Roberto Jacobs / Profilo

- Informazioni

|

8+ anni

esperienza

|

3

prodotti

|

75

versioni demo

|

|

28

lavori

|

0

segnali

|

0

iscritti

|

MQL5 Community:

Programmer + Forex Trader

Product on Market:

Forex Currency Power Index indicator for MT5

https://www.mql5.com/en/market/product/101322

Forex Currency Power Index indicator for MT4

https://www.mql5.com/en/market/product/101328

TrendColorBars

https://www.mql5.com/en/market/product/14715

Programmer + Forex Trader

Product on Market:

Forex Currency Power Index indicator for MT5

https://www.mql5.com/en/market/product/101322

Forex Currency Power Index indicator for MT4

https://www.mql5.com/en/market/product/101328

TrendColorBars

https://www.mql5.com/en/market/product/14715

Roberto Jacobs

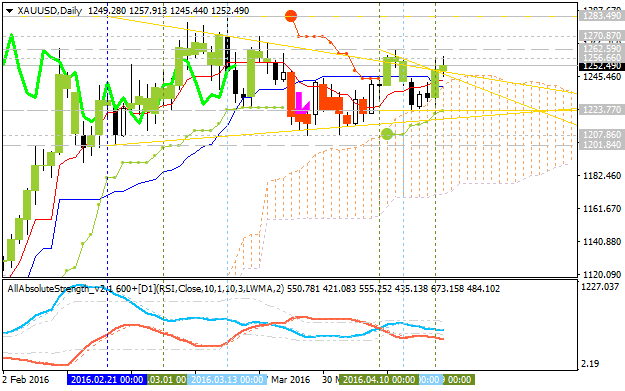

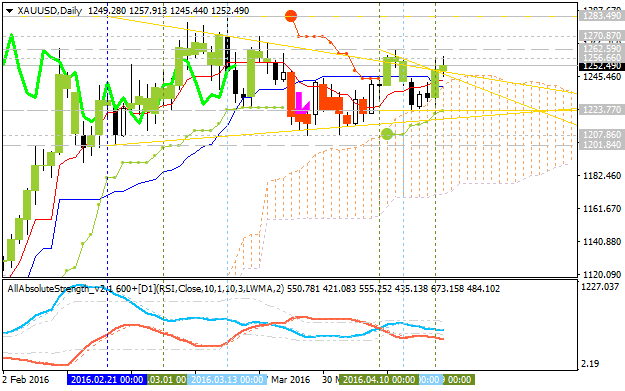

FxWirePro: Gold Tests Key 1256 Level, Scope for Further Upside

20 aprile 2016, 21:18

FxWirePro: Gold Tests Key 1256 Level, Scope for Further Upside Gold retreated slightly on Wednesday as dollar firmed after better than expected US housing data supported dollar and investors remained cautious ahead of the Eurozone interest rate decision followed by ECB press conference...

Condividi sui social network · 1

77

Roberto Jacobs

FxWirePro: USD/JPY Rebounds, Critical Resistance at Lies Ahead

20 aprile 2016, 21:12

FxWirePro: USD/JPY Rebounds, Critical Resistance at Lies Ahead The USD/JPY pair slipped towards 108.74 levels initially in the European session, however the pair rebounded back strongly gaining back all losses suffered earlier after the release of positive US housing data...

Condividi sui social network · 1

94

Roberto Jacobs

EUR/USD Drops to Test 1.1300 The euro dropped further against the US dollar and fell to 1.1300 hitting a new daily low. So far EUR/USD has been able to remain above 1.1300 but continues to hold a bearish intraday tone...

Condividi sui social network · 1

104

Roberto Jacobs

USD/CHF Reverses and Climbs Toward 0.9700, at 4-Week Highs

20 aprile 2016, 20:40

USD/CHF Reverses and Climbs Toward 0.9700, at 4-Week Highs The Swiss franc dropped sharply across the board during the American session and boosted the USD/CHF pair that rose from 6-day lows to 3-week highs. Yesterday the pair declined to 0.9584 and then rose modestly...

Condividi sui social network · 1

75

Roberto Jacobs

NZD/USD: are Bulls Dropping their Commitments? NZD/USD has been lacking in vigour, in comparison to recent performances through the 0.70 handle. However, that was a short-lived conquest and failures to maintain the top spot and close above 0.7000 have opened-up a chain of supply from 0...

Condividi sui social network · 1

64

Roberto Jacobs

Analytical Review of the Stocks of Johnson & Johnson Johnson & Johnson, #JNJ [NYSE] Health care, Production of drugs, USA Financial performance of the company: Index – DJIA, S&P 500...

Condividi sui social network · 1

79

Roberto Jacobs

USD/CHF: Swiss Index of Economic Expectations has Grown Swiss index of economic expectations has grown to 11.5 in April against 2.5 in March. However, this news has had only short-term effect on the market...

Condividi sui social network · 1

69

Roberto Jacobs

Yen Continues to Correlate with Stocks - Scotiabank Analysts at Scotiabank noted the continued correlation between stocks and the Yen. Key Quotes: The Nikkei gained strongly yesterday and managed to buck the trend of mixed to weaker global stocks with a modest gain overnight...

Condividi sui social network · 1

73

Roberto Jacobs

Status of 9/11 Bill and the Saudi Threat - BBH Analysts at Brown Brothers Harriman noted that there continues to be much discussion among investors of New York Times report last weekend in which a Saudi official threatened to sell $750 bln of US Treasuries and assets if a bill that would allow fa...

Condividi sui social network · 1

133

Roberto Jacobs

AUD/USD: Reaching New 10-Month Highs AUD/USD was lifted on a better risk sentiment in the European session and a positive close in the Nikkei that finished up 0.19%. Oil has been the catalyst along with flows through the yen. With oil prices tailing off overnight, the Yen picked up the bid...

Condividi sui social network · 1

54

Roberto Jacobs

USD/CAD Tumbles to Fresh 9-Month Lows USD/CAD broke below 1.2630 and tumbled to 1.2591, hitting the lowest level since July 6, 2015. A sharp increase in crude oil prices helped the loonie break higher across the board...

Condividi sui social network · 1

76

Roberto Jacobs

FxWirePro: Euro Rates Strategy ahead ECB's Meeting Euro’s strength – considerably EUR/USD has appreciated by almost 1.13% since last Thursday. In view of general USD weakness and in view of general risk-on sentiment on the FX market that is not a move that would require any EUR positive reasons...

Condividi sui social network · 1

75

Roberto Jacobs

EUR/GBP Drops to 3-Week Lows EUR/GBP broke a 24-hour trading range with resistance at 0.7915 and support at 0.7885 and dropped to 0.7867, hitting the lowest level since the beginning of the month. The pair remains near the lows, weakened by a stronger pound in the market...

Condividi sui social network · 1

64

Roberto Jacobs

Sergey Golubev

Commento all'argomento Press review

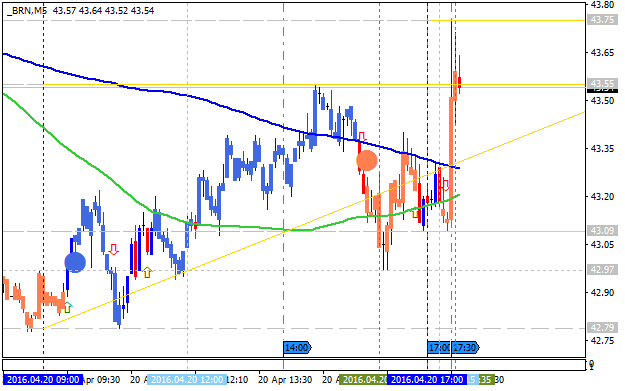

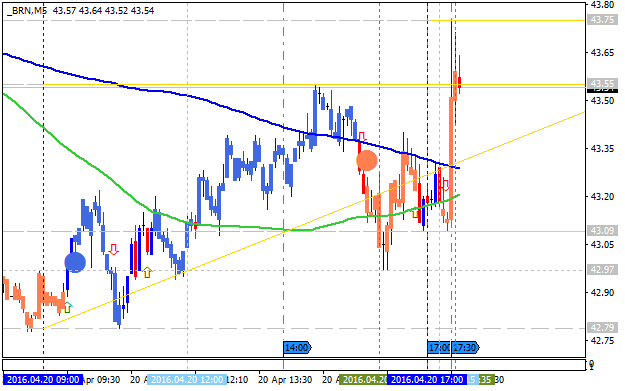

U.S. commercial crude oil inventories news event: Crude Oil Intra-Day Price Action Analysis - intra-day bullish trend to be continuing in the future with 44.89 level as a target 2016-04-20 14:30 GMT |

Roberto Jacobs

Sergey Golubev

Commento all'argomento Forecast for Q2'16 - levels for GOLD (XAU/USD)

Daily Technical Analysis for GOLD (XAU/USD) XAU/USD : daily bullish breakout to be started on open bar . The price is located near and above Ichimoku cloud in the beginning of the primary bullish area

Roberto Jacobs

FxWirePro: EUR/USD Runs Out of Steam But Maintains Bullish Outlook

20 aprile 2016, 17:12

FxWirePro: EUR/USD Runs Out of Steam But Maintains Bullish Outlook The EUR/USD declined at the beginning of the US session as the pair found short selling interest around 1.1390 levels. The pair further came under pressure after data showed US home sales rebounded more than expected in March...

Condividi sui social network · 1

79

Roberto Jacobs

WTI Flirts with $42.00 Post-EIA, Still in Red The barrel of West Texas Intermediate has seen its pullback trimmed today, currently testing the $42.00 neighbourhood following the EIA’s report...

Condividi sui social network · 1

74

Roberto Jacobs

API Reports Surplus, While WTI Awaits EIA Report's Calls Updated WTI is trading at key resistance area at $41.8/barrel...

Condividi sui social network · 1

72

Roberto Jacobs

FxWirePro: GBP/USD Retains Bullish Outlook With Scope to Target 1.4450

20 aprile 2016, 16:30

FxWirePro: GBP/USD Retains Bullish Outlook With Scope to Target 1.4450 The GBP/USD pair retreated back on Wednesday, as the Pound found short selling interest after data showed the number of unemployed in Britain rising and wage growth fell short of expectations...

Condividi sui social network · 1

73

Roberto Jacobs

US Dollar Rebounds to 94.20, Session Tops The greenback, gauged by the US Dollar Index, is now accelerating its daily upside to the area of 94.10/20. US Dollar retakes 94.00 The index has managed to regain the key 94.00 handle after bottoming out in the 93...

Condividi sui social network · 1

80

: