Bollinger Bands MT5

- Indicatori

- Tatiana Savkevych

- Versione: 1.0

- Attivazioni: 5

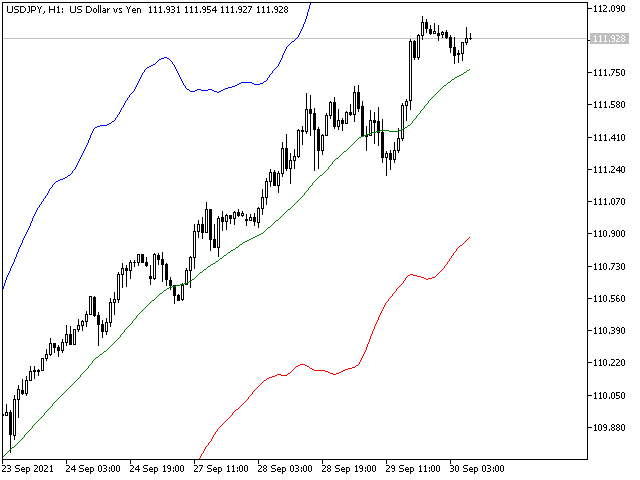

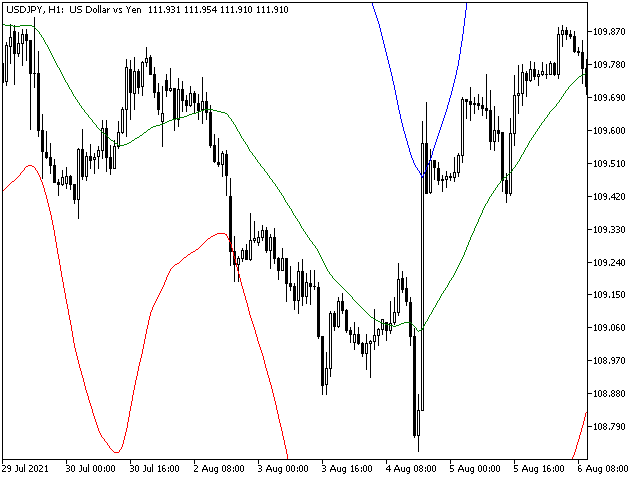

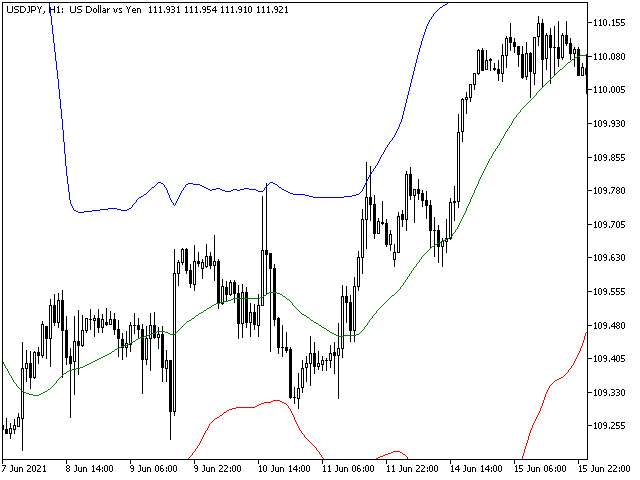

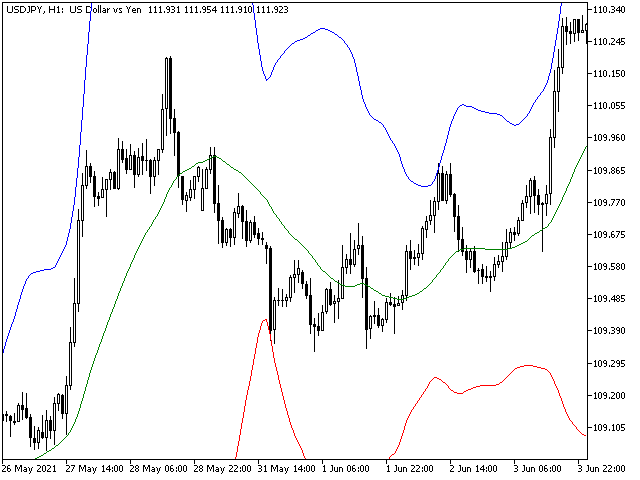

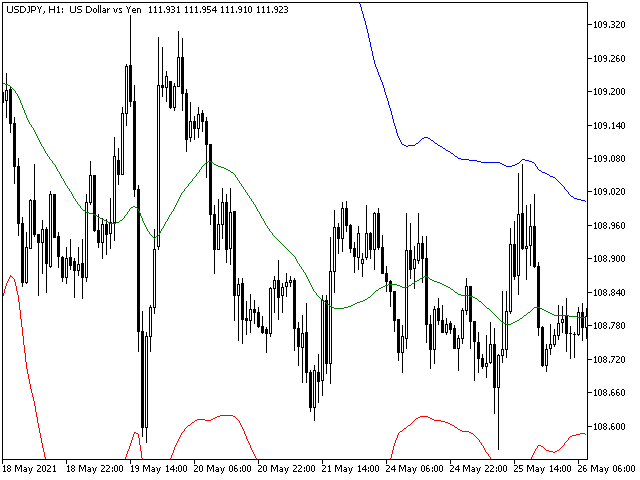

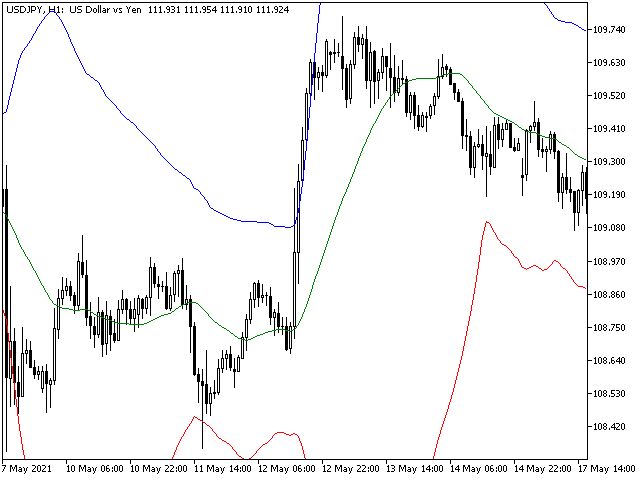

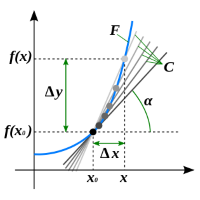

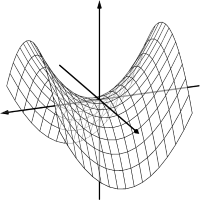

Bollinger Bands (BB) are similar to Envelopes. The difference between them is that the boundaries of the Trade Bands (Envelopes) are located above and below the moving average curve at a fixed percentage distance, while the Bollinger Bands are plotted at distances equal to a certain number of standard deviations. Since the magnitude of the standard deviation depends on volatility, the bands themselves adjust their width: it increases when the market is unstable, and decreases in more stable periods.

This indicator implements a more advanced channel based on the Bollinger Bands algorithm. The peculiarity of the implementation is that improved functionality is used to calculate moving averages. This indicator is suitable for those who are interested in the classic calculation method but with improved functionality. There is a version for both MT4 and MT5.

What is the channel? This is the price range (limited), in which all its dynamics (movement) takes place over a certain period of time. This method is very old, the Forex channel strategy dates back to a long time, when the theory was put forward that the price is constantly moving in a certain range. Accordingly, this range is called the "Forex channel". The difference between this channel is that mathematical integration is used to form trend lines. As well as improved functionality for plotting moving averages.

Bollinger Bands are formed from three lines:

- The middle line is a regular moving average.

- The top line is the same middle line shifted up by a certain number of standard deviations.

- The bottom line is the middle line shifted down by the same number of standard deviations.

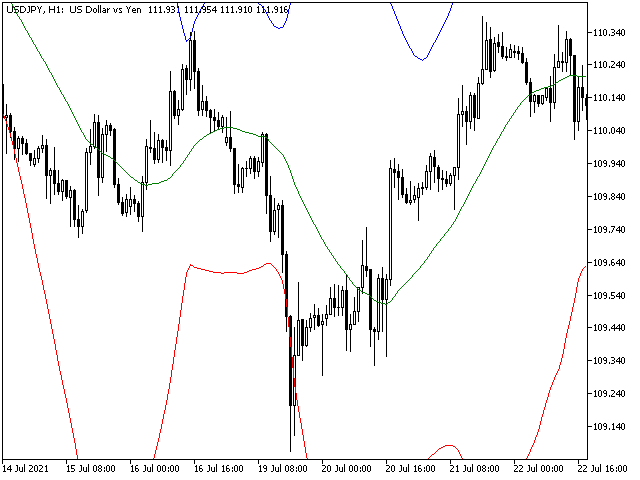

The features of this indicator include:

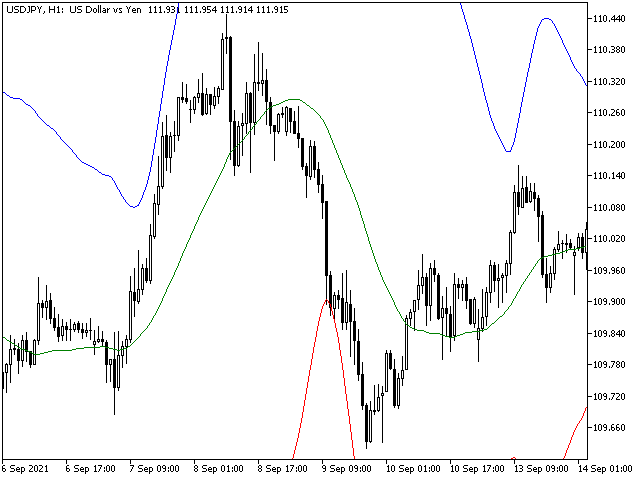

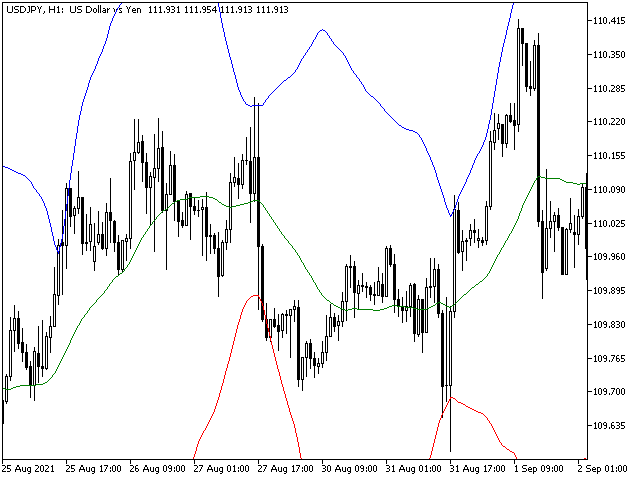

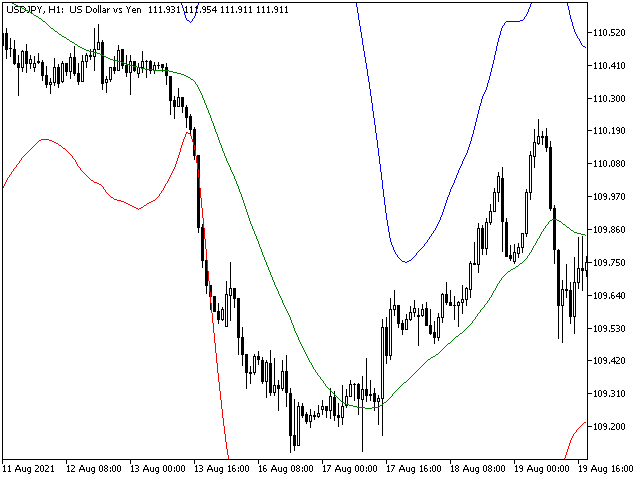

- sharp price changes, usually occurring after a narrowing band, corresponding to a decrease in volatility;

- if prices go beyond the band, a continuation of the current trend should be expected;

- if peaks and troughs outside the band are followed by peaks and troughs inside the band, a trend reversal is possible;

- a price movement that started from one of the band's borders usually reaches the opposite border.

- The latter observation is useful in predicting price targets.

The interpretation of Bollinger Bands is based on the fact that prices tend to stay within the upper and lower bounds of the band. A distinctive feature of Bollinger Bands is their variable width due to price volatility. During periods of significant price changes (i.e., high volatility), the bands widen to give room to prices. During periods of stagnation (i.e., low volatility), the bands narrow, keeping prices within their boundaries.

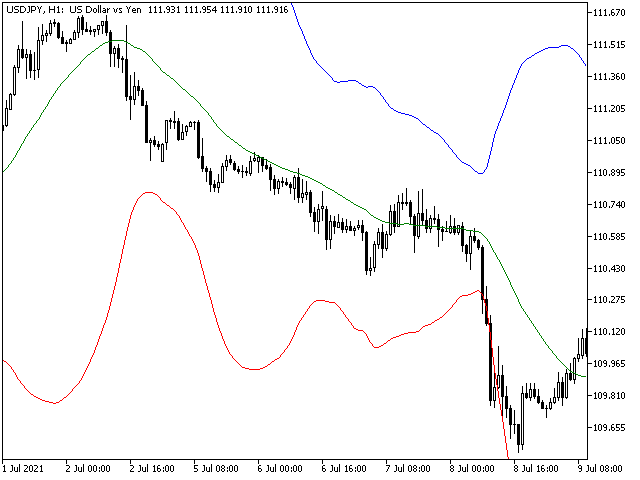

Peculiarities

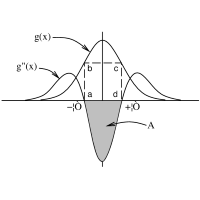

Moving averages are commonly used in time series data to smooth out short-term fluctuations and highlight major trends or cycles. Moving average is a type of convolution mathematically. This implementation differs in that it presents a whole set of different types of convolution, which is reflected in the settings by an extended set of methods.

- METHOD_SMA

- METHOD_EMA

- METHOD_SMMA

- METHOD_LWMA

- METHOD_WILDER_EMA

- METHOD_SINE_WMA

- METHOD_TRI_MA

- METHOD_LSMA

- METHOD_HMA

- METHOD_ZL_EMA

- METHOD_ITREND_MA

- METHOD_MOVING_MEDIAN

- METHOD_GEO_MEAN

- METHOD_REMA

- METHOD_ILRS

- METHOD_IE_2

- METHOD_TRI_MA_GEN

- METHOD_VWMA

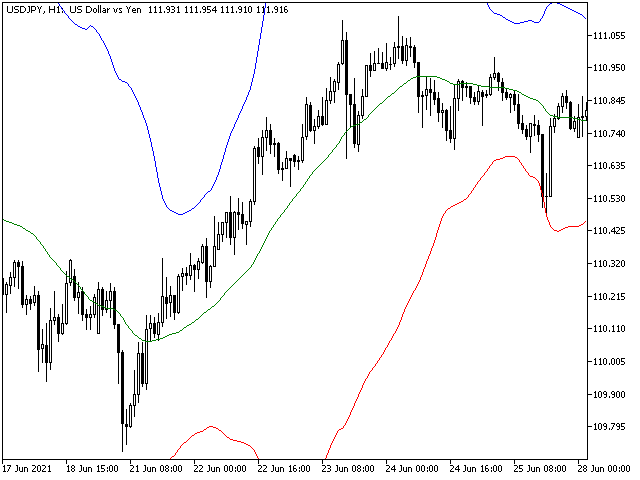

Also, this indicator implements the calculations of averages relative to an extended set of price calculations. What's in the settings is represented by the following list.

- TYPE_PRICE_CLOSE

- TYPE_PRICE_OPEN

- TYPE_PRICE_HIGH

- TYPE_PRICE_LOW

- TYPE_PRICE_MEDIAN

- TYPE_PRICE_TYPICAL

- TYPE_PRICE_WEIGHTED

- TYPE_PRICE_MEDIAN_OC

- TYPE_PRICE_TYPICAL_O

- TYPE_PRICE_WEIGHTED_O

- TYPE_PRICE_WEIGHTED_OC

- TYPE_PRICE_H_O

- TYPE_PRICE_H_C

- TYPE_PRICE_L_O

- TYPE_PRICE_L_C

- TYPE_PRICE_H_MIN

- TYPE_PRICE_H_MAX

- TYPE_PRICE_L_MIN

- TYPE_PRICE_L_MAX