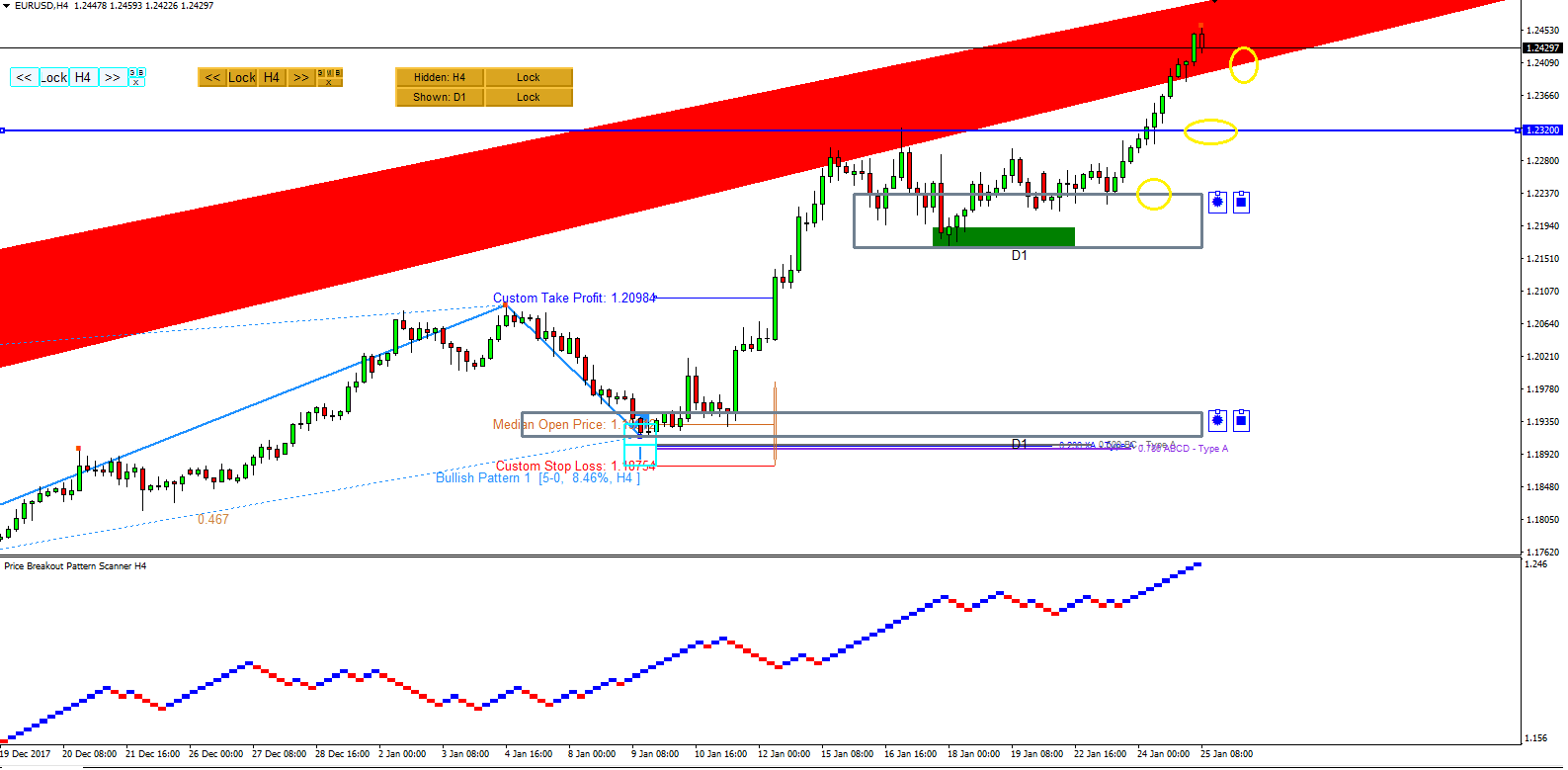

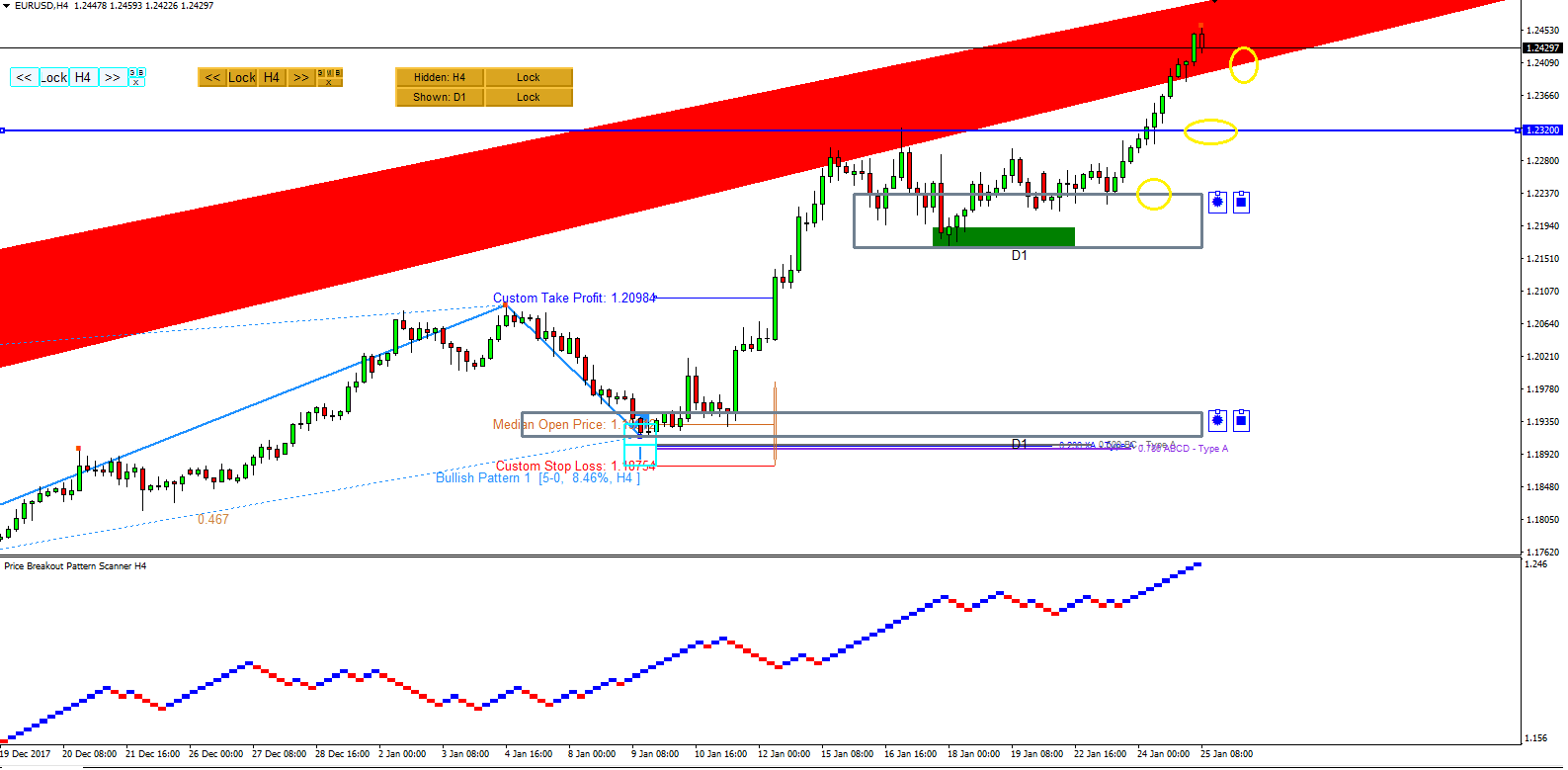

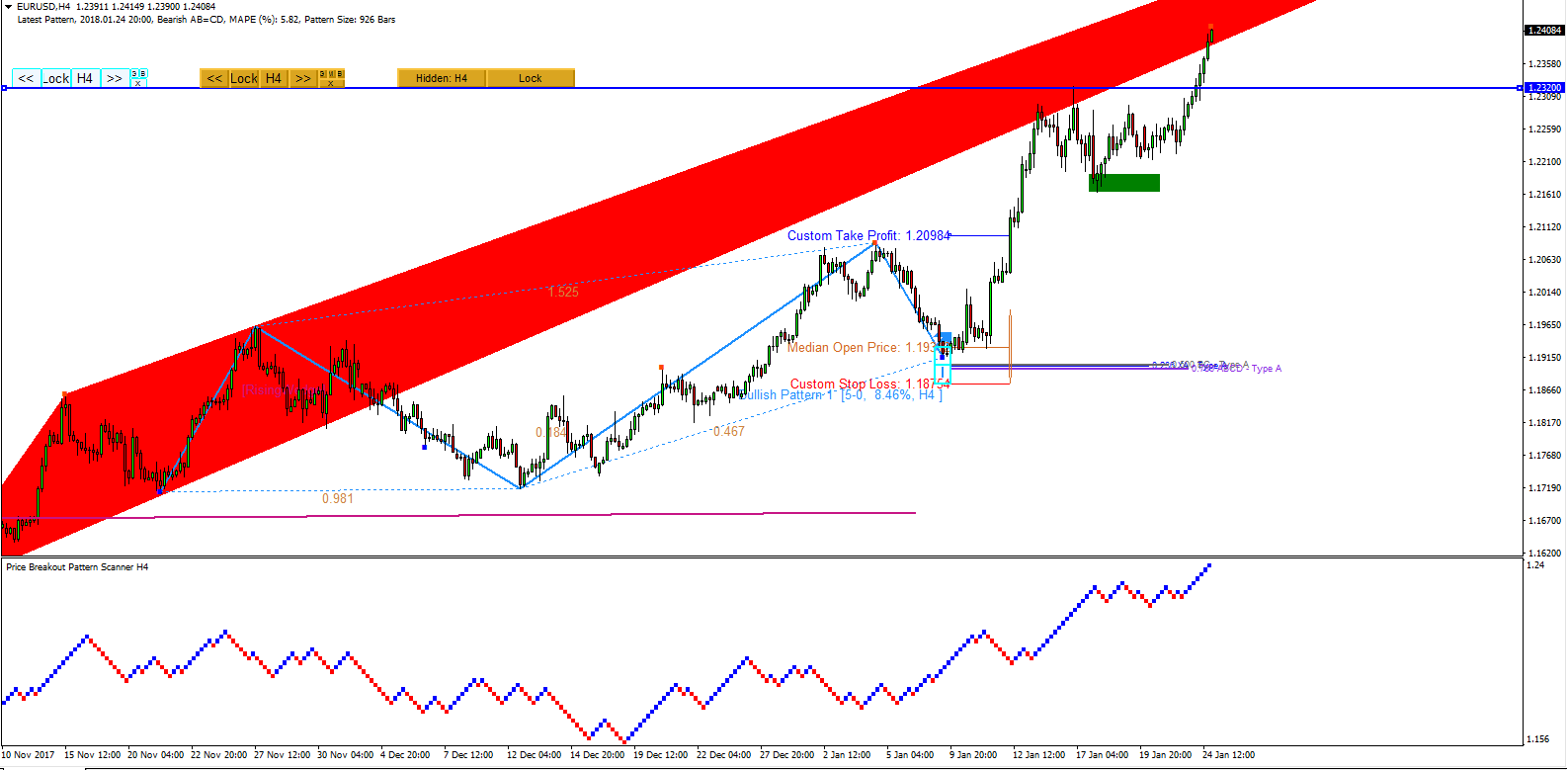

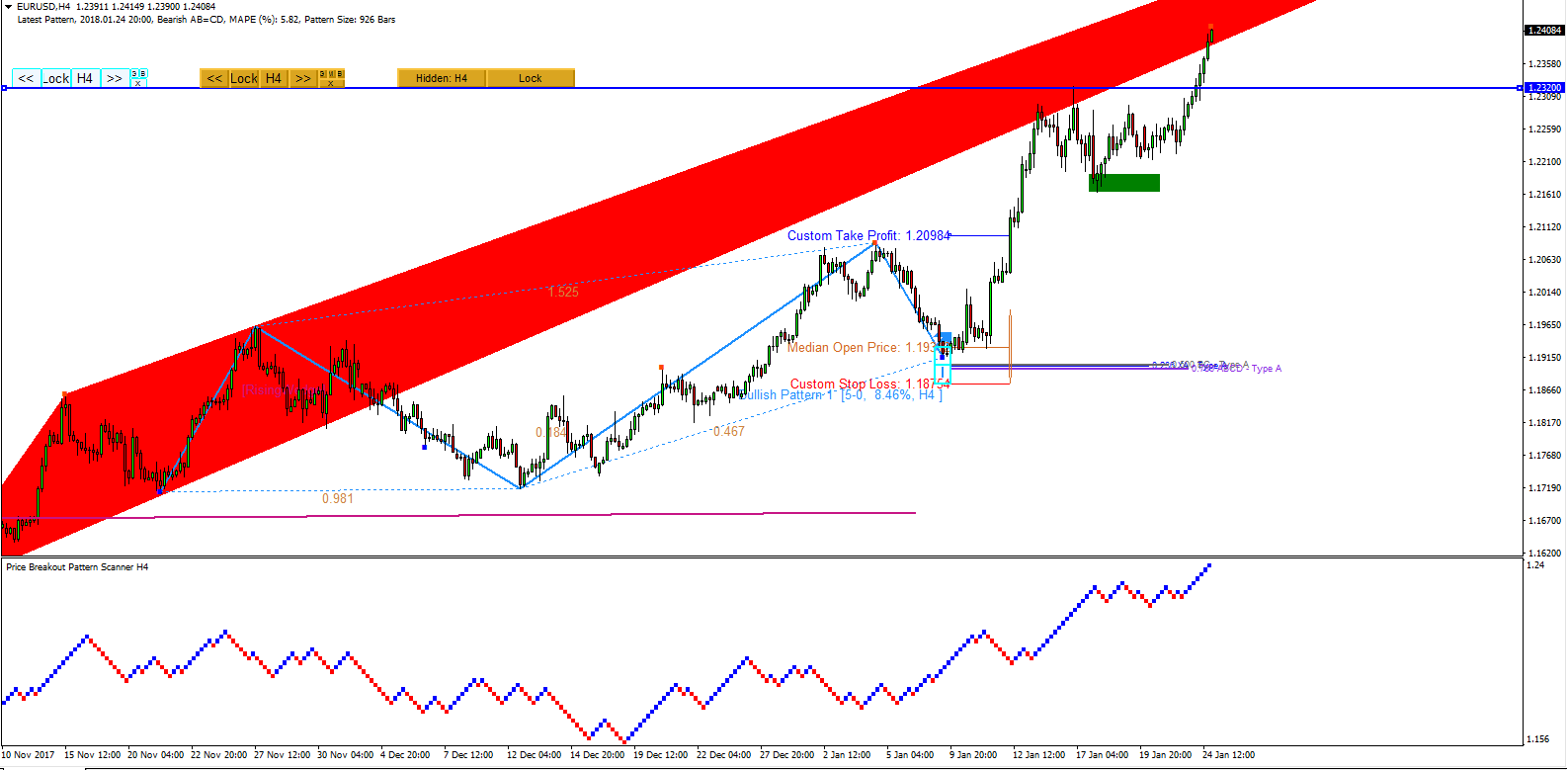

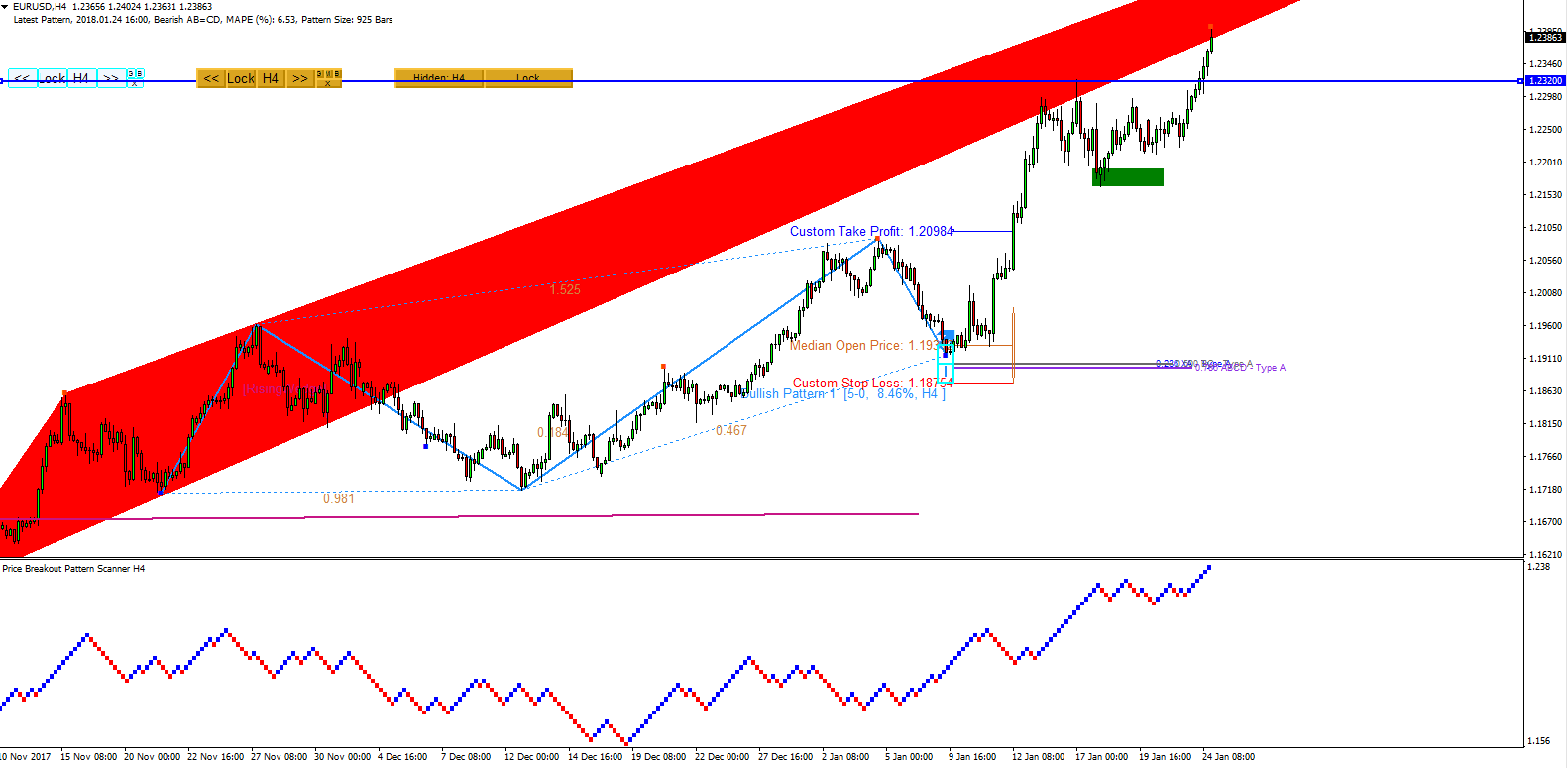

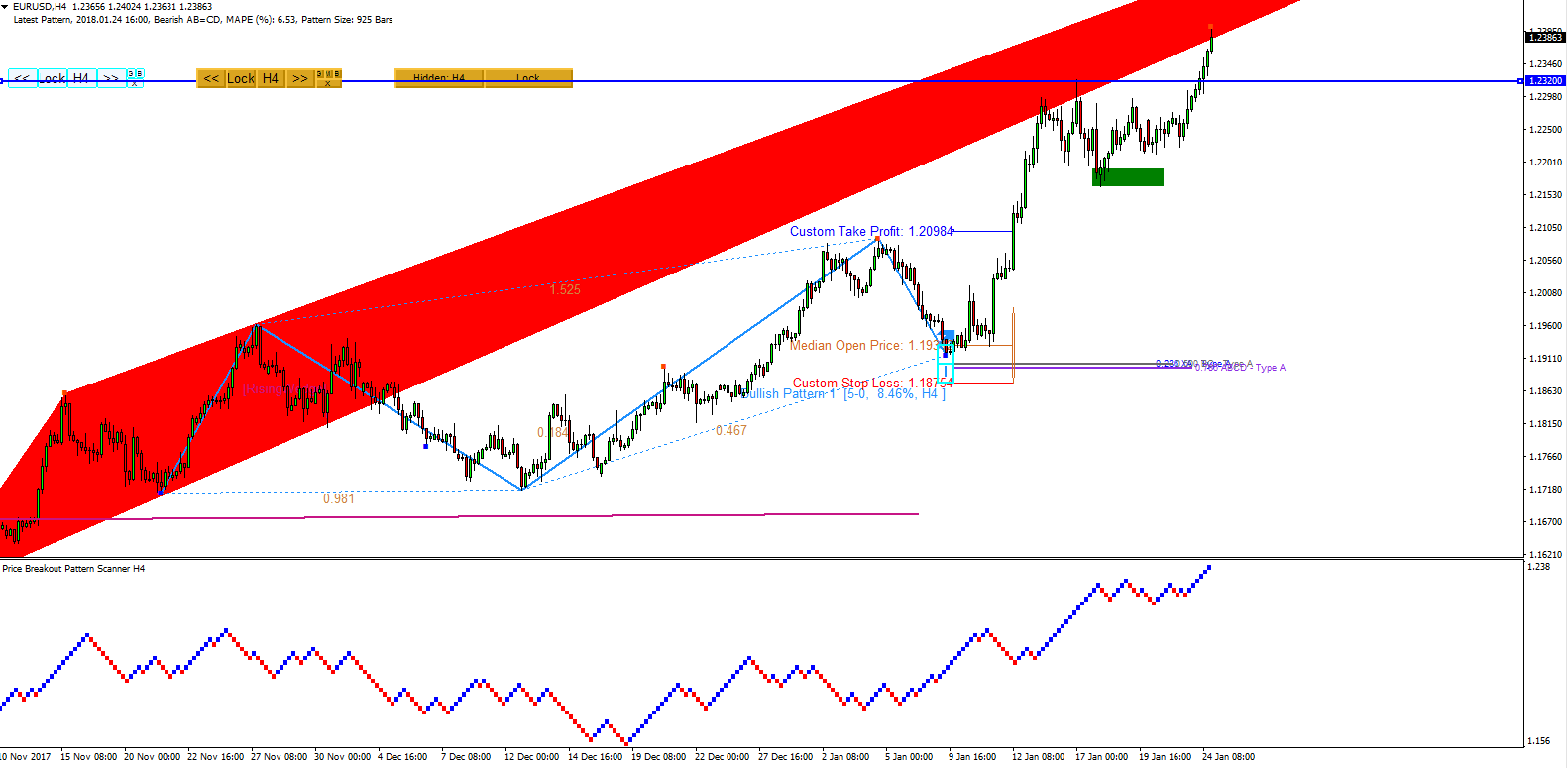

EURUSD Market Outlook 29 Jan 2018

With Market open, EURUSD slipped away and broke the support level we have outlined earlier (Smart Renko, Price Breakout Pattern Scanner). Next, 1.2320 level would act as the strong support. Below 1.2320 level, we have already outlined the important daily demand zone last few weeks (H4<D1 Mean Reversion Supply Demand). Hope this helps for your trading.

http://algotrading-investment.com/

https://www.mql5.com/en/users/financeengineer/seller#products

With Market open, EURUSD slipped away and broke the support level we have outlined earlier (Smart Renko, Price Breakout Pattern Scanner). Next, 1.2320 level would act as the strong support. Below 1.2320 level, we have already outlined the important daily demand zone last few weeks (H4<D1 Mean Reversion Supply Demand). Hope this helps for your trading.

http://algotrading-investment.com/

https://www.mql5.com/en/users/financeengineer/seller#products

Young Ho Seo

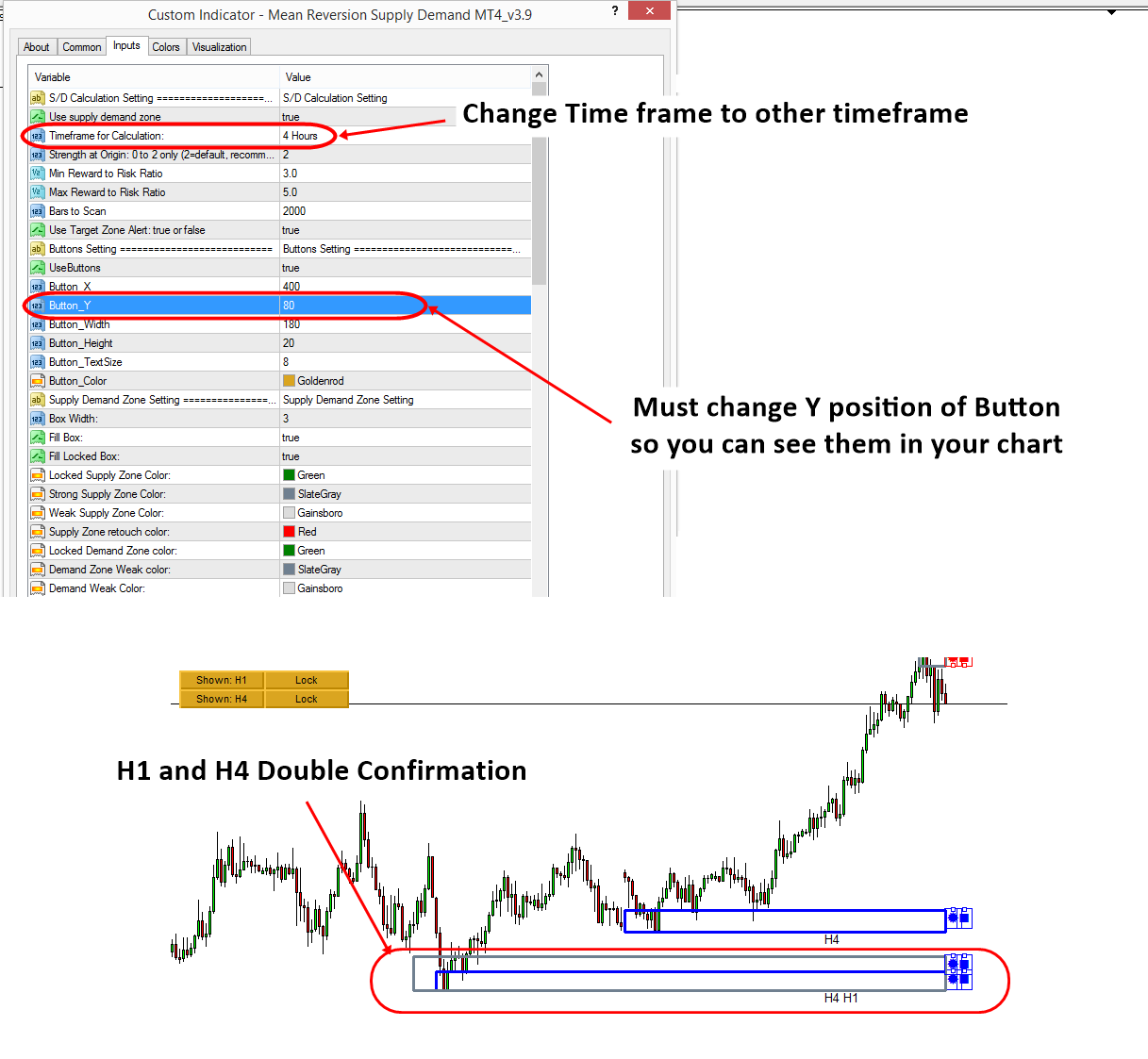

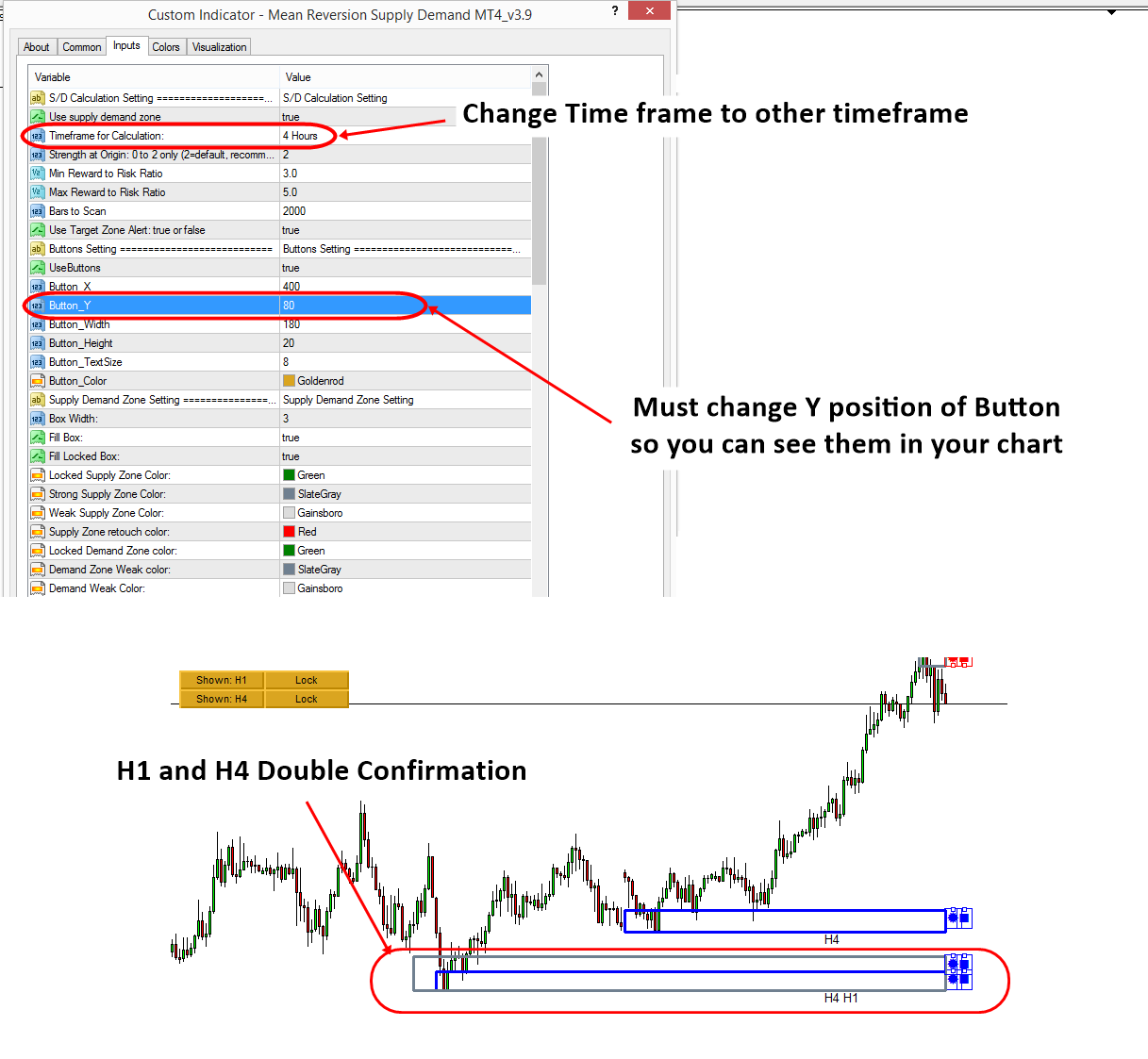

Mean Reversion Supply Demand Multiple TimeFrame analysis

Mean Reversion Supply Demand have a powerful multiple timeframe analysis features in it. It means that you can layout the demand and supply zones from several different timeframe in one single chart. This is very powerful because you can see the confirmation of your trading zones over several timeframe. For example, you can see the demand zone double confirmed from H1 and H4 timeframe in the screenshots.

http://algotrading-investment.com/portfolio-item/mean-reversion-supply-demand/

https://www.mql5.com/en/market/product/16851

https://www.mql5.com/en/market/product/16823

Mean Reversion Supply Demand have a powerful multiple timeframe analysis features in it. It means that you can layout the demand and supply zones from several different timeframe in one single chart. This is very powerful because you can see the confirmation of your trading zones over several timeframe. For example, you can see the demand zone double confirmed from H1 and H4 timeframe in the screenshots.

http://algotrading-investment.com/portfolio-item/mean-reversion-supply-demand/

https://www.mql5.com/en/market/product/16851

https://www.mql5.com/en/market/product/16823

Young Ho Seo

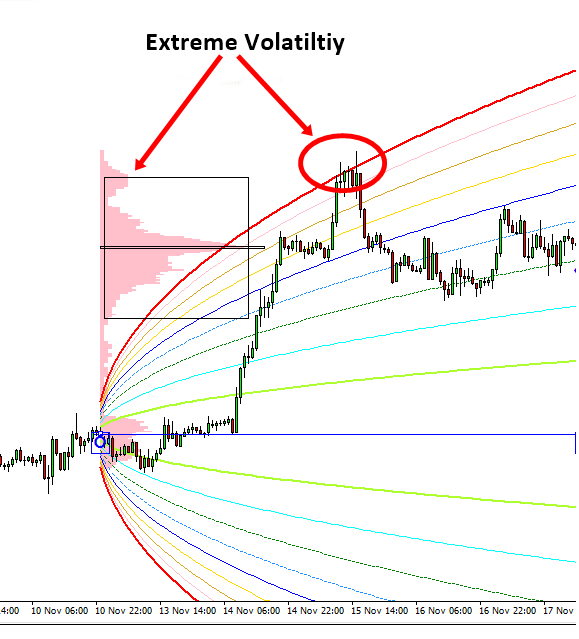

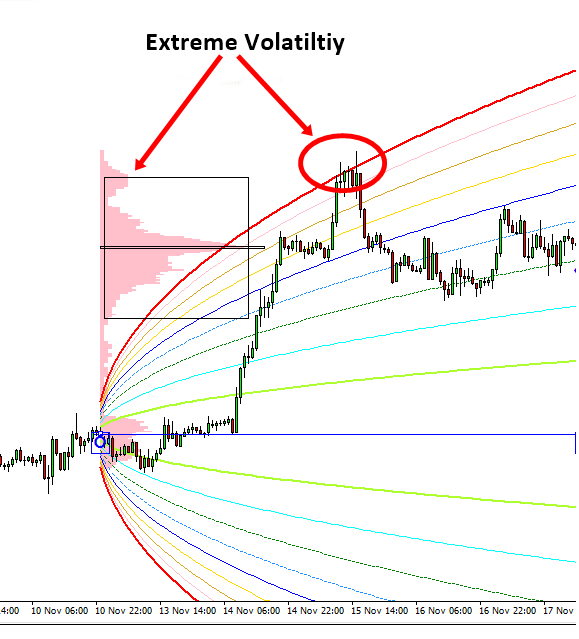

Harmonic Volatility Indicator VS Market Profile

Now I got many questions from traders, if they can have the Market Profile without developing period. What does it mean by developing period? It means that any Market Profile need to collect intra-market data to build up the statistics like Value area and control point, etc. As the market data arrive, the market profile algorithm will recalculate each statistics during developing period. Therefore, the value can continuously change. But the market profile is popular trading tools used by millions of traders. What can we do really?

If we are intra day trader, we have to use Market Profile while they are developing during intraday. As it gets developed, each statistics can be changed. Obviously many traders does not like this feature of the Market Profile. To avoid the developing period, you can probably use yesterday’s Market Profile but they are lagging. So if we prefer to have a faster signal, then we can not avoid this recalculating issues probably.

Depending on what is your purpose with Market Profile, there are some potential that harmonic volatility indicator can be used alternatively to Market Profile. For example, if your purpose of using Market Profile is monitoring the extreme volatility, then Harmonic Volatility Indicator can do the same job without the developing period. Check the screenshot for your information. Harmonic Volatility indicator does not require any recalculating even when the new price bar is keep arriving. Therefore, they will not change during your intraday trading.

Another advanced setup might is that you can use Harmonic Volatility indicator together with Market Profile. So you have one with developing period and the other one without developing period. So there is some rooms for improving your market profile with our Harmonic Volatility Indicator. When I want to find revesal area, I found that combining two tools is much better than just using one tool.

If you want to dig deeper about the harmonic volatility indicator, do not forget to read this article as your first step:

https://algotradinginvestment.wordpress.com/2017/11/20/harmonic-volatility-line-indicator/

Harmonic Volatility Indicator is exclusively available on our website:

http://algotrading-investment.com/portfolio-item/double-harmonic-volatility-indicator/

https://www.mql5.com/en/market/product/23779

https://www.mql5.com/en/market/product/23769

Now I got many questions from traders, if they can have the Market Profile without developing period. What does it mean by developing period? It means that any Market Profile need to collect intra-market data to build up the statistics like Value area and control point, etc. As the market data arrive, the market profile algorithm will recalculate each statistics during developing period. Therefore, the value can continuously change. But the market profile is popular trading tools used by millions of traders. What can we do really?

If we are intra day trader, we have to use Market Profile while they are developing during intraday. As it gets developed, each statistics can be changed. Obviously many traders does not like this feature of the Market Profile. To avoid the developing period, you can probably use yesterday’s Market Profile but they are lagging. So if we prefer to have a faster signal, then we can not avoid this recalculating issues probably.

Depending on what is your purpose with Market Profile, there are some potential that harmonic volatility indicator can be used alternatively to Market Profile. For example, if your purpose of using Market Profile is monitoring the extreme volatility, then Harmonic Volatility Indicator can do the same job without the developing period. Check the screenshot for your information. Harmonic Volatility indicator does not require any recalculating even when the new price bar is keep arriving. Therefore, they will not change during your intraday trading.

Another advanced setup might is that you can use Harmonic Volatility indicator together with Market Profile. So you have one with developing period and the other one without developing period. So there is some rooms for improving your market profile with our Harmonic Volatility Indicator. When I want to find revesal area, I found that combining two tools is much better than just using one tool.

If you want to dig deeper about the harmonic volatility indicator, do not forget to read this article as your first step:

https://algotradinginvestment.wordpress.com/2017/11/20/harmonic-volatility-line-indicator/

Harmonic Volatility Indicator is exclusively available on our website:

http://algotrading-investment.com/portfolio-item/double-harmonic-volatility-indicator/

https://www.mql5.com/en/market/product/23779

https://www.mql5.com/en/market/product/23769

Young Ho Seo

Market Outlook 28 Jan 2018

Here are the summary of last week important data release.

•Germand: ZEW sentimanet: bettern than our expection

•Japanese Trade balance: still keeps the postive trade balance but they are getting smaller.

•German and French PMI: still over 50, looks ok though.

•USD Existing home sales: it looks ok but below the expected value

•Crude inventory level: reduced but not notable

•CAD retail sales: good

•USD unemployment claims: it is better than forecasitng but higher than previous month.

•USD advanced GDP: slight adjustment over the previous month. However, it was much lower than forecasting

http://algotrading-investment.com/

https://www.mql5.com/en/users/financeengineer/seller#products

Here are the summary of last week important data release.

•Germand: ZEW sentimanet: bettern than our expection

•Japanese Trade balance: still keeps the postive trade balance but they are getting smaller.

•German and French PMI: still over 50, looks ok though.

•USD Existing home sales: it looks ok but below the expected value

•Crude inventory level: reduced but not notable

•CAD retail sales: good

•USD unemployment claims: it is better than forecasitng but higher than previous month.

•USD advanced GDP: slight adjustment over the previous month. However, it was much lower than forecasting

http://algotrading-investment.com/

https://www.mql5.com/en/users/financeengineer/seller#products

Young Ho Seo

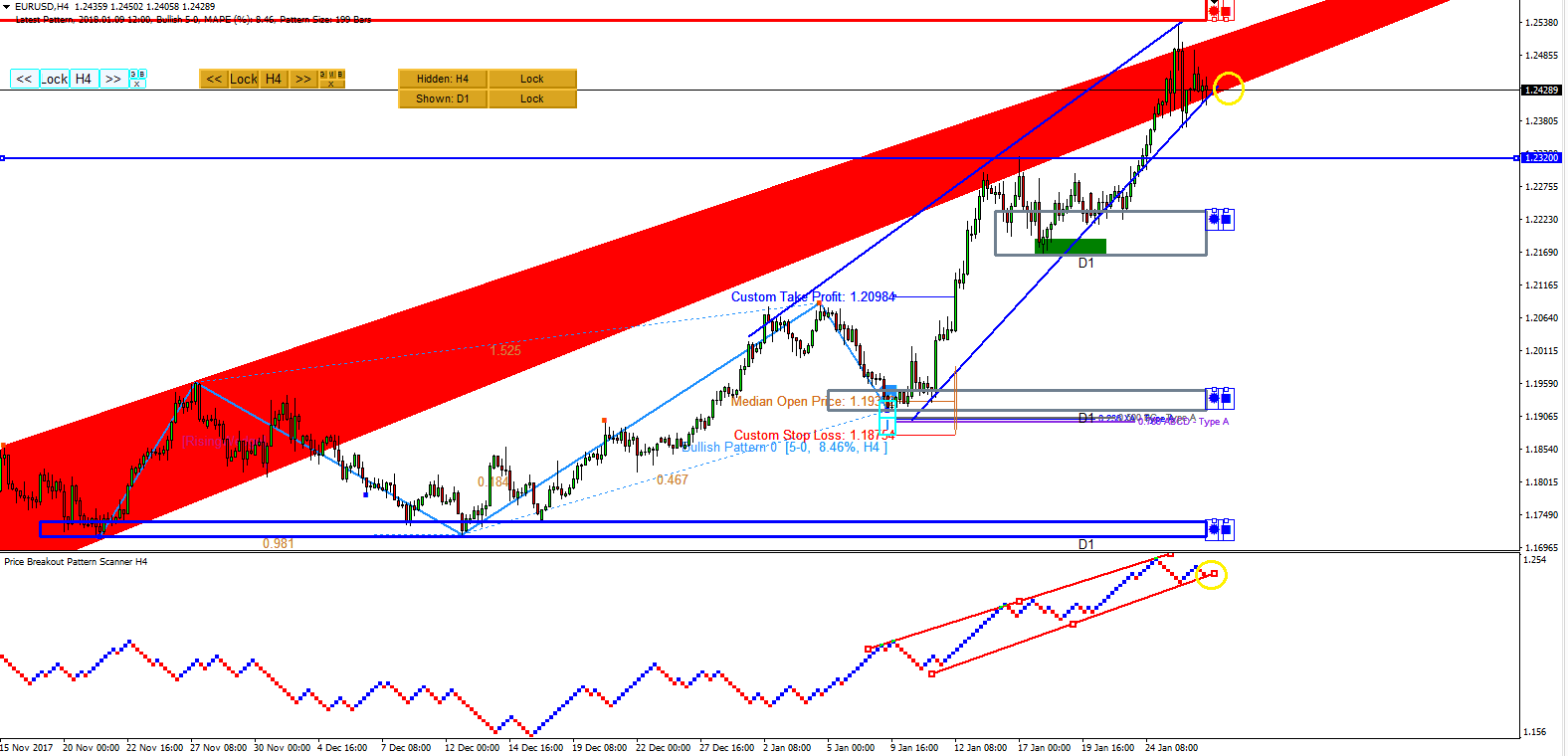

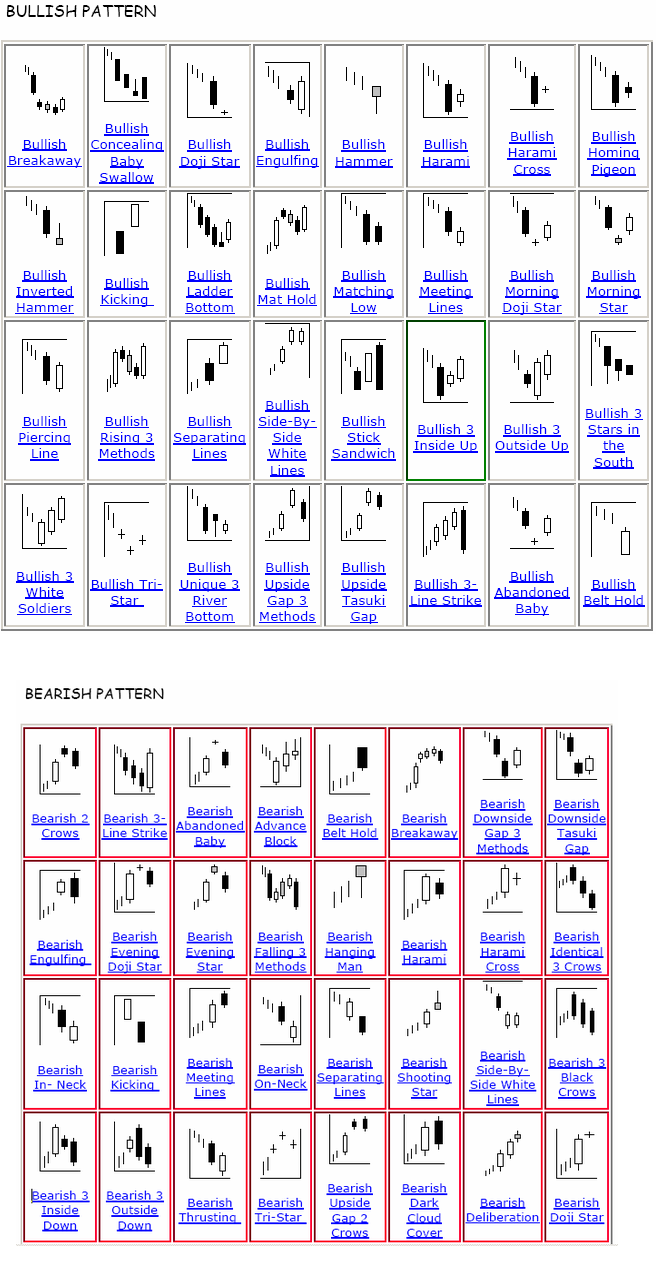

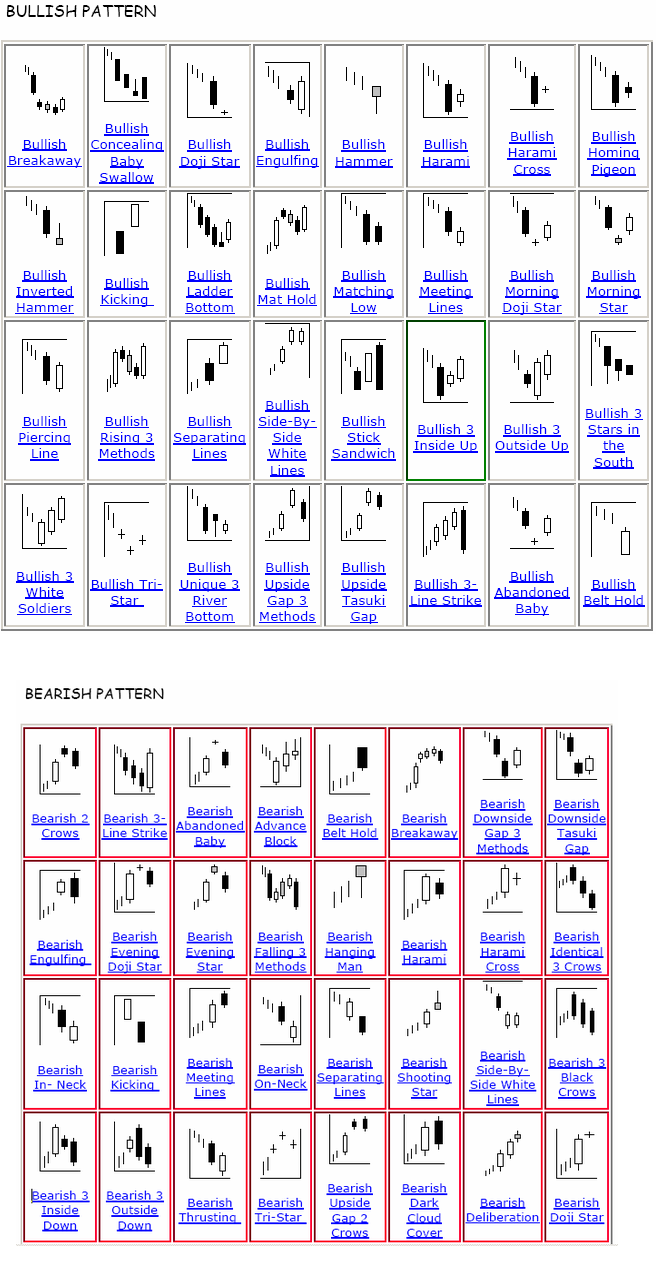

Candlestick Patterns Reference

Japanese candlestick pattern is a popular pattern analysis used by many traders. It provides visual insight for buying and selling momentum present in the market. Japanese candlestick pattern can provide both entry and exit signal for traders. At the same time, many traders use them as the confirmation techniques. Japanese candlestick patterns provide both trend continuation and trend reversal patterns. The main advantage of Japanese candlestick is that they are simple and universal. Japanese candlestick pattern can be detected visually without need of the sophisticated tool. At the same time, the accuracy of the Japanese candlestick can be quite subjective to traders. Unless you want to hold your trade for one bar or two bar only, sometime Japanese candlestick pattern can predict the direction wrong against long-term price movement. So the caution must be made to use together with other technical indicator or other pattern analysis. From my experience, Japanese candlestick has more values as the confirmation technique rather than main signal for your trading. However, how you want to trade is entirely up to you.

For your information our harmonic pattern plus and price breakout pattern scanner provide Japanese candle stick pattern recognition. Japanese candlestick pattern is some bonus trading system included in these powerful trading system.

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

http://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

https://www.mql5.com/en/market/product/4859

https://www.mql5.com/en/market/product/4858

http://algotrading-investment.com/portfolio-item/price-breakout-pattern-scanner/

Japanese candlestick pattern is a popular pattern analysis used by many traders. It provides visual insight for buying and selling momentum present in the market. Japanese candlestick pattern can provide both entry and exit signal for traders. At the same time, many traders use them as the confirmation techniques. Japanese candlestick patterns provide both trend continuation and trend reversal patterns. The main advantage of Japanese candlestick is that they are simple and universal. Japanese candlestick pattern can be detected visually without need of the sophisticated tool. At the same time, the accuracy of the Japanese candlestick can be quite subjective to traders. Unless you want to hold your trade for one bar or two bar only, sometime Japanese candlestick pattern can predict the direction wrong against long-term price movement. So the caution must be made to use together with other technical indicator or other pattern analysis. From my experience, Japanese candlestick has more values as the confirmation technique rather than main signal for your trading. However, how you want to trade is entirely up to you.

For your information our harmonic pattern plus and price breakout pattern scanner provide Japanese candle stick pattern recognition. Japanese candlestick pattern is some bonus trading system included in these powerful trading system.

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

http://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

https://www.mql5.com/en/market/product/4859

https://www.mql5.com/en/market/product/4858

http://algotrading-investment.com/portfolio-item/price-breakout-pattern-scanner/

Young Ho Seo

GBPUSD Market Outlook - 27 Jan 2018

In our EURUSD analysis, we have shown that EURUSD entered into bullish region. GBPUSD showed more or less same path. It seems GBP had even greater advantage over USD in comparing to EUR. In fact, GBPUSD made a two successive breakout through small (D1<H4 Price Breakout pattern scanner) and large rising wedges (D1<D1 Price Breakout pattern scanner). I think if GBPUSD is coming down, the top of wedge pattern will be very important support in the future. GBPUSD is also quite close to 1.4700 level the entry to the D1 supply zone. But this is still quite far away from now.

http://algotrading-investment.com/

https://www.mql5.com/en/users/financeengineer/seller#products

In our EURUSD analysis, we have shown that EURUSD entered into bullish region. GBPUSD showed more or less same path. It seems GBP had even greater advantage over USD in comparing to EUR. In fact, GBPUSD made a two successive breakout through small (D1<H4 Price Breakout pattern scanner) and large rising wedges (D1<D1 Price Breakout pattern scanner). I think if GBPUSD is coming down, the top of wedge pattern will be very important support in the future. GBPUSD is also quite close to 1.4700 level the entry to the D1 supply zone. But this is still quite far away from now.

http://algotrading-investment.com/

https://www.mql5.com/en/users/financeengineer/seller#products

Young Ho Seo

EURUSD Market Outlook 27 Jan 2018

Last week, USD was depreciated against all major currency pairs. Since EURUSD was penetrated the 3 year high, EURUSD made a strong bullish movement last few days. We have outlined several new support and resistance lines for your trading from the Smart Renko analysis in the screenshot. EURUSD have just touched the bottom of the support lines. The reaction around the support line should be watched carefully next week. Also remember that EURUSD is just 100 pips away from the daily supply zone though (H4<D1, Mean Reversion Supply Demand).

http://algotrading-investment.com/

https://www.mql5.com/en/users/financeengineer/seller#products

Last week, USD was depreciated against all major currency pairs. Since EURUSD was penetrated the 3 year high, EURUSD made a strong bullish movement last few days. We have outlined several new support and resistance lines for your trading from the Smart Renko analysis in the screenshot. EURUSD have just touched the bottom of the support lines. The reaction around the support line should be watched carefully next week. Also remember that EURUSD is just 100 pips away from the daily supply zone though (H4<D1, Mean Reversion Supply Demand).

http://algotrading-investment.com/

https://www.mql5.com/en/users/financeengineer/seller#products

Young Ho Seo

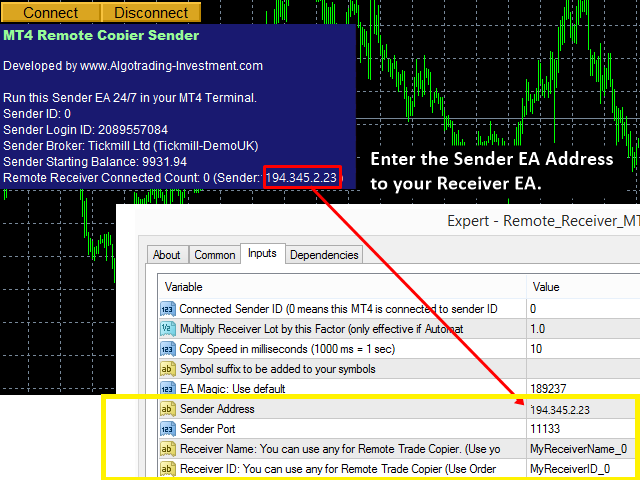

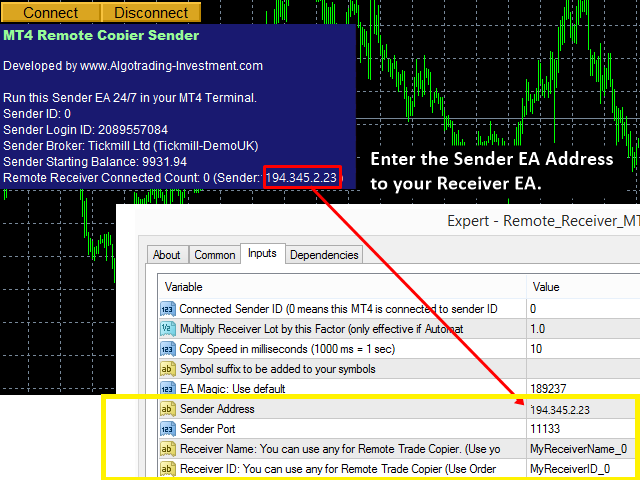

Complete Range of Trade Copier (Account Copier)

Besides the excellent trading system and strategy, we also provide the complete range of Trade (Account) Copier for your trading.

The Trade (Account) Copier include:

Firstly we have the local Trade Copier to copy your trades from one MetaTrader terminal to another MetaTrader terminal in the same computer.

MT4 to MT4 Account (Trade) Copier

http://algotrading-investment.com/portfolio-item/account-copier-mt4-to-mt4/

MT4 to MT5 Hedge Account (Trade) Copier

http://algotrading-investment.com/portfolio-item/account-copier-mt4-mt5-hedge/

MT5 to MT4 Hedge Account (Trade) Copier

http://algotrading-investment.com/portfolio-item/account-copier-mt5-hedge-mt4/

MT5 to MT4 Net Account (Trade) Copier

http://algotrading-investment.com/portfolio-item/account-copier-mt5-net-mt4/

Secondly we also offer the Remote Trade Copier to copy your trades from one MetaTrader terminal to another MetaTrader terminal in the different computer.

MT4 to MT4 Remote Trade Copier

http://algotrading-investment.com/portfolio-item/remote-trade-copier-mt4-mt4/

Our Trade (Account) copier provide the competitive price but many powerful feature. Especially our remote trade copier provide the faster copying operation in comparing to the classic remote trade copier using http and ftp technology.

All these Account copying solution can be found in one website:

http://algotrading-investment.com

Besides the excellent trading system and strategy, we also provide the complete range of Trade (Account) Copier for your trading.

The Trade (Account) Copier include:

Firstly we have the local Trade Copier to copy your trades from one MetaTrader terminal to another MetaTrader terminal in the same computer.

MT4 to MT4 Account (Trade) Copier

http://algotrading-investment.com/portfolio-item/account-copier-mt4-to-mt4/

MT4 to MT5 Hedge Account (Trade) Copier

http://algotrading-investment.com/portfolio-item/account-copier-mt4-mt5-hedge/

MT5 to MT4 Hedge Account (Trade) Copier

http://algotrading-investment.com/portfolio-item/account-copier-mt5-hedge-mt4/

MT5 to MT4 Net Account (Trade) Copier

http://algotrading-investment.com/portfolio-item/account-copier-mt5-net-mt4/

Secondly we also offer the Remote Trade Copier to copy your trades from one MetaTrader terminal to another MetaTrader terminal in the different computer.

MT4 to MT4 Remote Trade Copier

http://algotrading-investment.com/portfolio-item/remote-trade-copier-mt4-mt4/

Our Trade (Account) copier provide the competitive price but many powerful feature. Especially our remote trade copier provide the faster copying operation in comparing to the classic remote trade copier using http and ftp technology.

All these Account copying solution can be found in one website:

http://algotrading-investment.com

Young Ho Seo

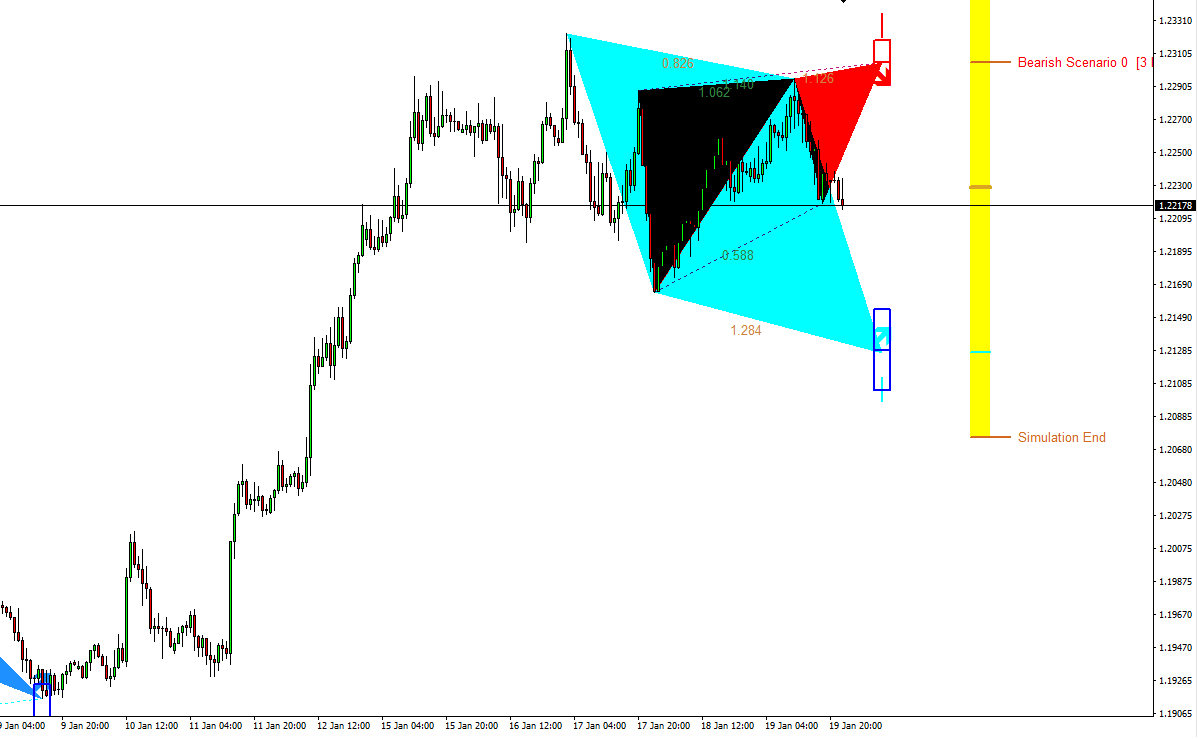

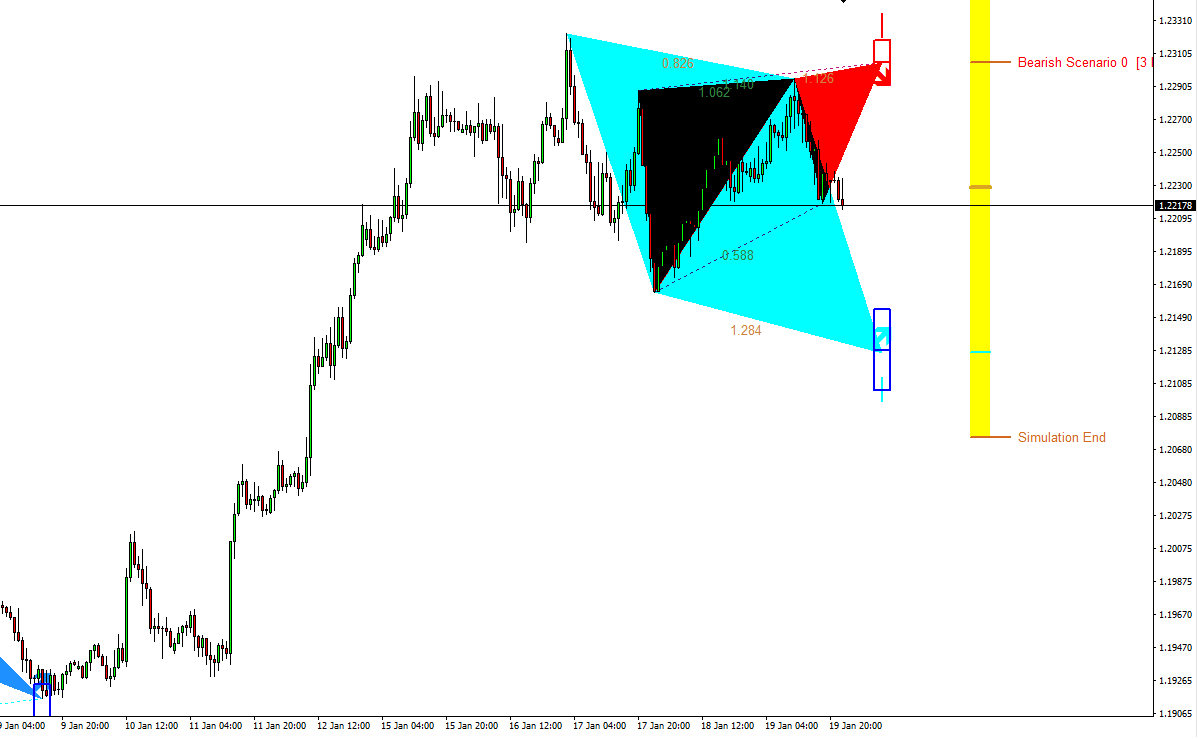

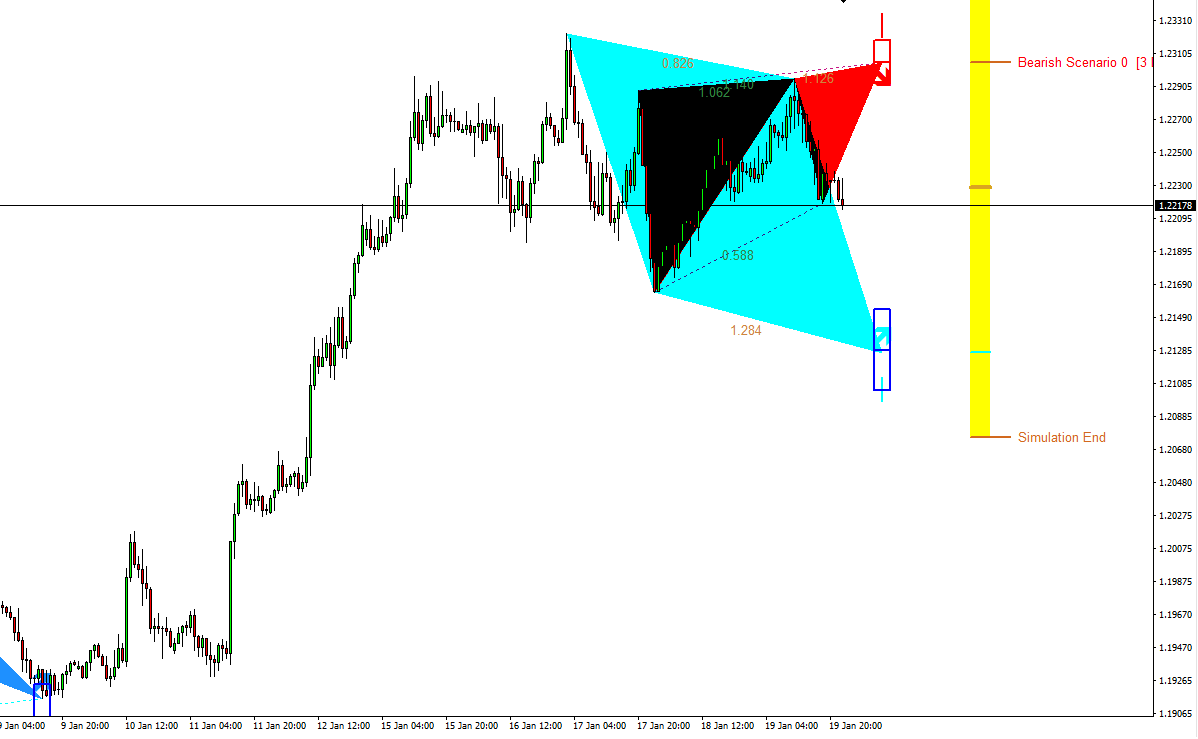

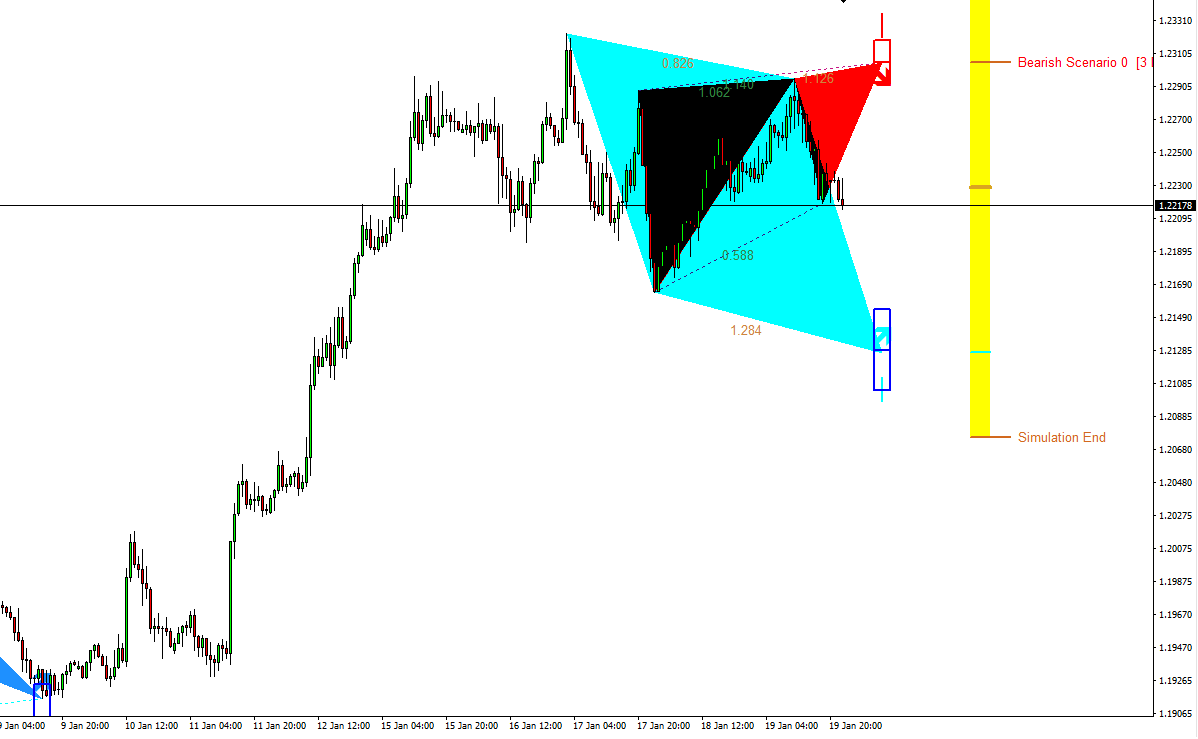

Scan and search future harmonic patterns with Harmonic Pattern Scenario Planner

Harmonic Pattern Scenario Planner is a tool you can scan and search future harmonic patterns in just one button click. It would detect any potential future harmonic patterns in your search range. You can even get the potential take profit and stop loss of the future patterns even before they form. What is even more, you can use all the features and functionality of harmonic pattern plus from your harmonic pattern scenario planner too. Harmonic Pattern Scenario Planner is also compatible with our Harmonic Pattern Order EA.

Have watched this interesting movie called “Next” ? Check out the guy can see the few minutes into the futures. How powerful the 2 minutes vision for future is. Predicting future is very tactical game but it is hard because future keep changing based on the presents. However, it is definitely an interesting game.

http://www.imdb.com/title/tt0435705/

We are only one selling the future predictive harmonic pattern scanner.

http://algotrading-investment.com/portfolio-item/harmonic-pattern-scenario-planner/

https://www.mql5.com/en/users/financeengineer/seller#products

Harmonic Pattern Scenario Planner is a tool you can scan and search future harmonic patterns in just one button click. It would detect any potential future harmonic patterns in your search range. You can even get the potential take profit and stop loss of the future patterns even before they form. What is even more, you can use all the features and functionality of harmonic pattern plus from your harmonic pattern scenario planner too. Harmonic Pattern Scenario Planner is also compatible with our Harmonic Pattern Order EA.

Have watched this interesting movie called “Next” ? Check out the guy can see the few minutes into the futures. How powerful the 2 minutes vision for future is. Predicting future is very tactical game but it is hard because future keep changing based on the presents. However, it is definitely an interesting game.

http://www.imdb.com/title/tt0435705/

We are only one selling the future predictive harmonic pattern scanner.

http://algotrading-investment.com/portfolio-item/harmonic-pattern-scenario-planner/

https://www.mql5.com/en/users/financeengineer/seller#products

Young Ho Seo

Scan and search future harmonic patterns with Harmonic Pattern Scenario Planner

Harmonic Pattern Scenario Planner is a tool you can scan and search future harmonic patterns in just one button click. It would detect any potential future harmonic patterns in your search range. You can even get the potential take profit and stop loss of the future patterns even before they form. What is even more, you can use all the features and functionality of harmonic pattern plus from your harmonic pattern scenario planner too. Harmonic Pattern Scenario Planner is also compatible with our Harmonic Pattern Order EA.

Have watched this interesting movie called “Next” ? Check out the guy can see the few minutes into the futures. How powerful the 2 minutes vision for future is. Predicting future is very tactical game but it is hard because future keep changing based on the presents. However, it is definitely an interesting game.

http://www.imdb.com/title/tt0435705/

We are only one selling the future predictive harmonic pattern scanner.

http://algotrading-investment.com/portfolio-item/harmonic-pattern-scenario-planner/

https://www.mql5.com/en/users/financeengineer/seller#products

Harmonic Pattern Scenario Planner is a tool you can scan and search future harmonic patterns in just one button click. It would detect any potential future harmonic patterns in your search range. You can even get the potential take profit and stop loss of the future patterns even before they form. What is even more, you can use all the features and functionality of harmonic pattern plus from your harmonic pattern scenario planner too. Harmonic Pattern Scenario Planner is also compatible with our Harmonic Pattern Order EA.

Have watched this interesting movie called “Next” ? Check out the guy can see the few minutes into the futures. How powerful the 2 minutes vision for future is. Predicting future is very tactical game but it is hard because future keep changing based on the presents. However, it is definitely an interesting game.

http://www.imdb.com/title/tt0435705/

We are only one selling the future predictive harmonic pattern scanner.

http://algotrading-investment.com/portfolio-item/harmonic-pattern-scenario-planner/

https://www.mql5.com/en/users/financeengineer/seller#products

Young Ho Seo

EURUSD Market Outlook 26 Jan 2018

USD is weak against all major currency pairs. So EUR is appreciated relative high against USD. By looking at the smart renko and price breakout pattern scanner, I was able to draw some sensible support and resistance around the current EURUSD price. Especially the resistance line get connected to the daily supply zone. Watch out the new support line during the potential correction.

http://algotrading-investment.com/

https://www.mql5.com/en/users/financeengineer/seller#products

USD is weak against all major currency pairs. So EUR is appreciated relative high against USD. By looking at the smart renko and price breakout pattern scanner, I was able to draw some sensible support and resistance around the current EURUSD price. Especially the resistance line get connected to the daily supply zone. Watch out the new support line during the potential correction.

http://algotrading-investment.com/

https://www.mql5.com/en/users/financeengineer/seller#products

Young Ho Seo

EURUSD Market Outlook 2 -25 Jan 2018

Wow, that was interesting movement from EURUSD today. EURUSD went straight through the top of the wedge from its bottom (H4, Price Breakout Pattern Scanner). Then it looked like heading to the one of the daily Supply zone. I am not sure how many years ago the zone was formed (H4<D1 Mean Reversion Supply Demand). I have to check later from daily chart though. However, EURUSD did not have a momentum to touch the daily supply zone yet. Instead, EURUSD made a fast correction to the bottom of the wedge. Currently EURUSD is showing some alternating move inside the wedge. Guess a lot of energy was dissipated today.

https://www.mql5.com/en/users/financeengineer/seller#products

http://algotrading-investment.com/

Wow, that was interesting movement from EURUSD today. EURUSD went straight through the top of the wedge from its bottom (H4, Price Breakout Pattern Scanner). Then it looked like heading to the one of the daily Supply zone. I am not sure how many years ago the zone was formed (H4<D1 Mean Reversion Supply Demand). I have to check later from daily chart though. However, EURUSD did not have a momentum to touch the daily supply zone yet. Instead, EURUSD made a fast correction to the bottom of the wedge. Currently EURUSD is showing some alternating move inside the wedge. Guess a lot of energy was dissipated today.

https://www.mql5.com/en/users/financeengineer/seller#products

http://algotrading-investment.com/

Young Ho Seo

Mean Reversion Supply Demand Multiple TimeFrame analysis

Mean Reversion Supply Demand have a powerful multiple timeframe analysis features in it. It means that you can layout the demand and supply zones from several different timeframe in one single chart. This is very powerful because you can see the confirmation of your trading zones over several timeframe. For example, you can see the demand zone double confirmed from H1 and H4 timeframe in the screenshots.

http://algotrading-investment.com/portfolio-item/mean-reversion-supply-demand/

https://www.mql5.com/en/market/product/16851

https://www.mql5.com/en/market/product/16823

Mean Reversion Supply Demand have a powerful multiple timeframe analysis features in it. It means that you can layout the demand and supply zones from several different timeframe in one single chart. This is very powerful because you can see the confirmation of your trading zones over several timeframe. For example, you can see the demand zone double confirmed from H1 and H4 timeframe in the screenshots.

http://algotrading-investment.com/portfolio-item/mean-reversion-supply-demand/

https://www.mql5.com/en/market/product/16851

https://www.mql5.com/en/market/product/16823

Young Ho Seo

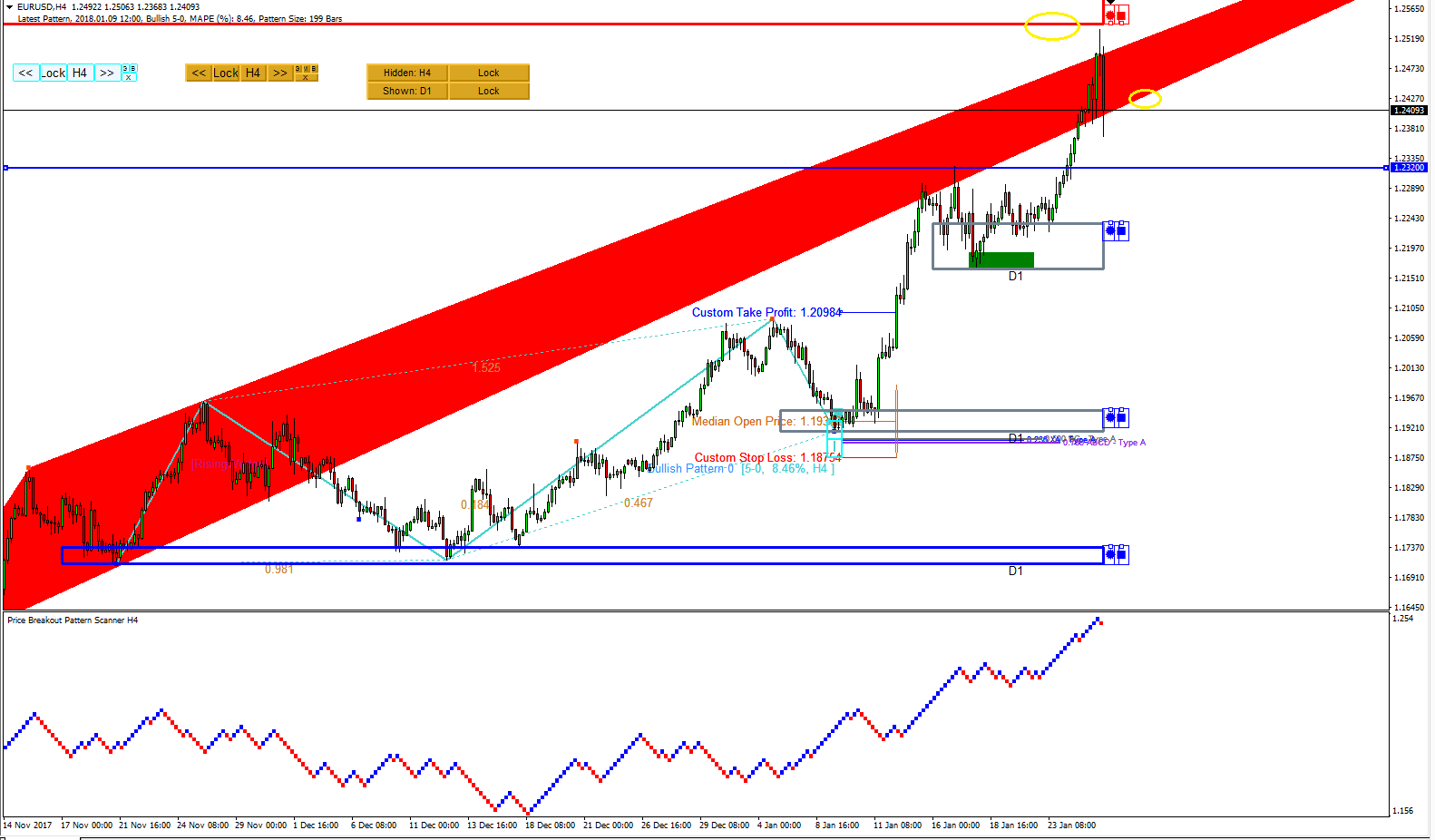

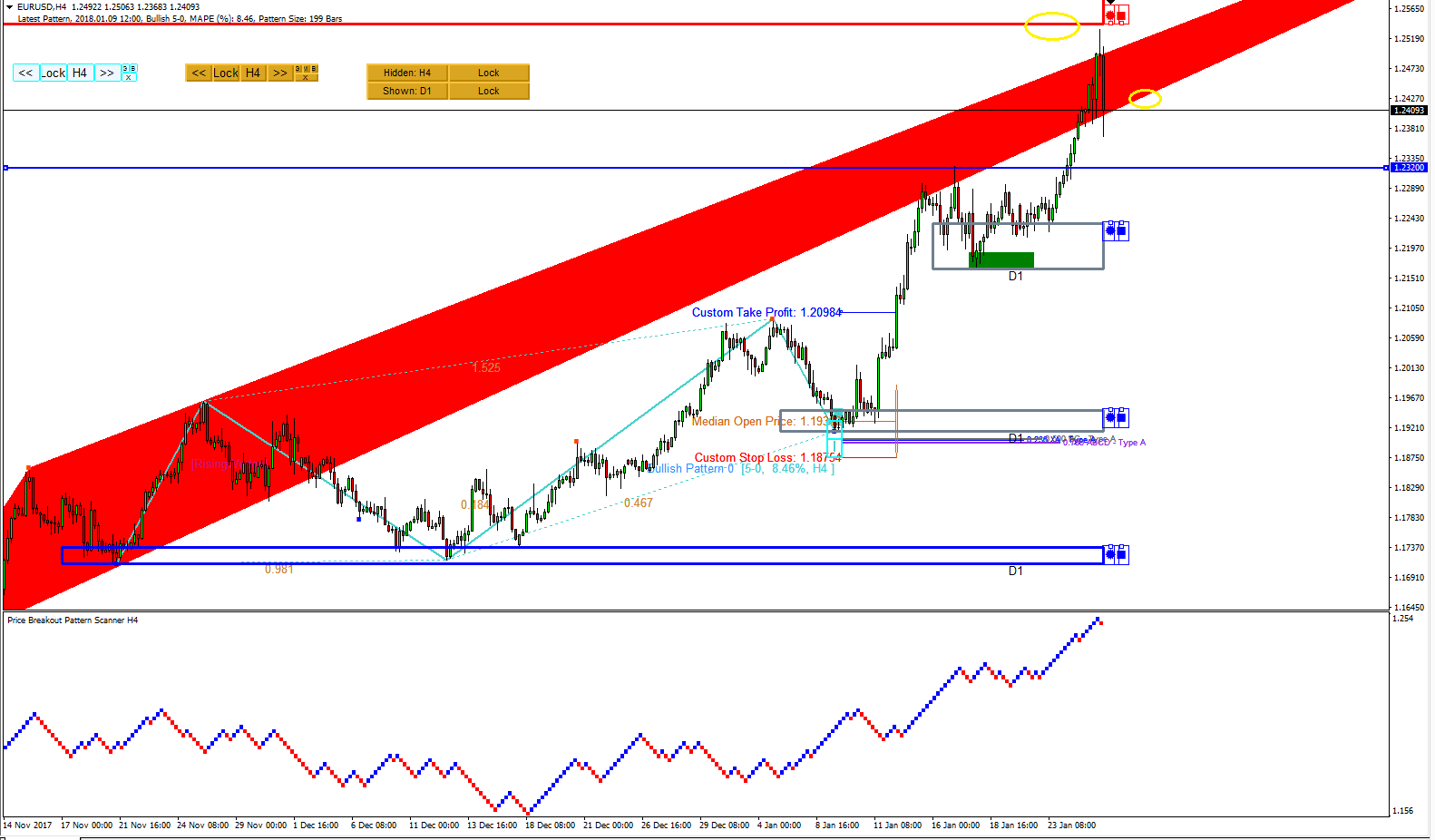

EURUSD Market Outlook 25 Jan 2018

EURUSD entered into bullish region breaking the last 3 years high. Now, it is making small correction during the Asian session. For your trading, we recommend to watch these three levels in the near future for now. Please check the screenshot. The analysis was generated in the combination of price breakout patterns scanner, harmonic pattern plus, Mean reversion supply demand. Watch out that we have set daily demand zone here.

http://algotrading-investment.com/

https://www.mql5.com/en/users/financeengineer/seller#products

EURUSD entered into bullish region breaking the last 3 years high. Now, it is making small correction during the Asian session. For your trading, we recommend to watch these three levels in the near future for now. Please check the screenshot. The analysis was generated in the combination of price breakout patterns scanner, harmonic pattern plus, Mean reversion supply demand. Watch out that we have set daily demand zone here.

http://algotrading-investment.com/

https://www.mql5.com/en/users/financeengineer/seller#products

Young Ho Seo

EURUSD Market outlook 5 - 24 Jan 2018

Well, we have already posted several posts about EURUSD market outlook today. EURUSD have gained 100 pips today. 3 years high is broken. EURUSD entered to the bullish region again.

http://algotrading-investment.com/

https://www.mql5.com/en/users/financeengineer/seller#products

Well, we have already posted several posts about EURUSD market outlook today. EURUSD have gained 100 pips today. 3 years high is broken. EURUSD entered to the bullish region again.

http://algotrading-investment.com/

https://www.mql5.com/en/users/financeengineer/seller#products

Young Ho Seo

EURUSD Market Outlook 3- 24 Jan 2018

EURUSD broke the 1.2320 level once again. It made around 60 pips up from 1.2320 level at the moment. Now EURUSD is testing the wedge again the wedge again (H4, Price Breakout Pattern scanner). USD is weak against all major currency pairs.

http://algotrading-investment.com/

https://www.mql5.com/en/users/financeengineer/seller#products

EURUSD broke the 1.2320 level once again. It made around 60 pips up from 1.2320 level at the moment. Now EURUSD is testing the wedge again the wedge again (H4, Price Breakout Pattern scanner). USD is weak against all major currency pairs.

http://algotrading-investment.com/

https://www.mql5.com/en/users/financeengineer/seller#products

: