Claws and Horns / Profilo

Claws and Horns

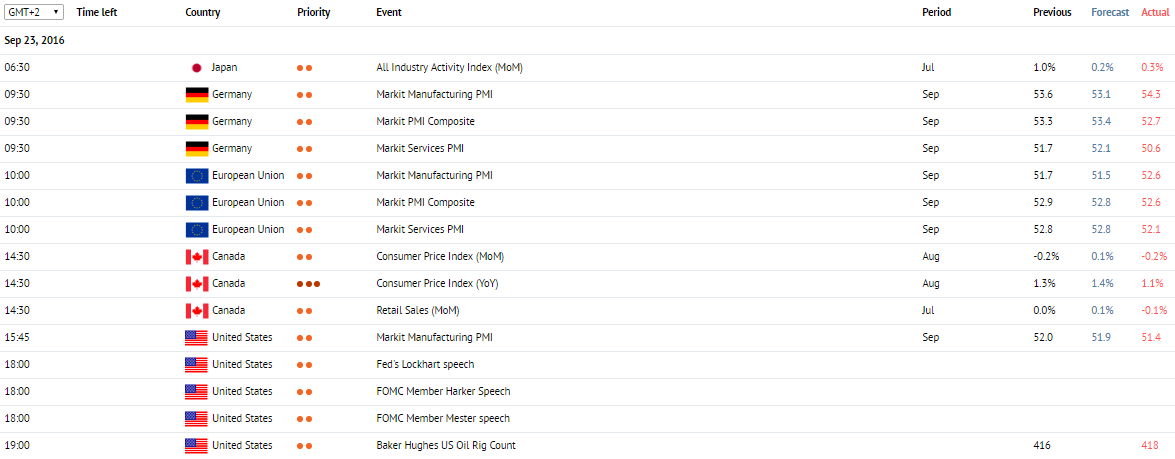

News of the day. 23.09.2016

All Industry Activity Index. Japan, 6:30 am

Data on the All Industry Activity Index for July is due at 6:30 am (GMT+2). On a month-to-month basis, the index is expected to fall from 1.0% to 0.2%. The index represents expenditures of large manufacturers in all sectors excluding the financial one. The index is considered a leading indicator of productivity growth. Generally, an increase in the index strengthens the JPY, while a fall weakens the JPY.

Markit Services PMI. Germany, 9:30 am

Data on the Markit Services PMI is due at 9:30 am (GMT+2). On a month-to-month basis, the index is expected to grow from 51.7 to 52.0 points. The index evaluates the state of the services sector. Is based on surveys of executives of German companies operating in the services sector regarding their opinion on current economic conditions in the sector. A reading above 50 is perceived as positive and strengthens the EUR. A reading below 50 is perceived as negative and weakens the EUR.

Markit Services PMI. EU, 10:00 am

Data on the Markit Services PMI is due at 10:00 am (GMT+2). In September, the index is forecasted to remain unchanged at 52.8 points. The index represents current economic conditions in the sector and its future prospects. A reading above 50 is perceived positive and strengthens the EUR. A reading below 50, on the contrary, is perceived negative and weakens the EUR.

Retail Sales. Canada, 2:30 pm

Data on Retail Sales for July is due at 2:30 pm (GMT+2). On a month-to-month basis, the index is expected to grow from -0.1% to 0.1%. Represents the change in the volume of retail sales. A growth in the index is positive for the national economy and strengthens the CAD. A fall in the index weakens the CAD.

Consumer Price Index. Canada, 2:30 pm

Data on the Consumer Price Index for July is due at 2:30 pm (GMT+2). On a year-over-year basis, the index is expected to increase from 1.3% to 1.4%. Represents the change in the price for the basket of goods and services. High values can lead to an increase in interest rates. A growth in the index strengthens the CAD. A fall in the index weakens the CAD.

Markit Manufacturing PMI. US, 3:45 pm

Data on the Markit Manufacturing PMI for September is due at 3:45 pm (GMT+2). On a month-to-month basis, the index is expected to fall from 52.0 to 51.9 points. The index represents current economic conditions in the manufacturing sector and its future prospects. A reading above 50 is perceived as positive and strengthens the USD. A reading below 50 is perceived as negative and weakens the USD.

All Industry Activity Index. Japan, 6:30 am

Data on the All Industry Activity Index for July is due at 6:30 am (GMT+2). On a month-to-month basis, the index is expected to fall from 1.0% to 0.2%. The index represents expenditures of large manufacturers in all sectors excluding the financial one. The index is considered a leading indicator of productivity growth. Generally, an increase in the index strengthens the JPY, while a fall weakens the JPY.

Markit Services PMI. Germany, 9:30 am

Data on the Markit Services PMI is due at 9:30 am (GMT+2). On a month-to-month basis, the index is expected to grow from 51.7 to 52.0 points. The index evaluates the state of the services sector. Is based on surveys of executives of German companies operating in the services sector regarding their opinion on current economic conditions in the sector. A reading above 50 is perceived as positive and strengthens the EUR. A reading below 50 is perceived as negative and weakens the EUR.

Markit Services PMI. EU, 10:00 am

Data on the Markit Services PMI is due at 10:00 am (GMT+2). In September, the index is forecasted to remain unchanged at 52.8 points. The index represents current economic conditions in the sector and its future prospects. A reading above 50 is perceived positive and strengthens the EUR. A reading below 50, on the contrary, is perceived negative and weakens the EUR.

Retail Sales. Canada, 2:30 pm

Data on Retail Sales for July is due at 2:30 pm (GMT+2). On a month-to-month basis, the index is expected to grow from -0.1% to 0.1%. Represents the change in the volume of retail sales. A growth in the index is positive for the national economy and strengthens the CAD. A fall in the index weakens the CAD.

Consumer Price Index. Canada, 2:30 pm

Data on the Consumer Price Index for July is due at 2:30 pm (GMT+2). On a year-over-year basis, the index is expected to increase from 1.3% to 1.4%. Represents the change in the price for the basket of goods and services. High values can lead to an increase in interest rates. A growth in the index strengthens the CAD. A fall in the index weakens the CAD.

Markit Manufacturing PMI. US, 3:45 pm

Data on the Markit Manufacturing PMI for September is due at 3:45 pm (GMT+2). On a month-to-month basis, the index is expected to fall from 52.0 to 51.9 points. The index represents current economic conditions in the manufacturing sector and its future prospects. A reading above 50 is perceived as positive and strengthens the USD. A reading below 50 is perceived as negative and weakens the USD.

Claws and Horns

News of the day. 22.09.2016

Economic Bulletin. EU, 10:00 am

The Economic Bulletin is released at 10:00 am (GMT+2). The publication takes place two weeks after the Governing Council meeting and provides an overview of the state of the economy in the region. It contains data on a series of macroeconomic indicators as well as commentaries regarding current economic conditions and monetary policy.

Initial Jobless Claims. US, 12:30 pm

Data on the Initial Jobless Claims is due in the US at 12:30 pm (GMT+2).The number of new unemployment claims is expected to increase from 260 000 to 262 000. The indicator is published weekly on Thursdays and allows approximating what the Nonfarm Payrolls will be. A fall in the index strengthens the USD. A growth in the index weakens the USD.

Housing Price Index. US, 3:00 pm

The Housing Price Index for July is due in the US at 3:00 pm (GMT+2). The index represents property prices dynamics. A high reading strengthens the USD. A low reading weakens the USD.

ECB President Draghi's Speech. EU, 3:00 pm

At 3:00 pm (GMT+2), ECB President Mario Draghi is giving commentaries regarding current economic conditions in the eurozone. Positive commentaries can strengthen the EUR; negative commentaries can pressure the EUR.

Economic Bulletin. EU, 10:00 am

The Economic Bulletin is released at 10:00 am (GMT+2). The publication takes place two weeks after the Governing Council meeting and provides an overview of the state of the economy in the region. It contains data on a series of macroeconomic indicators as well as commentaries regarding current economic conditions and monetary policy.

Initial Jobless Claims. US, 12:30 pm

Data on the Initial Jobless Claims is due in the US at 12:30 pm (GMT+2).The number of new unemployment claims is expected to increase from 260 000 to 262 000. The indicator is published weekly on Thursdays and allows approximating what the Nonfarm Payrolls will be. A fall in the index strengthens the USD. A growth in the index weakens the USD.

Housing Price Index. US, 3:00 pm

The Housing Price Index for July is due in the US at 3:00 pm (GMT+2). The index represents property prices dynamics. A high reading strengthens the USD. A low reading weakens the USD.

ECB President Draghi's Speech. EU, 3:00 pm

At 3:00 pm (GMT+2), ECB President Mario Draghi is giving commentaries regarding current economic conditions in the eurozone. Positive commentaries can strengthen the EUR; negative commentaries can pressure the EUR.

Claws and Horns

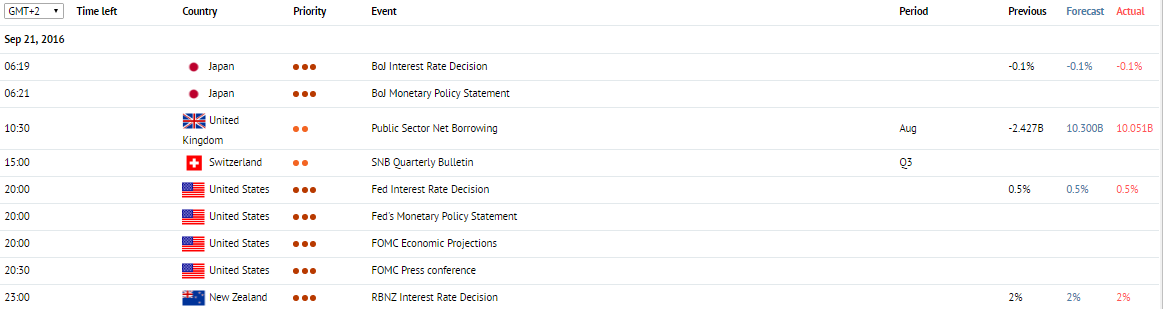

News of the day. 21.09.2016

BoJ Monetary Policy Statement. Japan, 5:00 am

The Bank of Japan releases its Monetary Policy Statement at 5:00 am (GMT+2). During a press conference, voting results regarding the recent interest rate decision as well as factors which influenced this decision are announced.

BoJ Interest Rate Decision Japan, 5:00 am

The Bank of Japan announces its decision on interest rates at 5:00 am (GMT+2). A rate increase strengthens the JPY; a rate cut weakens the JPY.

Public Sector Net Borrowing. UK, 10:30 am

Data on the Public Sector Net Borrowing for August is due in the UK at 10:30 am (GMT+2). The indicator is expected to grow from -1.472 billion to 10.3 billion pounds. The index represents the government debt. Positive values indicate a budget deficit and weaken the GBP. Negative values denote a budget surplus and strengthen the GBP.

SNB Quarterly Bulletin. Switzerland, 3:00 pm

The Swiss National Bank releases its Quarterly Bulletin at 3:00 pm (GMT+2). The bulletin contains information about monetary policy and current economic conditions.

Fed Interest Rate Decision. US, 8:00 pm

The Federal Reserve announces its decision on interest rates at 8:00 pm (GMT+2). The indicator is expected to remain unchanged at 0.5%. It is an important economic event. The interest rate has an impact on commercial banks’ interest rates and the USD exchange rate. A rate increase strengthens the USD; a rate cut weakens the USD.

Fed's Monetary Policy Statement and Press Conference. US, 8:30 pm

At 8:30 pm (GMT+2), after the interest rate decision is announced, the Fed Chair Janet Yellen answers questions regarding the current economic situation in the country. Generally, her commentaries have a strong impact on markets and can either strengthen or weaken the USD.

RBNZ Interest Rate Decision. New Zealand, 11:00 pm

The Reserve Bank of New Zealand announces its decision on interest rates at 11:00 pm (GMT+2). The indicator is expected to remain unchanged at 2%. A rate increase strengthens the NZD; a rate cut weakens the NZD.

BoJ Monetary Policy Statement. Japan, 5:00 am

The Bank of Japan releases its Monetary Policy Statement at 5:00 am (GMT+2). During a press conference, voting results regarding the recent interest rate decision as well as factors which influenced this decision are announced.

BoJ Interest Rate Decision Japan, 5:00 am

The Bank of Japan announces its decision on interest rates at 5:00 am (GMT+2). A rate increase strengthens the JPY; a rate cut weakens the JPY.

Public Sector Net Borrowing. UK, 10:30 am

Data on the Public Sector Net Borrowing for August is due in the UK at 10:30 am (GMT+2). The indicator is expected to grow from -1.472 billion to 10.3 billion pounds. The index represents the government debt. Positive values indicate a budget deficit and weaken the GBP. Negative values denote a budget surplus and strengthen the GBP.

SNB Quarterly Bulletin. Switzerland, 3:00 pm

The Swiss National Bank releases its Quarterly Bulletin at 3:00 pm (GMT+2). The bulletin contains information about monetary policy and current economic conditions.

Fed Interest Rate Decision. US, 8:00 pm

The Federal Reserve announces its decision on interest rates at 8:00 pm (GMT+2). The indicator is expected to remain unchanged at 0.5%. It is an important economic event. The interest rate has an impact on commercial banks’ interest rates and the USD exchange rate. A rate increase strengthens the USD; a rate cut weakens the USD.

Fed's Monetary Policy Statement and Press Conference. US, 8:30 pm

At 8:30 pm (GMT+2), after the interest rate decision is announced, the Fed Chair Janet Yellen answers questions regarding the current economic situation in the country. Generally, her commentaries have a strong impact on markets and can either strengthen or weaken the USD.

RBNZ Interest Rate Decision. New Zealand, 11:00 pm

The Reserve Bank of New Zealand announces its decision on interest rates at 11:00 pm (GMT+2). The indicator is expected to remain unchanged at 2%. A rate increase strengthens the NZD; a rate cut weakens the NZD.

Claws and Horns

News of the day. 20.09.2016

House Price Index. Australia, 3:30 am

The House Price Index for the second quarter is due in Australia at 3:30 am (GMT+2). The index represents the change in property prices. A growth in the indicator strengthens the AUD. A fall in the indicator weakens the AUD.

RBA Meeting's Minutes. Australia, 3:30 am

The Reserve Bank of Australia releases Minutes from the latest monetary policy meeting at 3:30 am (GMT+2). Minutes are released two weeks after each meeting. The publication contains commentaries regarding the most recent decisions as well as information about the votes of each individual member of the Board.

Producer Price Index. Germany, 8:00 am

The Producer Price Index for August is due in Germany at 8:00 am (GMT+2). The indicator is expected to be up from -2.0% to -1.5% on a year-on-year basis. The index represents the change in wholesale prices from producers. A growth in the index strengthens the EUR. A fall in the index weakens the EUR.

Housing Starts. US, 2:30 pm

Data on the Housing Starts for August is due in the US at 2:30 pm (GMT+2). The indicator is expected to fall from 1.211 to 1.200 million in monthly terms. The number of new building starts. A high reading strengthens the USD. A low reading weakens the USD.

House Price Index. Australia, 3:30 am

The House Price Index for the second quarter is due in Australia at 3:30 am (GMT+2). The index represents the change in property prices. A growth in the indicator strengthens the AUD. A fall in the indicator weakens the AUD.

RBA Meeting's Minutes. Australia, 3:30 am

The Reserve Bank of Australia releases Minutes from the latest monetary policy meeting at 3:30 am (GMT+2). Minutes are released two weeks after each meeting. The publication contains commentaries regarding the most recent decisions as well as information about the votes of each individual member of the Board.

Producer Price Index. Germany, 8:00 am

The Producer Price Index for August is due in Germany at 8:00 am (GMT+2). The indicator is expected to be up from -2.0% to -1.5% on a year-on-year basis. The index represents the change in wholesale prices from producers. A growth in the index strengthens the EUR. A fall in the index weakens the EUR.

Housing Starts. US, 2:30 pm

Data on the Housing Starts for August is due in the US at 2:30 pm (GMT+2). The indicator is expected to fall from 1.211 to 1.200 million in monthly terms. The number of new building starts. A high reading strengthens the USD. A low reading weakens the USD.

Claws and Horns

News of the day. 19.09.2016

Westpac consumer survey. New Zealand, 0:00 am

The Westpac consumer survey for September is released in New Zealand at 0:00 am (GMT+2). The indicator is based on survey responses from consumers regarding their assessment of current economic conditions and a short-term outlook for the economy. A growth in the indicator strengthens the NZD. A fall in the indicator weakens the NZD.

NAHB Housing Market Index. US, 4:00 pm

The NAHB Housing Market Index for September is due in the US at 4:00 pm (GMT+2). The indicator is expected to remain unchanged at 60 points from the previous month. The index is based on surveys of homeowners aimed at estimating the current value of their property and its further price dynamics for the next 6 months. A value above 50 represents favorable situation on the property market as respondents find house prices acceptable.

Westpac consumer survey. New Zealand, 0:00 am

The Westpac consumer survey for September is released in New Zealand at 0:00 am (GMT+2). The indicator is based on survey responses from consumers regarding their assessment of current economic conditions and a short-term outlook for the economy. A growth in the indicator strengthens the NZD. A fall in the indicator weakens the NZD.

NAHB Housing Market Index. US, 4:00 pm

The NAHB Housing Market Index for September is due in the US at 4:00 pm (GMT+2). The indicator is expected to remain unchanged at 60 points from the previous month. The index is based on surveys of homeowners aimed at estimating the current value of their property and its further price dynamics for the next 6 months. A value above 50 represents favorable situation on the property market as respondents find house prices acceptable.

Claws and Horns

News of the day. 16.09.2016

Labour Cost. EU, 11:00 am

Data on the Labour Cost in the eurozone for the second quarter is due at 11:00 am (GMT+2). The index represents the change in the cost of labour. A growth in the index may warn of a possible price increase for goods and services.

Consumer Price index. US, 2:30 pm

The Consumer Price index for August is due in the US at 2:30 pm (GMT+2). The indicator is expected to grow from 0.8% to 1.0% in annual terms and from 0.0% to 0.1% in monthly terms. The key indicator of inflation in the country. Represents the change in the value of the basket of goods and services. A positive reading strengthens the USD. A negative reading weakens the USD.

Reuters/Michigan Consumer Sentiment Index. US, 4:00 pm

The Reuters/Michigan Consumer Sentiment Index for September is due in the US at 4:00 pm (GMT+2). The indicator is expected to grow from 89.8 to 90.8 points. The index is calculated by experts from Reuters and Michigan University. Represents readiness of consumers to spend money in current economic conditions. A high reading strengthens the USD. A low reading weakens the USD.

Labour Cost. EU, 11:00 am

Data on the Labour Cost in the eurozone for the second quarter is due at 11:00 am (GMT+2). The index represents the change in the cost of labour. A growth in the index may warn of a possible price increase for goods and services.

Consumer Price index. US, 2:30 pm

The Consumer Price index for August is due in the US at 2:30 pm (GMT+2). The indicator is expected to grow from 0.8% to 1.0% in annual terms and from 0.0% to 0.1% in monthly terms. The key indicator of inflation in the country. Represents the change in the value of the basket of goods and services. A positive reading strengthens the USD. A negative reading weakens the USD.

Reuters/Michigan Consumer Sentiment Index. US, 4:00 pm

The Reuters/Michigan Consumer Sentiment Index for September is due in the US at 4:00 pm (GMT+2). The indicator is expected to grow from 89.8 to 90.8 points. The index is calculated by experts from Reuters and Michigan University. Represents readiness of consumers to spend money in current economic conditions. A high reading strengthens the USD. A low reading weakens the USD.

Claws and Horns

News of the day. 15.09.2016

Consumer Inflation Expectation. Australia, 3:00 am

Data on the Consumer Inflation Expectation for September is due in Australia at 3:00 am (GMT+2). The indicator, released by Melbourne Institute, represents how consumers expect inflation to change over the next 12 months. A high reading strengthens the AUD. A low reading weakens the AUD.

Unemployment Rate. Australia, 3:30 am

Data on the Unemployment Rate for August is due in Australia at 3:30 am (GMT+2). The unemployment rate in Australia is expected to remain steady at 5.7%. The indicator represents a percentage of the total labour force that is currently unemployed. A growth in the indicator is considered as a negative factor for the country’s economy and weakens the AUD. A fall in the indicator suggests economic growth and strengthens the AUD.

Employment Change. Australia, 3:30 am

Data on the Employment Change for August is due in Australia at 3:30 am (GMT+2). The indicator is expected to fall from 26,200 to 15,000. It is a measure of the change in the number of employed people in Australia. A growth in the indicator strengthens the AUD. A fall in the indicator weakens the AUD.

SNB Interest Rate Decision. Switzerland, 9:30 am

The Swiss National Bank announces its decision on interest rates at 9:30 am (GMT+2). The indicator is expected to remain unchanged at -0.75%. A rate increase strengthens the CHF, while a decrease weakens the CHF.

Retail Sales. UK, 10:30 am

Data on the Retail Sales for August is due in the UK at 10:30 am (GMT+2). The indicator is expected to fall from 1.4% to -0.5% in monthly terms and from 5.9% to 5.3% in annual terms. The index represents the total value of all receipts from retail shops in the country. Characterises the level of consumer expenditure and demand. A growth in retail sales is an important factor for the economy. A high reading strengthens the GBP. A low reading weakens the GBP.

Consumer Price Index. EU, 11:00 am

The eurozone’s Consumer Price Index for August is due at 11:00 am (GMT+2). The indicator is expected to grow from-0.6% to 0.1%. The key indicator of inflation in the eurozone. Represents the change in the value of the basket of goods and services. A growth in the indicator strengthens the EUR. A fall in the indicator weakens the EUR.

BoE Interest Rate Decision. UK, 1:00 pm

The Bank of England announces its decision on interest rates at 1:00 pm (GMT+2). The indicator is expected to remain unchanged at 0.25%. Depending on the current economic situation, the Bank of England makes its decision on the interest rate. A rate increase strengthens the GBP. If the rate remains unchanged or gets cut, the GBP weakens.

Retail Sales. US, 2:30 pm

Data on the Retail Sales for August is due in the US at 2:30 pm (GMT+2). The indicator is expected to remain unchanged at 0%. An indicator of consumer spending. Represents the change in the volume of retail sales. A growth in the index is a positive factor for the economy and strengthens the USD. A fall in the index weakens the USD.

Initial Jobless Claims. US, 2:30 pm

Data on the Initial Jobless Claims is due in the US at 2:30 pm (GMT+2). Represents the number of new unemployment claims. Published weekly on Thursdays. Allows approximating what the Nonfarm Payrolls will be. A fall in the index strengthens the USD. A growth in the index weakens the USD.

Consumer Inflation Expectation. Australia, 3:00 am

Data on the Consumer Inflation Expectation for September is due in Australia at 3:00 am (GMT+2). The indicator, released by Melbourne Institute, represents how consumers expect inflation to change over the next 12 months. A high reading strengthens the AUD. A low reading weakens the AUD.

Unemployment Rate. Australia, 3:30 am

Data on the Unemployment Rate for August is due in Australia at 3:30 am (GMT+2). The unemployment rate in Australia is expected to remain steady at 5.7%. The indicator represents a percentage of the total labour force that is currently unemployed. A growth in the indicator is considered as a negative factor for the country’s economy and weakens the AUD. A fall in the indicator suggests economic growth and strengthens the AUD.

Employment Change. Australia, 3:30 am

Data on the Employment Change for August is due in Australia at 3:30 am (GMT+2). The indicator is expected to fall from 26,200 to 15,000. It is a measure of the change in the number of employed people in Australia. A growth in the indicator strengthens the AUD. A fall in the indicator weakens the AUD.

SNB Interest Rate Decision. Switzerland, 9:30 am

The Swiss National Bank announces its decision on interest rates at 9:30 am (GMT+2). The indicator is expected to remain unchanged at -0.75%. A rate increase strengthens the CHF, while a decrease weakens the CHF.

Retail Sales. UK, 10:30 am

Data on the Retail Sales for August is due in the UK at 10:30 am (GMT+2). The indicator is expected to fall from 1.4% to -0.5% in monthly terms and from 5.9% to 5.3% in annual terms. The index represents the total value of all receipts from retail shops in the country. Characterises the level of consumer expenditure and demand. A growth in retail sales is an important factor for the economy. A high reading strengthens the GBP. A low reading weakens the GBP.

Consumer Price Index. EU, 11:00 am

The eurozone’s Consumer Price Index for August is due at 11:00 am (GMT+2). The indicator is expected to grow from-0.6% to 0.1%. The key indicator of inflation in the eurozone. Represents the change in the value of the basket of goods and services. A growth in the indicator strengthens the EUR. A fall in the indicator weakens the EUR.

BoE Interest Rate Decision. UK, 1:00 pm

The Bank of England announces its decision on interest rates at 1:00 pm (GMT+2). The indicator is expected to remain unchanged at 0.25%. Depending on the current economic situation, the Bank of England makes its decision on the interest rate. A rate increase strengthens the GBP. If the rate remains unchanged or gets cut, the GBP weakens.

Retail Sales. US, 2:30 pm

Data on the Retail Sales for August is due in the US at 2:30 pm (GMT+2). The indicator is expected to remain unchanged at 0%. An indicator of consumer spending. Represents the change in the volume of retail sales. A growth in the index is a positive factor for the economy and strengthens the USD. A fall in the index weakens the USD.

Initial Jobless Claims. US, 2:30 pm

Data on the Initial Jobless Claims is due in the US at 2:30 pm (GMT+2). Represents the number of new unemployment claims. Published weekly on Thursdays. Allows approximating what the Nonfarm Payrolls will be. A fall in the index strengthens the USD. A growth in the index weakens the USD.

Claws and Horns

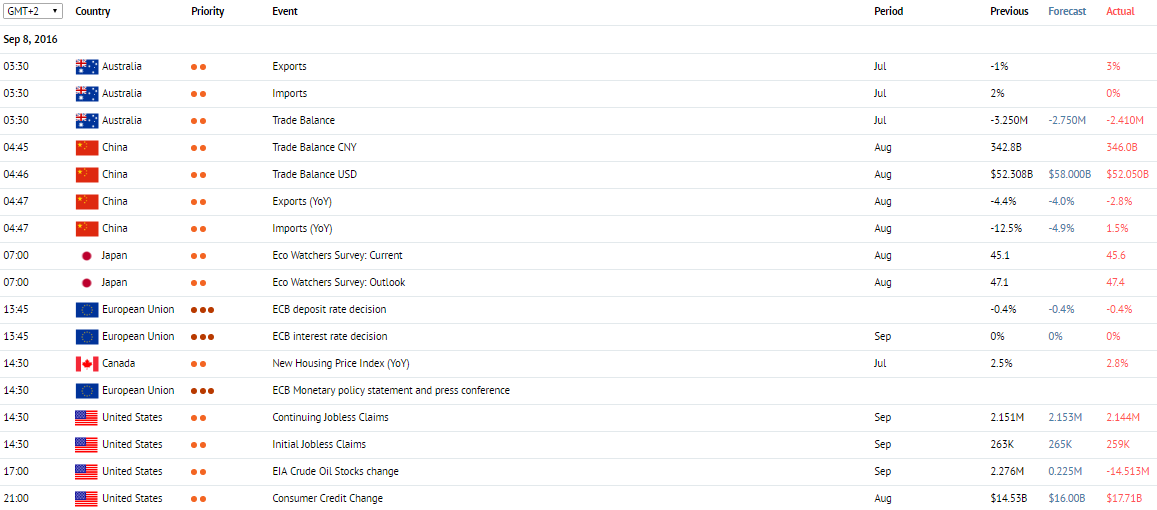

News of the day. 14.09.2016

Industrial Production. Japan, 6:30 am

Data on the Industrial Production for July is due in Japan at 6:30 am (GMT+2). The indicator represents the change in industrial output in Japan. It is one of the major indicators of the state of the national economy. A growth in the indicator supports the JPY. A fall in the indicator pressures the JPY.

ILO Unemployment Rate. UK, 10:30 am

Data on the ILO Unemployment Rate for July is due in the UK at 10:30 am (GMT+2). The indicator is expected to remain unchanged at 4.9%. It is one of the major indicators of unemployment in the UK. The unemployment rate represents a percentage of the total labour force of the country that is currently unemployed. A growth in the index weakens the GBP. A fall in the index strengthens the GBP.

Average Earnings excluding Bonus. UK, 10:30 am

Data on the Average Earnings excluding Bonus for July is due in the UK at 10:30 am (GMT+2). The indicator is expected to fall from 2.3% to 2.2%. The cost of labour index. A growth in the index represents a wage increase and strengthens the GBP. A fall in the index weakens the GBP.

Industrial Production. EU, 11:00 am

Data on the eurozone’s Industrial Production for July is due at 11:00 am (GMT+2). In monthly terms, the indicator is expected to fall from 0.6% to -0.9%. The indicator represents the change in industrial output. It is one of the major indicators of the state of the economy. A high reading strengthens the EUR. A low reading weakens the EUR.

ZEW Survey – Expectations. Switzerland, 11:00 am

Data on the ZEW Survey Expectations for September is due in Switzerland at 11:00 am (GMT+2). The index is released by the Centre for European Economic Research (ZEW) and represents an assessment of current economic conditions based on such criteria as business climate, employment situation and others. A high reading strengthens the CHF, a low reading weakens the CHF.

RBA Assist Gov Debelle Speech. Australia, 11:50 am

RBA Assistant Governor Guy Debelle is giving his speech at 11:50 am (GMT+2). He has oversight of the Bank's operations in the domestic and global financial markets.

Export Price Index. US, 2:30 pm

Data on the Export Price Index for August is due in the US at 2:30 pm (GMT+2). The indicator represents the price change for goods and services exported from the US. The US share in the world trade is about 20%. The index has a high impact on the market. A growth in the index pressures the USD as high prices reduce demand.

Industrial Production. Japan, 6:30 am

Data on the Industrial Production for July is due in Japan at 6:30 am (GMT+2). The indicator represents the change in industrial output in Japan. It is one of the major indicators of the state of the national economy. A growth in the indicator supports the JPY. A fall in the indicator pressures the JPY.

ILO Unemployment Rate. UK, 10:30 am

Data on the ILO Unemployment Rate for July is due in the UK at 10:30 am (GMT+2). The indicator is expected to remain unchanged at 4.9%. It is one of the major indicators of unemployment in the UK. The unemployment rate represents a percentage of the total labour force of the country that is currently unemployed. A growth in the index weakens the GBP. A fall in the index strengthens the GBP.

Average Earnings excluding Bonus. UK, 10:30 am

Data on the Average Earnings excluding Bonus for July is due in the UK at 10:30 am (GMT+2). The indicator is expected to fall from 2.3% to 2.2%. The cost of labour index. A growth in the index represents a wage increase and strengthens the GBP. A fall in the index weakens the GBP.

Industrial Production. EU, 11:00 am

Data on the eurozone’s Industrial Production for July is due at 11:00 am (GMT+2). In monthly terms, the indicator is expected to fall from 0.6% to -0.9%. The indicator represents the change in industrial output. It is one of the major indicators of the state of the economy. A high reading strengthens the EUR. A low reading weakens the EUR.

ZEW Survey – Expectations. Switzerland, 11:00 am

Data on the ZEW Survey Expectations for September is due in Switzerland at 11:00 am (GMT+2). The index is released by the Centre for European Economic Research (ZEW) and represents an assessment of current economic conditions based on such criteria as business climate, employment situation and others. A high reading strengthens the CHF, a low reading weakens the CHF.

RBA Assist Gov Debelle Speech. Australia, 11:50 am

RBA Assistant Governor Guy Debelle is giving his speech at 11:50 am (GMT+2). He has oversight of the Bank's operations in the domestic and global financial markets.

Export Price Index. US, 2:30 pm

Data on the Export Price Index for August is due in the US at 2:30 pm (GMT+2). The indicator represents the price change for goods and services exported from the US. The US share in the world trade is about 20%. The index has a high impact on the market. A growth in the index pressures the USD as high prices reduce demand.

Claws and Horns

News of the day. 13.09.2016

Industrial Production. China, 7:30 am

Data on the Industrial Production for August is due in China at 7:30 am (GMT+2). The indicator is expected to grow from 6.0% to 6.1% in annual terms. The indicator represents the change in industrial output in China. It is one of the major indicators of the state of the national economy. A growth in the index supports the CNY. A low reading pressures the CNY.

Retail Sales. China, 7:30 am

Data on the Retail Sales for August is due in China at 7:30 am (GMT+2). The indicator is expected to grow from 10.2% to 10.3% in annual terms. It is an indicator of consumer spending which represent the change in the volume of retail sales. A growth in the index is positive for the national economy and strengthens the CNY. A fall in the index weakens the CNY.

Consumer Price Index. Germany, 8:00 am

The Consumer Price Index for August is due in Germany at 8:00 am (GMT+2). The indicator is expected to fall from 0.1% to 0.0% in monthly terms. The index represents the change in prices for goods and services for households. It is the key indicator of inflation. A growth in the index strengthens the EUR. A fall in the index weakens the EUR.

Consumer Price Index. UK, 10:30 am

The Consumer Price Index for August is due in the UK at 10:30 am (GMT+2). It is the key indicator of inflation in the country. The index represents the change in prices for goods and services. A high reading strengthens the GBP. A low reading weakens the GBP.

ZEW Survey - Economic Sentiment. Germany, 11:00 am

The ZEW Economic Sentiment Index for Germany is due at 11:00 am (GMT+2). The indicator is expected to grow from 0.5 to 2.5 points in September. The index is published by the Centre for European Economic Research (ZEW) and is based on surveys of the leading financial experts who assess current economic conditions. Positive values represent their optimistic view on the economy and strengthen the EUR. Negative values represent pessimism and weaken the EUR.

ZEW Survey – Economic Sentiment. EU, 11:00 am

Data for September on the ZEW Economic Sentiment Index for the eurozone is due at 11:00 am (GMT+2). The index is published by the Centre for European Economic Research (ZEW) and is based on survey responses from 350 leading financial experts in Europe regarding their opinion on current economic conditions in Europe, the US and Japan. Positive values represent their optimistic view on the economy and strengthen the EUR. Values below forecasts represent pessimism and weaken the EUR.

Monthly Budget Statement. US, 8:00 pm

The Monthly Budget Statement for August is due in the US at 8:00 pm (GMT+2). The indicator represents the difference between the government revenue and expenditures. The budget deficit appears when expenditures exceed revenues. When the opposite happens, the budget is said to be in surplus. Positive values strengthen the USD, and negative values weaken the USD.

Industrial Production. China, 7:30 am

Data on the Industrial Production for August is due in China at 7:30 am (GMT+2). The indicator is expected to grow from 6.0% to 6.1% in annual terms. The indicator represents the change in industrial output in China. It is one of the major indicators of the state of the national economy. A growth in the index supports the CNY. A low reading pressures the CNY.

Retail Sales. China, 7:30 am

Data on the Retail Sales for August is due in China at 7:30 am (GMT+2). The indicator is expected to grow from 10.2% to 10.3% in annual terms. It is an indicator of consumer spending which represent the change in the volume of retail sales. A growth in the index is positive for the national economy and strengthens the CNY. A fall in the index weakens the CNY.

Consumer Price Index. Germany, 8:00 am

The Consumer Price Index for August is due in Germany at 8:00 am (GMT+2). The indicator is expected to fall from 0.1% to 0.0% in monthly terms. The index represents the change in prices for goods and services for households. It is the key indicator of inflation. A growth in the index strengthens the EUR. A fall in the index weakens the EUR.

Consumer Price Index. UK, 10:30 am

The Consumer Price Index for August is due in the UK at 10:30 am (GMT+2). It is the key indicator of inflation in the country. The index represents the change in prices for goods and services. A high reading strengthens the GBP. A low reading weakens the GBP.

ZEW Survey - Economic Sentiment. Germany, 11:00 am

The ZEW Economic Sentiment Index for Germany is due at 11:00 am (GMT+2). The indicator is expected to grow from 0.5 to 2.5 points in September. The index is published by the Centre for European Economic Research (ZEW) and is based on surveys of the leading financial experts who assess current economic conditions. Positive values represent their optimistic view on the economy and strengthen the EUR. Negative values represent pessimism and weaken the EUR.

ZEW Survey – Economic Sentiment. EU, 11:00 am

Data for September on the ZEW Economic Sentiment Index for the eurozone is due at 11:00 am (GMT+2). The index is published by the Centre for European Economic Research (ZEW) and is based on survey responses from 350 leading financial experts in Europe regarding their opinion on current economic conditions in Europe, the US and Japan. Positive values represent their optimistic view on the economy and strengthen the EUR. Values below forecasts represent pessimism and weaken the EUR.

Monthly Budget Statement. US, 8:00 pm

The Monthly Budget Statement for August is due in the US at 8:00 pm (GMT+2). The indicator represents the difference between the government revenue and expenditures. The budget deficit appears when expenditures exceed revenues. When the opposite happens, the budget is said to be in surplus. Positive values strengthen the USD, and negative values weaken the USD.

Claws and Horns

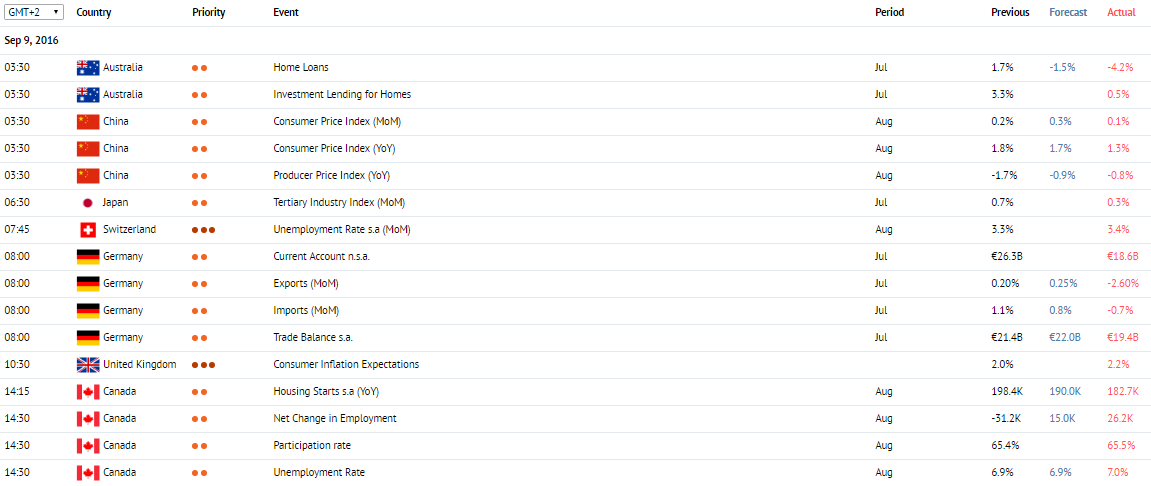

News of the day. 09.09.2016

Consumer Price Index. China, 3:30 am

The Consumer Price Index for August is due in China at 3:30 am (GMT+2). The indicator is expected to grow from 0.2% to 0.3% in monthly terms and to fall from 1.8% to 1.7% in annual terms. The index represents the change in prices for goods and services for households. It is the key indicator of inflation. A moderate growth in the index strengthens the CNY. A fall in the index weakens the CNY.

Home Loans. Australia, 3:30 am

Data on the Home Loans for July is due in Australia at 3:30 am (GMT+2). The indicator is expected to fall from 1.2% to -1.5%. It is one of the key indicators of the property market which represents the number of recently extended home loans. A growth in the indicator strengthens the AUD. A fall in the indicator weakens the AUD.

Tertiary Industry Index. Japan, 6:30 am

The Tertiary Industry Index for July is due in Japan at 6:30 am (GMT+2). The index represents current economic conditions in the service sector. A growth in the index strengthens the JPY. A low reading weakens the JPY.

Unemployment Rate. Switzerland, 7:45 am

Data on the Unemployment Rate for August is due in Switzerland at 7:45 am (GMT+2). The indicator represents the percentage of the total labour force of Switzerland that is currently unemployed. A growth in unemployment suggests a slowdown of the economy. A high reading weakens the CHF, a low reading strengthens the CHF.

Trade Balance. Germany, 8:00 am

Data on the Trade Balance for July is due in Germany at 8:00 am (GMT+2). Germany’s trade surplus is expected to widen from €21.7 billion to €22.0 billion. The indicator represents the difference between the value of exports and imports. Positive values imply the balance is in surplus indicating that exports exceed imports. Negative values imply the balance is in deficit indicating that imports exceed exports. A growth in exports has a positive impact on the country's economy. A high reading strengthens the EUR. A low reading wakens the EUR.

Consumer Inflation Expectations. UK, 10:30 am

Data on the Consumer Inflation Expectations is due in the UK at 10:30 am (GMT+2). The indicator represents consumer inflation expectations for the next 12 months.

Housing Starts. Canada, 2:15 pm

Data on the Housing Starts for August is due in Canada at 2:15 pm (GMT+2). In annual terms, the indicator is expected to fall from 198 400 to 190 000. The index is published by Canada Mortgage and Housing Corporation and represents the number of housing starts for single-family homes. Construction volumes are closely linked to the population income, thus a growth in the indicator suggests an improvement in economic conditions. A high reading strengthens the CAD. A low reading weakens the CAD.

Unemployment Rate. Canada, 3:30 pm

Data on the Unemployment Rate for August is due in Canada at 3:30 pm (GMT+2). The indicator is expected to remain unchanged at 6.9%. The index is published by Statistics Canada and represents the number of unemployed as a percentage of the total labour force. A growth in unemployment suggests a slowdown of the economy and weakens the CAD. A fall in the indicator supports the national economy growth and strengthens the CAD.

Consumer Price Index. China, 3:30 am

The Consumer Price Index for August is due in China at 3:30 am (GMT+2). The indicator is expected to grow from 0.2% to 0.3% in monthly terms and to fall from 1.8% to 1.7% in annual terms. The index represents the change in prices for goods and services for households. It is the key indicator of inflation. A moderate growth in the index strengthens the CNY. A fall in the index weakens the CNY.

Home Loans. Australia, 3:30 am

Data on the Home Loans for July is due in Australia at 3:30 am (GMT+2). The indicator is expected to fall from 1.2% to -1.5%. It is one of the key indicators of the property market which represents the number of recently extended home loans. A growth in the indicator strengthens the AUD. A fall in the indicator weakens the AUD.

Tertiary Industry Index. Japan, 6:30 am

The Tertiary Industry Index for July is due in Japan at 6:30 am (GMT+2). The index represents current economic conditions in the service sector. A growth in the index strengthens the JPY. A low reading weakens the JPY.

Unemployment Rate. Switzerland, 7:45 am

Data on the Unemployment Rate for August is due in Switzerland at 7:45 am (GMT+2). The indicator represents the percentage of the total labour force of Switzerland that is currently unemployed. A growth in unemployment suggests a slowdown of the economy. A high reading weakens the CHF, a low reading strengthens the CHF.

Trade Balance. Germany, 8:00 am

Data on the Trade Balance for July is due in Germany at 8:00 am (GMT+2). Germany’s trade surplus is expected to widen from €21.7 billion to €22.0 billion. The indicator represents the difference between the value of exports and imports. Positive values imply the balance is in surplus indicating that exports exceed imports. Negative values imply the balance is in deficit indicating that imports exceed exports. A growth in exports has a positive impact on the country's economy. A high reading strengthens the EUR. A low reading wakens the EUR.

Consumer Inflation Expectations. UK, 10:30 am

Data on the Consumer Inflation Expectations is due in the UK at 10:30 am (GMT+2). The indicator represents consumer inflation expectations for the next 12 months.

Housing Starts. Canada, 2:15 pm

Data on the Housing Starts for August is due in Canada at 2:15 pm (GMT+2). In annual terms, the indicator is expected to fall from 198 400 to 190 000. The index is published by Canada Mortgage and Housing Corporation and represents the number of housing starts for single-family homes. Construction volumes are closely linked to the population income, thus a growth in the indicator suggests an improvement in economic conditions. A high reading strengthens the CAD. A low reading weakens the CAD.

Unemployment Rate. Canada, 3:30 pm

Data on the Unemployment Rate for August is due in Canada at 3:30 pm (GMT+2). The indicator is expected to remain unchanged at 6.9%. The index is published by Statistics Canada and represents the number of unemployed as a percentage of the total labour force. A growth in unemployment suggests a slowdown of the economy and weakens the CAD. A fall in the indicator supports the national economy growth and strengthens the CAD.

: