Omega Point Indicator

- Indicatori

- Tom Seljakin

- Versione: 1.34

- Aggiornato: 14 maggio 2022

- Attivazioni: 5

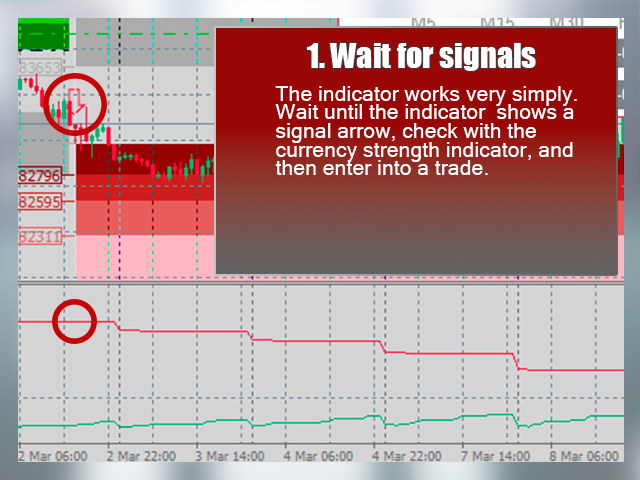

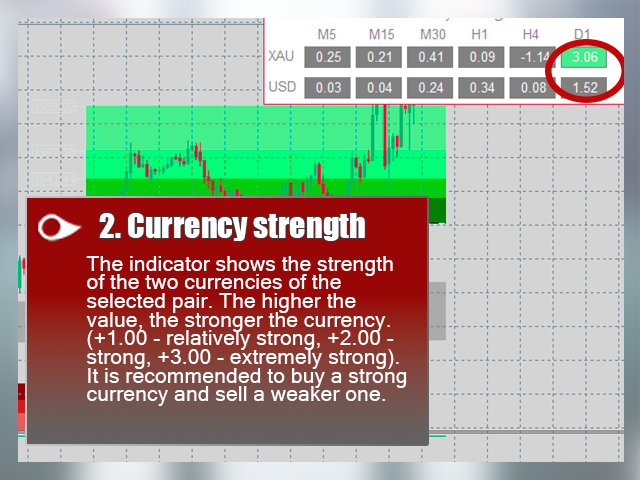

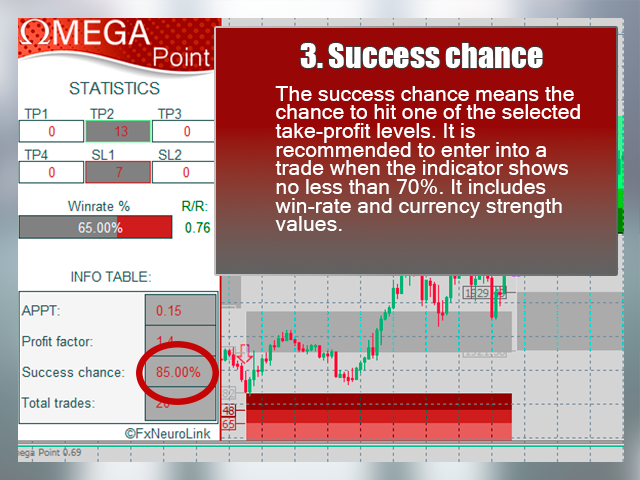

The Omega Point indicator uses a complex multilayered system that is used by the top world traders which helps to determine the beginning of trends that are highly likely to last for a long time. The system uses several complex trend calculation modes, due to which the indicator adapts to the specifications of different currency pairs, and is suitable for both conservative and aggressive trading. The indicator makes the necessary calculations and shows important information about how the trade would have been executed if the trader had entered the market, thus the trader can always calculate what profit to expect.

- A complex mathematical system for calculating a start of a trend.

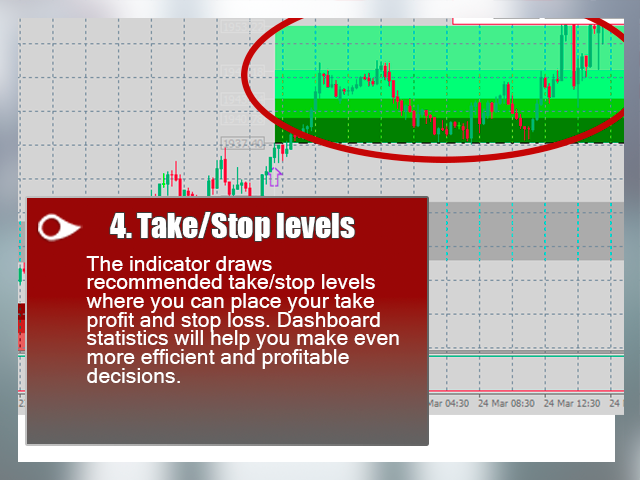

- The indicator shows multiple levels of profit taking for maximum profit.

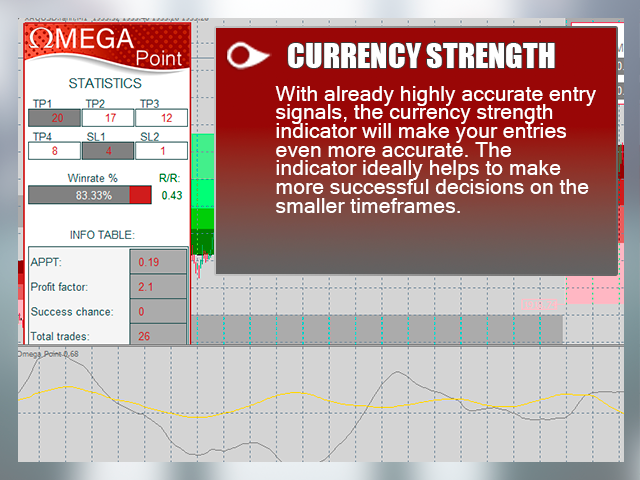

- The most detailed and honest statistics showing how transactions would be executed if the trader entered the market.

- It has three unique strategies (entry into an emerging markets, entry into a continuing trend, scalping in the end of a trend).

- Suitable for various trading instruments and timeframes.

- Suitable for both scalping and long-term trading.

- Easy to learn.

- Doesn't repaint.

Description of parameters:

- Indicator's mode: There are three signaling modes to choose from.

- Early trend catcher - the indicator will give signals in case of emerging trends.

- Confirmed trend continuer - the indicator will give signals on confirmed trends.

- Late scalpigng - the indicator will give signals when the trend loses its strength.

- Indicator's sensitivity - signal sensitivity. The higher the sensitivity, the more often there will be signals to enter a trade.

- Stop-level 1 mode - the distance between the entry price and the price of the first stop level.

- Take/Stop-levels volatility levels: definitions of take/stop levels.

- Automatic - take-level width will be determined automatically by the ''Indicator's sensitivity'' parameter (the higher the sensitivity, the shorter the take-level width will be).

- 1x-6x - certain fixed width of take levels.

- Show take profit-levels - show/hide take/stop levels.

- Panel corner - indicator panel anchoring angle.

- Panel x/y offset - offset of the indicator panel along the x/y axis.

- Count type: Take/stop level counting mode.

- Count all take-profit - the indicator will count all take profits, stop losses, regardless of what the price touched first (take level or stop level).

- Take-level 1/2/3/4 to stop-level 1/2 - the indicator will count how many times this or that take/stop level has been touched.

- MaxHistoryBars - How many bars on the chart to use for counting signals.

Indicator has good potential but tough to work with indicator and with little support from author.