Donchian Channels Bands

- Indicatori

- Jonathan Destailleur

- Versione: 1.0

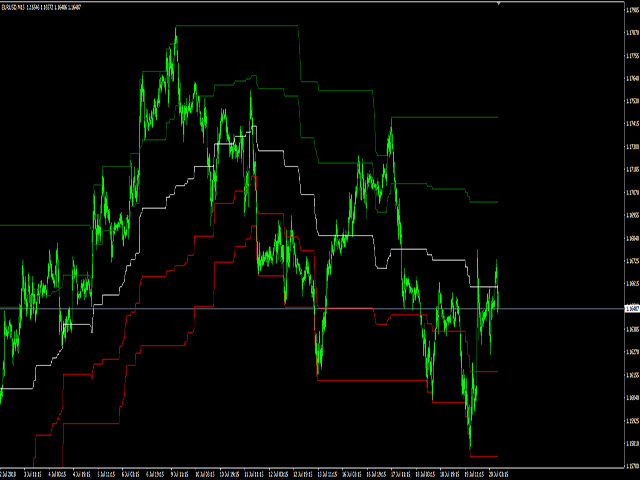

Price Channels are also known as Donchian Channels being named after Richard Donchian. They use the highest and lowest price of a set number of periods to create an upper and lower channel or envelope around the price. The upper channel shows the high of the number of periods chosen. The lower channel shows the low of the number of periods chosen. For example, the screenshot shows the Price Channels using 320 periods. The upper channel in the screenshot shows the highest high of the previous 320 bars. The lower channel in the screenshot shows the lowest low of the previous 320 bars.

Typical use is to see when the price breaks out of the channels to create a new high or low. This can indicate the beginning of a new trend if the price continues to increase or decrease. This indicator is most commonly known from the Turtle System in the futures markets. Richard Dennis, William Eckhardt, Dale Dellutri, and the Turtles had one system using the Price Channels at 20 bars and 10 bars and a second system using the Price Channels at 55 bars and 20 bars.

This version is adding 50% retracement lines

супер