Aleksandr Belykh / Profilo

- Informazioni

|

7+ anni

esperienza

|

2

prodotti

|

100

versioni demo

|

|

0

lavori

|

0

segnali

|

0

iscritti

|

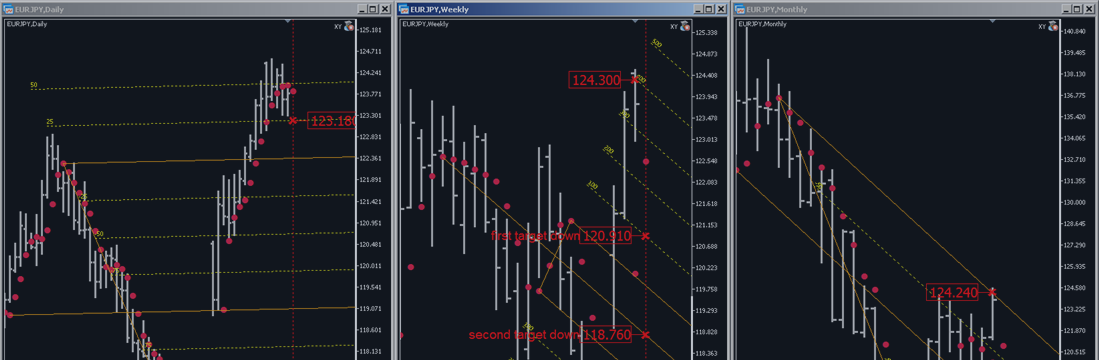

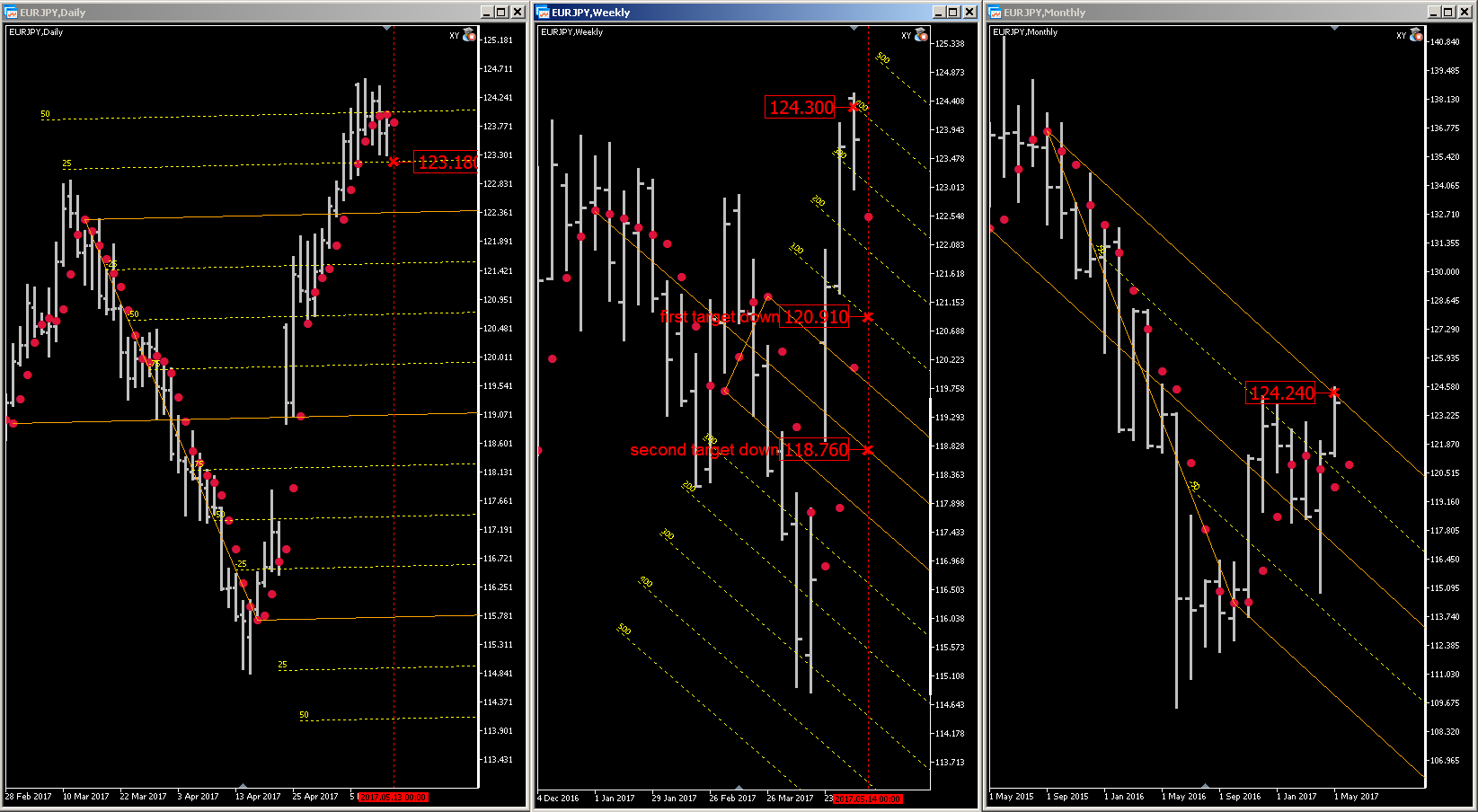

EURJPY trading opportunity 05.15 - 05.19 2017

EURJPY has good trading opportunity next week 05.15 - 05.19 2017. Multi time frame research using my tools (Multi time frame navigation and research tool XY adviser, MA and Andrews Pitchfork) on Monthly and Weekly charts has identified the key level 124.24 (M), 124.30 (W), and 123.18 (D), where the price highly likely to bounce down from 124.30 (W) to first target down 120.91 (W) and second target down 118.76 (W), because area 124.24 (M) - 124.30(W) is strong resistance zone. Selling after broken level 123.18 (D) is a good idea.

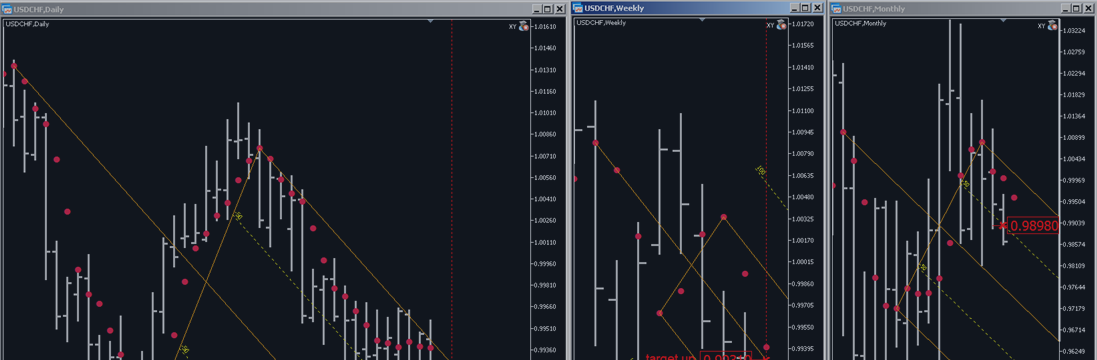

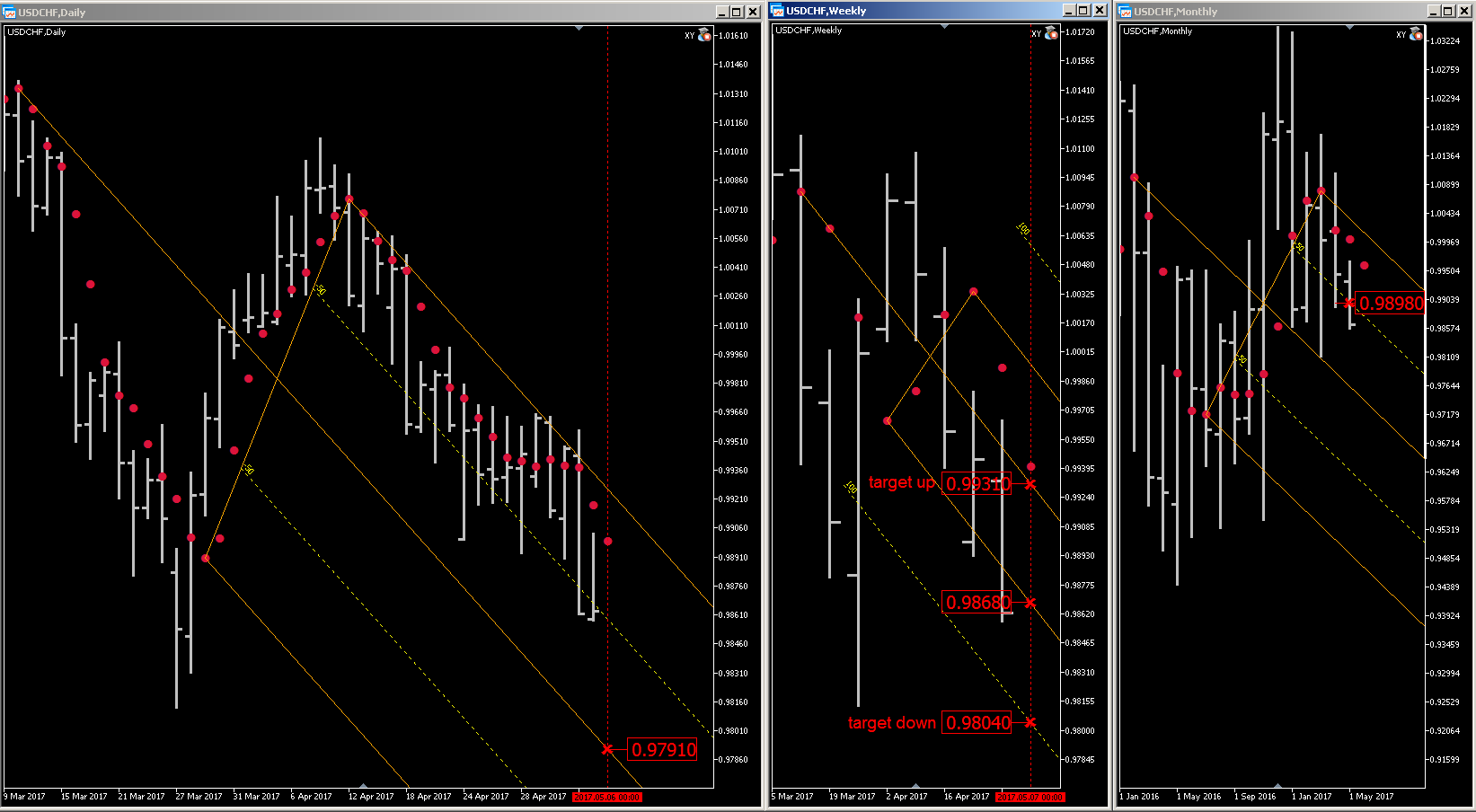

USDCAD trading opportunity 05.08 - 05.12 2017

USDCAD has good trading opportunity next week 05.08 - 05.12 2017. Multi time frame research using my tools (Multi time frame navigation and research tool XY adviser, MA and Andrews Pitchfork) on Monthly and Weekly charts has identified the key level 0.9898 (M), 0.9868 (W), and 0.9791 (D), where the price at first highly likely to bounce down from 0.9868 (W) to target down 0.9804 (W), because 0.9804 (W) is brocken that is confirmed by the last two bars on daily timeframe. Since the price is in the monthly support area of the level 0.9898 (M) is highly likely price to bounce up from strong support zone 0.9804 (W) 0.9791 (D) is a good idea, if the price do nont breaks through the key level zone 0.9804 (W) 0.9791 (D) down on daily time frame, the target up is 0.9931 (W).

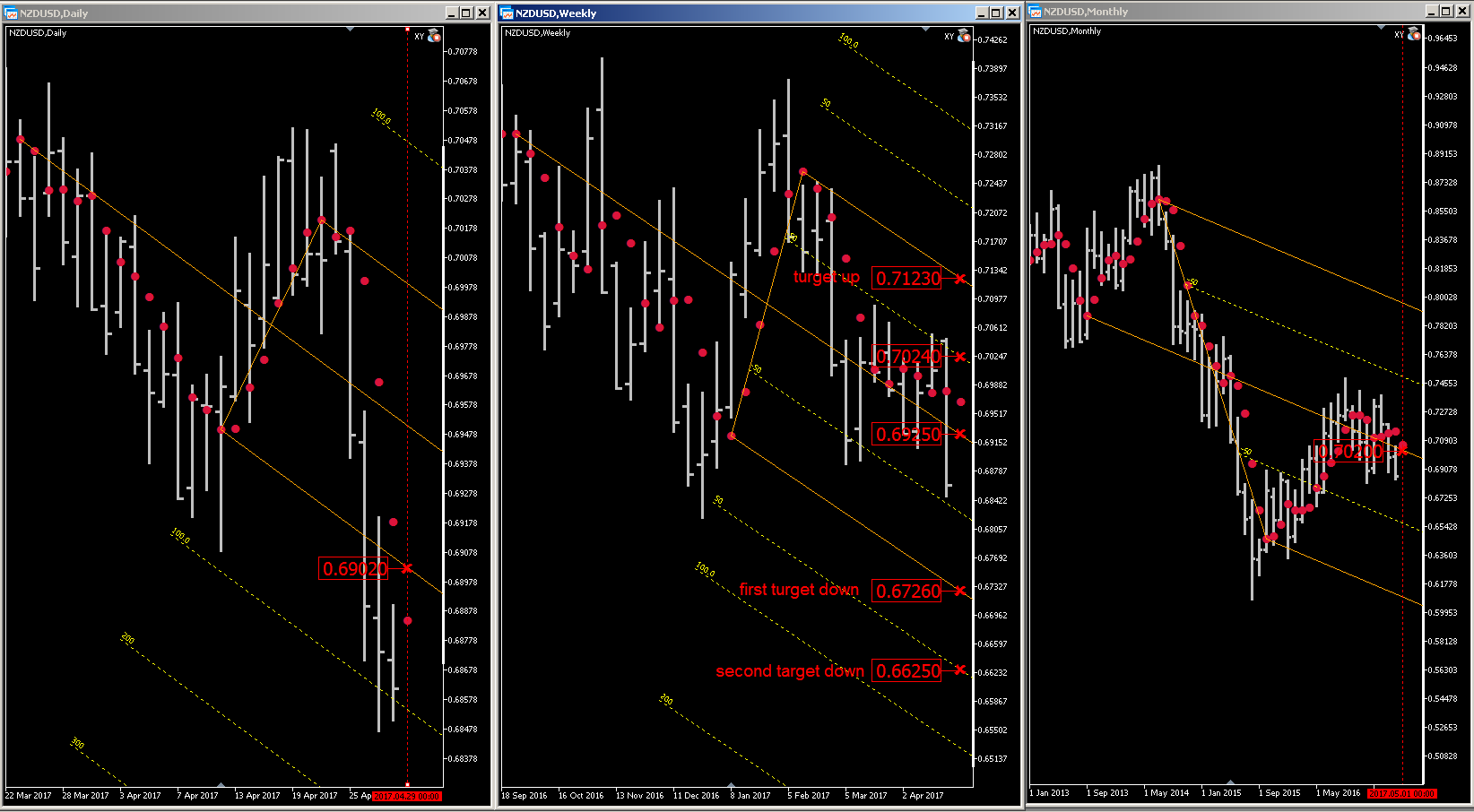

NZDUSD trading opportunity 05.01 - 05.05 2017

NZDUSD has good trading opportunity next week 05.01 - 05.05 2017. Multi time frame research using my tools (Multi time frame navigation and research tool XY adviser, MA and Andrews Pitchfork) on Monthly and Weekly charts has identified the key level 0.7020 (M), 0.6925 (W), and 0.6902 (D), where the price is highly likely to bounce down to the target down level 0.6726 (W) as first target and 0.6625 (W) as second target, because area 0.7020 (M) - 0.6925(W) is strong resistance zone. Selling in the area 0.6925 (W) - 0.6902 (D) is a good idea. If the price breaks through the key level 0.7024(W) up on daily time frame, the target is 0.7123 (W).

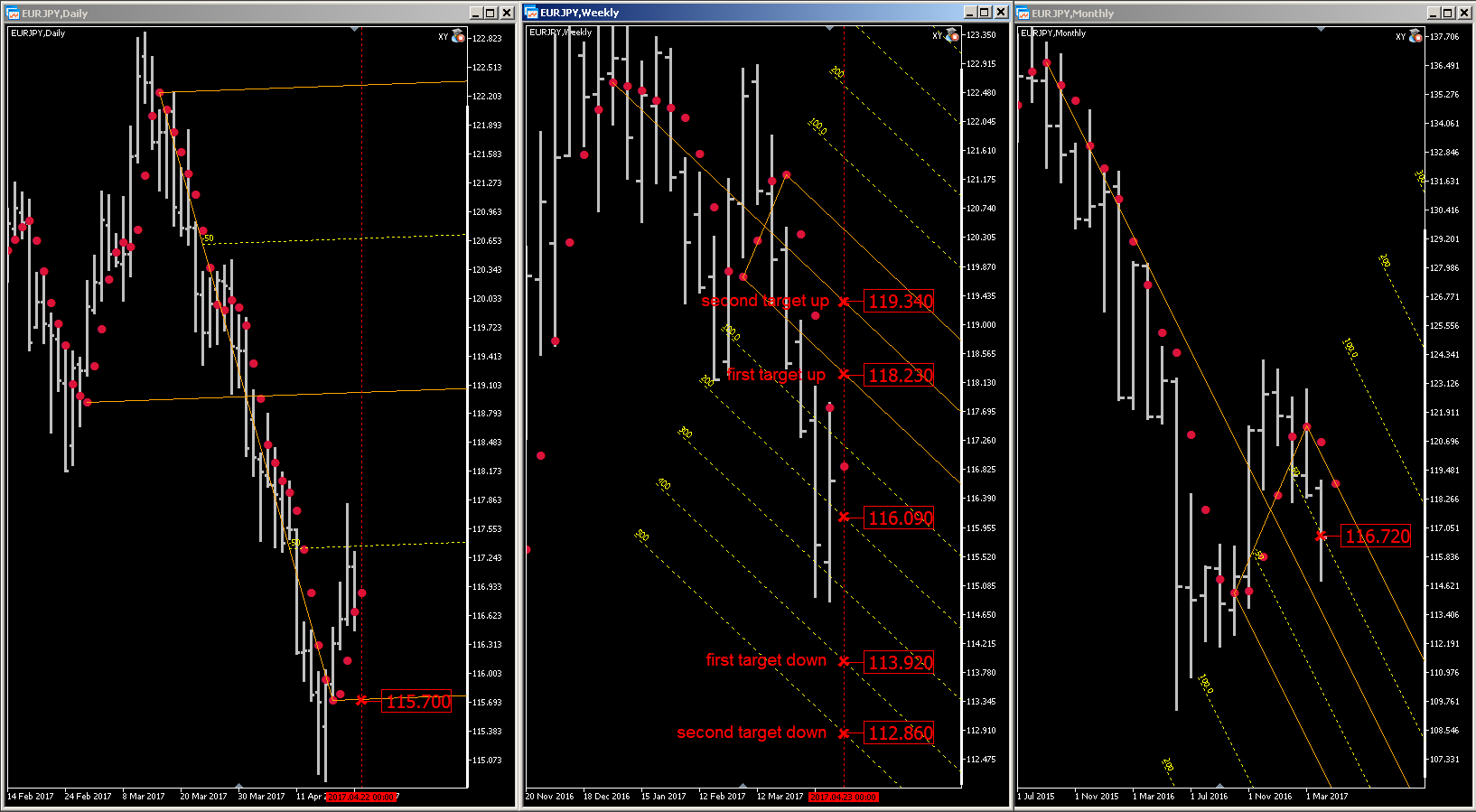

EURJPY trading opportunity 04.24 - 04.28 2017

EURJPY has good trading opportunity next week 04.24 - 04.28 2017. Multi time frame research using my tools (Multi time frame navigation and research tool XY adviser, MA and Andrews Pitchfork) on Monthly and Weekly charts has identified the key level 116.72 (M), 116.09 (W) and 115.70 (D), where the price is highly likely to bounce up to the target up level 118.23 (W) as first target and 119.34 (W) as second target, because area 116.72 (M) - 116.09 (W) is strong support zone. Buying in the area 116.09 (W) - 115.70 (D) is a good idea. If the price breaks through the key level 115.70(D) down, the first target is 113.92 (W) and second target is 112.86 (W).

È passato più di un anno da quando MQL5 ha iniziato a fornire supporto nativo per OpenCL. Tuttavia, non molti utenti hanno capito il vero valore nell'utilizzo del calcolo parallelo nei loro Expert Advisor, indicatori o script. Questo articolo ti aiuta a installare e configurare OpenCL sul tuo computer in modo che tu possa provare a utilizzare questa tecnologia nel terminale di trading MetaTrader 5.

Questo articolo si concentra su alcune funzionalità di ottimizzazione che si aprono quando si tiene conto almeno dell'hardware sottostante su cui viene eseguito il kernel OpenCL. Le cifre ottenute sono lungi dall'essere valori limite, ma suggeriscono anche che avere le risorse esistenti disponibili qui e ora (l'API OpenCL implementata dagli sviluppatori del terminale non consente di controllare alcuni parametri importanti per l'ottimizzazione, in particolare la dimensione del gruppo di lavoro), il miglioramento delle prestazioni rispetto all'esecuzione del programma host è molto sostanziale.

Alla fine di gennaio 2012, la società di sviluppo software che sta dietro lo sviluppo di MetaTrader 5 ha annunciato il supporto nativo per OpenCL su MQL5. Utilizzando un esempio illustrativo, l'articolo espone le basi della programmazione in OpenCL in ambiente MQL5 e fornisce alcuni esempi della semplice ottimizzazione del programma per l'aumento della velocità operativa.

Multitimeframe navigation and research tool MT4 ( XY expert advisor) is a convenient tool that allows analyzing the trading instruments on different time frames and fast switching between them. Easy to use. It has no adjustable parameters. Charts with an XY Expert Advisor can be either the same symbol (instrument) or different (from version 2.0). When a symbol is changed on one of the charts with the XY expert advisor , cascade change of symbols occurs on other charts with the XY attached. The

The Market Profile è stato sviluppato dal geniale pensatore Peter Steidlmayer. Ha suggerito di utilizzare la rappresentazione alternativa delle informazioni sui movimenti di mercato "orizzontali" e "verticali" che porta a un insieme completamente diverso di modelli. Ha assunto che ci sia un impulso sottostante del mercato o un modello fondamentale chiamato ciclo di equilibrio e squilibrio. In questo articolo considererò Price Histogram - un modello semplificato di Market Profile e descriverò la sua implementazione in MQL5.

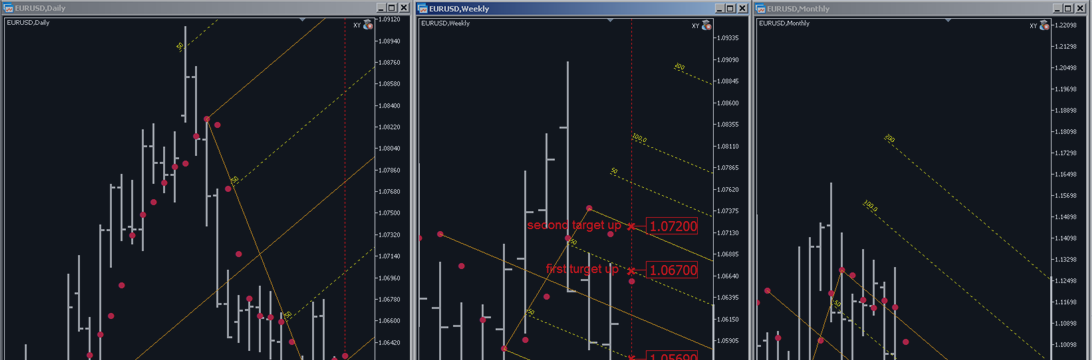

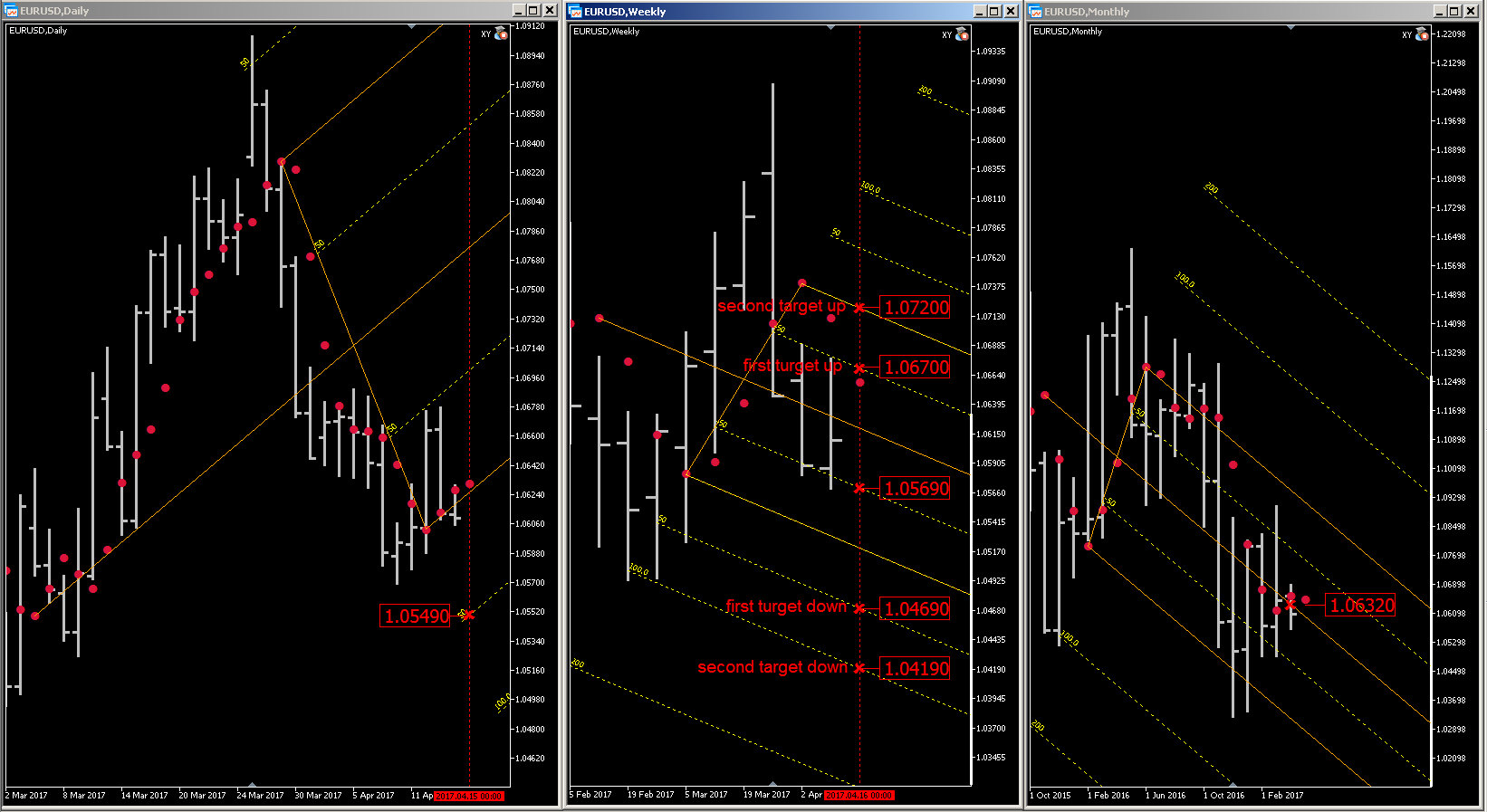

EURUSD trading opportunity 04.17 - 04.21 2017

EURUSD has good trading opportunity next week 04.17 - 04.21 2017. Multi time frame research using my tools (XY adviser, MA and Andrews Pitchfork) on Monthly and Weekly charts has identified the key level 1.0632 (M), 1.0569 (W) and 1.0549 (D), where the price is highly likely to bounce up to the target up level 1.0670 (W) as first target and 1.0720 (W) as second target. Buying in the area 1.0569 - 1.0549 is a good idea. If the price breaks through the key level 1.0549 (D) down, the first target is 1.0469 (W) and second target is 1.0419 (W).

Multitimeframe navigation and research tool (XY expert advisor) is a convenient tool that allows analyzing the trading instruments on different time frames and fast switching between them. Easy to use. It has no adjustable parameters. Charts with an XY Expert Advisor can be either the same symbol (instrument) or different (from version 2.0). When a symbol is changed on one of the charts with the XY expert advisor , cascade change of symbols occurs on other charts with the XY

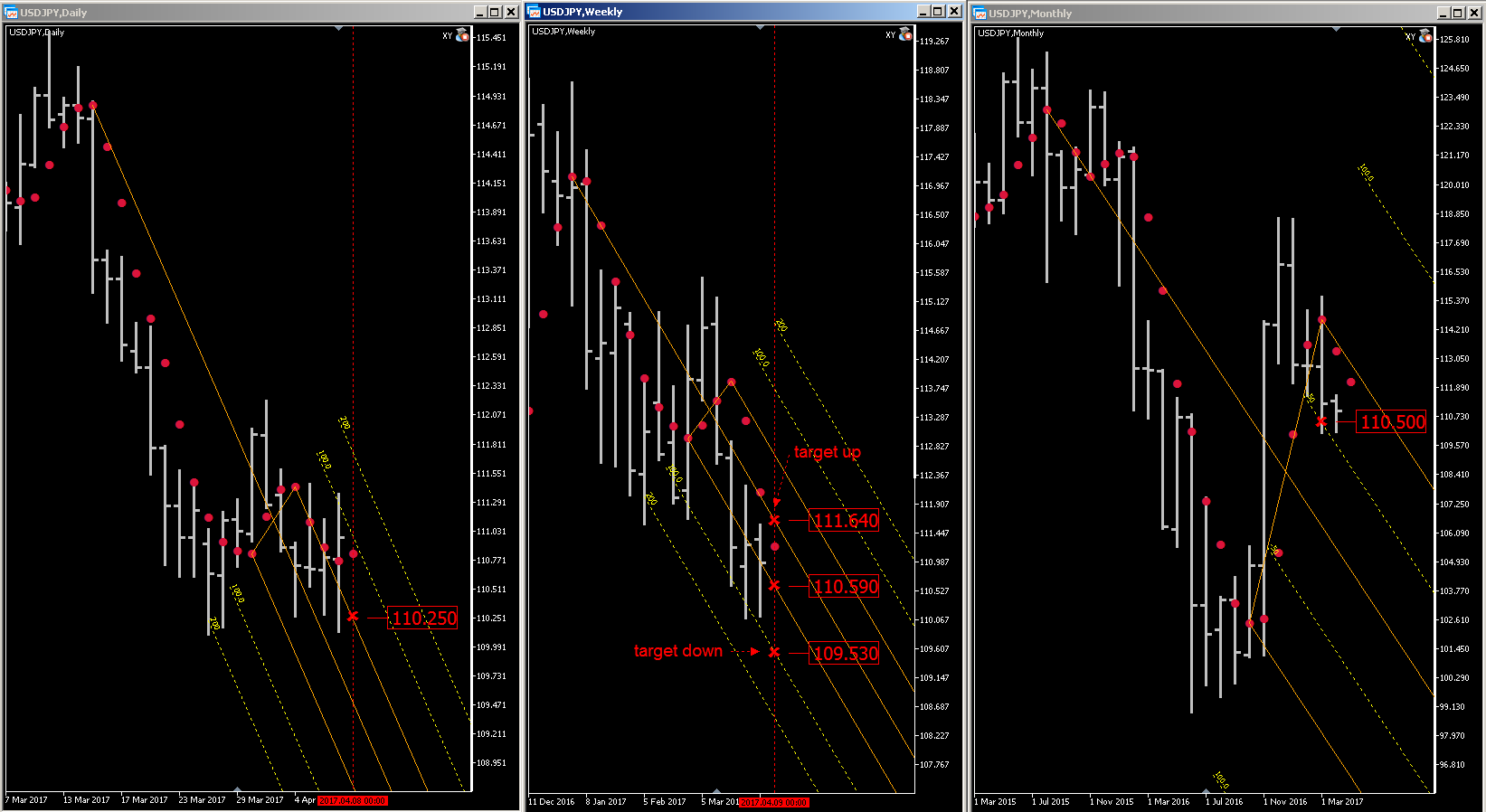

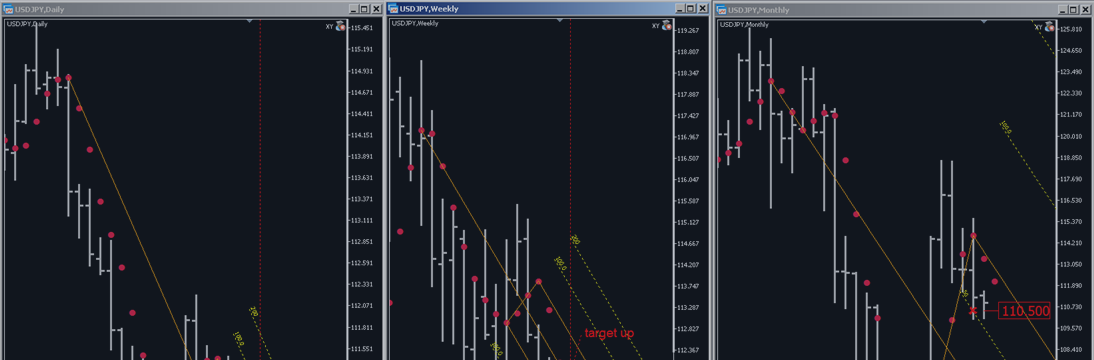

USDJPY trading opportunity 04.10 - 04.14 2017

USDJPY has good trading opportunity next week 04.10 - 04.14 2017. Multi time frame research using my tools (XY adviser, MA and Andrews Pitchfork) on Monthly and Weekly charts has identified the key level 110,50 (M), 110,59 (W) and 110,25 (D), where the price is highly likely to bounce up to the target up level 111,64 (W). Buying in the area 110,59 - 110,25 is a good idea. If the price breaks through the key level 110,25 (D) down, the target is 109,53 (W).