Versione 3.62

2024.10.28

“Quick Direction Correction” (only for GBPUSD) feature has been added.

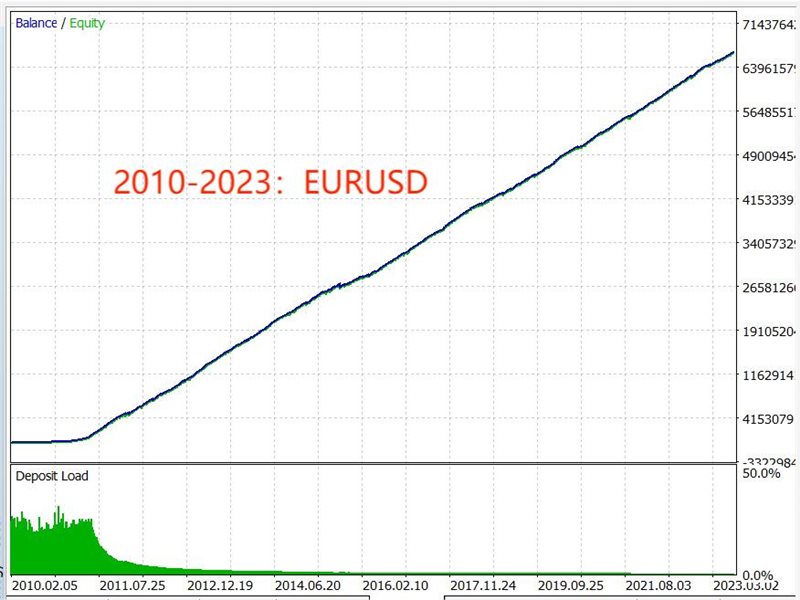

It can more quickly identify market directions and close orders in the wrong direction. However, it may sometimes exit too early, resulting in not achieving optimal profits. It is suitable for recent market conditions and is enabled by default but can be turned off manually. This feature only applies to GBPUSD. Currently, EURUSD is performing well.

Versione 3.61

2024.08.21

1.The strategy research to address the latest market conditions has been completed. We will conduct an extra update, hoping that the EA can quickly adapt to market changes.

The new strategy has been integrated into the Intelligent Market Filtering System. It is recommended to keep it enabled by default.

2. The default value for the order mode "The mode used to place the number of lots" has been changed to "Initial Capital Risk Mode". This mode allows for a more intuitive observation of market changes and capital recovery. The previous "Risk Mode" is a compound interest mode, more suitable for capital growth in favorable market conditions. You can choose according to your preference.

Versione 3.60

2024.08.13

1. Added "Daily Maximum Drawdown Limit (%)" function, mainly for use by prop firms, not recommended for use as a stop loss.

2. Adjusted parameters for EURUSD and AUDUSD based on real account performance.

3. Updated training data.

Versione 3.59

2024.06.09

1. Added start trading time function, accurate to the second.

2. Added support for currency pair conversion with suffixes.

3. No longer need to switch time frames to obtain market information.

4. Added profit percentage closing function. (for prop firm)

5. Added unique entry point function. (for prop firm)

6. Fixed the issue where changing settings required a reload to take effect.

7. Retrained the EURUSD currency pair with new parameters.

8. Set risk mode as the default mode.

9. Updated the latest training data.

The unique entry point function will add or subtract random price points from 0 to the specified value, reducing order similarity without affecting performance within 5 points. The EA has added necessary functions for the prop firm challenge and is now prop firm ready.

Versione 3.57

2024.03.12

1. The default setting "RiskMod" has been changed to "InitialCapitalRiskMode," removing the compounding effect to facilitate easier observation of EA performance changes, thus enhancing trading confidence. Keeping the order size constant despite a reduction in capital also favors profit recovery. Users may change this as needed.

2. Based on live trading performance, the "Intelligent Dynamic Parameters" has been set to off by default, and the parameters have been optimized when turned off. Turning it on will restore performance to the level of version 3.56.

3. An optimized "AutoGetData" function has been added to address the issue of some clients' trading platforms not placing orders for extended periods.

4. The "FIFO Rule" has been set to true by default.

5. The "Reduce close conditions after long times" has been set to true by default.

6. Some minor issues have been corrected.

The update has not reduced performance; the decrease in profits is due to the new default "InitialCapitalRiskMode" not employing compounding growth. Switching to "RiskMod" will restore compounding growth, significantly increasing profits. Both modes have their pros and cons, and users can modify them as needed.

Versione 3.56

2024.02.09

Significant upgrade includes:

1. Addition of a profit target, after which the EA will stop placing orders. The value is the percentage growth since the EA started running, and it will be recalculated from zero upon a reload or setting change.

2. Introduction of a FIFO option, as most US brokers follow this rule. When the FIFO option is enabled, hedging functions will be unavailable.

3. Algorithm has been readjusted, and the issue of not opening trades due to insufficient information has been resolved.

4. Training data have been updated.

It is normal for the algorithm adjustments in this upgrade to result in different order positions in backtesting compared to previous trades.

Versione 3.55

2023.12.26

1,A dynamic parameter feature has been added, activated by default.

When enabled, the EA will automatically adjust parameters such as stop-loss (SL) and trailing stop based on market conditions at the time of order placement. Once an order is placed, the SL will no longer change, but the trailing stop will continue to adjust with the market. Disabling this feature will revert to the previous fixed parameter settings.

2,"Reduce close conditions after long times" has been set to default off.

Versione 3.53

2023.11.09

1. Introduced a feature to lower the liquidation standard when a position is held past a certain number of days. This is designed to reduce the holding period. We have determined the optimal value based on big data analysis and built it into the system as a parameter.

2. Updated with the latest training data.

Please note that changes in the backtest order position due to alterations in the holding period are normal.

Versione 3.52

2023.10.12

In response to requests from some clients, we have combined versions 3.5 and 3.51:

1. Added option to select version 3.50. If market situation is set to off=Version3.50, it will be version 3.50, which disables this feature. The default is adaptive, which is version 3.51.

2. Fixed auto-calculation feature for non-USD accounts. Since some brokers do not provide the data needed for calculations, auto-calculation could not be implemented. It is now changed to manual input. 1 account currency in USD: The number of USD that 1 unit of account currency can be exchanged for. The lot size calculated by the EA will be multiplied by this value when placing orders. The default is 1 for USD accounts.

Clients who do not need version 3.50 and usd USD accounts do not need to update.

In the 3.51 upgrade, we introduced a new trend oscillation judgment system, aiming to improve our EA (Expert Advisor). However, there are always two sides to things. While reducing trades against the trend, it may also misjudge similar market conditions, thus reducing trading opportunities, impacting backtest results, and lowering profits. Some clients prefer more trading opportunities, this is just two different trading styles. We provide clients the option to choose. Since the platform cannot select versions, we added the option in version 3.52.

Versione 3.51

2023.10.09

Important upgrade

1. Added market condition judgement function (market situation). The default is adaptive. The adaptive mode can already identify some strong trending markets. If there is an obvious trending market due to big news, you can manually switch to trend mode or range mode for human monitoring of the loop.

2. Added account currency pair recognition. This function will automatically convert the user's account balance to "USD" based on the latest exchange rate for position sizing. This allows different currency accounts to achieve standardized risk per trade. It also fixes the issue of oversizing with JPY accounts.

3. Updated with the latest training data.

Note that changing settings or upgrading the EA will reset accumulated drawdown to zero for recalculation.

Versione 3.50

2023.09.12

Major Upgrade 3.5 version

1. Added a new filtering algorithm to decrease the drawdown rate

2. Adjusted the sensitivity of hedge protection

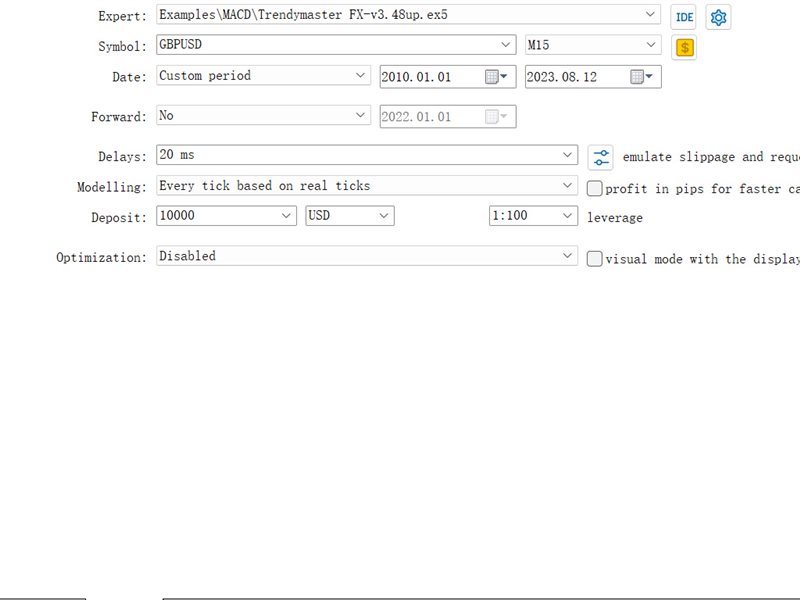

3. Expanded the training data, with the new model utilizing 20 years of training data

Given the substantial changes brought by the new model, it's normal for the order position to differ from before.

Versione 3.49

2023.08.21

1. Added support for USDJPY, completing support for all 6 major currency pairs. All configuration files are now internally integrated.

2. The maximum number of open positions allowed, exceeding the maximum lot size, is capped at 100.

3. Fixed a bug related to hedging.

4. Lowered the default risk value for backtesting to 0.08.

5. Routine updates are carried out weekly.

Versione 3.48

2023.08.13

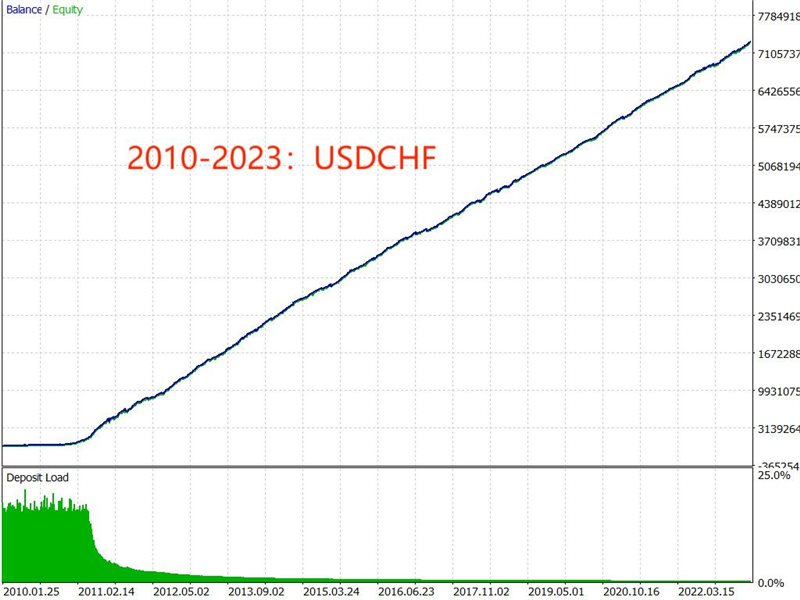

1. Added support for the USD/CHF currency pair.

Current supported currency pairs include GBPUSD,USDCAD, EURUSD, AUDUSD,USDCHF.

2. Reduced the default risk value for live trading to 0.01, with the maximum spread adjustment set to a default of 50 points.

The previous value of 0.05 was set for individual currency pairs. When using multiple currency pairs in the same account, although the risk is not simply additive, the simple risk coefficient summation serves as a feasible and conservative reference due to factors such as currency interlinkage. Adjust the risk value yourself if necessary, based on the number of currency pairs you are using.

3. New model training has been completed. Version 3.48 has been updated to use the new model to increase accuracy.

Versione 3.47

2023.08.05

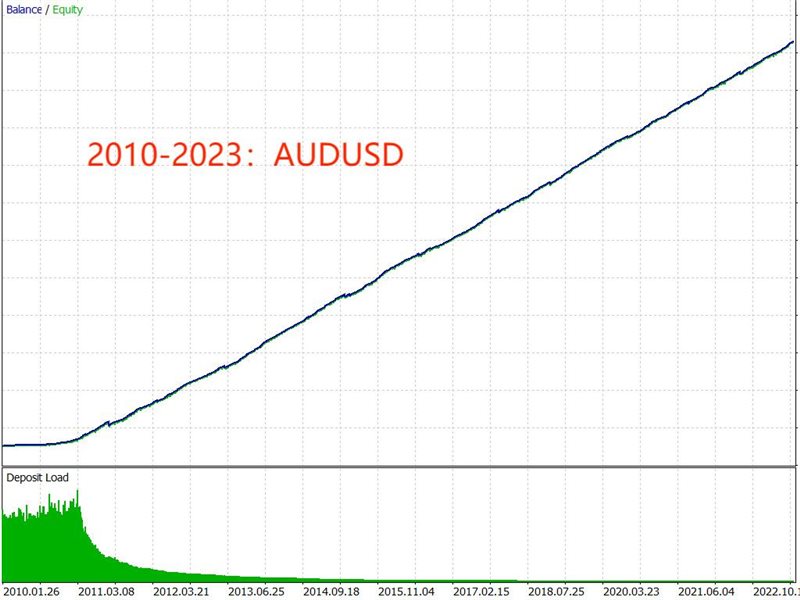

1. Added real-time calculation support for the AUDUSD currency pair.

2. Added a new parameter "Reset Time for Order Resumption After Maximum Drawdown (hour)", the function is to reset the maximum drawdown value to 0 after a specified number of hours so that the EA can continue to place orders.

3. Optimized the algorithm. The order points after the upgrade will be different from the previous version.

4. Updated the weekly training data.

The currency pairs now supported by the server for real-time calculation are USDCAD, GBPUSD, EURUSD, AUDUSD.

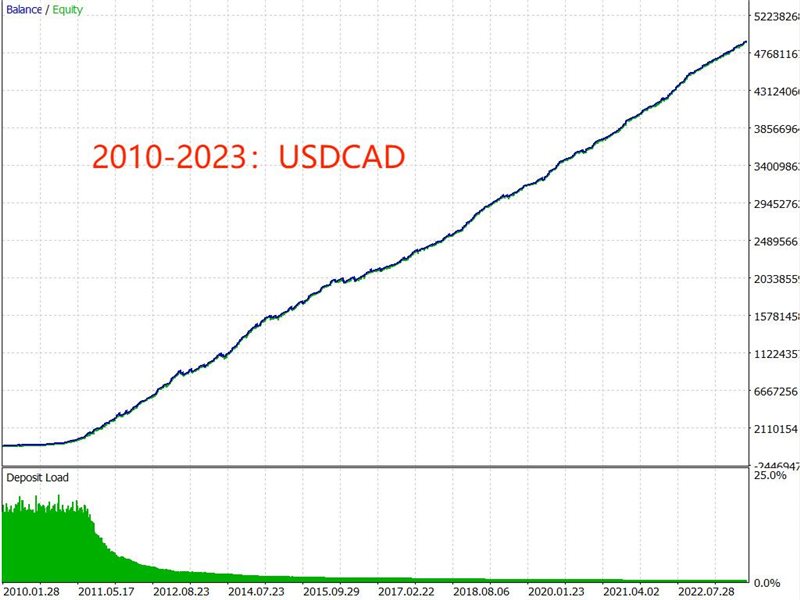

USDCAD is least affected by US news market trends.

Versione 3.46

2023.07.20

Major update:

1. Added real-time calculation support for the USDCAD currency pair, which is less affected by major US news and is currently the most ideal currency pair. It has the best algorithm adaptability. Recommended.

2. The training parameters for EURUSD and GBPUSD have been fine-tuned to increase market adaptability.

3. Adjusted some default parameters.

The recommended currency pairs for use now: USDCAD is the first choice. EURUSD and GBPUSD are the second choices. Real-time computing power support for other currency pairs is gradually being opened, and it is not recommended to use other currency pairs in live trading at present.

As one customer said, we cannot please all customers, and it is obviously inappropriate for developers with decades of trading experience to follow the guidance of those with only a few years or even novices. Suggestions can be listened to, but it is not worth changing the original development plan for fear of negative reviews. In the future, we will continue to improve the EA according to the plan.

A true EA always has market conditions that it is not adapted to. Forex traders must have patience and remove greed and fear. A true EA cannot avoid drawdowns. It is not advisable to exchange high risk for a good-looking profit curve. We should prioritize account safety and use a risk value that we can bear.

Versione 3.45

2023.07.11

The 3.45 version update includes the following:

1. Training adaptation for EURUSD has been completed, and real-time computing power support for EURUSD has been added. It is recommended to only use the EURUSD and GBPUSD currency pairs in live trading, and not to use other currency pairs for the time being.

2.Added “Maximum allowed number of trades per 24 hours”. If the number of trades within 24 hours exceeds this value, the EA will consider it an abnormal situation and will stop placing orders and alert the user. After 24 hours, the EA will automatically resume placing orders.

3. The "Maximum lot size limit" has been changed to false by default, and the "Lot mode" has been changed to "Initial capital risk mode" by default. This allows for a better display of our EA's long-term performance curve, allowing newcomers to better understand the EA instead of just focusing on large profits.

In "Initial capital risk mode", the lot size is calculated once based on the initial capital each time the EA is run, and is not recalculated based on changes in capital during operation.

We have temporarily cancelled the weekly routine training data update plan. Although we believe that updating training data with the latest market changes on a weekly basis helps the EA adapt more accurately to new market changes, it can also cause misunderstandings among newcomers. From one negative review, some people mistakenly believe that even if data is updated, it will only change backtest results and cannot make a profit. Even though we explained the design philosophy of our EA, such negative reviews still seriously mislead new potential customers. We are not sure if most people do not like such updates or if only a few people misunderstand while the silent majority supports it. If you support us, please give us a 5-star rating and support us with any content, thank you. We will determine whether weekly routine training data updates are needed based on the number of supporters.

Versione 3.44

2023.06.25

1. Add CustomLotSizeMode. When this mode is selected, the EA will strictly place orders according to the value of CustomLotSize.

2. Add a new filtering algorithm to greatly increase accuracy and slightly reduce the number of orders placed. The old filtering algorithm is set to false by default to turn it off.The RiskMode is set to be selected by default.

3. Update training data on a weekly basis.

The deep learning neural network has learned this strong market trend well, and with the new filtering algorithm, this will cause changes in backtesting, but don’t worry about it. Continuous learning is the only way to adapt to new market changes. We are working hard to prevent the same market from happening again.

Versione 3.43

2023.06.19

1. Fix code that may cause bugs.

2. Update training data on a weekly basis.

3. The "Maximum lot size limit allowed to be breached" option is now turned off by default.

4. Added "FixedMode" to the "Risk" settings and set it as the default. In FixedMode, the EA places orders based on the initial capital ratio according to the Risk value and recalculates every time the EA is restarted or updated. The difference from RiskMode is that RiskMode recalculates every time an order is placed. MinLotMode uses the minimum lot size for each order.

If you want to get the same backtest results and settings as version 3.42, just set the "Maximum lot size limit allowed to be breached" option to true and change "FixedMode" in the "Risk" settings to "RiskMode".Double-click to modify the value.

Reason for change: Some customers do not understand the amplification effect and risk of risk, and are even afraid of common drawdowns, giving a 1-star rating and not listening to explanations. Although we cannot guarantee that the EA will definitely make money in the future, we should at least understand the operating principles of the EA. Using the new default settings allows new and old customers to better observe the EA from backtesting, more intuitively observe the drawdown curve, and help achieve no surprises in drawdowns. FixedMode is also a commonly used order mode in forex. Forex is always risky, we hope you understand.

After selling EA for more than a month, we have realized that we cannot satisfy all customers, and we do not want to spend energy explaining negative reviews. We hope that customers who like our EA or have expectations for our EA can give us a 5-star rating to encourage us to continue improving our EA and hedge against the morale impact of negative reviews. In the future, we will try our best to do things according to our ideas.

Versione 3.42

2023.06.12

1.Added additional filtering function, which is enabled by default. This function can improve the accuracy of algorithm judgment, and the overall algorithm score is improved.

2.Added hedging protection function, which is enabled by default. This function can protect the account in various major events and market situations, and automatically activate when the algorithm misjudges the opposite direction of the market with a large increase. This function will open a lock on some orders in the opposite direction, which can better protect the account than a hard stop loss. This function is only enabled when the account supports hedging. Although this method may not significantly increase the profit potential and may even cause small losses, it can still generate profits overall, and the main function is capital protection.

3.To protect the interests of our users, we have decided to separate the risk value. Many users tend to use the default value without changing the risk value according to their own situation, so we need to set a safer risk value. When the default value is lowered, some old users find that the backtesting results become worse after upgrading the EA, and some customers cannot understand this situation. Therefore, we have decided to use a separate approach to set different risk values for backtesting and live/demo trading, in order to meet the needs of different users.This can also avoid users mistakenly using a higher risk value during live trading that was intended for backtesting.

Please note that the default risk value for backtesting is set at a maximum of 0.15, whereas the default risk value for live trading is lowered to 0.05. Please adjust accordingly.

4.update the new training data.

Instructions for use: https://www.mql5.com/en/blogs/post/753099

Versione 3.41

2023.06.04

1,Increase global DD. When the maximum drawdown reaches a certain level, the system can stop placing orders and close all positions. These two options can be set separately, with 0 ,indicating no restrictions. Please note that each reload or update will reset the maximum drawdown to 0, so please set it accordingly.

maxDrawdown does not place orders (%): Orders will not be placed when the maximum drawdown exceeds this value. However, the EA will continue to wait for opportunities to close positions.

maxDrawdown does not place orders and closes all positions(%): Orders will not be placed when the maximum drawdown exceeds this value. Moreover, all positions generated by this EA will be forcibly closed.

2,Support for accounts with different minimum trade sizes, such as accounts with a minimum of 0.1 lots.

3,Redesign the Risk calculation formula to make it more accurate.

4,Fix issues with SL settings.

5,Fix the bug where the system does not place short positions when the trade size exceeds the maximum limit.

6,Update data.

Versione 3.40

2023.06.01

According to customer feedback, using the MQL5 platform's VPS will result in a prompt that MT5 does not allow trading. This is because the MQL5 platform's VPS is different from a regular client.

Update:

1. Added the MT5 configuration check option, and even if a prompt is displayed, the program will not be interrupted.

If you are not using the MQL5 platform's VPS, you can ignore this update.

Versione 3.39

2023.05.28

After communicating with the customers who requested version 2.38, we found out that they wanted the high returns shown in the demo video. In fact, this was only due to different data weights used during training. Now we have integrated two different weight modes for users to choose from. There is no conclusive answer as to which one is better.

Updates:

Added Training data weights mode, allowing users to select data weights

Added allowed trading direction option, enabling users to manually restrict the trading direction

Refactored code, now allowing mixed EA and manual orders, without limitations

Updated training data

Channel link:

https://www.mql5.com/en/channels/tendmaster

Our EA was taken down by the platform because the name contained “auto” and we were forced to change it. Due to this name issue, our EA received negative feedback from some unreasonable people, causing our rating to drop and seriously affecting our sales. This is a big blow to our enthusiasm for upgrading and improving our EA. Therefore, we ask you, if you are satisfied with or looking forward to this EA, please give us positive feedback. A five-star rating is the best encouragement for us. Thank you.

You can also join our channel Channel link: https://www.mql5.com/en/channels/tendmaster

Versione 3.38

2023.05.26

Version rollback 2.38 (Many customers think this version works best)

Fixed the bugs in 2.38 and added a hard stop loss. And updated the latest training data parameters. Friends who do not want to roll back the version should be cautious when upgrading.

Risk increases from 0.03 to 0.08 by default.Please note

We saw a 2-star negative review about upgrading the version. At first we were puzzled as to why upgrading would result in a negative review. Later we figured it out, the version that the customer purchased at the time was different from the upgraded one. Algorithm upgrades can cause mismatches.

So in the future we will only fix bugs and update data parameters for the program, and will not make major algorithm updates.

New algorithms will be released as new products. Thank you for your understanding.

Because the platform stipulates that the updated version can only be higher, so the actual 3.38 is the previous 2.38.

Versione 2.51

2023.05.24

Major upgrade.

1. Refactored over 4000 lines of code, significantly reducing the occurrence of bugs.

2. Added a position increase mode, now able to better increase profits.

3. Added filtering conditions, now with higher accuracy, and the number of orders may decrease accordingly.

4. Fixed a bug where a position could not be closed because of a manual order

Versione 2.41

2023.05.15

fix bug 3

Versione 2.39

2023.05.14

1.Automatically calculate risk by obtaining leverage. The new formula is: (ACCOUNT_MARGIN_FREE)MaximumRisk/margin (required margin)/leverage100. In other words: with a remaining balance of 1000 US dollars, Risk 0.01 corresponds to an order size of 0.01 lots. The default is 0.03 and the maximum is 0.15. It is recommended to keep it below 0.1 for greater safety. The account leverage is automatically obtained to get a more standard value. Now the same lot size is maintained regardless of the leverage.

2.Added initial stop loss point (currently locked and optimized, cannot be changed).

3.Limited maximum risk to 0.15 (it is still recommended not to be too large, below 0.1 is safer).

4.Fixed a bug where test orders could not be completed when there were manual orders.

5.In response to many users’ desire for backtest points to match live trading, the update of the latest training data has been suspended (updating data may cause slight differences).

6.Fixed a bug where multiple different currencies may interfere with each other (do not hang several EAs on the same currency).

Versione 2.38

2023.05.11

1, Add TestTrade testing function

The TestTrade will incur a minimum lot size transaction fee.

If you are sure your EA will be working, turn it off.

If you don't see the pop-up window to prove that you don't have MT5 set up correctly

2, Solve the lot size error when the user has too little money and uses too small a Risk.

3, Upgrade to AI adaptive parameters to prevent users from using them incorrectly and causing losses (as suggested by users)

Versione 2.36

2023.05.09

a little bug

Versione 2.35

2023.05.09

a little bug

Versione 2.34

2023.05.09

a little bug

Versione 2.33

2023.05.09

fix magic bug

Versione 2.32

2023.05.08

Add parameter settings and fix bugs.

Practice has proven that this EA performs well and truly generates profits.