Maximas e Minimas

- Experts

- Lucas Ricardo Almeida Muniz

- Versione: 2.0

- Aggiornato: 17 dicembre 2023

- Attivazioni: 5

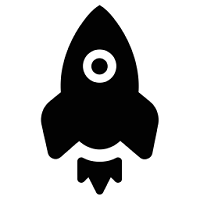

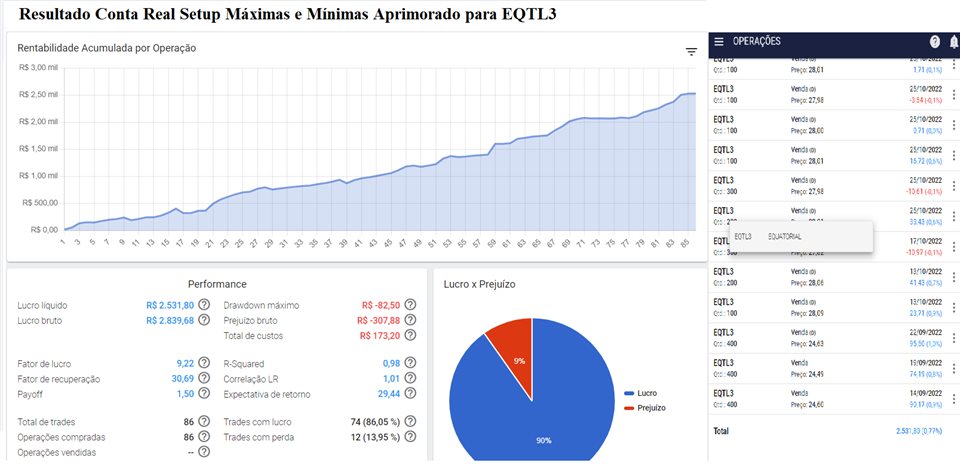

Users can choose from different strategies, including the classic "Highs and Lows" and a strategy developed for daily operations using the Keltner indicator.

Additionally, various indicators have been added, such as RSI, Bollinger Bands, Moving Averages with custom time intervals, and Stochastic. Each indicator allows for the establishment of specific rules for opening and closing positions.

The robot offers flexibility in position-closing strategies, allowing customization with options such as closing based on highs and lows, moving average crossovers, Bollinger Bands, among others.

Additional possibilities include candlestick patterns for opening positions, patterns to inhibit position opening, and various options for calculating stops.

The robot's configuration parameters are comprehensive, allowing the user to set the magic number for operation identification, choose the desired strategy, define allowed directions, adjust runtime, and configure a wide range of options to optimize operations.

Resource management is also flexible, allowing the use of different methods such as a fixed quantity of contracts, calculation based on available funds, aggressive betting, or the use of the Kelly formula.

Furthermore, the robot is designed to operate in both fractional and standard lots on the B3 exchange, as well as in the futures market.

The configuration parameters are organized into groups for easy understanding, including detailed comments to guide users in setting up the robot according to their preferences and operational strategies.

1. **SETUPS**

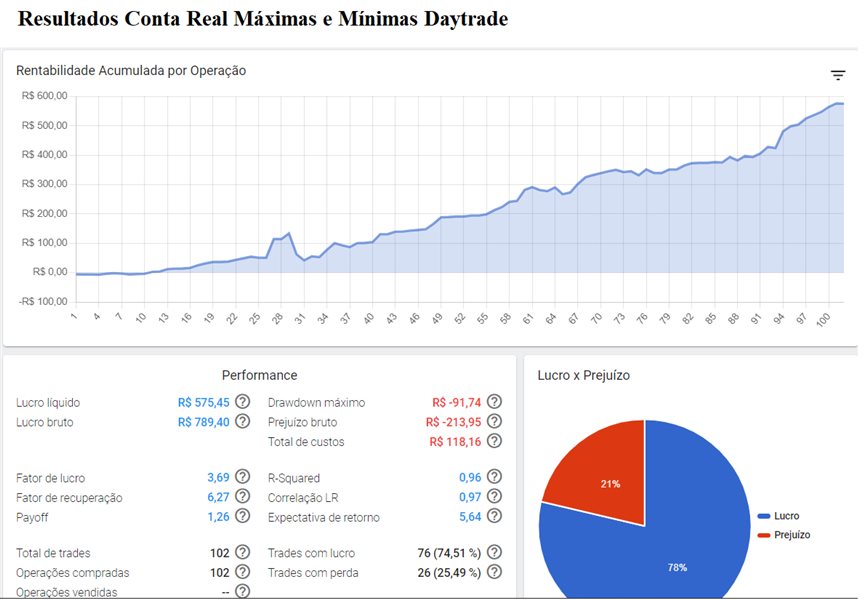

2. **2.1. Highs and Lows DayTrade (LS QUANT)**

Place a limit buy order when the price reaches the minimum of the last n candles and the closing price is above the upper Keltner band. Close the operation when the price exceeds the maximum of the last n candles.

3. **2.2. Parameters for Highs and Lows DayTrade (LS QUANT)**

- Setup: MAX_MIN

- NC_IN: Number of candles considered for evaluating position opening.

- NC_OUT: Number of candles considered for evaluating position closing.

- OP_TYPE: MOVING_LIMIT - Limited orders at the minimum or maximum.

- KELTNER_SETUP: KELTNER_CLOSES_OUT

4. **2.3. Classic Highs and Lows**

Perform a buy operation when the price reaches the minimum of the last n candles and close the operation when the price exceeds the maximum of the last n candles. (Does not use stops or any other indicators.)

5. **2.3.1. Parameters for Highs and Lows**

- Setup: MAX_MIN.

- NC_IN: Number of candles considered for evaluating position opening.

- NC_OUT: Number of candles considered for evaluating position closing.

- CLOSE_POSITION_1: CLOSES_ON_MAX_MIN - Close position at the maximum of n candles.

6. **2.4. Enhanced Highs and Lows**

Perform a buy operation when the price reaches the minimum of the last n candles and is below the Keltner band.

7. **2.4.1. Parameters for Enhanced Highs and Lows**

- Setup: MAX_MIN.

- NC_IN: Number of candles considered for evaluating position opening.

- NC_OUT: Number of candles considered for evaluating position closing.

- KELTNER_SETUP: KELTNER_CLOSES_OUT

8. **2.5. Moving Average Trap (Fox Trap)**

Perform a buy operation when the previous candle has a minimum lower than the value of the moving average, and the current candle exceeds the maximum of the previous candle.

*Figure 3 - EXAMPLE FOX TRAP ENTRY*

9. **2.5.1. Parameters for Fox Trap**

- Candle filter:

- Stop calculation:

- Takes the breakout candle as a reference,

- SL = 0 to place a stop just below the breakout candle,

- TP = 1 to calculate 100% of the breakout candle for gain.

- Moving Average:

- AVRG_SETUP = AVRG_MA_TURNS configures it to act in favor of the trend.

- MA = 9 uses a 9-period moving average.

L'utente non ha lasciato alcun commento sulla valutazione.