Instrument Variation

- Utilità

- Michele Massa

- Versione: 1.0

- Attivazioni: 10

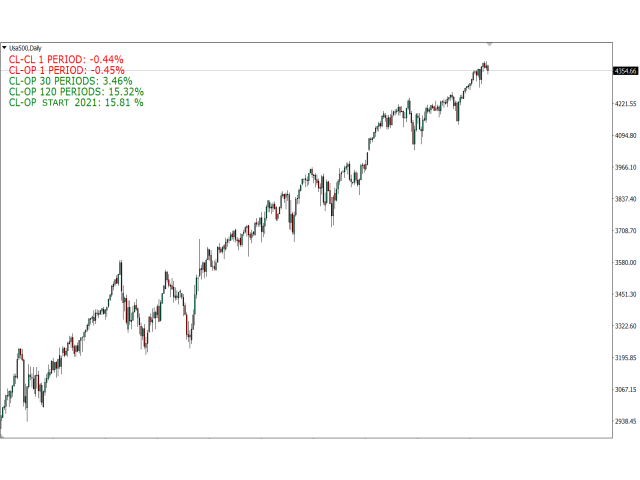

You can always keep the market variation under control by setting the time frame you prefer.

Once applied to a chart, such as EUR/USD or SP500, we can choose different parameters for our utility.

- back_periods_1

- back_periods_2

- years_back

- align

THE FIRST TWO PARAMETERS(1, 2): Allow you to set the two time periods that refer to the chart, so if we have set the parameters as default, that is 30 and 120, and we have dragged the utility onto a chart on a 1 day timeframe, the time period that will be considered for the variations will be 30 days and 120 days, if instead we had set the chart on a 1 minute timeframe, the variation considered would have been 30 minutes and 120 minutes.

THE THIRD PARAMETER(3): Allows you to set the years back for the calculation of another variation of the instrument. So leaving the default parameter, that is 0, and finding ourselves in the year 2021, the period used to calculate the variation will be from the beginning of 2021 to today, if instead we are in the year 2021 and we set as a value 1, then the period used for the change will be from the beginning of 2020 to today.

THE FOURTH PARAMETER(4): Allows us to set where we want our utility to be shown on the chart of the Metatrader 4, it can be set to the right or left.

- CL-CL 1 PERIOD

- CL-OP 1 PERIOD

- CL-OP (back_periods_1) PERIODS

- CL-OP (back_periods_2) PERIODS

- CL-OP START (years back)

THE FIRST VALUE(1): refers to the variation in the market from the previous close to the current price (therefore 1 period back, also considering any price gaps).

THE SECOND VALUE(2): refers to the variation in the market from the opening of the current candle to the current price (therefore 1 period back NOT considering also any gaps in the price).

THE THIRD VALUE(3): refers to the variation in the market from the opening of the candle to "back_periods_1" at the current price.

THE FOURTH VALUE(4): refers to the variation in the market from the opening of the candle to "back_periods_2" at the current price.

THE FIFTH VALUE(5): refers to the variation in the market from the opening of the "years_backward" candle at the beginning of the year at the current price.