VolumeCapacitor

- Indicatori

- Paulo Henrique Faquineli Garcia

- Versione: 1.7

- Aggiornato: 10 giugno 2020

- Attivazioni: 5

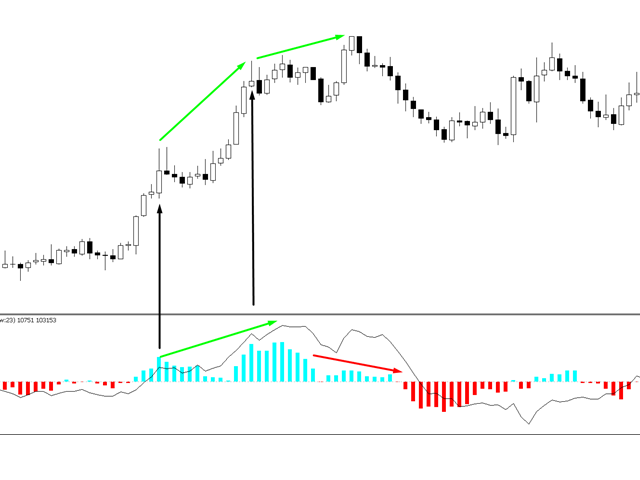

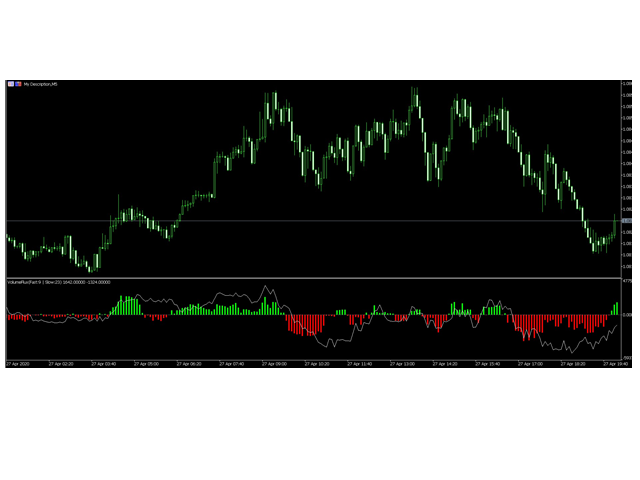

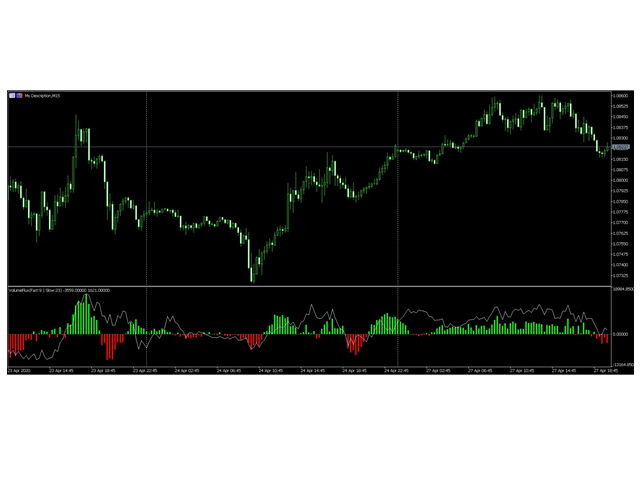

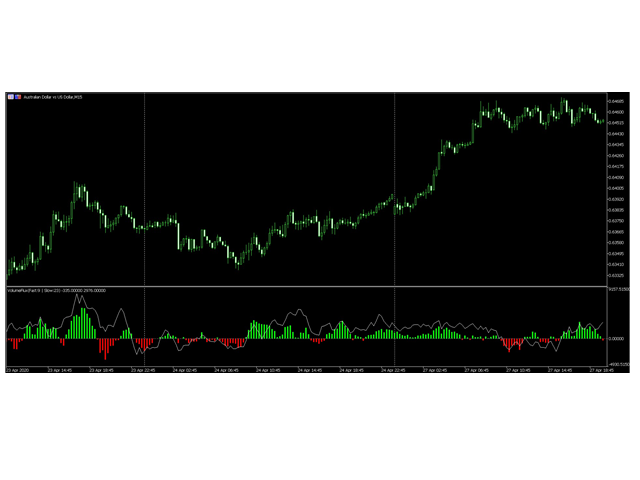

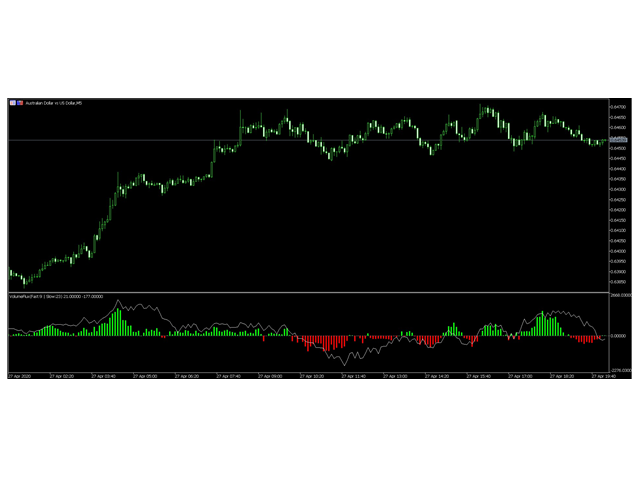

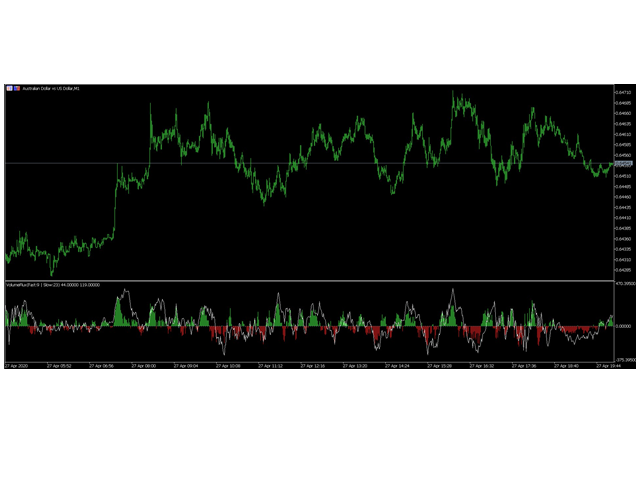

Designed by Fábio Trevisan, VolumeCapacitor is an indicator that, in addition to showing the volume quantity, shows its direction, having as

main characteristic, the possible price tops and bottoms, or pullback areas. With its simple but not simplistic calculation method,

it is able to determine areas where the defense of long and short positions can be assessed with a simple observation. VolumeCapacitor

uses in its unique formula the OBV (Balance of Volume, or On-Balance Volume) idealized by Joseph Granville, in a unique way. By

adjusting the periods of the VolumeCapacitor (Fast for the Histogram, Slow for the Line), reading in different timeframes is

obtained, facilitating the reading of the volume flow.

The basic assumption, in relation to the On Balance Volume analysis, is that changes in OBV precede changes in prices. According to the

theory, smart money can be seen flowing into assets when OBV is rising. When the public is interested in the asset, both the price of the

asset and the OBV will gain momentum. If the price movement of the asset precedes the OBV movement, then an "unconfirmed movement" was

produced. Unconfirmed movements can occur in bull markets (when the asset rises before or without the OBV) or in bear markets (when the

asset falls before or without the technical indicator On Balance Volume).

OBV is in an upward trend when each new top is greater than its precedent and each new fund is greater than its previous one. Likewise, On

Balance Volume is in a downward trend when each new top is less than its precedent and each new fund is less than its previous. When the OBV

is moving sideways and it is not making successive tops and bottoms, it is in a doubtful trend. Once a trend has been established, it

remains in effect until it is broken. There are two ways in which the trend of On Balance Volume can be broken. The first occurs when the

trend changes from an upward trend to a downward trend, or from a downward trend to an upward trend.

The second way that the OBV trend can be broken is if the trend changes to a dubious trend and remains that way for more than three days. Thus, if

the asset changes from a bullish trend to a doubtful one and continues like this just two days before returning to an upward trend, On

Balance Volume is considered to have always been in a bullish trend. When the OBV changes to an upward or downward trend, a "break"

occurred. Since disruptions in the OBV generally precede price disruptions, investors should buy in the long term when On Balance

Volume breaks up. Likewise, investors must short sell when the OBV breaks down. Positions should be maintained until the trend

changes.

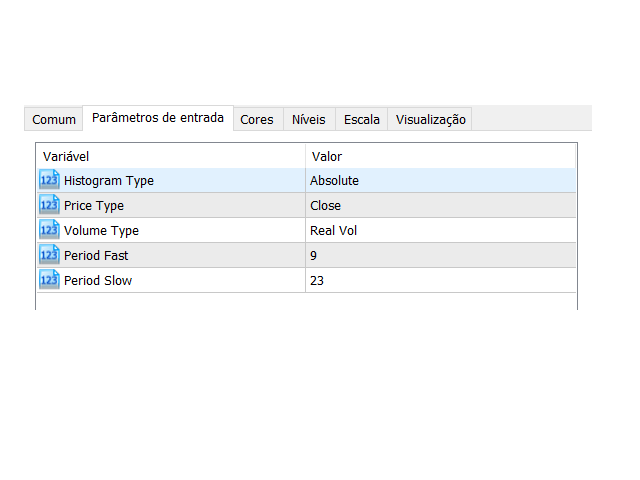

For smart calculation of OBV, the indicator has different price parameters, being:

- Closing (default)

- Opening

- Maximum

- Minimum

- (Opening + Closing) / 2

- (Maximum + Minimum) / 2

- (Maximum + Minimum + Closing) / 3 or Typical Price

- (Maximum + Minimum + Opening + Closing) / 4

It also has the ability to plot ABSOLUTE or PERCENTAGE variation, in addition to the different type of Volume: REAL or TICKS.

L'utente non ha lasciato alcun commento sulla valutazione.