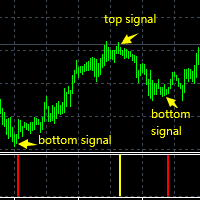

Super Top bottom signal

- Indicatori

- Yong Fang Li

- Versione: 2.0

- Aggiornato: 16 aprile 2022

- Attivazioni: 10

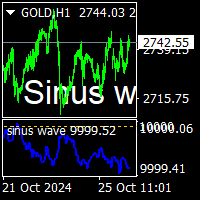

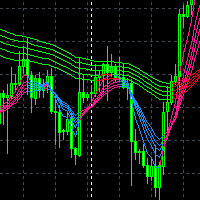

The super trade signals channel index system automatically calculates the supporting lower track and resistance upper track according to the fluctuation amplitude of K-line at this stage and the position of space.

The super trade signals channel indicator system will automatically calculate and detect the supporting lower rail line and resistance upper rail line at the position of K line in real time. When the price of K line touches the supporting lower rail line, it will automatically prompt the buying arrow signal. When the price of K line touches the resistance upper rail line, it will also automatically prompt the selling arrow signal. These buying and selling arrow signals prompted on and off rail are simple and clear, It can automatically prompt the buying and selling arrow signal in real time. The user can operate the buying transaction when the K-line price touches the buying arrow signal prompted by the track under the support and the selling transaction when the K-line price touches the selling arrow signal prompted by the track above the resistance. Of course, the user can also cooperate with other index systems to improve the efficiency and success rate of buying and selling transactions. Using the super trade signals channel index system can more effectively assist users in buying and selling the current K-line price.

The super trade signals channel indicator system will automatically calculate and detect the supporting lower rail line and resistance upper rail line at the position of K line in real time. When the price of K line touches the supporting lower rail line, it will automatically prompt the buying arrow signal. When the price of K line touches the resistance upper rail line, it will also automatically prompt the selling arrow signal. These buying and selling arrow signals prompted on and off rail are simple and clear, It can automatically prompt the buying and selling arrow signal in real time. The user can operate the buying transaction when the K-line price touches the buying arrow signal prompted by the track under the support and the selling transaction when the K-line price touches the selling arrow signal prompted by the track above the resistance. Of course, the user can also cooperate with other index systems to improve the efficiency and success rate of buying and selling transactions. Using the super trade signals channel index system can more effectively assist users in buying and selling the current K-line price.

Can be better