Neyron New Generation

- Experts

- Andriy Sydoruk

- Versione: 1.7

- Attivazioni: 10

Requires a learning network (optimization)!

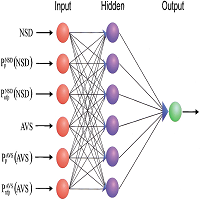

Professional robot, which implemented trading strategy using neural networks. Used multi-layer fully connected feedforward networks MLP (multilayer perceptron).

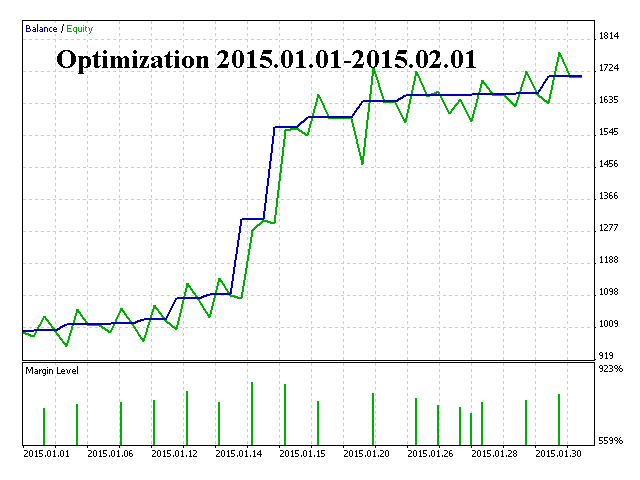

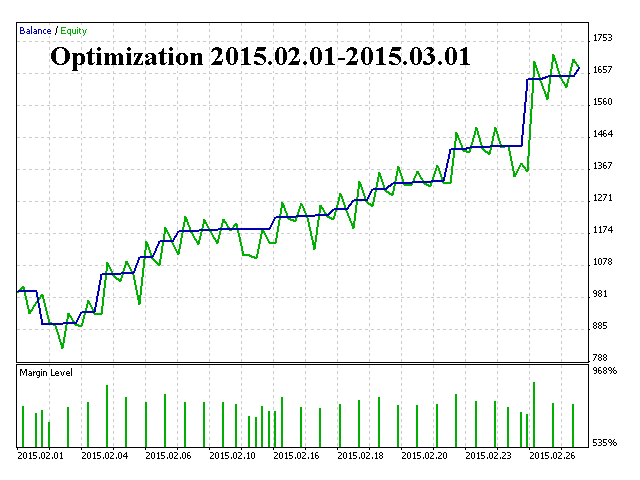

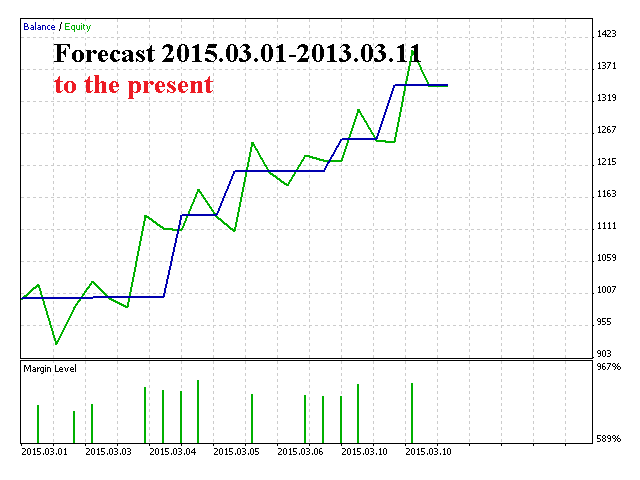

The ability to learn is the main feature of the brain. Artificial neural networks for learning refers to the process of configuring the network architecture (structure of connections between neurons) and synaptic weight (affecting signals coefficients) for the efficient solution of the problem. Usually the training of the neural network is carried out on a sample (historical data). As the learning process that occurs on some algorithm (used for training optimization genetic algorithm), the network must become better and better in responding to input signals.

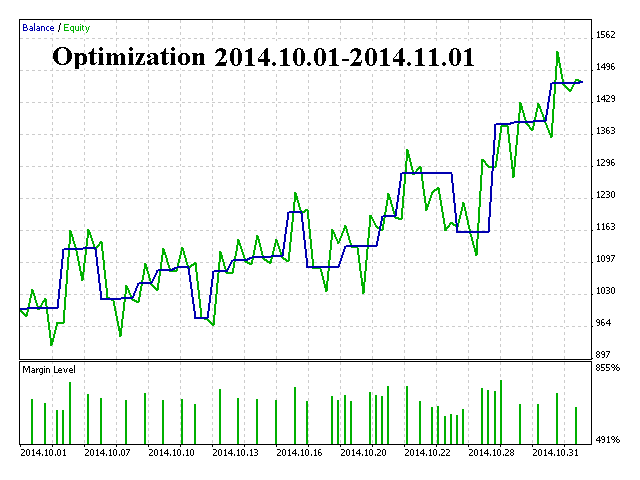

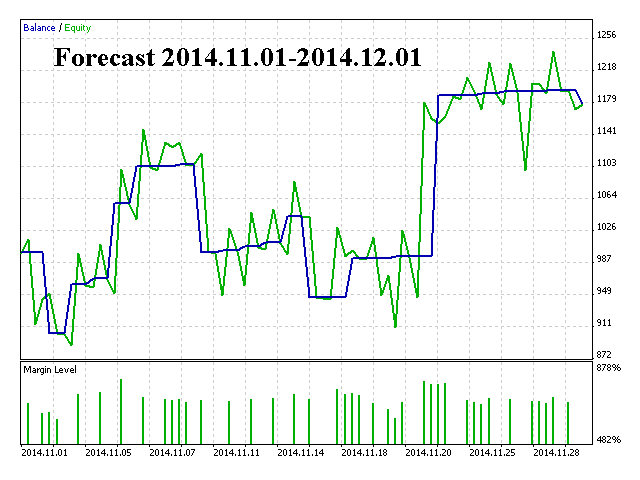

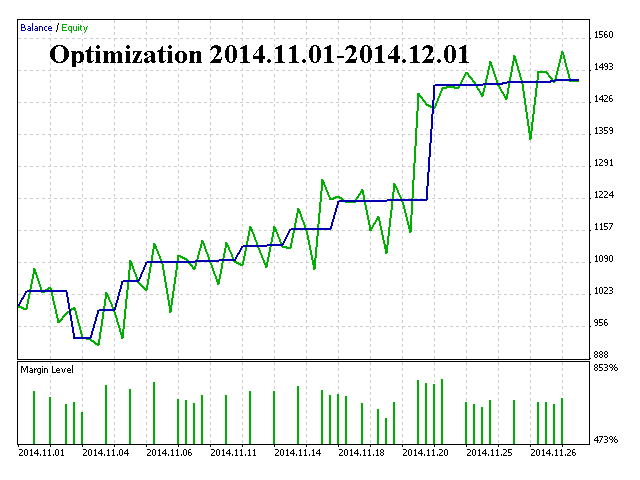

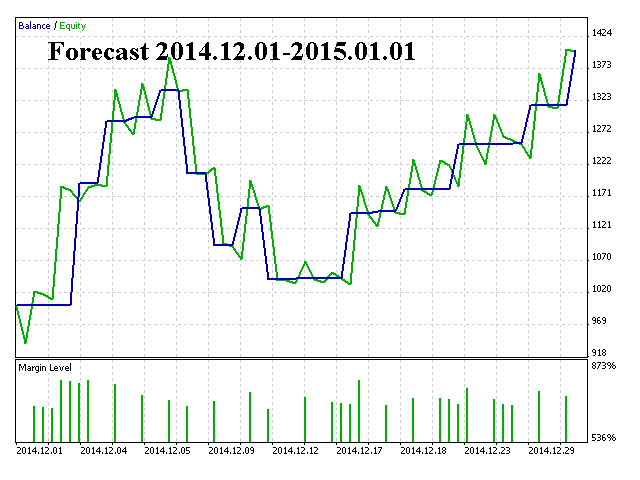

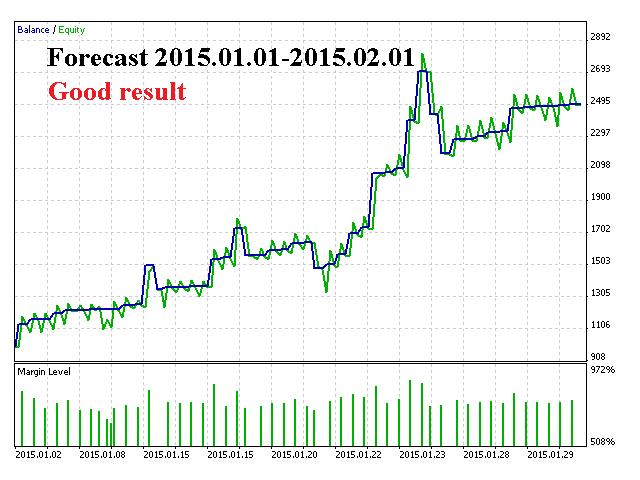

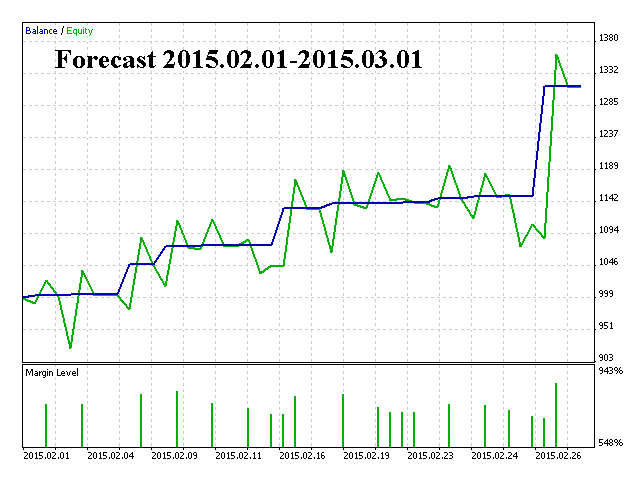

It remains only to check how accurate optimized parameters make it possible to forecast the future. For that end a phased check of results is applied. An example is given in comments together with optimization settings.

Indicator RSI are analyzed at the beginning of the current bar. Results of 10 bars of each indicator fall on input of the neural network. The weighting factors are formed separately for buys and sells. The network is trained on data from the indicators and, depending on the signal level at the output of the neural network, there may be 4 teams (at TypeDual = true): open / close a buy order, open / close a sell order. And depending on it the robot will open a BUY or SELL and keep the deal until the closing signal is received from the network. There is also a mode of neural network with two outputs (when TypeDual = false): first - the entrance to buy with automatic exit from the market, the second - input on sell with automatic exit from buy.

Expert correctly handles errors and works reliably with a capital from 100 USD. Expert uses the basic concepts: breakeven, trailing stop, stop loss and take profit, as well as the closing on the opposite signal, closing the signal and the correct calculation of risk.

Main parameters:

- WorkOpenLong - Allows you to open a long position.

- WorkOpenShort - Allows you to open a short position.

- WorkCloseLong - Allows you to close long positions.

- WorkCloseShort - Allows you to close the short position.

- WorkCloseReversLong - Allows you to close a long position when opening a short one.

- WorkCloseReversShort - Allows you to close a short position at the opening of a long one.

- SignalBar - The main signal bar.

- PeriodSignal - The period in which the indicators, and therefore the neural network, are enabled.

- TypeDual - Switch neural network mode with 2 or 4 outputs.

- LevelInLong - Input threshold of neural network for a long position.

- LevelOutLong - Output threshold of neural network for a long position.

- LevelInShort - Input threshold of neural network for a short position.

- LevelOutShort - Output threshold of neural network for a short position.

The following fields relate to the RSI indicator, by analogy, all subsequent indicators:

- EnabledRSI - Activating the indicator.

- k1_RSI_long - Factor of the indicator's influence on the total signal for a long position.

- k1_RSI_short - Factor of the indicator's influence on the total signal for a short position.

- Period1_RSI - Indicator period.

- Layer_1AL - Field 1 to adjust the neural network for a long position.

- Layer_1BL - Field 2 to adjust the neural network for a long position.

- Layer_1AS - Field 1 to adjust the neural network for a short position.

- Layer_1BS - Field 2 to adjust the neural network for a short position.