Regr

- Indicatori

- Andriy Sydoruk

- Versione: 1.1

- Aggiornato: 28 luglio 2024

- Attivazioni: 5

A regression channel is a technical indicator that comprises two parallel lines equidistant from the regression trend line. These lines create a channel within which the price of an asset tends to oscillate. The distance between the channel boundaries and the central regression line is determined by the maximum deviation of the closing price from the regression line. This approach allows traders to better understand the current market dynamics and make informed decisions.

Key Characteristics of the Regression Channel:

- Symmetry and Precision: The two channel lines are symmetrically positioned relative to the central regression line, ensuring an accurate reflection of price fluctuations.

- Dynamic Adaptation: The channel parameters automatically adjust to market changes as calculations are based on the latest data.

- Trend Indicator: The regression line shows the overall trend, while the channel boundaries help identify overbought and oversold conditions.

- Ease of Interpretation: An easily interpretable indicator suitable for both novice and experienced traders.

Advantages of Using a Regression Channel:

- Trend Identification: Enables traders to quickly determine the direction and strength of the current trend.

- Market Deviation Assessment: Channel boundaries help identify extreme price values, indicating potential reversals.

- Support and Resistance: The channel lines can serve as support and resistance levels, aiding traders in finding optimal entry and exit points.

- Application Flexibility: Can be used on any time frame and for any financial instruments, including stocks, currencies, and commodities.

How to Use a Regression Channel in Trading:

- Trend Determination: The slope of the regression line indicates whether the current trend is upward, downward, or sideways.

- Entry and Exit Points: Enter trades when the price touches the channel boundary and exit when it touches the opposite boundary.

- Deviation Analysis: Use maximum price deviations from the regression line to assess potential reversals and corrections.

- Risk Management: Set stop-losses and take-profits at the channel boundary levels to minimize risks.

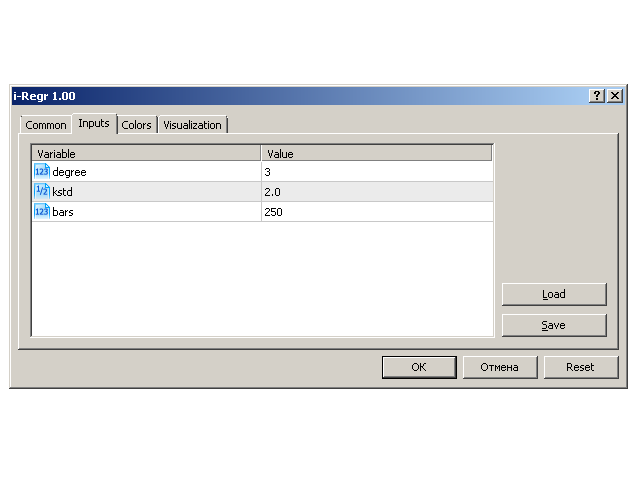

Practical Application in MetaTrader 5:

- Indicator Installation: Add the regression channel indicator to the asset's chart in MetaTrader 5.

- Parameter Adjustment: Adjust the period and other parameters for optimal display of current market conditions.

- Chart Analysis: Use visual signals from the regression channel to make trading decisions.

The regression channel is a powerful tool for analyzing and forecasting market movements. Its use allows traders to make more informed decisions based on objective data and mathematical calculations. Incorporating this indicator into your trading strategy can significantly enhance your efficiency and profitability in the Forex market.